Sterling Partners Equity Advisors portfolio commentary for the month of December 2019, titled, “Uncertainty is Our Friend… I Think.”

The last few months in the market should be enough to shake anyone’s confidence that they can predict the future. This has been demonstrated in dramatic fashion by the rush toward certainty at any cost. Investors now want certainty so badly that portfolio managers around the world, according to Deutsche Bank, have invested $15 trillion at a quoted yield-to-maturity that is below zero as of September 2019. Not only do below zero interest rates cause a variety of quantitative valuation models literally to breakdown, but they also fail to pass the grandmother test, in that my grandmother does not understand how in the world she can pay back less money than she borrows. Of course, she’s smart enough to immediately ask to borrow a lot of money.

Q4 2019 hedge fund letters, conferences and more

Certainty is expensive. When lenders are willing to pay you to safeguard their money, instead of demanding a return, it’s a hint that certainty has become perhaps a bit too expensive. My bond buddies tell me that it’s not the rates themselves, but the spread to longer maturities that are forcing short-term rates below zero. My grandmother is not convinced. On the other hand, the math says that if the coupons on a long bond are invested at positive rates, and not the negative yield to maturity that is quoted, that the actual compound return, or realized compound yield will still be positive. Grandma does not understand that.

Ultimately, the flip side of certainty that is too expensive should be poor long-term returns. But while current rates keep falling, the low coupon returns are kept at bay by rising asset values, and momentum buyers keep buying regardless of the quoted yield. Encouraging buyers is the fact that many valuation models start to go parabolic on the upside with quarter point rate drops from such a low base, as demonstrated by the strong long bond returns this year. So, while certainty should provide a lower return, the growing demand for assets with certain cashflows has pushed prices and returns up and yields down. Another contributor to negative rates is the excess supply of capital created by the biggest generation of capitalists in history. As they move toward retirement, they need more certainty, not necessarily more return. So, in effect, low rates may simply be an excess supply driven price decline. If so, the floor to negative rates is the point when building a safe and hiring security is less expensive than the loss on the loan. But this is so unusual that the Bank of England had not offered rates below 2% in over 300 years until just recently, a time which also enjoys the most excess capital in history.

It’s worth pointing out that recessions are not that bad. Excluding 2008-09 as a mistake by accountants clinging to a mark-to-market rule for too long, most other recent recessions have been reasonably mild and getting farther apart. While there are many theories about the causes behind fewer recessions, one view is that more timely information available through the internet is creating less uncertainty all along the supply chain, leaving fewer opportunities for inventory dislocations that cause recession, and therefore continuing the trends of more years between recession as a natural outgrowth of better information. As we discussed last quarter, the economy still looks pretty good. We see a full employment economy with low interest rates, good access to credit, U.S. energy self-sufficiency, and a well-educated growing population. These are usually good elements for continued economic growth.

With regards to a market outlook, the stock market, according to Ben Graham, is a voting machine in the short term and a weighing machine in the long run. We subscribe to that view. In the near term, headline risk of shifting interest rates, trade wars, hot wars, oil shocks, tweet streams, elections –all impact the stock market in ways that often look very much like random. In the long run, population growth times productivity growth equals GDP growth, and businesses and industries that manage to do things faster, better or cheaper than alternatives will gain share of the economy and prosper. In the long run, we believe that better education, better access to information, and easier access to collaboration will create an acceleration in innovation and productivity, even as academics find it difficult to measure. The benefits of the app Open Table, for example, struggle to find a way into GDP. The time we all save to work on other projects or read a book gets lost in translation. But these entrenched trends will, in our opinion, continue to drive the economy to new heights, in the long run.

During these uncertain times, we strive to earn excess returns for our clients by continuing to do what we have been doing for nearly 20 years. We use a consistent process that fundamental investors have used for a long time. Between Ben Graham’s “margin of safety” and John Burr Williams’ discovery of the discounted cashflow model, we use tools that have been honed by time. Although markets have become more efficient, our universe includes some of the last eddies of opportunity to uncover information that has not yet been absorbed into market prices and we use fundamental research to find those opportunities for excess return. By identifying undervalued companies with good balance sheets that target growing industries and offer products or services that are better, cheaper, or faster than the competition, we have a universe of superior businesses that we believe on average will prosper in the future. By exercising discipline around our valuation approach and narrowing the bell curve around our estimates of intrinsic value, we rely on our expected return estimates to allow us to continue to buy stocks that we believe will deliver excess return over time. Uncertainty has driven the expected inflation adjusted return on our universe to levels that have rarely been higher. Does that make uncertainty our friend? For small-cap investors the answer is almost certainly, yes.

U.S. Concrete, Inc. (USCR)

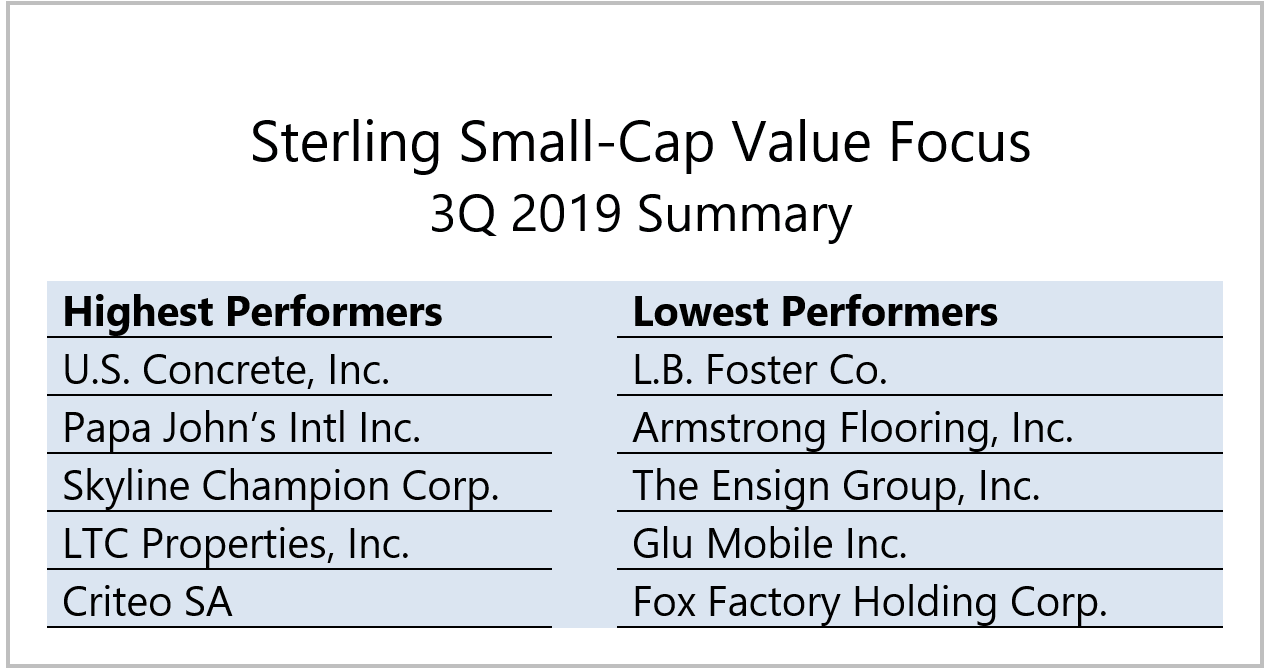

Highest 5 Performing Security: Sterling Small-Cap Value Focus

U.S. Concrete is a leading supplier of concrete and aggregates for large-scale commercial, residential and infrastructure projects across the country. The company holds leading market positions in the metropolitan markets of New York, San Francisco, Dallas Fort Worth and Washington D.C.

We have a long history of owning cement and concrete companies on the evidence that owners enjoy a bit of local monopoly as a result of transportation costs limiting the physical area that can be served from a particular quarry. We believe USCR is a low-cost producer in its market area. Our thesis includes the view that both commercial and residential construction activity will benefit from the current strong economy and employment.

Management indicated that deferrals of product sales are not lost in this year so we can expect a strong second half. Weather did have a meaningful impact in the first half of 2019.

Papa John’s International, Inc. (PZZA)

Highest 5 Performing Security: Sterling Small-Cap Value Focus, Sterling Small-Cap Value Diversified

Papa John’s is one of the world’s largest pizza delivery and carry out companies in the world with company owned and franchise stores located in all 50 states and 46 countries.

We see the delivery pizza business as a consumer hot food convenience and low cost which will only get better with the use of technology. The management has restructured the C-Suite and Board to make strategic changes to compete with others in the industry. We look forward to seeing this team execute on their plans.

While announcing their quarterly earnings, management indicated that with an addition of a new chief restaurant operations officer, their table is set to begin rolling out a new marketing campaign in the second half of 2019. One month after the quarterly earnings report, Papa John’s announced a “Better Day” campaign with Shaquille O’Neal signaling a new marketing strategy to appeal to a new generation of customers. We believe this campaign with “Papa Shaq” can raise attention for this brand and reward shareholders along the way.

Skyline Champion Corp. (SKY)

Highest 5 Performing Security: Sterling Small-Cap Value Focus, Sterling Small-Cap Value Diversified

Skyline Champion is one of the largest factory-built housing companies in North America with a leading portfolio of manufactured and modular homes, park-models and modular buildings for the multi-family, hospitality, senior and workforce sectors. Skyline also operates a factory-direct retail business, Titan Factory Direct, with 21 retail locations in the Southern United States.

Our thesis on Skyline Champion is that it is a low-cost housing producer in areas where land is not the major cost and traditional home affordability is a concern.

As the merger synergies play out, Skyline has reported improvements to gross profit driven by product offerings, favorable lumber pricing, and plant operating improvements. Skyline also ended the quarter with a healthy balance sheet.

LTC Properties, Inc. (LTC)

Highest 5 Performing Security: Sterling Small-Cap Value Focus, Sterling Small-Cap Value Diversified

LTC Properties is a real estate investment trust investing in seniors housing and health care properties, approximately 50% seniors housing and 50% skilled nursing properties, primarily through sale-leasebacks, mortgage financing, joint-ventures and structured finance solutions. LTC holds more than 200 investments in 28 states with 30 operating partners.

This business benefits from the aging demographics of the U.S. population, a thesis we believe will accelerate as a greater number of ‘baby boomers’ begin to reach retirement age each year. In addition, the recent policy shift that favors looser monetary policy and lower interest rates provides lower cost financing as LTC continues to acquire senior housing properties and skilled nursing facilities across the country.

LTC continues to complete deals across the country, highlighted by a two facility, 180-bed acquisition of Missouri based Ignite Medical Resorts for $23 million this past August. LTC and other REITs greatly benefited from changes in interest rate policy as the Federal Open Market Committee voted in favor of a 25 basis point rate cut during both August and September meetings. The change in August marks the first time the Federal Reserve has cut interest rates in nearly ten years.

Criteo S.A. (CRTO)

Highest 5 Performing Security: Sterling Small-Cap Value Focus

Criteo is an advertising platform designed to deliver advertising across web and mobile channels. Our thesis is that advertising spending will continue to migrate to online and mobile from TV, and Criteo is positioned to benefit from that continuing migration.

Despite on-going concerns about online privacy, Criteo reported $20 million in Free Cash Flow despite the challenging business. During the second quarter, CRTO added 360 new clients and maintained client retention at close to 90%. Customer checks suggest CRTO remains a best in class solution to target marketing online.

Once again, CRTO ended the quarter with a strong balance sheet with $422 million in cash. In addition, CRTO announced a share repurchase authorization, which should give investors confidence in the management’s strategic direction and ability to deliver on its plans.

CTS Corporation (CTS)

Highest 5 Performing Security: Sterling Small-Cap Value Diversified

CTS is a designer and manufacturer of products including sensors, actuators, and electronic components in North America, Europe, and Asia across many industries.

CTS is a high-margin business with large contracted booked business across many industries. We enjoy owning this business as it flies under the radar with little Wall Street coverage but continues to grow profitably across strong industries which should lead to continued margin improvement and consistent performance in the portfolio.

CTS management improved SG&A margins by 2.5% over the prior year period in 2018. Their total booked business was $1.875 billion, up 4.2% versus the prior quarter 2018. Management repurchased 142,000 shares for $4.2 million under their repurchase plan.

National Storage Affiliates Trust (NSA)

Highest 5 Performing Security: Sterling Small-Cap Value Diversified

National Storage Affiliates Trust is a real estate investment trust focused on the ownership, operation and acquisition of self-storage properties located within the top 100 metropolitan statistical areas throughout the United States.

Our thesis is that outside storage will continue to gain share from residential and commercial properties primarily due to growing needs for convenience and security. We believe that the stock is attractive, and that NSA will continue to offer us good returns over time.

NSA acquired 24 wholly-owned self-storage properties for $183.5 million during the second quarter. After the end of the second quarter, the company took steps to strengthen its balance sheet for future acquisition opportunities. NSA benefited from the first Fed Funds rate cuts in nearly 10 years as the FOMC voted in favor of a 25 basis point cut in both August and September meetings. In general, the long-term value of real estate increases the further interest rates fall, as debtors benefit from lower borrowing costs.

L.B. Foster Company (FSTR)

Lowest 5 Performing Security: Sterling Small-Cap Value Focus, Sterling Small-Cap Value Diversified

L.B. Foster is a manufacturer and distributor of transportation and energy infrastructure products and services with locations in North America and Europe.

The third quarter was a difficult time for the market. L.B. Foster pulled back some due to recession fears generally and concerns about the energy production and transportation industries specifically. FSTR did report slight declines in their backlog which the market didn’t like, but management indicated they were anticipated, and the backlog remains high. We expect strong cash flow in the second half of the year due to the unwinding of working capital needs that fueled growth in the first half.

We believe that the company’s high-quality product will gain market share over the long run as infrastructure spending both in transportation and energy will drive stable growth. We expect management will use free cash flow to reduce debt, helping grow the net profit margin and ROI. At the current price, we believe FSTR offers an attractive long-tern return.

Armstrong Flooring, Inc. (AFI)

Lowest 5 Performing Security: Sterling Small-Cap Value Focus, Sterling Small-Cap Value Diversified

Armstrong Flooring is a leader in the design and manufacture of resilient flooring products across North America, spun out from Armstrong World Industries just a few years ago. We believe AFI will emerge as the low-cost producer in the space, as legacy systems are rationalized, and as a result we expect some share and margin gain.

Management acknowledged the headwinds of the business, which has negatively impacted the stock price, but we remain confident in turnaround efforts. During the quarter, AFI announced and finished a $50 million share repurchase.

If management can achieve its cash flow targets for 2019 and 2020, as capacity and capital spending are rationalized, that will lead to a higher valuation for the company and a good return for shareholders.

The Ensign Group, Inc. (ENSG)

Lowest 5 Performing Security: Sterling Small-Cap Value Focus, Sterling Small-Cap Value Diversified

The Ensign Group provides a broad spectrum of skilled nursing and assisted living services, physical, occupational and speech therapies, home health and hospice services and other rehabilitative and healthcare services at 257 healthcare facilities, 28 hospice agencies, 26 home health agencies, and 9 home care businesses across the United States.

This business benefits from the aging demographics of the U.S. population, a high conviction thesis we hold, providing a broad spectrum of skilled nursing and assisted living services, physical, occupational and speech therapies, home health and hospice services and other rehabilitative and healthcare services.

Ensign’s business model includes acquiring complimentary businesses and improving the cost structure. For the quarter, they continued to execute on this strategy and management indicated that the pipeline for acquisitions is as full as ever. The spin-off of the home health and hospice agencies and a majority of its senior living facilities into a separate publicly-traded company, The Pennant Group (PNTG), finished on October 1st. This impacted performance leading up to the spin-off which was recaptured in the value of our new holding PNTG.

Glu Mobile Inc. (GLUU)

Lowest 5 Performing Security: Sterling Small-Cap Value Focus, Sterling Small-Cap Value Diversified

Glu Mobile is a leading creator of mobile games. With a diverse portfolio of original and licensed IP titles including: Cooking DASH, Covet Fashion, Deer Hunter, Design Home and MLB Tap Sports Baseball.

We believe in the continuing growth of the video game space over the long term - not only due to the expected continuing share gains of the leisure industry generally, but also as a low-cost alternative to other leisure activities or baby-sitters.

Glu continued to pull back from all-time highs recently as we believe the expectation for Glu’s near-term earnings got ahead of itself. Once management reset near-term guidance, we added to our position based on our long-term outlook for the company and the space.

Fox Factory Holding Corp. (FOXF)

Lowest 5 Performing Security: Sterling Small-Cap Value Focus

Fox Factory Holding designs and manufactures performance ride dynamics products primarily for bicycles, on-road and off-road vehicles and trucks, side-by-side vehicles, all-terrain vehicles, snowmobiles, specialty vehicles and motorcycles.

We have owned FOXF for many years around the thesis that leisure activities will continue to gain share of GDP and we like that FOX operates in the luxury end of their market niche. Management has exhibited much skill in making accretive bolt-on acquisitions and optimizing ROA for years. We anticipate these trends to continue.

Fox Factory did end the prior quarter with strong performance, so most of the pull back is not a surprise to us as we invested in this company for the long term. During the quarter, management reported a 22.5% increase in sales from the prior Q2 in 2018. Most of this increase is due to the new Powered Vehicles OEM Channel which we believe will contribute strongly going forward.

MasterCraft Boat Holdings, Inc. (MCFT)

Lowest 5 Performing Security: Sterling Small-Cap Value Focus Diversified

MasterCraft Boat Holding is an innovator, designer, manufacturer and marketer of premium recreational powerboats through its three subsidiaries, MasterCraft, NauticStar and Crest Marine. Our thesis on MCFT is again a view that leisure is in a long cycle of gaining share of the economy.

Management did express concerns for retail trends declining but the company is well positioned for the future with its low-fixed cost, highly-variable cost, best-in-class net working capital management, and strong balance sheet to perform well through troubled times.

We have the patience to wait for these concerns to dissipate and look forward to strong unit volume across all boat brands including a newly released luxury brand, Aviara.

MCFT is part of our leisure theme due to the consistent long-term growth of the leisure industry relative to GDP. The stock is caught up in the fears of recession stoked by current events, and now trades at a 30% cash-on-cash yield, as measured by EBITDA / Enterprise Value, a level we believe is extremely attractive.