“When everybody knows something is so, nobody knows nothin’” – Andy Grove*

Dear fellow investors,

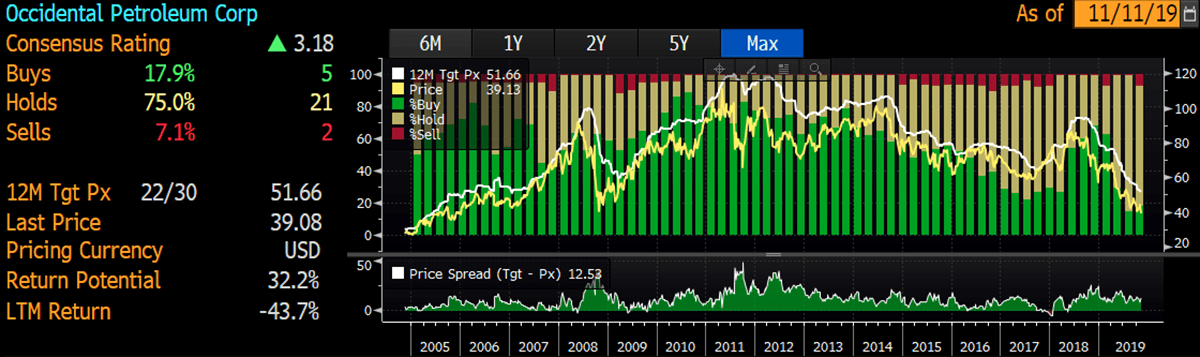

As Carl Icahn bailed out on Occidental Petroleum (OXY) common shares recently, selling spread as traders and algorithms begged on more selling. The research analysts who follow OXY have become even more negative and have adjusted their overwhelming bearishness to the highest level of negativity since at least 2004 (see chart below).

Q3 2019 hedge fund letters, conferences and more

Source: Bloomberg.

There are two psychological extremes in the stock market. First, when a group of stocks has an unusually long streak of success, the success gets extrapolated way out into the future. In effect, the massive crowd “knows that something is so.” Second, groups of stocks which stay in the doghouse a long time or suffer a huge price decline in an uninterrupted fashion become nearly universally hated.

Is there anyone who doesn’t “know” how much technology has affected our lives? If you didn’t “know” better, you’d think that you should put all your money into data analytics and artificial intelligence. Unfortunately for investors, technology doesn’t make the top 20 industries which will be prospered by the aging of our largest adult population group (see chart below).

Source: Bloomberg.

We consider the Wall Street research analysts to be very representative of measuring “when everyone knows something is so.” See the analysts’ consensus on stocks like Microsoft (MSFT), Amazon (AMZN), Salesforce (CRM), Visa (V), Mastercard (MA) and Facebook (FB) below:

Source: CNBC.

We’d like to argue that investors are running the risk of “knowing nothin’.” Where will the additional enthusiasm for these popular stocks come from?

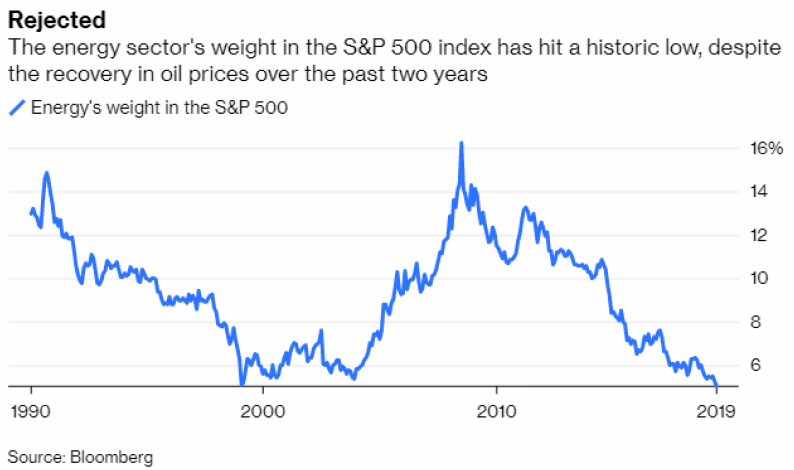

Here is the chart of energy in the S&P 500 Index:

Everyone knows how bad energy stocks have done the last five years and how much excitement electric cars have created. We believe smart money investors inside and outside the industry have taken notice. Icahn bought a sizable stake in OXY. Chevron (CVX) offered $33 billion to buy Anadarko Petroleum and got outbid by OXY at $38 billion.

Warren Buffett and Charlie Munger were happy to provide $10 billion of capital in exchange for preferred shares yielding 8% and providing 80 million warrants to buy OXY common shares at $62.50. Be reminded, he did the same thing for Goldman Sachs in late 2008 and Bank of America in 2010. At that time, the analysts thought the banks were lousy investments because they all “knew” the recovery would take too long.

If you want a better feel in understanding why OXY wanted Anadarko, click on the link to Chevron’s presentation when they thought they had sealed their acquisition of Anadarko before OXY stepped in.

As contrarian investors, we seek to buy meritorious companies when the analysts appear to be in complete agreement and “know” what “everyone knows.” We could be wrong about OXY and their officers and directors (who have been aggressive open market buyers) could be wrong about loading up on the stock themselves, but it represents a very cheap set of assets that are in an S&P 500 sector at 40-year lows in affection.

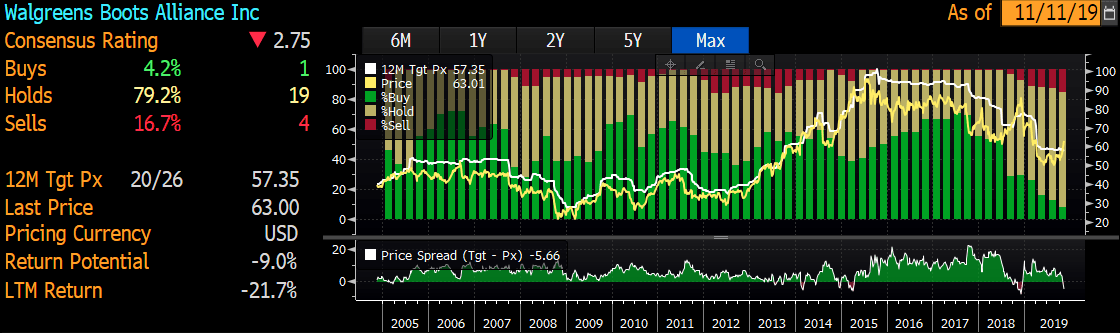

Lastly, Walgreens (WBA) issues 23% of all the prescriptions in the U.S. They have 17,000 attractive locations all over the world for distributing goods conveniently. They have been a consistent wealth creator whose stock has plummeted in the last two years. “Everyone knows” that Amazon will happily lose money delivering low-margin products to your doorstep forever.

Therefore, until last week, WBA was trading at a “walking dead” earnings multiple of 9 times. If you look below you will find that the analysts seem to “know” they are doomed.

Source: Bloomberg.

In reaction, the largest shareholder, Stefano Pessina (16%), is seeking to take the company private. How did the analysts react? Just like they did on OXY, by becoming more bearish as it went down.

In summary, we are thankful that the crowd has been wrong at extremes historically and believe that analysts provide an easy way to look at it when “everyone” might “know nothin’.” In today’s environment that could mean lightening up on glamor tech stocks and expensive growth stocks while adding to depressed holdings which could be affected by the aging of the population

Warm regards,

William Smead

*Quoting his professor from the City College of New York.

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO and CEO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2019 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com.