Transcript of RealVision‘s interview with Bitcoin Legend Dan Morehead of Pantera on comprehensive conversation between money managers about the most critical aspects of the crypto trade.

The content and use of this transcription is intended for the use of registered users only. The transcription represents the contributor’s personal views and is for general information only. It is not intended to amount to specific investment advice on which you should rely. We will not be liable to any user for any loss or damage arising under or in connection with the use or reliance of the transcription.

Q3 2019 hedge fund letters, conferences and more

DAN MOREHEAD: Yeah, so I think the reason I'm excited about Bitcoin is when you have a disruptive technology, they call it a category killer. Bitcoin's a serial killer. It's going to go through 40 or 50 different industries, well storage, cross border money movement, property titles, voting rights, identity. Those are all the biggest use cases on earth.

DAN TAPIERO: Good afternoon, everybody. I'm Dan Tapiero of DTAP Capital, GBI, Gold Bullion International. Today, I'm happy to be here with an old friend, one of the few guys with a strong macro background who is in the Bitcoin world, Dan Morehead, and I have to say we've known each other probably 20 years, so this might be a little lighthearted chat as well. Now, Dan was the first traditional macro fund manager to identify the Bitcoin opportunity.

Just so the audience understands, what that means is that the macro world that we're in is filled with some of the greatest investors of all time, George Soros, Julian Robertson, who we both worked for and Dan was the sole manager in this space to identify it and execute on it in that world. Of course, others followed. Some of our contemporaries as well. I think generally, as a macro guy and looking out at the Bitcoin world, Dan is one of the guys on the Mount Olympus. I know I said that the other day and you chuckled a little bit, but from our perspective, the guys who saw the opportunity but didn't execute and transact on it, Dan really lead the way. With great pleasure, I introduced Dan Morehead. Dan.

DAN MOREHEAD: It's great to be here. Thanks.

DAN TAPIERO: Yeah. Why don't we just talk about that initial moment? There's a lot of-- you've done a few interviews and I've watched them and I don't want to go over the same stuff like, what was your Bitcoin moment, but in a way, having your macro background, what in that allowed you to see that Bitcoin was a great opportunity?

DAN MOREHEAD: Yeah. In macro, we're always traveling around the world looking for asymmetric opportunities. You put $1 in, you might be able to make five or 10, but you can only risk one. There are a few those that come along. Every three, four years there's something like Russian privatization or Argentine farmland or Tesla Motors. There's a trade like that that comes up. That's been a fun experiences. Tiger and my career before that, looking around for those things, and then in 2011, my brother introduced me to Bitcoin. It took a while to get my head around it.

There was only a few things on the white paper and Wikipedia was like a half a page. I thought, oh, yeah, that's really great idea. I hope it happens, but didn't really do much about it. The funny bit is that was back when they were giving away free Bitcoins. Gavin Andreessen, who was the chief scientist of Bitcoin had a thing called the Bitcoin Faucet and all you had to do is log in and get free bitcoins, that's how fuzzy that thing was.

Then in 2013, Pete Berger of Fortress and Mike Novogratz, who I'd worked with and gone to school with, called and said, hey, we're starting to think about Bitcoin, you want to have a coffee and talk about it? After about an hour, my head was starting to spin. I basically just focused on it for the next three or four months, didn't do anything else other than read about Bitcoin and I can't believe it's the biggest trade of our generation, so I'm all in.

DAN TAPIERO: Yeah, but how did you-- I understand you did the digging, but there are a lot of macro guys just as smart, they didn't quite make that adjustment, they couldn't quite see it. Bitcoin to me is different than those other macro opportunities because you could still use a traditional macro framework for understanding it. Yes, a symmetric risk reward etc., but what was it that pushed you over?

DAN MOREHEAD: Yeah, so I think the reason I'm excited about Bitcoin is when you have a disruptive technology, they call it a category killer. Bitcoin's a serial killer. It's going to go through 40 or 50 different industries, well storage, cross border money movement, property titles, voting rights, identity, and those are all the biggest use cases on earth. If you think about somebody who invents like a new medical device, and there's only 100,000 people on earth that have that condition, it's pretty kept on with that medical device's worth.

This is going after the biggest things, 300 billion of electronic payments, remittance. Well storage, gold is your well where $7 trillion market cap, and even currency, currency is 100 trillion market cap. All of the cryptocurrencies combined are a quarter of a trillion. That's the leverage I'm talking about, you're starting with such a small base against an enormous opportunity. Even if blockchain fails that 10 of those use cases, there's still 40 other use cases it's really good at and that's why I think it's the trade of a generation.

DAN TAPIERO: Why do so many smart guys still resist it? I can go through various examples, while one of my old mentors even went on TV a month or two ago and said, I just don't-- a guy in his late 60s, very well known, I just don't get it. I want no part of it.

DAN MOREHEAD: Yeah. One of the rationales is we already have a currency, the US dollar. Why do we need to currency? My argument to that would be yes, you and I live in the United States, we have solid financial system, we have a currency that only depreciates 90% over the last 80 years, so it's not as bad as some of the other currencies out there. But keep in mind there's 200 currencies on earth and bitcoin's just to a one. There's a lot of people that are--

DAN TAPIERO: But a global macro guy should get that. What's stopping them? You know the crowd? Our old crowd.

DAN MOREHEAD: 6 billion people live in countries with really crappy currencies. They vastly benefited by using Bitcoin or another cryptocurrency. Sometimes, I think people just resent something that's an asymmetric trade that they missed and maybe this is a bit of a West Coast, East Coast thing. Like every Lyft driver in California is talking crypto and Wall Street people are probably more negative than people on the West Coast.

DAN TAPIERO: Right, and that's where traditionally the financial macro guys have been and are so. That's interesting. Is that also an age divide thing?

DAN MOREHEAD: Yeah. I think there's a big age divide, obviously, millennials have grown up, VenMo and everything and totally living on their phone and mobile money makes sense to them. Then the older generation might be a bit more reactionary. A good example of the negative opinion from very famous investors, Warren Buffett has been a fantastic investor but on Bitcoin, he's been super negative. He likes to call it rat poison.

DAN TAPIERO: He's still rat poisoning.

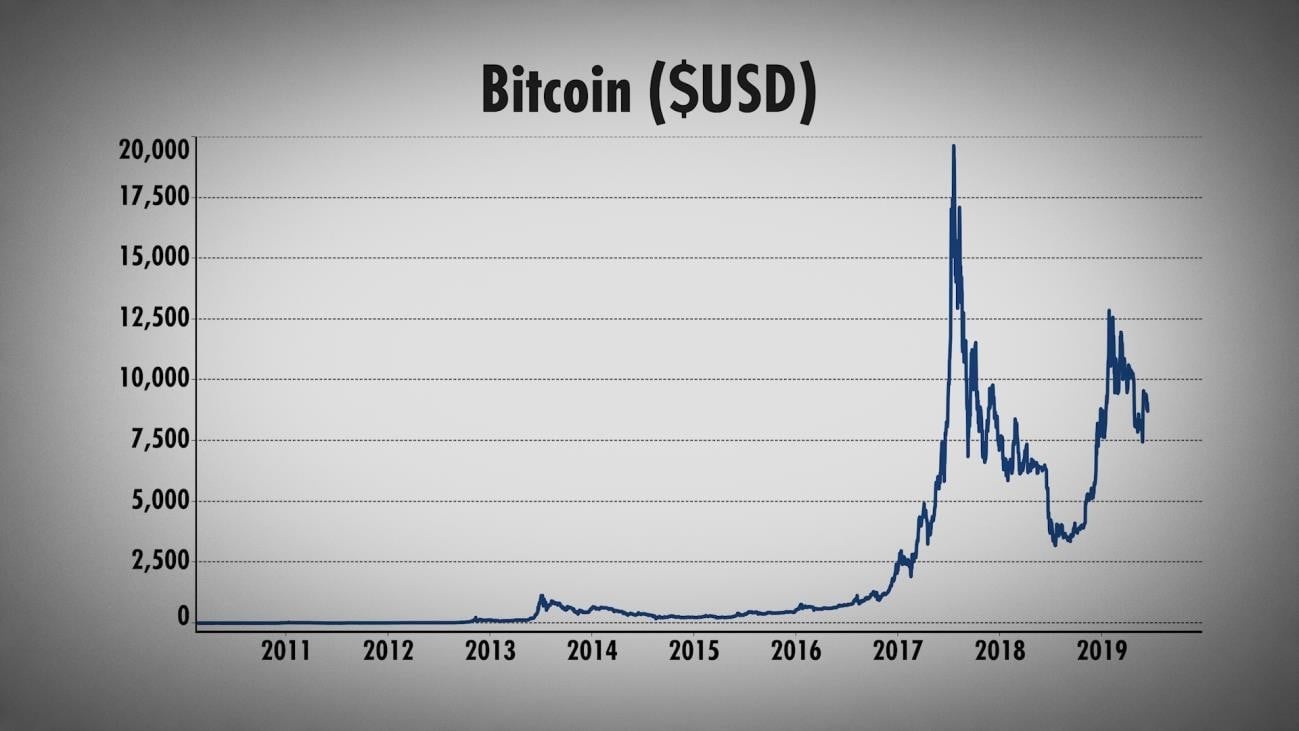

DAN MOREHEAD: I think he caught up, but at least a year ago, he's still doing it. My point would be when he first said that, Bitcoin was trading at 200 bucks, it's now at 10,000. I don't think it's 100% certainty that Bitcoin was going to go up at $200. Even here, I don't think it's 100% certain it's going to go up, but on a risk adjusted basis, it's a fantastic trade. Because if you say it's a bad trade at 200, and it actually goes to 10,000, you needed to be 99% sure it was going to go to zero when it was at 200 to have it not be a rational trade.

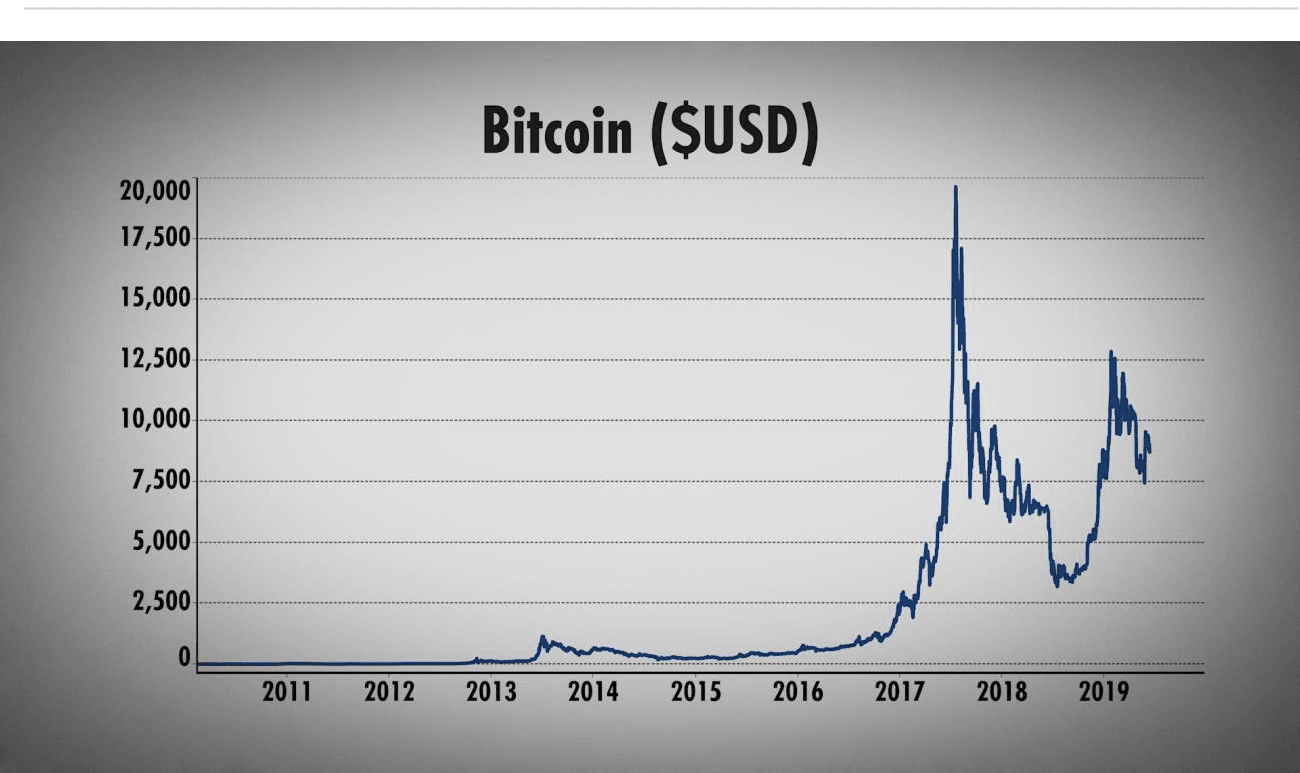

That's my view, is it's speculative, it could certainly go down. It's had some periods where it goes down 80% in six months, but it could go up 10x, 50x, numbers you just don't see in any other asset. That's the asymmetry that I think makes it a great trade.

DAN TAPIERO: Yeah. People in the space talk a lot about adoption. That's why I was asking you about when can we get some of these smarter guys imagine -- Xi, President Xi of China comes on TV and he says, well, we're going to be the leaders in blockchain technology then goes up 30%. I don't like attributing news to movement in Bitcoin. I think that's the trade. That was a very supportive comment, when-- we talked about adoption a lot in the space, what's going to be that Netscape moment where guys go, aha?

DAN MOREHEAD: Yeah. A common thing for the negative people on Bitcoin is like, hey, there's no killer app of Bitcoin. There's really two answers to that. The first half ironic answer is well, bitcoin's the killer app of Bitcoin. It's already storing 200 billion of wealth. It's been doing a great for 11 years. It's 24/7 uptime, never been counterfeited, never been hacked. That's the combined value of all the sexy unicorns together. Like Lyft, Uber, whatever, WeWork, that all that were still--

DAN TAPIERO: WeWork disappeared.

DAN MOREHEAD: Well, 7 billion still. You add up all those supposedly amazing apps, it's no less than Bitcoin. Bitcoin's done a great job already. Even when the detractors say, oh, it's just digital gold. Well, if that's its worst case, that's amazing. 7 trillion market, that's fine. That's at least the first layer, but when you peel that onion back, it's really already working great for cross border money movement. In the US, our systems were great. My REI card gives me 1% cash back so I don't think the system's broken.

But if you do don't live in a developed economy, the system's totally broken. Like if you live in an emerging market current country, you know your currency is depreciating and it's very hard to move money around. In the developing world, Bitcoins are already very well used. I'm on the board, I recently left the board of [indiscernible] in Africa, it's now doing $150 million a month of business helping people move money around Africa with Bitcoin. The funny surprise, when we started the company, we thought it was all about remittance, 300 bucks, 500 bucks. They have huge multinationals using it because it's so hard to move money around Africa [indiscernible].

DAN TAPIERO: Is that right? Like which ones?

DAN MOREHEAD: It's like top10. It's like top 10 multinationals because the banking system is so difficult. The regulations, very expensive. There's only two correspondent banks on earth that can move money into or out of the 29 countries of Africa. It's really expensive. The remittance cost into Africa is 12%. If you have a migrant worker in the United States, they spend more than a month working for their remittance company. Their family only gets 10 and a half months of their wages. It's very expensive.

The other example would be we just sold a company called Coin.ph in the Philippines, they have one out of every 10 adults as a client. That's already totally real. It's totally happening. That'd be a great example of the future of money. There are three times as many Filipinos with a Facebook account, as with a bank account, and honestly, that's where we're heading. That people are used to dealing online on their phone, and the future of money is on a phone rather than with some big ionic column marble bank branch built in every 10,000 islands in the Philippines.

DAN TAPIERO: Right. Where you worked for years before Tiger. That's a nice segue into Libra. You mentioned Facebook and Libra and Culebra. Do you think that's the future?

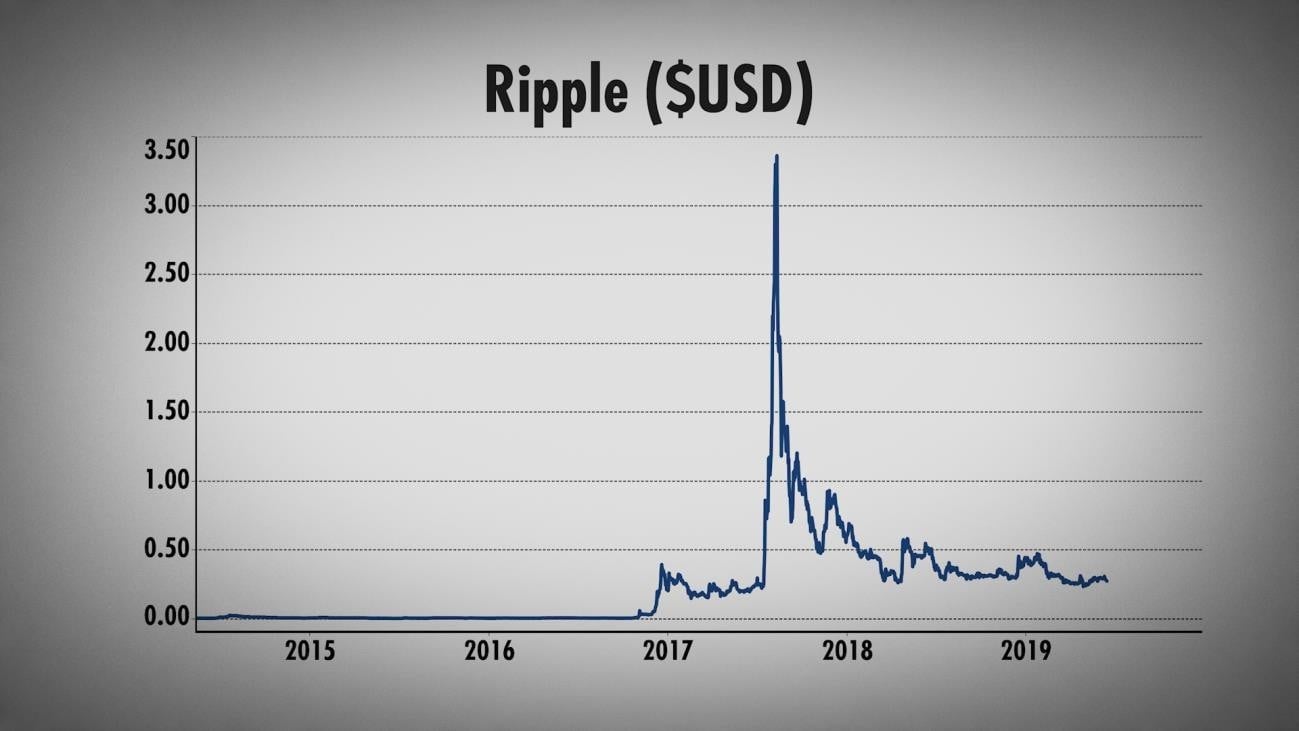

DAN MOREHEAD: Oh, I think that is definitely the future to have a global, essentially stable coin, a token that doesn't have the volatility that Bitcoin or XRP has. There's different use cases, Bitcoin, XRP are going to do some amazing things, but the global consumer wants something that's not crazy volatility, something pegged to a basket of currencies. I think David Marcus at Facebook did a great job creating Libra and all the partners that came together. It's a brilliant design, I think they walked a fine line between being totally centralized, walled garden, like the data monopolists are doing most of the businesses and that's very difficult to get through. That would be DOA basically.

Then on the other extreme, it would be totally decentralized, which is really hard to organize and probably wouldn't ever get off the ground. They did a federated system where 100 different entities will stand this thing up and then over time decentralize it. Facebook's only one of those hundreds, so they're taking an enormous amount of the attention, but they're only 1% of the ownership of Libor. It's going to be very broad constituent group.

I think they did a genius job picking a basket of currencies. Most stable coins are backed by the US dollar, a few are backed by gold, but this is the first one at least I'm aware of where they picked four or five currencies, the dollar, the Euro, the oldest currency on Earth, the British pound, and one of the oldest

currencies, the yen, and gives-- so it gives everybody on Earth a currency that's pretty stable relative to their own currency. They don't really have to think about it. They can store a couple hundred bucks in Libra and if they need to buy something from a foreign merchant, or if they want to do an Airbnb purchase in another country, they can use that as a global payment system.

DAN TAPIERO: Do you think they'll incorporate Bitcoin in there even 5% or 3%?

DAN MOREHEAD: Oh, that's a good question. I don't think there's any current plans to do that. In reality, I think they didn't do themselves as-- by calling it a brand new currency really got the regulators hyperventilate. It's really just a money market fund with a little IOU depository thing attached to it. I think it's funny that Franklin Templeton announced a money market fund that's on the blockchain and essentially, nobody cared. When Facebook announced something that's just a for-currency money market fund, but they called it a new global currency, everyone went crazy.

DAN TAPIERO: I guess that leads into the next thing about regulation. Everyone goes crazy just on a buzzword. How do you see regulation developing, it seems to be more intrusive in the US and less so other places, want to talk about how do you see that developing?

DAN MOREHEAD: Yeah. There's a great line that the former chairman of CFTC, Christian Carla, said at our conference couple weeks ago in San Francisco. He called Libra and then the Chinese announcement, the Sputnik moment for global currency. I really think that's a great line. For the youngsters out there, Sputnik was when the Soviets launched the rocket and the US was way behind in the so-called space race, and really got the entire government, Eisenhower and Kennedy, to engage.

I think we're there now. Facebook put us on notice that they're going to launch a global payment system slash currency. Then the Chinese announced essentially similar and competitive venture. It is essentially game on for blockchain. I think that Facebook's announcement's fantastic, because it basically started the clock ticking. Somebody has to get this done, whether it's Libra or something like it, or even the Chinese version, somebody will get this done in the next couple of years. I think I'd love to see the United States continuing to lead. The US basically led the development of the internet, we should hopefully lead the development of a global currency.

DAN TAPIERO: Oh, so you think that's where we're heading? We're heading towards a global currency in some form or another?

DAN MOREHEAD: I think so. There's a great line I've always loved from the Watergate era, Haldeman told the White House Council, once the toothpaste gets out of the tube, it's going to be really hard to put it back in. Satoshi got blockchain out of the tube. I feel like regulators right now were trying to stuff that toothpaste back in the tube and it's out-- so it's game on, somebody's going to do it. There will be I think a handful-- I'm not a maximalist, there's just be one global currency.

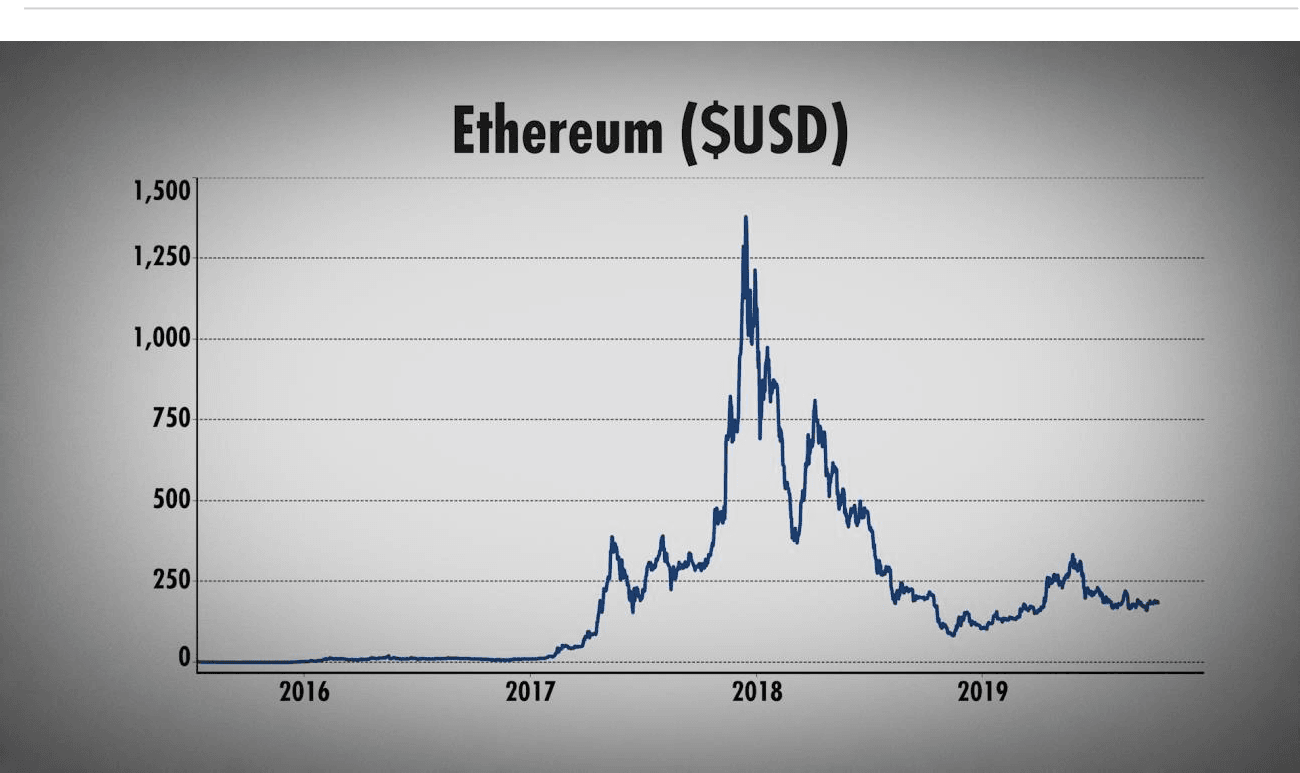

I think there's going to be a single digit number of global currencies. There's going to be probably the existing ones, Bitcoin, Ethereum, XRP but there will be some stable coins, like Circles, USDC or Libra. Then obviously, there's going to be Chinese version of those.

DAN TAPIERO: Yeah, but what about other countries getting involved? The market now is still relatively small. If you think the entire market cap, including the value of the equity, the old coins, it's close to 400 billion. Big number versus what it was. Does Russia get involve? Does the EU decide that they want to get involved? What's the chance that you have some other countries really start to focus on it and that it really is a global Sputnik moment?

DAN MOREHEAD: I think you're right, is that it's now game on. All the countries are going to try and figure out their digital currency strategy but digital currencies don't make things better just by being digital. Russia's announcing bit ruble. It's probably going to be episodically terrible as the ruble, ruble. By just making it a token doesn't make it something you'd want to store your global currency reserves in.

Tokenization has only a few advantages. One is speed of transfer and in the US, Fed wires is three hours. Antiquated. There are countries like Korea where you can do domestic payment like two nanoseconds, whereas in the US, it's three hours. Even if you want to send your counterparty a million dollars, it would still take you three hours to get it done. A token can do it in seconds. That's great.

The other one is borderlessness. US Fed wire only works in the United States. If you want to send money to Japan, it doesn't work. Then you have to click into SWIFT or some other really slow system and so those are really the two principal advantages, borderlessness and speed. The principal value still-- of what's backing it like US dollars or a basket like in Libra, I think it's what people are going to be comfortable with rather than getting some new currency like the bit ruble, I don't think it's going to be huge.

DAN TAPIERO: Right. I often say that if Bitcoin is 20 things, digital gold, for instance, is just one of those 20 or payments is another one. What about the whole concept of programmable money or the leverage off of the security network? How do you think some of those things projects in those spaces are looking and what do you see in the future?

DAN MOREHEAD: Yeah, it's really exciting.

DAN TAPIERO: It's other use cases in ways.

DAN MOREHEAD: Yeah, Bitcoin has collective communities decided to keep it very stable, not change it, which is an advantage if you're storing a couple hundred million dollars of wealth in it. Disadvantage if you want to do higher order things like smart contracts. Ethereum has essentially taken that use case.

It is like you said programmable money, so you can do really cool things where you have conditional payments that only a computer is activating, so you take out all those middlemen, the Escrow agents, the casinos, all the people that take a rake from helping conditional payments be processed. Those have not been as successful as people had hoped essentially because of the very small throughput of both the Bitcoin blockchain and Ethereum blockchain. Each of those can do about seven transactions per second.

DAN TAPIERO: What about Lightning and some of these things, haven't we gone beyond that?

DAN MOREHEAD: Yeah, so we're just now there. The way I would say it is four or five years ago, bitcoins seemed to change the world. Then it got to seven transactions per second and it got capped out and then we started paying $20 for a Bitcoin transaction. That was essentially what we're trying to get away from, is paying huge fees to do transactions.

We've had three years of stalled growth in the ecosystem where we're capped at a certain number of transactions per second. There's a dozen really cool projects like Lightning and Arbitrum and StarkWare, bloXroute that are building either solutions on top of the existing blockchains, layer two solutions or bloXroute's called the layer zero because it's below the blockchain itself. Each of those is trying to scale blockchains orders of magnitude like 100x, 1000x.

A couple of years ago, it was all just an idea and hope. Now, it's code. bloXroute's actually ready to go live, the other ones are in testing, going to go live in the next six months. That, to me, is the biggest news in blockchain right now is that we've had this frustrating period where you build these really cool apps that just actually you have terrible user experience, because they're just too slow, wherein probably a year's time, if you're pumping through hundred times more transactions than we are now, things like Auger and other projects that really need higher throughput to be useful will really take off.

DAN TAPIERO: What about the nonpayment uses?

DAN MOREHEAD: Yeah, so there's obviously, cross border money movements broken. That's where it's taking off. There's a lot of nonpayment use cases coming. A lot of those are still stymied, like gambling and all the other cool things that smart contracts can do, just because that they're in, can't pump through enough transactions to make the user experience great. Then there's all kinds of things like property titles, mortgages on the blockchain, identity, but those are going to take a while to roll out. Those, for either bureaucratic reasons or adoption reasons, they'll take a decade for some of those to roll out.

DAN TAPIERO: Yeah, I'm asking about this, because you're generally known as one of the most prolific investors in the ecosystem. I think a lot of the people who don't understand Bitcoin or who are nowhere in terms of adoption, they don't quite understand that there is this entire world that has grown up around the Bitcoin invention is what I would call it, and that there are literally thousands of-- 10s of thousands of super high quality young people in this space, building all kinds of interesting things. Maybe talk about some of those projects, some of the things you're most excited about.

DAN MOREHEAD: Yeah. Right now, the stuff we're investing in, scalability is really paramount. We've invested in a handful of projects that are going to help pump more transactions through these main blockchains. bloXroute is a fantastic project, StarkWare, Arbitrum, those are the ones they're going to be able to allow the existing blockchains to do much higher throughput. The other big theme, we're still investing in exchanges. There will come a day where everyone's being paid by their employer in crypto, and they can pay for groceries in crypto, but that's not yet. In order to get crypto you have to go through an exchange.

We've most recently invested in Bax, which the intercontinental exchange, the parent company of NYSE, New York Stock Exchange has done, they've just gone live with the fascinating set of products. It's the first daily physical [indiscernible] future in the world. You can do daily futures that if you let it go to expiry, which is the end of the day, you get delivered Bitcoin and that is just I think a really cool hybrid of all the benefits to futures for those people who don't want to take delivery, they just want to trade something and cash it out. It's just a futures contract but people actually want to end up owning Bitcoin can use that.

Especially on the flip side, retailers, merchants can use that to cash in whatever Bitcoin they're taking at their point of sale in for US dollar. Say if you're one of the bank partners with Starbucks, they're a US- based company, they report earnings in dollars so when they sell a coffee in Japan, they immediately convert the yen back into dollars. They need to do the same with Bitcoin. Bitcoin's just another one of their foreign currencies. On Bakkt, they can essentially send their Bitcoin and at the end of the day, cash out and get back into US dollars. I think that's going to allow a greater adoption of merchants to start taking Bitcoin.

DAN TAPIERO: Yeah, that's I guess on the retail level. What do you think about the-- and I don't know if you've read Saifedean Ammous' book, The Bitcoin Standard.

DAN MOREHEAD: I've heard him speak, he's on speaker.

DAN TAPIERO: Yeah. Well, this concept that it's going to be-- it's not really for payments, retail payments, but it's more that it'll end up being the final settlement layer, that it will be the architecture underneath all of the payment, the money movement rails for everything around the world. That argument is really that don't worry about scalability. It's a store of value and at some point when the value was high enough, it will become used more, but that it's true because of its intense security properties, that that will be its true use.

DAN MOREHEAD: I like that argument that it's going to be the interoperability layer for moving money around. I don't think it's ever going to be on the board at Starbucks. It's you're never going to see the prices in Satoshi's. Because everyone has their own local native currency and even if Bitcoin or another blockchain is massively used around the world, trillions of dollars in market cap and all that stuff. You and I bumped into each other at Starbucks on the way here, it's still going to mean US dollars and in Japan, it's still going to mean yen. Because not enough people even have Bitcoin or whichever currency they will be using. It's impractical to ever quote anything other than the native currency.

Then an issue currently, not 10 years from now, is Bitcoin is such a deflationary currency. Most people don't want to spend it. The first transaction in Bitcoin was Lazlo buying two pizzas for 10,000 bitcoins. Everyone was talking about that. The reality is most people are unwilling to want to part with their Bitcoin. The thing I think about is in 2014, Expedia started taking Bitcoin so in order to support the system, I made sure that Pantera, every time we booked any travel, we always pay with Bitcoin. I could probably buy them [indiscernible]. That is the thing that annoys people from wanting to use it.

DAN TAPIERO: Yeah. The-- not counterargument, but there is an argument that at a certain price, most people will be willing to part with it. I think the Bitcoin maximalist people think, well, yeah, well, when Bitcoin's $500,000 as a Bitcoin, plenty of it will come out. I actually think that's-- I like that as a framework. People would say that it's put away, so what's the point of it if no one actually uses it and spends it, but then you said Satoshi's sats, stack sats and all of that, that whole concept, that could be the way that we think about it.

DAN MOREHEAD: Yeah, that's like any other very exponential asset, like you probably don't want to spend your Apple stock in 1980, but now that Apple's at an equilibrium, and it's not going to go up 10x from here, people want to sell their Apple stock and buy something with it. It's the same with Bitcoin, that in 10 years, it's going to be at 500,000 or wherever the number is, where it's at something more of an equilibrium price. I just think right now, you wouldn't want to buy a coffee with Bitcoin because you might be able to buy a cup of coffees next year with it yet.

DAN TAPIERO: Or Starbucks itself in a few years. As you've said, you're all in, in Bitcoin an ecosystem. What-- and you've already had huge success, but what keeps you up at night? What's that little worry you have about the space itself?

DAN MOREHEAD: Yeah. I guess I would say the early days, there were a ton of worries. Like Bitcoin might get hacked or G7 might outlaw the possession of Bitcoin or whatever. I think we've really reached the escape velocity on most of those issues. I don't worry anymore that, 20 years from now, blockchain's not going to have been big and important. It definitely will be.

The thing I worry about from a business perspective is maybe we're just drinking too much the Kool Aid and it's going to take a decade or two rather than three or four years and as a venture investor, you're writing a check to an entrepreneur who's going to burn through that money over the next couple years. If it takes 10, they're going to burn through the money and we missed it because we're too early. That's always an interesting question in trading is are you too early on something? I'm not any more worried about where the blockchain is going to be relevant.

DAN TAPIERO: Couldn't you just avoid that problem a little bit by investing in companies that are more mature in the space?

DAN MOREHEAD: Somewhat and then--

DAN TAPIERO: I mean you don't have the same risk, the same return profile?

DAN MOREHEAD: Yeah. On the flip side, investing in the tokens themselves like Bitcoin, there's no cost to carry. There's no expiration date, there's no burn. You buy a bitcoin, you secure your password and don't look at it for 20 years. There is no cost of carry there. The main worry is really just timing whether we might be early on this.

DAN TAPIERO: That's interesting. It's funny because I think hear that argument and I think it has a 10- year track record of being a 300% annualized. I just think to myself looking at different funds, if I saw any fund or anything that had a 10-year track record of even 17%, I would be totally like blown away. There's somehow this, I guess, it's cognitive dissonance about it, that doesn't compute with people. That it actually is an asset, and so maybe talk about like the development of Bitcoin as an asset within people's portfolio.

DAN MOREHEAD: Yeah. I think it's like the other, what are now called asset classes, like EEM or commodities. When we started, they weren't asset classes. They had nothing to do with what we were trading. I started out as a mortgage trader and I had no idea what's going on the oil market. I didn't care because bonds were completely separate from stocks and stocks are completely separate from commodities.

Then we invented things like the GSCI and your bullion futures to allow people to get access to things that used to be really funky and different. With modern portfolio theory, everyone was looking for uncorrelated assets, so much so they all bought the same thing and joke of modern portfolio theory is we all end up with the same portfolio. Even the Fed chairman is talking about risk on, risk off like even it's now a phrase that is used in business. Because if we all own the same portfolio and some shock to the system happens, and everyone wants to reduce their risk by 3%, they're all selling exactly the same stuff. That's why in shocks, things that aren't completely uncorrelated in the real world like timber and the S&P 500 actually both go down together.

That's why blockchain is a dream asset. Like you said, it's got an eight-year compound annual growth rate of 235% a year and has zero correlation to anything and that is that's a dream asset. You should have that in your portfolio.

DAN TAPIERO: You would think but it's still I'm sure you're out there on the road speaking to investors, and somehow, they're still saying, well, what about Mt. Gox, or, I heard it was hacked and like, no, it wasn't hacked. A big part I think of being in this space is education. In this interview that I did with Real Vision a few months ago, I really stressed this like the people in this space somehow have to, I don't know, they say Bitcoin has no marketing department and Bitcoin has no CEO and those are all wonderful things. Somehow, somebody has to explain to people in English, in normal language that they can understand, the benefits and so what have you done on the education front or Pantera? Are you going to endow a school at Princeton maybe, a scholarship, of Bitcoin [indiscernible] and get together and do that? What's your thought about that?

DAN MOREHEAD: Yeah. That's a great question that we're evangelizing a whole new asset class. We're trying to spread the good news to everyone and get it out there. There's been a couple of things that were sticking points if I look back, and I was out there talking to the top and down in 2013, saying, hey, buy Pantera Bitcoin Fund because it could go up like 100x. Nobody did buy that.

DAN TAPIERO: More than 100.

DAN MOREHEAD: It's like 150x.

DAN TAPIERO: 150x. Okay. That was a good call.

DAN MOREHEAD: The two things I learned in hindsight were if you go to an asset allocator and say I want to sell you a single stock thing, that's putting a lot of pressure on them because then they essentially are picking this stock. In this case, it's called Bitcoin but it put so much direct heat on them compared to normally, they're allocating to whole asset classes, or five managers that each have 100 things in their portfolio, they get a diversified thing. You're offering incredibly concentrated thing.

The risk reward in their careers is pretty lopsided. If they invest in a thing, and it really does go up 150x, I'm sure they get some kudos around the office. If it goes to zero, they get fired. It was a really bad risk reward to offer and the big change there is now, there are dozens of different assets to invest in. It's not just Bitcoin anymore. There's probably 30 or so really interesting blockchains that we're invested in.

DAN TAPIERO: Even tokens, specifically.

DAN MOREHEAD: Different tokens, Ethereum, XRP, whatever, a bunch of things now, so you can build a basket of things. Then the other big one is custody. When we're aftermarketing this thing, there was a point, I had 250,000 bitcoins in my head, and that's pretty edgy. There wasn't a lot, Xapo didn't exist. Coinbase didn't exist. We had to build our own cold storage and all those things.

DAN TAPIERO: Never wrote it down. It didn't happen.

DAN MOREHEAD: I had it backed up here and there but like, it's pretty edgy. That was the other bigger line from institutional investors that hey, we can't do this until there's like totally dialed custody. We're actually there now. That's the great news. It's backed. It's doing custody. It's insured.

Fidelity is doing custody. There's other, SX, Xapo, Coinbase, it's a bunch of people doing very institutional grade custody and I think that's the huge change where if a couple of years ago, an endowment said hey, I want to buy $5 million of Bitcoin and I'm going to do it on some young Bitcoin exchange, then went to the Investment Committee with that, they get fired. If you go in now and say hey, I want to do it on the New York Stock Exchange's parent Bitcoin exchange, you might not get it through the IC but you're not going to get fired for saying that.

DAN TAPIERO: Talk to me a little bit about the education side. Like general to the broader population, are you involved in that at all? You're a real spokesman for this space.

DAN MOREHEAD: Yes, we've taken it as part of our role to be out there and just try and educate the world on blockchain. We do the things like our summit that we did in San Francisco, getting all of our LPs together, regulators, lawyers, portfolio companies, trying to help educate our LP base with 850 LPs so it's a lot of people that we're educating. Then on a broader thing, we send out a monthly investor letter and back in the day, we used to manage a billion dollars of normal hedge funds with about 1000 people on the distribution list. I was pretty proud of that. That's really cool. Like you and other our peers would read it. We have 40,000 people on it now.

DAN TAPIERO: Oh my goodness, on a monthly letter. 40,000.

DAN MOREHEAD: Yeah.

DAN TAPIERO: Well, done.

DAN MOREHEAD: It's been read half a million times.

DAN TAPIERO: Wow, I'm going to track these things now. Yeah.

DAN MOREHEAD: That's what we're doing try and spread the information.

DAN TAPIERO: What about GC? Because we talked about the Sputnik moment. There aren't that many people who can speak to it the way you can. What would be the plan to reach out to them? There is no plan? I don't know.

DAN MOREHEAD: Oh, yeah. I've met with regulators all around the world trying to convince them that this is something big they should address and there are some countries like Luxembourg. They're very progressive and their prime minister's visited Pantera a couple of times to see how to make their country better for blockchain, Prime Minister of Luxembourg, we actually had a king just recently visit to see how to make his country all on the blockchain.

DAN TAPIERO: Is that right? It's a small country though. DAN MOREHEAD: They're relatively small but still a country. DAN TAPIERO: Can you put a tie on for that?

DAN MOREHEAD: To me, that's a sign that things are really changing that regulators, heads of state are really trying to get engaged to figure out where this is going. You're seeing US, Steve Mnuchin's been commenting on Bitcoin, even the president of the United States is tweeting about Bitcoin. It's not totally a message yet but he's at least talking about it, which is great for visibility. I think over the next couple years, every country is going to have to get engaged.

DAN TAPIERO: One of the most interesting things about Bitcoin is it really is, it might truly be the first global not just asset, but I can't think of anything that has the ability or that does has the ability to touch every single person. Certainly who has a phone. In some ways, some people might say, well, that replacing or-- I don't want to say replacing gold, but gold is probably the only asset that is known by-- I don't want to say every single person on the planet but it certainly has-- you think about network effect, everyone knows gold. Bitcoin has the ability to be more widespread, understood more by a larger population, the whole world. The global macro background is helpful in understanding so maybe talk a little bit about this transition from gold or how it compares with gold. How do you think about that?

DAN MOREHEAD: Yeah, I think the phrase digital gold is fantastic. Gold's been great for 5000 years and like you said, ubiquitous, like everyone on earth recognizes gold and totally understands what it is. Bitcoin's going to take a long time to even get remotely close to that, but it's a similar concept that it's a global currency that can be used for transactions anywhere on Earth, but it has some properties that are better than gold. Gold is great because it's very dense, but it's not infinitely dense like Bitcoin is, it's just like a password like gold's still a physical thing. It's if you have enough of, it's heavy and it's hard to store and all those things.

DAN TAPIERO: It's actually not hard to store. I know the Bitcoin people love going on this. I have a sales and storage company. It is very, very easy to store. I'm going to put that, for all the Bitcoin people watching. It is not expensive to store. It's not hard to store, sorry. Sorry about that.

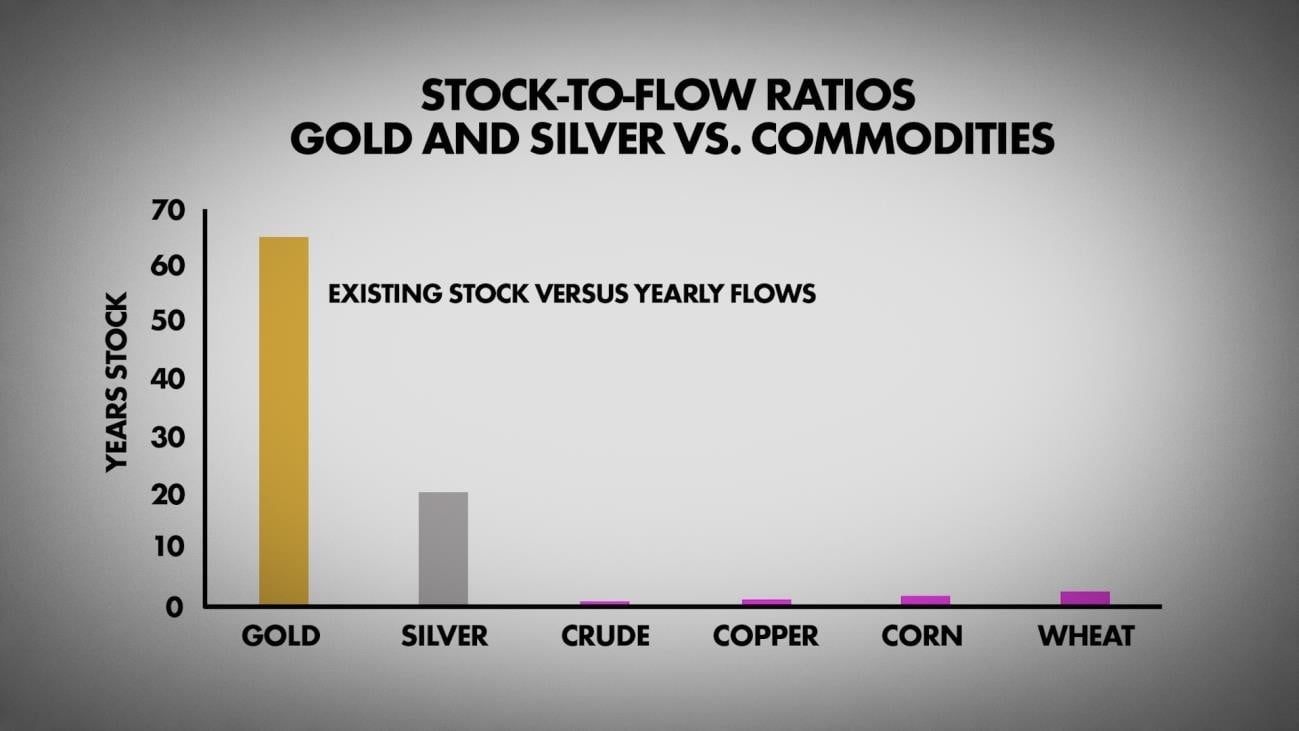

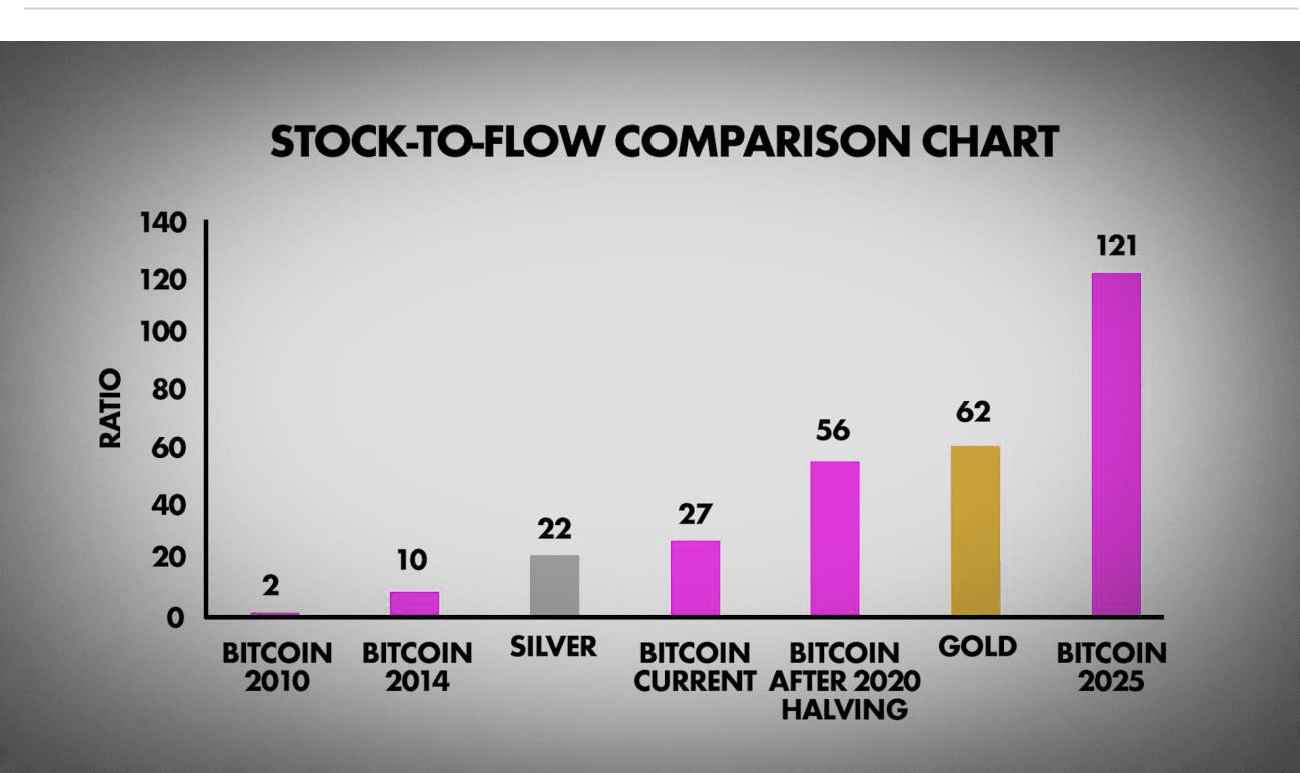

DAN MOREHEAD: Bitcoin has a lot of the properties gold has. One of the main ones is gold has very, very small production relative to the amount that's above ground. All the gold has ever been mined fits into Olympic swimming pools. That's a very small amount, and then a couple percent a year are mined, that's like Bitcoin. Bitcoin right now is mining about 3% of its stock in 2025, so only five years from now. It is going to be-- there's going to be 125 years' worth of stock above ground, if you will, in Bitcoin. Then it would be a fixed quantity like and the world goes back to the gold standard.

As soon as we went off the gold standard, all kinds of hyperinflation happen. A bunch of currencies have been destroyed. Venezuela is going through the worst humanitarian crisis it's ever been caused by something other than a war, which is amazing. Economic policy is literally resulting people dying. If we went on to a global regime where at least some citizens around the world storing their wealth in Bitcoin, people would be better off.

DAN TAPIERO: Yeah, I saw some story somewhere, maybe it was on Twitter that a guy in Argentina had invested a big chunk of his savings in Dash. The funny thing is that even what some people call non-Bitcoin, some of the old coins aren't as high quality, but even having your wealth in something of lower quality than Bitcoin still saved you, basically. In a way that that is a gold, in a way, a gold proxy.

DAN MOREHEAD: It is amazing actually how much government store in gold, that 40 centuries ago, the Pharaoh in Egypt built this huge stone pyramid and put a bunch of gold underneath it. The US has a big stone pyramid in Kentucky called Fort Knox and we store 12 million years of American worker wages under there in gold.

DAN TAPIERO: Well, Ollari think about that 12 million--

DAN MOREHEAD: 12 million worker years stored under Fort Knox. Someday, a small percentage of that's going to go into Bitcoin and it'll start growing. I think over time, Bitcoin will start becoming a reserve currency slash gold.

TAPIERO: Okay, but no governments have-- or have some governments wanting to buy--

DAN MOREHEAD: I'm not aware of any government buying Bitcoin as a reserve as of yet, but I think within the next couple of years, you'll see smaller, edgier countries do it.

TAPIERO: You're talking more about the countries that have problems with their monetary regimes or a king who visited you?

DAN MOREHEAD: He did want to talk about that.

TAPIERO: Maybe it really works and like that becomes a test case.

DAN MOREHEAD: Well, yeah, and I think the client base for that theory would be the countries that complain about US dollar hedged money. There's a whole group of countries that are saying, hey, we really wish the US dollar wasn't a global reserve currency, but there isn't another choice right now. Bitcoin and or some future thing like a Libra could ultimately end up being a global reserve currency that takes away the US dollar hedged money.

DAN TAPIERO: Well, yeah, as you said before, that's probably something that happens over a long period of time because the world has just become more global. The US in the '50s and '60s was so dominant, other countries barely existed. I find that the language that the gold people have used for-- not gold bug language but the hedge against fiat debasement and words like that. The equity guys don't talk in that language and even the macro guys, not some but not as much. It's interesting that Bitcoin crowd has appropriated that language and I think it's connected to this issue of scarcity. Scarcity of Bitcoin.

When I mention that argument sometimes to people they say, well, is it really-- yeah, those 21 million units, but can't you just fork off your own one and it's the same thing? It's open source, it's easy to replicate. What do you say about that?

DAN MOREHEAD: Yeah, so that's the super snarky argument. It's like, oh, well, Bitcoin might have a fixed number, but there's an infinite number of Bitcoin copies. Bitcoin is open source software. You could make a copy and make [indiscernible] coin.

DAN TAPIERO: I have [indiscernible] coin. I'm long [indiscernible] coin.

DAN MOREHEAD: Awesome. If you get 50 million people to start using [indiscernible] coin, it's going to be worth $200 billion. That's the rub, is that bitcoin's already there, and it already has an enormous network effect, and it has an enormous number of people using it. A copy is never going to work, a new currency has to have some revolutionary advantage over Bitcoin to take market adoption. That really is the problem.

I was on Andrew Ross Serkan show and he was super negative on Bitcoin. He used the same arguments like my wife and I were walking down the street yesterday in New York, we saw some guy had his own coin and so we decided we're going to do our own coin around the kitchen table. I'm like, I got a better idea. Photo sharing. If you and your wife can get 2 billion people to share photos on your website, this can

be worth a lot. That's really the thing-- it's like Bitcoin already has 50 million people using it. It hasn't broken for 11 years like it's hard to compete with.

DAN TAPIERO: I agree with you. I think the arguments are spurious. In the community, there's a lot of focus on the scarcity model that's out there. I think that's just one component of it. I think the space tends to get very focused on certain narratives and then forgets everything else. As much as I'm very bullish on gold, and I think it's preponderance doesn't disappear. I don't think Bitcoin is impacting it negatively. I certainly don't think that people who own gold will drop gold to buy bitcoin.

There is some generational shift I think that maybe over 20, 30 years, the 35 and under crowd say, well, I see that more as a store of value and I don't know what to do with gold. The mental framework, the mental model I have is that they're cousins, and that they worked together. That language of Bitcoin, really, should speak to the gold people first so I think the early adopters, a lot of them have been people who are gold affinity.

DAN MOREHEAD: Yes. Gold is not quantitatively easible. That's the whole point.

DAN TAPIERO: Well, right. Bringing it back to macro.

DAN MOREHEAD: Back in the day, you used to be able to change $100 bill for three ounces of gold. That was a commitment of the government for 108 years. Then they broke that, and ironically criminalized the possession of gold. You could wander around with uranium, plutonium. All that was curable, but if you own gold, that was illegal. That's essentially what's happening here, is bitcoin's not quantitatively easible. It's no surprise that it now takes $4,000 to buy three ounces of gold, because they've printed a lot more dollar. If the quantity of dollars goes up, it takes more money to buy a fixed unit.

DAN TAPIERO: Yeah. Let's talk a little bit about that. That's the global macro. I think a lot of people in the Bitcoin space, they're technologists, they don't really understand that. Within the context, so people might say, well, why Bitcoin now? How much of people's interest in Bitcoin do you think is driven by negative interest rates around the world and the policies of the last 10 years? Like would we have Bitcoin anyway?

DAN MOREHEAD: Oh, yeah. That's a great question. No, Bitcoin attempts at what's now Bitcoin that were made over the last 40 years, HashCash, gold or Bitgold, there's a lot of things trying to be Bitcoin when we're in high interest rate environments, low interest rate environments, so it was going to come anyway. Given that we have low and or negative interest rates, it just makes assets like Bitcoin that have a high likelihood of going way up all that much more attractive.

You're talking about the low storage costs of gold. There's a storage cost to Swiss francs now, they have interest rates. German bunds are like negative 25 basis points. That's the storage cost of your money. You're giving them euros and paying them 25 basis points a year just to give you your money back at the end and I guess there's an Austrian bond that's trading $170 a face, you're paying 170 bucks to get 100 back in 100 years like you're paying a huge storage cost for money and again, bitcoin's neutral, there's no storage

cost. You buy it, you hold your password wherever you want to hold your password and it doesn't cost you anything to store it. Even now, you can start lending it out and there's a 68% yield you can get on.

DAN TAPIERO: Talk about that. I wanted to touch on that a little bit, the whole de-fi world. People don't realize that you can earn a pretty chunky interest rate on Bitcoin.

DAN MOREHEAD: Yeah, so projects like Maker have already got a couple hundred million of loans outstanding, where people are collateralizing it with crypto and borrowing money.

DAN TAPIERO: Can you just explain how that works? Because I think people don't understand.

DAN MOREHEAD: Decentralized finance is essentially taking the middleman out the bank or the credit card company or whoever. It has two huge features. One, it's cheaper, so you don't have to pay all the infrastructure. The other one, it's open 24/7. If you want to borrow $400 Saturday at four, it's tough. Whereas in Maker or these compound other de-fi applications, you can do it anytime day anywhere. You don't need to be physically in the United States or wherever, you can do it from Indonesia or wherever and you're collateralizing with crypto, you're borrowing money, and you're able to access borrowers and lenders are setting rates. The similar thing is then lending of crypto via-- like stock lending in Wall Street prime broker type model that now yields about 8%.

DAN TAPIERO: How are they getting 8%?

DAN MOREHEAD: Well, because people who want to short crypto need to borrow it. There's a market for people that want to-- just like the old days of shorting stocks, you need to check the borrow and attain it and that's given a yield on borrow. Then there's also a transition out of proof of stake protocols. Bitcoin, obviously proof of work, it's huge amount of computing power and electricity. Most of the newer protocols are proof of stake, which is essentially one share, one vote rather than one CPU, one vote. It's much more similar to the securities--

DAN TAPIERO: You just lost like 90% of the people who are just about to buy Bitcoin proof of stake and CPU. Then all of a sudden, everyone over 50, just like hung up on this [indiscernible].

DAN MOREHEAD: In one sense, some of the new coins pay you a yield for owning them. It's called proof of stake or proof of work. You get a 6% or 8% yield, essentially, just for owning the currency itself.

DAN TAPIERO: Yeah, I think that's phenomenal and one use case that is not discussed that much is that I think Bitcoin could end up becoming the world's savings vehicle. If you're in one of those African countries and who knows, okay, the currency is unstable, or if you're in Switzerland with minus 75 basis points, you say, hey, you know what, I'm going to hold, let's just say even 10% of my cash deposits in Bitcoin and earn a 5%, 6%, 7% yield. I think there are people out there who are-- you know what, they're the unbanked, but also people earning no savings.

It could be that that's what Bitcoin turns into, rather than something else, it just becomes a global savings. If the interest rate is really-- I mean scalable, because I know it's not that big at the moment, but that's an unbelievable possibility in my mind, because it restores a philosophy of savings in a world where we have QE and everyone is expected to leverage up because the rates are zero, so of course, you want to borrow, this is the opposite. That could usher in a change in the way people think and behave. But is that too far? Some people really look at the philosophy of Bitcoin and maybe it's where it is in terms of its cultural importance. Does that make any sense, or is that just a bridge too far?

DAN MOREHEAD: No, it does. The real beauty of Bitcoin and crypto generally is everyone sees different things in it. Some people are in it 100% for libertarian philosophical reasons. Some people just want a 8% yield right. Some people want to do wealth savings if they're a, say Chinese national and they don't trust that their banks are solvent or that when the currency is starting to devalue, they might get their wealth wiped out.

Everyone sees different things in it and yield I think is one of the next ones where you can imagine a fund starting up where you raised dollars from normal hedge fund type investors and you invest it in a basket of you yielding cryptocurrencies. Again, it's only 6% or 8% so it's not 235% a year, so you're not getting that, but you don't have any downside. Yeah, you could do it in a hedged way, where it's just a fixed income style vehicle.

DAN TAPIERO: Right. I think maybe that's a great place to end because Bitcoin, I think its strength is that it's so many different things. Some of those things can fail and it can still be awesome. It's also its weakness, because in trying to explain to the people who are on the outside, what it is, it's extremely confusing and complex. People are probably saying that, like what do you mean it's all those things? I think it'll take time and work and research and hopefully you'll be out there spreading the good word and need to a little bit and people will come to realize what I think we both think is the certainly the greatest macro opportunity that we've seen in our careers.

DAN MOREHEAD: Yeah, so I find that when I'm trying to explain Bitcoin to people, everyone has a different perspective and an aha moment happens in a different way with different people. The way I think about it is some people call it a commodity. The CFTC says it's commodity. The IRS calls it property. People call it digital gold. It's a payment rail. It does all these things. I just cycle through each one of those until it clicks and you can see that person ultimately gets it and the reason it's such a great investment, it's like the Miracle Whip of Finance. It just does all these different things.

DAN TAPIERO: Dan, thanks for being with us. I think the Real Vision audience is going to be thrilled, lots of great nuggets there. Thanks for being here.

DAN MOREHEAD: Thanks, Dan.

DAN TAPIERO: Yeah.