Elliott Management stepped up its campaign against Altran Technologies’ sale to Capgemini last week, publishing a presentation detailing its position. Although the activist agrees that a deal makes sense, it argued the takeover price of 14 euros per share “neither reflects Altran’s intrinsic fair value, nor [is] an adequate premium for control.” Elliott said Altran shareholders could miss out on “significant value creation” as a result.

Elliott’s letter comes shortly after Capgemini CEO Paul Hermelin told Reuters he will not increase his offer and expressed confidence he would get 50.1% of shareholders behind the deal at the current price. “We saw things we liked and others we liked less,” Hermelin said, after seeing Altran’s books.

Q3 2019 hedge fund letters, conferences and more

Elliott and Altran

Elliott, which owns economic exposure to 10% of the stock in Altran, said the process was "conflict-ridden," and that Altran CEO Dominique Cerutti's opinion was "likely compromised," including through an agreement with Apax Partners, its largest shareholder, which Elliott said was seeking to exit its stake."The CEO is still refusing to disclose the amount which he has already received as a result of the sale of the largest shareholder to Capgemini," Elliott said in a presentation. The activist said that four "conflicted" directors, including Cerutti and two Apax representatives, deliberated the offer on June 24 and August 9 when they should have recused themselves. The four directors did not vote on September 22.

Elliott's concerns are also shared by the Association of Minority Shareholders (ADAM), a body representing the rights of minority shareholders led by Colette Neuville. ADAM said it had commissioned a valuation expert that put Altran’s worth at 17 euros per share.

What We'll Be Watching For This Week

- How will Nuveen Ohio Quality Municipal Income Fund shareholders vote regarding Saba Capital Management’s three board nominees and proposal for declassification at the meeting on Thursday?

- Will Blina Minerals’ recent board restructuring calm investor worries?

- Will Vivendi find a buyer for part of its 28.8% stake in Mediaset?

ACTIVIST SHORTS UPDATE: MiMedx Securities Fraud Charges

MiMedx settled fraud charges with the U.S. Securities and Exchange Commission while the Department of Justice indicted some of the company’s former top men.

CEO Parker Petit and former Chief Operating Officer William Taylor were charged by the DoJ with one count of conspiracy to commit securities fraud, which carries a maximum 5-year prison sentence, and a single count of securities fraud, which carries a maximum 20-year prison sentence.

MiMedx was accused of prematurely recognizing revenue and entering into side agreements with five distributors to exaggerate growth - the channel stuffing alleged by activist short sellers Viceroy Research, Aurelius Value (since renamed Marcus Aurelius Value), and Marc Cohodes from 2017 onward. MiMedx paid $1.5 million to settle the charges, while the SEC is seeking "permanent injunctions, disgorgement plus interest, penalties, and officer-and-director bars against Petit, Taylor and Senken, and clawback of bonuses and other incentive-related compensation paid to Petit and Senken during the alleged fraud."

Petit, Taylor, and Chief Financial Officer Michael Senken have been charged with "violating the antifraud, reporting, books and records, and internal control provisions of the federal securities laws," according to the SEC.

Petit denied the charges, arguing his actions have been inaccurately "twisted," and vowed to "vigorously" fight the accusations in court. The ex-CEO defended his track record at MiMedx, adding that he has "conducted himself with the highest degree of integrity and professionalism." Petit also questioned the fairness of the recent internal investigation, saying that it was prompted by "false allegations" by short sellers and attacked the directors that served during the probe, saying they made "self-serving decisions with poor business judgment."

MiMedx Chair Kathleen Behrens, however, applauded the settlement. "Bringing this investigation to conclusion is another step toward the company's commitment to resolve past issues and move forward without distraction from our efforts in advanced wound care," she said in a statement. "We appreciate the SEC's recognition of our cooperation and remediation efforts as part of this settlement," added CEO Timothy Wright.

To arrange an online demonstration of Activist Insight Shorts, email us or view our product brochure to find out more.

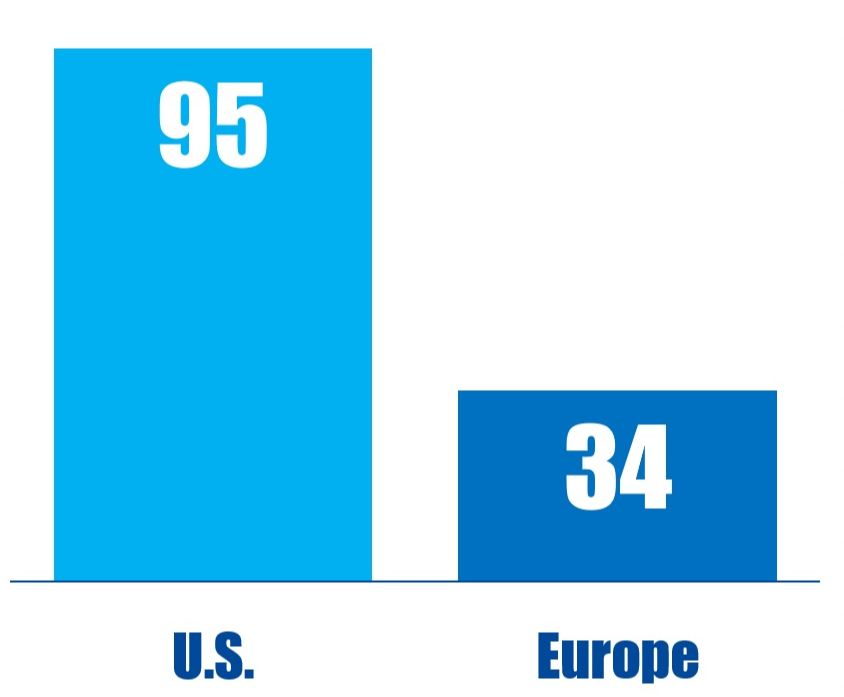

Chart Of The Week

As of November 29, 2019, U.S.-based companies have been targeted by investors with an activist investment strategy nearly three times more than Europe-based companies have in the same period.