Black Bear Value Partners annual letter to investors for the year ended December 31, 2019.

“Patience is not passive, on the contrary, it is concentrated strength.” – Edward G. Bulwer-Lytton

Q4 2019 hedge fund letters, conferences and more

To My Partners and Friends:

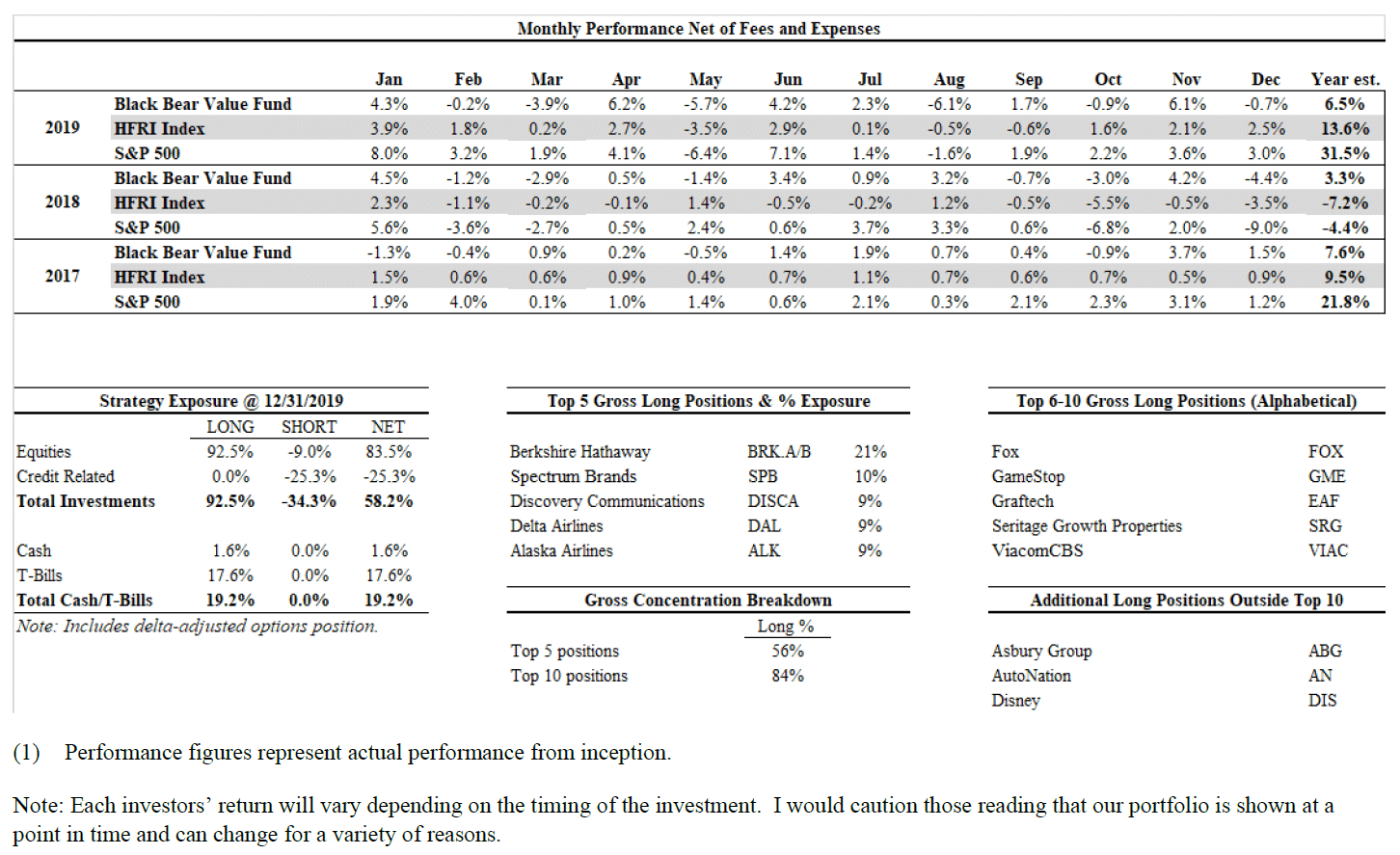

- Black Bear Value Fund, LP (the “Fund”) returned +6.5%, net, in 2019.

- The S&P 500 returned +31.5% in 2019 while the HFRI index returned 13.6%

- We do not seek to mimic the returns of the S&P 500 and there will be variances in our performance.

In 2019 our equity portfolio contributed meaningfully to our overall returns. Our shorts suffered as both bond and stock markets significantly rallied. Our prospective returns look attractive with a cushion to the downside. The portfolio looks very asymmetric and think we are well positioned for the coming years.

Please see the attribution below.

Our 3 Year Anniversary

Time sure flies. As we enter our fourth year, I am extremely fortunate to have a great investor base. Running this partnership is a labor of love and I appreciate all our partners. I wanted to summarize our mission to remind you of our goals and motivations.

- Black Bear has a long-term view of success rooted in patience and discipline.

- Everything we do is through the lens of creating equitable relationships with our LP’s to foster deep and long-lasting roots.

- We invest in undervalued businesses whose prices do not reflect their true intrinsic value.

- We focus on making the best 10-year business decisions, even if it comes at a short-term cost.

- Today’s news is riddled with a lack of trust. We seek to provide an antidote to this, always treating our partners with honesty and integrity.

Black Bear Value Partners On Alignment and Prudent Investing

My family has most of our liquid-investable net worth in the partnership, meaning we share in the downside as well as the upside. The fund is managed like it is 100% my money and given I own the downside; I will only invest in a prudent manner. In 2018 that served us well, but in 2019 it meant our neighbors made more than us.

In order for us to have greater long-term performance, I am prepared to accept periods of underperformance. Protecting our capital and sensibly investing is less fun when everyone else is having a party. Sticking to our philosophy requires fortitude and a willingness to look different. So far through 2020, our businesses have gotten cheaper as the unpopular remains so. We view these as opportunities that will benefit out partnership long term. Eventually the valuation will catch up to the business performance.

Giving Thanks

Thank you to all our partners. The partnership has continued to grow, and I am fortunate to have such a great group. We continue to focus on growing with the right LP base who take a longer-term and more patient view to investing.

Thank you to my wife, Lauren and our girls, Sydney and Zoey. They are as much a part of Black Bear as I am and provide an encouraging environment. We all plan on being back in Omaha for the Berkshire Hathaway annual meeting this spring. Sydney and Zoey had a good time and have already asked if they can have lunch, aka perpetual dessert, at Dairy Queen and See’s. Say hi if you see us.

Black Bear Value Partners Performance Summary

Black Bear Value Partners: Top 5 Businesses We Own

Brief descriptions of the top 5 long positions follow. These positions comprise ~56% of the portfolio at year-end.

Berkshire Hathaway (20.5% of assets)

For the sake of brevity, I will point you to our Q2 letter which discusses our valuation framework.

Berkshire’s stock price lagged the overall market, growing ~11% vs. ~32% despite book value and intrinsic value growing at a much higher clip. Some of the underperformance can be explained by a large amount of cash being held at the company. The cash is a sign of strength, especially for an insurer, even if it comes at a short-term cost. In time, they will find an appropriate use of the cash.

As a thought experiment, let’s presume the underlying stocks they own are fairly valued. If we were to price their operating businesses at ~7% FCF yield (a slight discount to a historical market multiple) and presume a small premium for the cash on the balance sheet, you arrive at a price roughly 30% higher than today. The cash serves as a long-term call option with no expiration and with many potential uses ranging from a large buyback to an elephant-sized acquisition. The collection of businesses at current prices provide a margin of safety and we stand to benefit as long-term partners of Mr. Buffett, Mr. Munger and the next generation of management.

Spectrum Brands (9.6% of assets)

Spectrum Brands has grown to become a top 5 position due to its appreciation in price. The company is a diversified consumer products company that focuses across pet supplies, hardware/home improvement, home/garden and appliances. Some of the more well-known brands are Nature’s Miracle, Black & Decker, George Foreman, Kwikset and Baldwin.

I started following Spectrum as one of our former holdings, Jefferies, was their largest shareholder. A key dynamic that contributed to the opportunity was JEF’s decision to spin-off their 15% holding to their shareholders. Spin-offs can create interesting dynamics. Existing holders typically receive a small amount of “new” stock in a business they know very little about…so they sell with little contemplation of price. In this case the “new” stock was SPB and the price dropped 20% in a matter of several days. Past study of SPB allowed us to move fast with conviction and buy the stock at a meaningful discount to its intrinsic value.

SPB historically had a high amount of leverage which is what kept us on the sidelines. Recently they sold two businesses and substantially de-leveraged the balance sheet. The current/new management team is reinvesting in the business which serves to dampen the near-term cash generation. The company’s core product sales have stabilized and should turn to growth in time.

Having a healthy balance sheet is key to making the right strategic long-term decisions. When a company has too much leverage it hamstrings the ability to make effective decisions. Spectrum is well equipped to manage the business to the benefit of long-term shareholders. We own SPB ~10-12% free-cash flow yield that should be able to grow 2-4% a year with high insider ownership and a focus on buying back cheap stock.

Black Bear Value Partners on Discovery Communications (9.2% of assets)

Discovery is the largest holding in our media basket. We have discussed the company in past letters so please refer to them for more discussion. Many in the media world are focused on developing expensive content for their streaming/direct to consumer businesses. Most of Discovery’s content is significantly cheaper to develop and has strong loyalty among their core constituencies. Discovery owns all of their IP providing various avenues of monetization. They have de-levered as planned and been buying back stock. This is a business that is trading at a 13-15% free-cash flow yield and should be able to grow.

Black Bear Value Partners on Alaska Airlines/Delta Airlines (8.5%/8.7% of assets respectively)

We recently gave a talk to MOI Global on our airline investment. You can find the presentation and webcast on our website or YouTube. At year-end prices, the credit card cashflow supports the valuation of the total business. In Delta’s case we should be getting ~$3-$3.50 in cash from the credit card business before we consider the airline or their MRO (Maintenance/Repair business). At a current market multiple, this would imply a stock price of $60+ vs. a 12/31 price of ~$58, ignoring the value of the planes/airline business.

Alaska has a similar dynamic with their credit card plan. There is additional execution upside at Alaska as they are exiting the integration of Virgin America. ALK’s team has historically been excellent operators and the business performance could exceed expectations. Most importantly, they are nearly finished paying down the debt from the Virgin acquisition and will have a substantial amount of capital to deploy. If the stock remains undervalued, I am hopeful they will buy back a lot in the year ahead.

Black Bear Value Partners: Shorts

As discussed earlier, our short positions cost us in 2019. We still hold them and continue to believe there is a tremendous amount of asymmetry.

Prospective returns for corporate credit look anemic at best. Spreads and overall rates are near record lows while we are facing an economy that is a bit long in the tooth. There is more debt in the market with high leverage multiples, poor covenants and supported by general investor apathy/complacency. This is compounded by ETF vehicles that hold bonds and promise minute-by-minute liquidity for underlying assets that sometimes trade by appointment.

So far, this bet has been a net loser, which is not surprising given the general happiness in the market. If and when sentiment changes, we will be in a good position.

The Importance of Game Selection & Runways

Howard Marks stole a little bit of my thunder with his recent letter on the parallels of gaming and investing. Given his accomplishments relative to mine, I’ll be generous and give him a pass.

Poker has always been a passion and hobby of mine. I started at the smallest stakes and over time ultimately began playing against some extremely talented and accomplished players at the higher stakes.

Both poker and investing require making decisions with incomplete information. Similarly, one can see good decisions rewarded with lousy outcomes or bad decisions rewarded with good outcomes. There is a natural temptation to stray from fundamentals aka “going on tilt” when this is happening. Sticking to the fundamentals results in the reward going to the player/investor with the most skill and discipline in the long run. That said, in the short run, losing can be frustrating and irritating, especially when you are seeing your less skilled opponents stacking the chips. Without a fundamental structure underlying your decisions, you could lose focus and make mistakes negating any element of skill.

Over the years, I have struck up friendships with some of the world’s best players, particularly those who have had long-lasting careers. I have tried picking their brain on the secret to their success. What differentiates the “great” from the “good” is not the ability to pull off a huge bluff or read someone’s hand. Many people can do that with a high degree of regularity. The BIG differentiator is game selection and knowing which games advantage you versus games where you are the dog. If you are losing over a big enough sample size, you’re not unlucky…you’re playing in a bad game for your skillset (presuming you have a skillset).

If you are the 7th best poker player in the world you stand to win most of the time, unless you’re sitting with players 1-6 on a repeated basis. The same is true in investing. If you try to play a tough game with short time horizons and a lack of knowing what you own, you stand to lose.

You need to play in games and invest in businesses you understand with an adequate runway to let the short-term variance play out. Having the appropriate business setup is a critical differentiator. Our ability to outwait and have a longer horizon is a huge edge relative to funds with short-term timelines.

General partnership business

We recently added Pershing (Bank of New York) as a secondary custodian in addition to Goldman Sachs. Pershing allows us to lend some of our more heavily shorted equities in addition to giving us another strong custodian.

I anticipate timely K-1’s and no need for any extensions from Black Bear.

Being patient and disciplined can look out of step at times. We know what we own and why we own it. In due course the values will catch up with the underlying business performance.

Thank you for your trust and support. I wish you and your families a happy and healthy 2020.

Black Bear Value Partners, LP