Choice Equities Fund letter to investors for the third quarter ended September 30, 2019.

Q3 2019 hedge fund letters, conferences and more

Dear Investor:

Markets were up and down in Q3. The large caps again continued their outperformance over small caps, as the S&P 500 added +1.7% to year-to-date gains while the Russell 2000 gave back -2.4% for the quarter. Our portfolio was up +5.5% in the quarter. This latest update now means $1 invested in our portfolio since becoming independent in 2017 is worth $1.58 versus our Small/Large blended benchmark of $1.22.

Executive Summary

In this letter, we highlight Bluelinx (BXC) and The Rubicon Project (RUBI) as the notable performance drivers for the quarter. We then discuss new portfolio additions At Home (HOME) and Quantum Corp. (QMCO) before closing with a few thoughts on our investment outlook.

Notable Performance Drivers

This quarter’s positive performance came from a portfolio that looked a little lopsided at times. At one point, our largest position was an almost 30% holding in cash, followed in size by our position in The Rubicon Project. Combined with three other “core” positions sized around ~10%, several smaller ones and a few small hedges, our net exposure touched as low as ~60% for some stretches of the quarter. So, for the very brief 90-day period that was Q3, this posture combined to create the intended result: our portfolio returns were largely driven by our chosen stocks and less so by the markets in which they trade.

Bluelinx shares performed well in the third quarter as the company continues to make steady progress integrating their highly accretive Cedar Creek acquisition. Last winter’s lull in housing market activity is proving to be just that, as single-family starts are again growing due to steady structural demand and the recent impetus from lower interest rates. As we suggested in our prior letter, the company appears to be at an inflection point. Management seems to agree, with CEO Mitch Lewis stating on their last earnings call that they expect “the second quarter will prove to have been an inflection point for our company.” Continued tailwinds from a growing housing market should do wonders for the company to enable their strong cash flow generation ability to shine through. With continued steady execution on the synergy case, we think it is possible investors will see as much as $9/share of annualized free cash flow in the coming quarters.

The Rubicon Project is also performing well. The 2Q report was the third consecutive quarter to feature 30%-plus topline growth and came with a similarly strong outlook for the upcoming quarter. The above market growth has been driven by continued share gains from smaller subscale supply-side platforms in both desktop and mobile verticals. Rubicon has also had important wins in high growth formats like video and audio. Recent product introductions like nToggle and Estimated Market Rate have made their efficient platform more attractive to publishers, and the company appears to have yet another share-winning product in the pipeline. In September, I had the pleasure of attending the company’s demo event for its new Demand Manager offering at their New York offices. The product is a new suite of analytical tools that overlay the Prebid open-source software platform the company was instrumental in building. The user-friendly product lowers the cost for publishers to evaluate and analyze the ROI associated with their ad inventory across all advertising formats. Though it is early, feedback has been quite positive, and the offering seems to have been a contributor to new customer wins. With continued iterative improvements in product offerings and scale advantages over smaller peers, the company appears well positioned to fulfill the marketplace’s need for a strong independent, omnichannel, global supply-side exchange.

Portfolio Activity

In the quarter, we exited Chipotle, one of our core positions, and replaced it with At Home as a new core position. We also added Quantum in the special situation bucket.

CMG – After nearly tripling in just under the last two years since we initiated our position, we completed our exit of Chipotle in Q3. CEO Brian Niccol has the company firing on all cylinders. Improved marketing, delivery expansion, digital initiatives and continued new store growth have enabled the company to successfully complete its turnaround. Chipotle is now back to playing offense. Investors seem to agree the future is bright and have rewarded the strong execution by bidding shares up to a level that no longer meets our margin of safety or expected return thresholds. Accordingly, we exited the position.

HOME – Little more than a year ago, At Home was regarded as a high-quality growth stock with a successful and differentiated approach to brick and mortar retailing. The furniture and décor retailer had garnered investor favor for its differentiated business model that won over consumers with its tremendous breadth of products (typically 50,000 SKUs per store) and attractive price points (typically 15 – 25% lower than peers like Wal-Mart or Wayfair). Smart sourcing of private label products and a lean low-cost operating model serving customers from big box stores (typically ~100,000 sq. ft) generated strong unit economics and attractive returns on capital. The company’s strong share gains and growing store base positioned the retailer as something of a category-killer. Since coming public in 2015, the company was one of just a handful of retailers to post uninterrupted positive comps and an earnings CAGR in the mid-20s percentage level for the last three years.

But times and sentiment changed swiftly this past year. The short version of the story is this: first growth investments, then tariffs and subsequently softening comp trends all culminated in a nasty confluence of events that wreaked havoc on the company’s near-term earnings growth trajectory. Due to these factors and some other one-time events, GAAP financials now paint the picture of progress interrupted, with a severe dent impaled into the company’s growing earnings stream. Growth investors would subsequently abandon this one-time darling, sending shares to levels that seem to suggest these issues are entirely permanent.

Our research suggests otherwise. We believe most of these unfavorable trends are temporary and certain elements of the company’s business model are simply misunderstood. After a deep dive bolstered by a meeting with management at their Plano, TX headquarters and conversations with multiple former employees, we believe the company’s recent course correction and downshift in near term unit growth targets presents an attractive buying opportunity, much like we have seen in other growth retailers in prior periods of comp softness. At recent prices, investors are paying little for shares of a company with a successful concept that has an opportunity to triple their store base. With continued steady execution and a medium-term fair value estimate in the $40s, we see an opportunity to earn multiples on our investment over a multiyear time horizon. For investors interested in the long version of the story, please see our full write-up which you can find on our website here.

QMCO – When I first started looking at Quantum Corp in the spring of 2018, I couldn’t help but think it was one of the more interesting situations I had seen in sometime. Of course, there was more than a little hair on it. With a market cap under $200M, shares had just experienced what could be described as a lost decade of sorts. Revenues and the stock price had done little but fall, with sales shriveling to ~$400M from a prior run rate of ~$1B in 2008. Though the company still maintained a strong competitive position in some important product areas and continued to own a stake in a valuable royalty-paying technology consortium, it seemed of little consolation as these end markets drifted listlessly into secular decline. Numerous changes in leadership would follow, including a nearly unprecedented five CEOs in under six months, ultimately leading to nasty headlines like this one: Quantum seems to go through CEOs like a hot knife through butter. As a last and final straw, the company would incur accusations of impropriety in the filing of their financials with the SEC. With the accuracy of the financials in question, the company would quit reporting quarterly results in early 2018, and later that year, shares would be delisted from the NYSE. The company would effectively go radio silent.

Indiscriminate selling would follow, as investor views would default to the worst given the information vacuum. But a closer looker would show there were some good things developing. In May of 2018 the company would hire Mike Dodson, a CFO with strong experience in turnarounds and SEC investigations. Two months later, a well-regarded data storage veteran would join the team as CEO. Our contacts gave the incoming Jamie Lerner high marks for his in-depth product knowledge and strategic rationale, particularly for his work in quickly turning around the Cloud and Systems Technology Group of Cisco by repositioning their go-to-market strategy. With an impressive team coming together, shareholders had reason for a little optimism. But there was perhaps more good news on the horizon as rumors began swirling that tape – the means of data storage around which most of the company’s products are oriented – might be making a comeback.

There were plenty of doubters. After all, as a cheap and clunky means of data storage, tape had done nothing but lose share to faster and more efficient offerings like hard disk drive, flash and the cloud for the last ten years. Given all the skepticism around this potential tape renaissance, I decided I had to go see for myself. That July, I went to a trade show the Sports Video Group hosted in New York called Sports Content Management and Storage. Expecting to encounter the sort of down-and-out feeling of nostalgia one might find at a Betamax convention, I found something different.

Quantum reps seemed to be in their element. They were optimistic and talking excitedly about upcoming next-generation products on the way. Industry players were also talking about new use cases for tape. Storage of sporting and gaming events was becoming a challenge as tens of thousands of high-definition clips from multiple video angles were creating immense amounts of data. On top of that, video surveillance was even more of a concern, with some forecasts suggesting it would be responsible for as much as 80% of the data created in the world by the year 2025. Storing all of this data was getting expensive, especially when using the recent innovations which had placed a premium on quick retrieval. But tape was cheap. And though it still took a minute or two to access, its ~5:1 cost advantage over other mediums in a world of rapidly expanding data was becoming too great to ignore. Tape was making a comeback.

Despite these developing positives and a steady stream of press releases from Quantum about new products and customer wins, as far as quarterly financials were concerned, the company still had little to say. Management did demonstrate they were making progress in an 8k filed this spring. They showed they had isolated the issue down to recognizing only the timing of a certain set of historical revenues, thus eliminating any negative implications around historical or future cash flows. But few noticed. With shares depressed, downside protection available from the high margin royalty stream and end markets potentially turning in their favor, we initiated a small position this summer.

This August the company would finally speak. As anticipated, their financials required little in the way of a restatement of anything of consequence. Instead, what they showed was that new management had made a great deal of progress with the company while away from the spotlight. The team had changed the sales rep compensation scheme to reward profits over sales and similarly implemented a streamlined go-to-market strategy focused on only its strongest product offerings. The result: in a year and a half, management had cut some $70M of annualized costs and driven gross margins 400 bps higher. The EBITDA run rate had nearly doubled to ~$51M from the prior year, and management would discuss expectations for high-single-digit annual revenue growth from the secular gains of a growing tape market going forward. The outlook was improving.

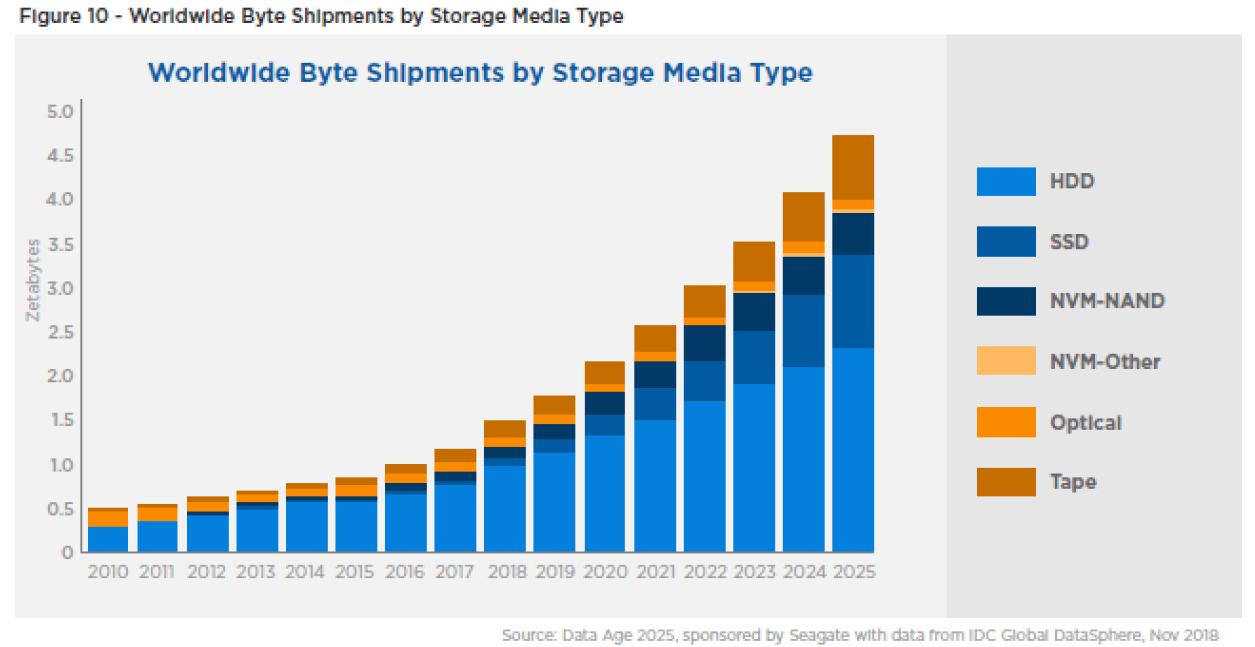

Interestingly, this revenue outlook contemplates little in the way of new business from fulfilling the data needs of the hyperscalers. These are the giant companies like Google, Amazon, Microsoft, Facebook and Apple who are storing the world’s data and accordingly have massively expanding data storage needs of their own as the chart on the right from IDC shows. Though any contract wins here will be episodic in nature and come with long selling cycles, they can be material, potentially to the tune of $30M or more in annual revenues. There are of course no guarantees Quantum will land any of this business. But as a result of the company’s legacy position in the industry, they look well positioned. They already have an existing relationship with one of the largest hyperscalers, and at least for the time being, look to be fighting primarily with just one other player to win the rest.

Though Silicon Valley character Gavin Belson’s views of data shortages and data rationing from an impending datageddon are of course a bit hyperbolic, the point, as the IDC forecast suggests, is the same: the world will soon be awash in data and it’s going to have be stored somewhere. At 8x this year’s FY20 EBITDA, little growth or further improvement in operations looks to be priced in, despite an outlook that appears to be improving. In the short term, we see coming catalysts with an up-listing back onto the Nasdaq on the horizon, a growing royalty stream and new customer wins. Over the medium to long term, we believe Quantum is poised to benefit from the secular trend of growing data storage needs and see an opportunity to earn multiples on our investment over a multiple year time horizon with continued steady execution.

2019 Outlook

Our domestic economy appears to continue to run at two speeds. Growth in many industrial businesses is sluggish or stalling out. While an input for the rate of growth of the economy at large, at ~11% of activity today, the manufacturing economy doesn’t carry the same ramifications for the rest of the economy it once did. On the other hand, most areas of the economy reliant on consumer spending continue to show resilience. Several interest rate sensitive areas of the economy seem to be perking up, as data series like existing home sales and furniture sales are now growing again after a couple quarters of weakness.

Against this uneven backdrop, markets are now generally flat with their levels from a year ago, with both the level of earnings and the multiple paid for them mostly static over this period. Current indications suggest we continue to flirt with another brief earnings recession, though its worst effects may be moving to the rearview mirror for the time being.

Regardless of the market’s gyrations in the short term, I believe our eclectic portfolio looks to offer greater value and appears set to perform well in this environment. Though our holdings will assuredly be influenced by the market direction in the short term, in the medium to longer term, our performance will be driven by the business results of these specific companies and the unfolding catalysts that lie ahead.

Conclusion

In closing, while I know our approach will not yield outperformance each and every quarter, I continue to believe it will be well worth our while over the long haul. Perhaps more importantly, given the overwhelming majority of our investable assets are invested alongside yours, we would never ask investors to assume risks we ourselves will not.

Thank you for your continued support as we work to grow our capital together. As always, we are happy to discuss our investment outlook with you at your convenience. Please reach out any time.

Best regards,

Mitchell Scott, CFA

Portfolio Manager

- All market and company data is sourced from Factset and company filings and is current as of 9/31/19.

- CEF uses the S&P 500, Russell 2000, a custom Blended Small/Large Benchmark and the Barclays Hedged Long/Short indices as its primary benchmarks. The S&P 500 and Russell 2000 are common large and small cap US equities-based indices. The custom Blended Small/Large Benchmark is provided to capture a larger proportion of small cap performance versus large cap performance (at a 3:1 ratio) due to the similarly high proportion of small caps found on the Good Businesses Focus List as well as the strategy’s general preference of having an investment mix more heavily weighted towards investment in small caps. The Barclays Hedged Long/Short index (an index of equities-based hedge funds) serves as an appropriate benchmark over the long-term given the index has a similar long-term goal of capital appreciation through equities investing.

- CEF Net Returns are hypothetical results calculated from actual gross results in a manner consistent with the 1% management fee and 18% performance fee offered to clients.

APPENDIX

CEF GOALS, PHILOSOPHY, APPROACH AND ALIGNMENT

GOALS – We seek to generate market-beating returns over any rolling multiyear investment horizon while minimizing the risk of permanent impairment of capital. Additionally, we seek to communicate with our investors in a transparent and straightforward manner and ask only that they accept investment risks that we ourselves are willing to take. Given the majority of our investable capital is invested alongside theirs, we invest our limited partners’ capital as if it were our own, because it is.

PHILOSOPHY – We approach investing in public equities as an opportunistic businessman would. We spend most of our time studying businesses and building circles of competence in areas likely to offer attractive investment prospects and invest in only our most compelling opportunities. We view risk primarily as the likelihood of a permanent impairment of capital and pursue a carefully balanced willingness to trade some short-term portfolio fluctuations for the opportunity to earn higher returns over the long-term. We focus on growing, understandable businesses and seek to buy them at a substantial discount to our estimate of their intrinsic value. When we find them trading at attractive prices, we often act in size and weight our best ideas accordingly. And all things being equal, we prefer to devote more of our efforts to small stocks where we believe greater price/informational inefficiencies can often be found.

APPROACH – We invest via a long-bias hedge fund structure and concentrate our long investments in our best 10 to 15 ideas. Our work begins with a two or three-year outlook, and we only pursue investments we believe are likely to offer us a reasonable chance to generate an annualized return of 20% or better. While we pursue long-term oriented investments and seek to compound capital in a tax efficient manner, we readily acknowledge the often-turbulent markets do not always fit neatly into this framework and know some trading activity is sure to follow as a result. In the short book, we seek to generate absolute profits in a few stocks where we have uncovered a company entering financial duress or an excessively optimistic valuation where we feel their earnings outlook is likely to worsen materially. We will also use industry or market specific ETFs to mitigate market risk and will look to employ options and other opportunistic hedges when conditions appear favorable.

ALIGNMENT – We believe appropriate alignment of interests is the bedrock upon which all successful partnerships are built. Our primary means of ensuring proper incentive alignment is through significant co-investment of our personal wealth alongside our limited partners. Secondarily, we offer an investor friendly fee structure. We charge a modest management fee to support investment operations and charge an annual incentive fee on new profits only. Finally, commensurate with our fee structure which is intentionally structured such that the majority of fund earnings will be earned only if we generate compelling investment results, we commit to operating the fund as a boutique shop with a limited asset size. As many of our best investments often come from small stocks, we believe it is important to preserve our ability to take concentrated positions in our best ideas. Our size and structure ensure we are incentivized to generate compelling returns, not gather assets.

Think of it this way. On the one hand, we are incentivized to generate the best investment results possible. On the other hand, we are unwilling to invest in a way we feel is likely to result in a meaningful loss of our own investment capital. What more could one want from an investment manager?