Stanphyl Capital’s letter to investors for the month ended September 30, 2019.

Friends and Fellow Investors:

For September 2019 the fund was down approximately 2.5% net of all fees and expenses. By way of comparison, the S&P 500 was up approximately 1.9% while the Russell 2000 was up approximately 2.1%. Year-to-date 2019 the fund is up approximately 16.4% while the S&P 500 is up approximately 20.6% and the Russell 2000 is up approximately 14.2%. Since inception on June 1, 2011 the fund is up approximately 91.3% net while the S&P 500 is up approximately 163.6% and the Russell 2000 is up approximately 101.7%. Since inception the fund has compounded at approximately 8.1% net annually vs 12.3% for the S&P 500 and 8.8% for the Russell 2000. (The S&P and Russell performances are based on their “Total Returns” indices which include reinvested dividends.) As always, investors will receive the fund’s exact performance figures from its outside administrator within a week or two and please note that individual partners’ returns will vary in accordance with their high-water marks.

Q2 hedge fund letters, conference, scoops etc

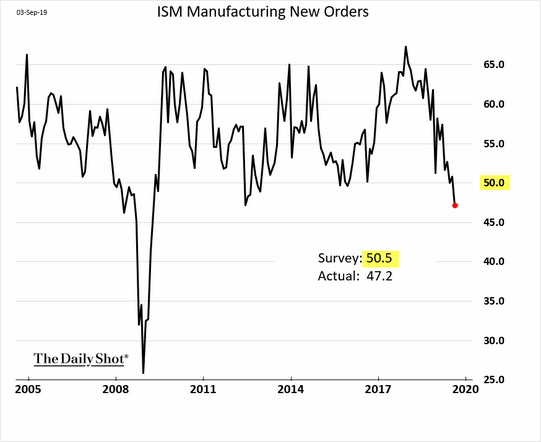

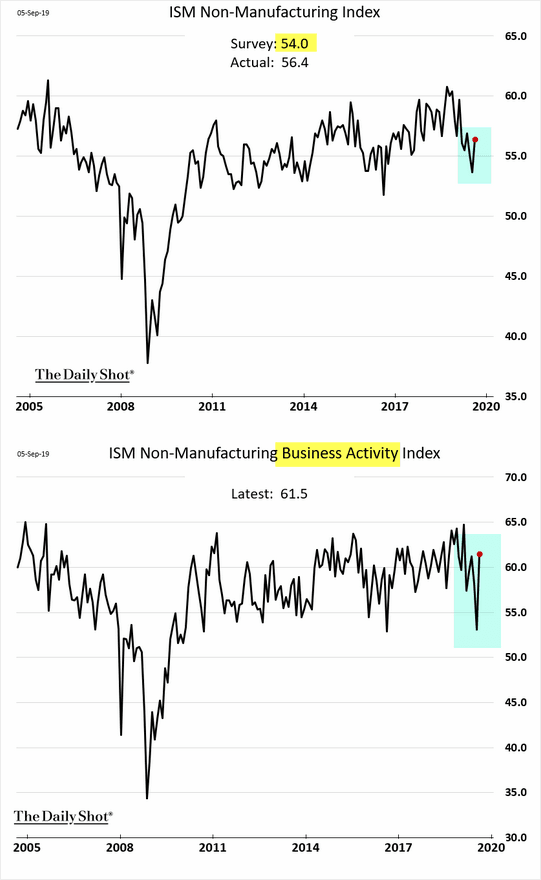

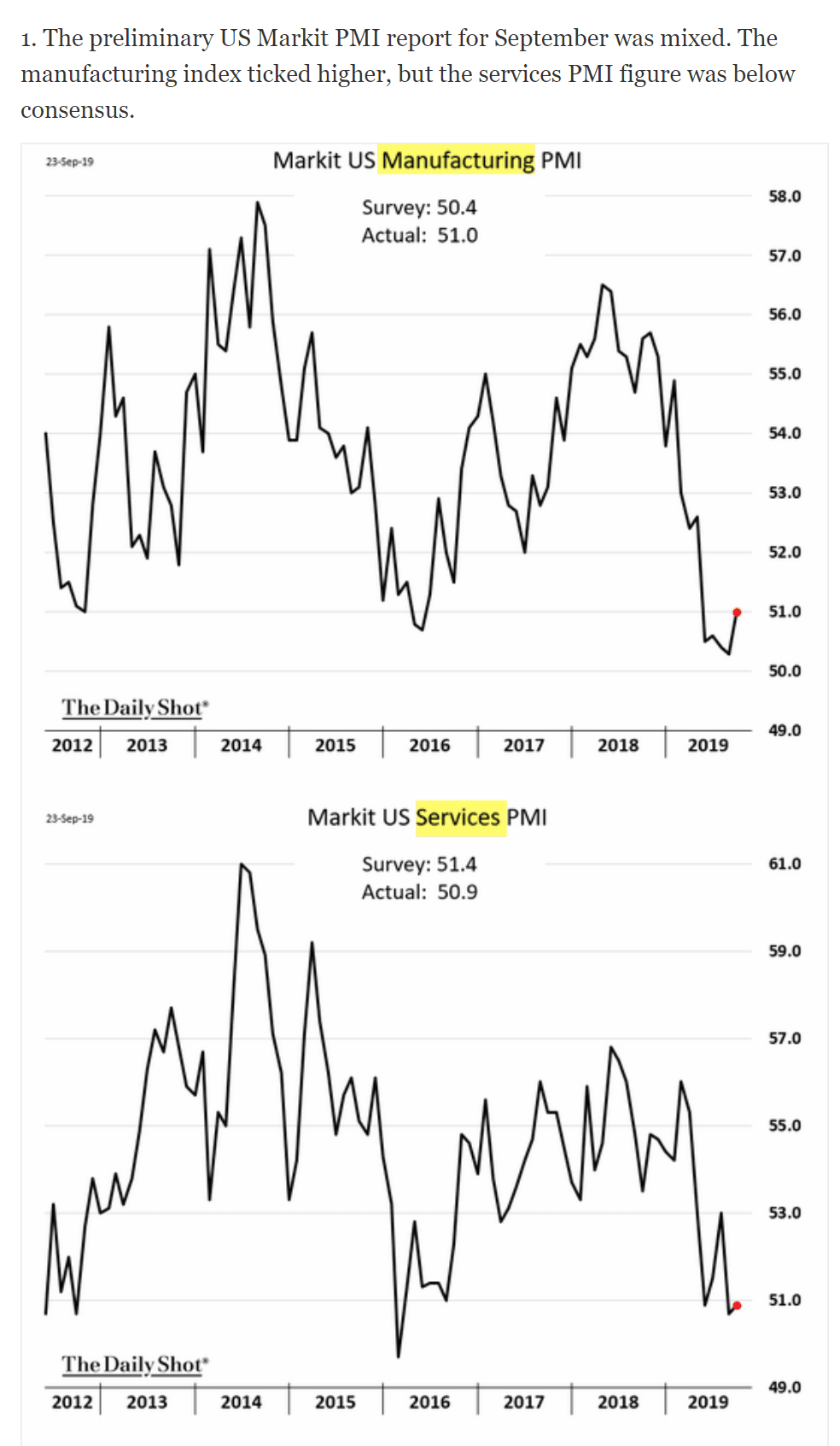

The fund remains very net short, as I continue to believe we’re entering a bear market for U.S. stocks as the U.S. economic slowdown worsens. Here are some charts explaining why:

The ISM “services” figure was okay…

…but the order backlog was lousy:

…while the Markit PMIs show an economy hanging on for dear life…

…and the Chicago PMI (out today, September 30th) was downright ugly:

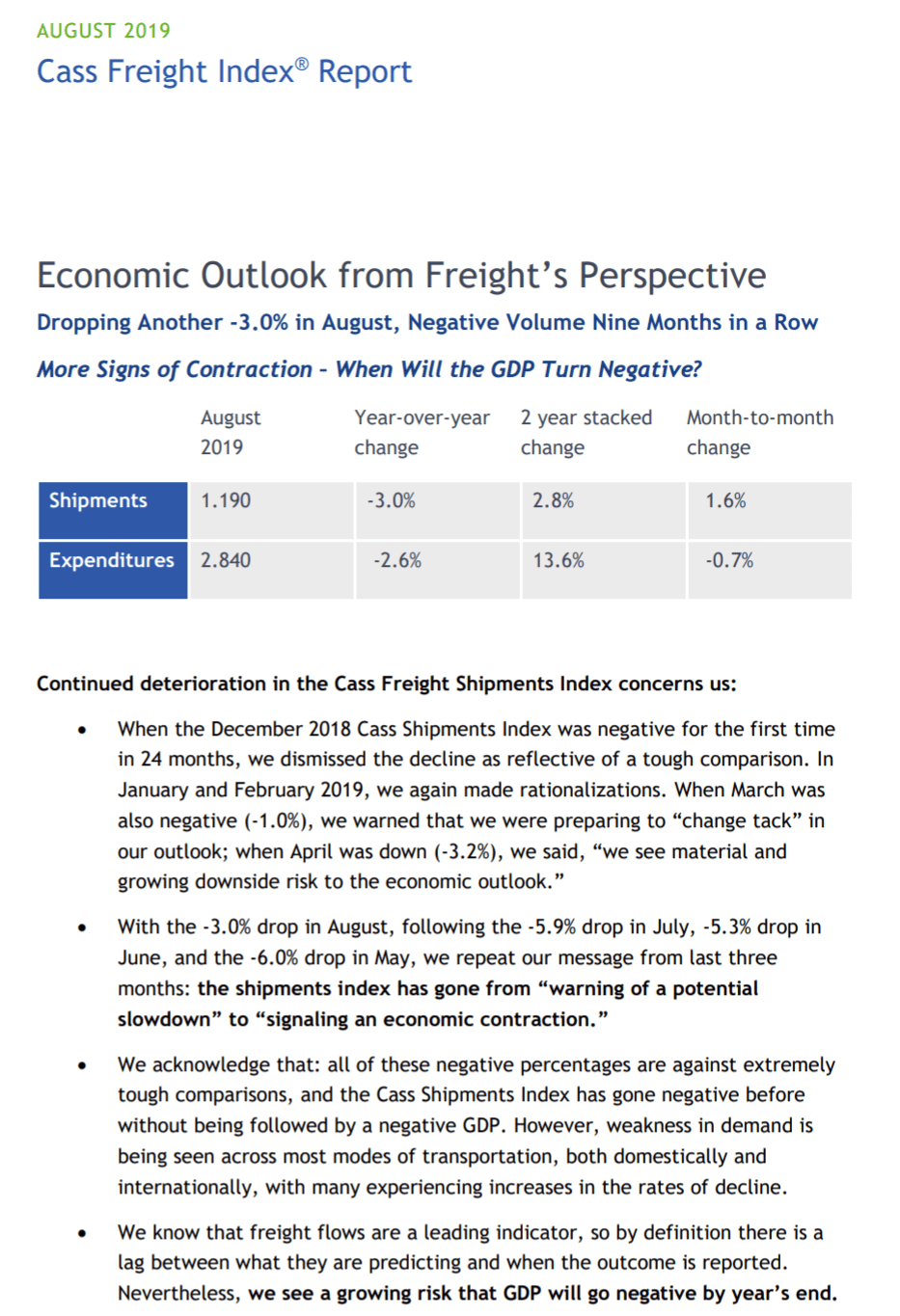

…and the Cass freight index was once again awful…

And have a look at how ugly U.S. rail traffic is.

Also, keep in mind that much of the U.S. bull market’s rise came from corporate buybacks and those tend to slow drastically when the economy does. As the looming recession unfolds and those buyers disappear, look out below.

On the other hand the short-lived era of net “quantitative tightening” among the big three central banks (the Fed, ECB and BOJ) is over. The Fed’s balance sheet contraction stopped in August and resumed in September (to meet short-term liquidity needs), and in October the ECB resumes printing €20 billion/month while the BOJ continues printing. I’m very aware of the effect these moves may have on already grossly inflated asset prices, and thus I’m a bit more cautious in my short bias than I’d been previously. On the other hand, this ECB stupidity may blow up its banks and perhaps even the euro, resulting in all kinds of stock market carnage. After all, if printing money is the solution to economic stagnation, why bother collecting taxes and having government budgets? (There’s no need to answer that—it’s a rhetorical question!) So we’re very short, but prepared to cover via upside breakout stops if necessary.

Also, stocks are not at all pricing in the increasing possibility of a Democratic presidency. Trump’s corporate tax cuts juiced earnings by an instant 10% or so and his easier regulatory environment may have helped earnings by another couple of percent. This would be almost instantly reversed (and then some!) by any Democratic candidate, all of whom have also endorsed strict limits on the corporate stock buy-backs that have been another huge force behind this bull market.

Although stocks have often done well during Democratic administrations, we’re now in a unique situation due to the three factors (tax rates, buybacks and regulation) I mentioned above, as well as the fact that Trump is running budget deficits that would make any Democrat “proud,” thus leaving minimal room for a new administration to increase them.

Thus, seeking the most overvalued of all stock indices (and the one least likely to be bought by overseas investors with their newly printed yen and euros), we remain short the Russell 2000 (IWM), which has a trailing twelve-month GAAP PE ratio of 41 on what I believe are peak earnings, while 35% of its constituents lose money. We’ve also been short the S&P 500 (SPY) since Trump said it’s likely China won’t make a trade deal until after the 2020 Presidential election, as rumors of such a deal have been a huge positive driver of stocks and international trade is much more important for the constituents of the S&P 500 than it is for those in the Russell 2000.

Elsewhere in the fund’s short positions…

We remain short stock and call options in Tesla, Inc. (TSLA), which I consider to be the biggest single stock bubble in this whole bubble market. The core points of our Tesla short thesis are:

- Tesla has no “moat” of any kind; i.e., nothing meaningfully proprietary in terms of electric car technology, while existing automakers—unlike Tesla—have a decades-long “experience moat” of knowing how to mass-produce, distribute and service high-quality cars consistently and profitably, as well as the ability to subsidize losses on electric cars with profits from their conventional cars.

- Tesla is losing a ton of money and has a terrible balance sheet.

- Tesla is now a “busted growth story”; revenue is declining both sequentially and year-over-year while unit demand for its cars is only being maintained via continual price reductions.

- Elon Musk is a securities fraud-committing pathological liar.

Estimates for July and August show U.S. Tesla sales for all three of its models (S/X/3) were down substantially year-over-year, and September will likely show the same. Tesla is only showing overall unit delivery growth (with declining revenue) by slashing prices and fulfilling Model 3 backlog in countries where deliveries just began (most notably the UK in July and South Korea this fall), and where EV incentives are about to expire (the Netherlands until year-end). In other words, the Tesla growth story is over. In Q3 & Q4 2019 Tesla will show significant revenue declines vs. Q3 & Q4 2018 and its 2019 full-year GAAP loss will be roughly $2 billion.

In September, in a desperate attempt to recognize some (non-cash) deferred revenue to cut Q3 losses, Musk recklessly unleashed a half-baked remote-control feature called “Summon,” which allows his 5000-pound unguided missiles to drive (with no one behind the wheel) to their owners in public parking lots and on residential streets. As multiple crashes and near-misses are already appearing in social media I expect this deadly “feature” to be banned soon, with any accompanying revenue/profit recognition swiftly reversed, thereby ballooning the company’s Q3 (or Q4) earnings loss well beyond whatever is initially claimed.

The party’s over, folks. With no profitable growth, massive ongoing losses, tens of billions of dollars in debt & purchase obligations and billions more in legal liabilities, the equity in Tesla will eventually prove worthless. Yet as the stock miraculously closed today at $240.687/share, I shall continue…

For those of you looking for a resumption of growth from Tesla’s (supposedly) upcoming Model Y, by the time it’s available in late 2020 (if Tesla is still in business), it will both massively cannibalize sales of the Model 3 sedan and face superior competition from the much nicer electric Audi Q4 e-tron, BMW iX3, Mercedes EQB, Volvo XC40 and Volkswagen ID Crozz, while less expensive and available now in limited supply (because like Tesla’s cars they lose money) are the excellent new all-electric Hyundai Kona and Kia Niro, extremely well reviewed small crossovers with an EPA range of 258 miles for the Hyundai and 238 miles for the Kia, at prices of under $30,000 inclusive of the $7500 U.S. tax credit. Meanwhile, the Model 3 sedan will have terrific direct "sedan competition" in 2020 from Volvo’s beautiful new Polestar 2, the BMW i4 and the premium version of Volkswagen’s ID.3.

And if you think China is the secret to the resumption of Tesla’s growth, let’s put that market in perspective: Tesla currently sells around 30,000 Model 3s a year in China. The rule of thumb for the elasticity of auto pricing is that every 1% price cut results in a sales increase of 1% to 2.4%. If we assume a 2.4x “elasticity multiplier,” domestically produced Model 3s that are 25% cheaper (due to the 10% sales tax savings plus the 15% tariff savings) would result in annual sales of 48,000 Model 3s (25% x 2.4 = 60% more than the current 30,000), meaning Tesla’s new Chinese factory would be a massive money-loser as it would be running at less than 1/3 of its initial 150,000-unit annual capacity. And here’s a great overview of what a dogfight the Chinese EV market has become. And meanwhile Beijing is switching its subsidies to hydrogen fueled cars, which it perceives as better than EVs.

In July Tesla released a disastrous Q2 financial report, with a GAAP loss of $408 million despite higher-than-expected deliveries of a bit over 95,000 cars. In fact, due to massive price cuts to maintain demand, Tesla actually booked significantly less revenue than it did in Q4 2018 when it sold nearly 5000 fewer cars. And to kick off Q3 (the quarter that ended today), Tesla cut prices yet again!

Keep in mind too that Tesla’s Q2 loss would likely have been $100 million greater if it were providing adequate customer service. The internet is filled with complaints from aggrieved owners who can’t reach anyone to fix their myriad problems within a reasonable timeframe, thereby resulting in real-time brand destruction. Yet due to the high cost of batteries, Teslas are inherently unprofitable, and thus improving the ownership experience would only increase the company’s losses. In other words, Tesla is truly a non-viable business.

Meanwhile, sales of Tesla’s highest-margin cars (the Models S&X) are down by nearly 40% worldwide this year, thanks to cannibalization from the Model 3 and the recently introduced Audi e-tron and Jaguar I-Pace, and this sales drop is before this fall’s arrival of the Mercedes EQC and absolutely spectacular Porsche Taycan and soon-to-follow less expensive Taycan, with multiple additional electric Audis, Mercedes and Porsches to follow, many at starting prices considerably below those of the high-end Teslas. (See the links below for more details.)

Meanwhile, Tesla has the most executive departures I’ve ever seen from any company; here’s the astounding full list of escapees. These people aren’t leaving because things are going great (or even passably) at Tesla; rather, they’re likely leaving because Musk is either an outright crook or the world’s biggest jerk to work for (or both). Could the business (if not the stock price) be saved in its present form if he left? Nope, it’s too late. Even if Musk steps down in favor of someone who knows what he’s doing, emerging competitive factors (outlined in great detail below) and Tesla’s balance sheet and massive additional liabilities make the company too late to “fix” without major financial and operational restructuring.

In May Consumer Reports completely eviscerated the safety of Tesla’s so-called “Autopilot” system; in fact, Teslas have far more pro rata (i.e., relative to the number sold) deadly incidents than other comparable new luxury cars; here’s a link to those that have been made public. Meanwhile Consumer Report’s annual auto reliability survey ranks Tesla 27th out of 28 brands and the number of lawsuits of all types against the company continues to escalate-- there are now over 700 including one proving blatant fraud by Musk in the SolarCity buyout and a real beauty in August from Wal-Mart which was a victim of a secret Tesla cover-up of solar roof fires.

So here is Tesla's competition in cars (note: these links are regularly updated)…

Porsche Taycan Deliveries Start November 2019

A cheaper Porsche Taycan EV is coming this year

Porsche Taycan Cross Turismo to launch in 2020 after Taycan Sedan

The next generation of the Porsche Macan will be electric

The Audi e-tron: Electric Has Gone Audi

Audi e-tron Sportback comes early 2020

AUDI E-TRON GT FIRST DRIVE: LOOK OUT, TESLA (available 2020)

Audi's Q4 e-tron previews entry-level EV for 2021

New Audi e-tron compact hatch to lead brand’s electrification plans

THE AWARD-WINNING ALL-ELECTRIC JAGUAR I‑PACE

Jaguar Land Rover readies electric XJ and Range Rover

Mercedes EQC Electric SUV Available Late 2019

Mercedes EQV Electric Minivan Revealed – Available Early 2020

Mercedes EQB Small SUV to boost brand's electric line-up

Mercedes EQS will be built in addition to the S-Class on a new dedicated electric platform

Mercedes to launch more than 10 all-electric models by 2022

Volvo Polestar 2 Arrives early 2020

Volvo teases all-electric XC40 SUV coming November, releases images

Volvo XC40 full-electric variant to debut later this year

Volkswagen unveils the ID.3, its first ‘electric car for the masses’

VW's EV crossover for U.S. will be called ID4

VW Group to launch 70 pure electric cars over the next decade

258-Mile Hyundai Kona electric is available now for under $40,000

239-Mile Kia Niro EV is Available Now For Under $40,000

Kia Soul (available mid-2019) EV’s Range Jumps to 243 Miles

Kia Europe to have six pure electric models by 2022

Chevrolet Bolt Now Offers 259 Miles of Range

GM is transforming Cadillac into an electric brand

Ford, GM rev up electric pickup trucks to head off Tesla

Ford performance EV crossover comes 2020, electric F-150 2021, 2 midsize EV crossovers 2022

Ford to build two European EVs based on VW’s MEB platform

Nissan LEAF e+ with 226-mile range is available now

Nissan gives dealers a look at compact crossover EV with 300-mile range

BMW iX3 electric crossover goes on sale in 2020

New BMW i4: fresh shots reveal electric saloon's design

BMW’s 2021 iNEXT Returns In New Teasers Showing Prototypes Production

Rivian electric pickup truck- funded by Amazon, Ford, Cox & others- is on the way

Renault upgrades Zoe electric car as competition intensifies

Peugeot 208 to electrify Europe's small-car market

Peugeot to offer EV version of new 2008 small crossover

Toyota and Subaru Agree to Jointly Develop BEV-dedicated Platform and BEV SUV

Mazda plans to unveil full EV at Tokyo show

SEAT will launch 6 electric and hybrid models and develop a new platform for electric vehicles

Opel sees electric Corsa as key EV entry

Opel/Vauxhall will launch electric SUV and van in 2020

Skoda accepting deposits for electric cars

New Citroen C4 Cactus to be first electrified Citroen in 2020

FCA to invest $788M to build new 500 EV in Italy

Maserati to launch electric sports car

Bentley Will Offer Hybrid Versions of Every Car It Makes and Add an EV by 2025

Dyson electric car: new patents show mould-breaking design

Lucid Motors closes $1 billion deal with Saudi Arabia to fund electric car production

Meet the Canoo, a Subscription-Only EV Pod Coming in 2021

Two new electric cars from Mahindra in India by 2019; Global Tesla rival e-car soon

Former Saab factory gets new life building solar-powered Sono Sion electric cars

And in China…

Volkswagen takes over leading position for electro-mobility in China

SAIC Volkswagen to roll out 3 MEB-based EV models in 2020/2021

Audi Q2L e-tron debuts at Auto Shanghai

Audi will build Q4 e-tron in China

FAW-Volkswagen’s Foshan plant said to produce e-tron Sportback

FAW Hongqi starts selling electric SUV with 400km range for $32,000

FAW (Hongqi) to roll out 15 electric models by 2025

China’s BYD launches six new electrified vehicles

Daimler & BYD launch new DENZA electric vehicle for the Chinese market

Denza Concept X Debuts; On Sale Early 2020

BAIC Goes Electric, & Establishes Itself as a Force in China’s New Energy Vehicle Future

BAIC BJEV, Magna ready to pour RMB2 bln in all-electric PV manufacturing JV

Daimler to Start EQC Electric SUV Production in China in 2019

Daimler and BMW to cooperate on affordable electric car in China

Chevrolet's new China-only EV is called the Menlo and it looks good

Buick Rolls Out First Electric Car for China

GM China raises new-energy vehicle target to 20 models through 2023

Nissan & Dongfeng to invest $9.5 billion in China to boost electric vehicles

Toyota, BYD will jointly develop electric vehicles for China

Hyundai Motor Transforming Chongqing Factory into Electric Vehicle Plant

GAC unveils new NEV offshoot dubbed HYCAN

Jaguar Land Rover's Chinese arm invests £800m in EV production

Renault reveals series urban e-SUV K-ZE for China

Renault & Brilliance detail electric van lineup for China

Renault forms China electric vehicle venture with JMCG

Honda Debuts New Everus VE-1 All-Electric SUV, But Only For China

Honda to roll out over 20 electric models in China by 2025

Geely launches new electric car brand 'Geometry' – will launch 10 EVs by 2025

Mazda to roll out China-only electric vehicles by 2020

Xpeng Motors sells multiple EV models

Chery

China's cute Ora R1 electric hatch offers a huge range for less than US$9,000

JAC Motors releases new product planning, including many NEVs

Seat to make purely electric cars with JAC VW in China

Iconiq Motors

Hozon

EV maker Bordrin skips flash, keeps real-car focus

NEVS launches electric-car output with Saab 9-3 platform in China

CHJ Automotive begins to accept orders of Leading Ideal ONE

Infiniti to launch Chinese-built EV in 2022

Zotye Auto to roll out 10 plus NEV models by 2020

Thunder Power

Continental, Didi sign deal on developing EVs for China

Mine Mobility (Thailand)

Here’s Tesla's competition in autonomous driving…

Consumer Reports finds Tesla's Navigate on Autopilot is far less competent than a human driver

Navigant Ranks Tesla Last Among Automakers & Suppliers for Automated Driving

Tesla has a self-driving strategy other companies abandoned years ago

Waymo and Lyft partner to scale self-driving robotaxi service in Phoenix

Jaguar and Waymo announce an electric, fully autonomous car

Renault, Nissan partner with Waymo for self-driving vehicles

Fiat Chrysler partners with Aurora to develop self-driving commercial vans

Hyundai and Kia Invest in Aurora

Aptiv and Hyundai Motor Group Form Autonomous Driving Joint Venture

Cadillac Super Cruise™ Sets the Standard for Hands-Free Highway Driving

Honda Joins with Cruise and General Motors to Build New Autonomous Vehicle

SoftBank Vision Fund to Invest $2.25 Billion in GM Cruise

Ford-VW alliance with Argo could redraw self-driving sector

VW taps Baidu's Apollo platform to develop self-driving cars in China

Audi to join Daimler, BMW self-driving tech alliance

Daimler's heavy trucks start self-driving some of the way

SoftBank, Toyota's self-driving car venture adds Mazda, Suzuki, Subaru Corp, Isuzu Daihatsu

Volvo, Nvidia expand autonomous driving collaboration

Continental & NVIDIA Partner to Enable Production of Artificial Intelligence Self-Driving Cars

Intel’s Mobileye has 2 million cars (VW, BMW & Nissan) on roads building HD maps

Nissan gives Japan version of Infiniti Q50 hands-free highway driving

Nissan and Mobileye to generate, share, and utilize vision data for crowdsourced mapping

Magna joins the BMW Group, Intel and Mobileye platform as an Integrator for AVs

Uber unveils next-generation Volvo self-driving car

Baidu kicks off trial operation of Apollo robotaxi in Changsha

Toyota to join Baidu's open-source self-driving platform

Baidu, WM Motor announce strategic partnership for L3, L4 autonomous driving solutions

Baidu plans to mass produce Level 4 self-driving cars with BAIC by 2021

Volvo, Baidu to co-develop EVs with Level 4 autonomy for China

Geely selects Volvo, Veoneer joint venture as autonomous tech supplier

BMW and Tencent to develop self-driving car technology together

BMW, NavInfo bolster partnership in HD map service for autonomous cars in China

FAW Hongqi readies electric SUV offering Level 4 autonomous driving

Tencent, Changan Auto Announce Autonomous-Vehicle Joint Venture

Huawei looks to self-driving cars in bid to broaden AI focus

BYD partners with Huawei for autonomous driving

Pony.ai, GAC Group launches Aion LX’s level 4 self-driving version

Lyft, Magna in Deal to Develop Hardware, Software for Self-Driving Cars

Deutsche Post to Deploy Test Fleet Of Fully Autonomous Delivery Trucks

ZF autonomous EV venture names first customer

Magna’s new MAX4 self-driving platform offers autonomy up to Level 4

Groupe PSA’s safe and intuitive autonomous car tested by the general public

Apple acquires self-driving startup Drive.ai

Self-driving startup Momenta ready to launch fully automated driving solution in Q3 2019

JD.com Delivers on Self-Driving Electric Trucks

NAVYA Unveils First Fully Autonomous Taxi

Fujitsu and HERE to partner on advanced mobility services and autonomous driving

Lucid Chooses Mobileye as Partner for Autonomous Vehicle Technology

First Look Inside Zoox’s Autonomous Taxi

Nuro’s Robot Delivery Vans Are Arriving Before Self-Driving Cars

Here’s where Tesla's competition will get its battery cells…

Panasonic (making deals with multiple automakers)

LG

CATL

Northvolt (backed by VW & BMW)

Farasis

Cenat

Wanxiang

Svolt

Toyota accelerates target for EV with solid-state battery to 2020

ProLogium Technology Will Produce First Next Generation Lithium Ceramic Battery For EVs

BMW invests in Solid Power solid-state batteries

Ford invests in Solid Power solid-state batteries

Hyundai Motor developing solid-state EV batteries

Most car makers will use those battery cells to manufacture their own packs. Here are some examples:

Daimler starts building electric car batteries in Tuscaloosa – one of 8 battery factories

GM inaugurates battery assembly plant in Shanghai

PSA to assemble batteries for hybrid, electric cars in Slovakia

Honda Partners on General Motors' Next Gen Battery Development

France's Saft plans production of next-gen lithium ion batteries from 2020

Sokon aims to be global provider of battery, electric motor, electric control systems

BMW Group invests 200 million euros in Battery Cell Competence Centre

BMW Brilliance Automotive opens battery factory in Shenyang

Rimac is going to mass produce batteries and electric motors for OEMs

Here’s Tesla’s competition in charging networks…

Electrify America is spending $2 billion building a high-speed U.S. charging network

EVgo is building a U.S. charging network

191 U.S. Porsche dealers are installing 350kw chargers

ChargePoint to equip Daimler dealers with electric car chargers

GM and Bechtel plan to build thousands of electric car charging stations across the US

Ionity has over 150 European 350kw charging stations

E.ON and Virta launch one of the largest intelligent EV charging networks in Europe

Volkswagen plans 36,000 charging points for electric cars throughout Europe

Smatric has over 400 charging points in Austria

Allego has hundreds of chargers in Europe

BP Chargemaster/Polar is building stations across the UK

Instavolt is rolling out a UK charging network

Fastned building 150kw-350kw chargers in Europe

Deutsche Telekom launches installation of charging network for e-cars

Shell starts rollout of ultrafast electric car chargers in Europe

Total to build 1,000 high-powered charging points at 300 European service-stations

Volkswagen, FAW Group, JAC Motors, Star Charge formally announce new EV charging JV

BP, Didi Jump on Electric-Vehicle Charging Bandwagon

Evie rolls out ultrafast charging network in Australia

Evie Networks To Install 42 Ultra-Fast Charging Sites In Australia

And here’s Tesla’s competition in storage batteries…

Panasonic

LG

AES + Siemens (Fluence)

NEC

ABB

Saft

EnerSys

NantEnergy

Kreisel

Leclanche

UET

ENGIE

Bluestorage

Orison

Powervault

Schmid

Ecoult

Natron Energy

Yet despite all that deep-pocketed competition, perhaps you want to buy shares of Tesla because you believe in its management team. Really???

Elon Musk Settles SEC Fraud Charges

Elon Musk, June 2009: “Tesla will cross over into profitability next month”

More Broken Promises From Tesla

Tesla SEC Correspondence Shows A Pattern Of Inaccurate, Incomplete & Misleading Disclosures

Tesla: Check Your Full Self-Driving Snake Oil Expiration Date

As Musk Hyped and Happy-Talked Investors, Tesla Kept Quiet About a Year-Long SEC Probe

The Truth Is Catching Up With Tesla

With Misleading Messages And Customer NDAs, Tesla Performs Stealth Recall

Who You Gonna Believe? Elon Musk's Words Or Your Own Lying Eyes?

How Tesla and Elon Musk Exaggerated Safety Claims About Autopilot and Cars

When Is Enough Enough With Elon Musk?

Musk Talked Merger With SolarCity CEO Before Tesla Stock Sale

Tesla Continues To Mislead Consumers

Tesla Misses The Point With Fortune Autopilot Story

Tesla Timeline Shows Musk's Morality Is Highly Convenient

Tesla Scares Customers With Worthless NDAs, The Daily Kanban Talks To Lawyers

Tesla: O, What A Tangled Web We Weave When First We Practice To Deceive

Tesla: A Failure To Communicate

Elon Musk Appears To Have Misled Investors On Tesla's Most Recent Conference Call

Understanding Tesla’s Potemkin Swap Station

So in summary, Tesla is losing a massive amount of money even before it faces a huge onslaught of competition (and things will only get worse once it does), while its market cap is larger than Ford’s and roughly 80% of GM’s despite selling fewer than 400,000 cars a year while Ford and GM make billions of dollars selling 6 million and over 8 million vehicles respectively. Thus this cash-burning Musk vanity project is worth vastly less than its over $50 billion enterprise value and—thanks to roughly $34 billion in debt, purchase and lease obligations—may eventually be worth “zero.”

Elsewhere among our short positions…

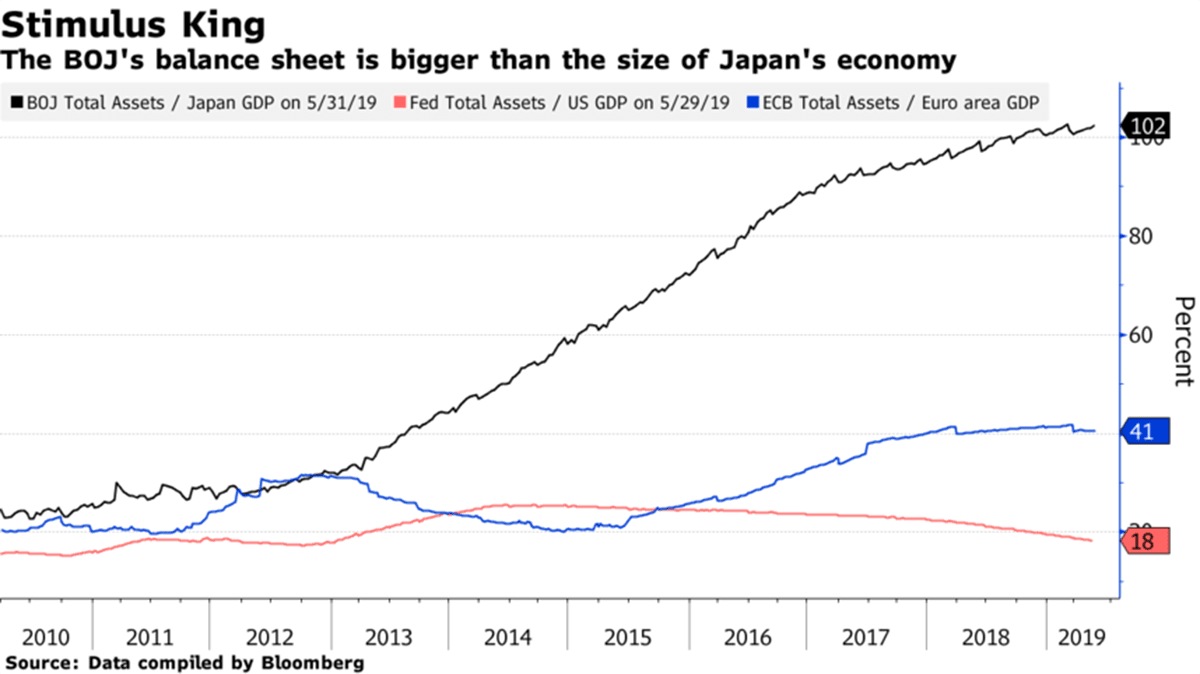

We continue (since late 2012) to hold a short position in the Japanese yen via the Proshares UltraShort Yen ETF (ticker: YCS) as Japan (despite having substantially tapered its QE) continues to print nearly 3% of its monetary base per year after quadrupling that base since early 2013. In 2018 the BOJ bought approximately 67% of JGB issuance and in 2019 it anticipates buying 70%! In fact, the BOJ’s balance sheet is now larger than the entire Japanese economy…

…as it owns nearly 45% of Japan’s debt and 78% (!) of its ETFs by market value.

Just the interest on Japan’s debt consumes 8.9% of its 2019 budget despite the fact that it pays a blended rate of less than 1%. What happens when Japan gets the 2% inflation it’s looking for and those rates average, say, 3%? Interest on the debt alone would consume nearly 27% of the budget and Japan would have to default! But on the way to that 3% rate the BOJ will try to cap those rates by printing increasingly larger amounts of money to buy more of that debt, thereby sending the yen into its death spiral.

When we first entered this position USD/JPY was around 79; it’s currently in the 108s and long-term I think it’s headed a lot higher—ultimately back to the 250s of the 1980s or perhaps even the 300s of the ‘70s before a default and reset occur.

We continue to hold a short position in the Vanguard Total International Bond ETF (ticker: BNDX), comprised of dollar-hedged non-US investment grade debt (over 80% government) with a ridiculously low “SEC yield” of 0.37% at an average effective maturity of 10.1 years, and with Eurozone core inflation now printing around 1% annually I believe this ETF is a great way to short what may be the biggest asset bubble in history. Currently the net borrow cost for BNDX provides us with a positive rebate of 1.2% a year and I think it’s a terrific place to sit and wait for the inevitable denouement of this insanity.

We also have relatively small short positions in Netflix (NFLX) due to its egregious valuation within the context of increasing cash burn and competition (particularly from Disney), Square (SQ) due to its egregious valuation and a stock-dumping CEO who so effusively praises (and enables) Elon Musk that I suspect he’s equally untrustworthy (and indeed in June the company fired its auditor), Carvana (CVNA) due to a laughable business model with escalating losses, a founder with a sketchy past and insiders who dump stock steadily, and Wayfair (W), an egregiously bad on-line furniture business with yet another team of insider stock-dumpers.

And now for the fund’s long positions…

We continue to own Communications Systems, Inc. (ticker: JCS), an IOT (“Internet of Things”) and internet connectivity & services company. The company’s multiple divisions are best explained by the slide presentation from its annual meeting and this terrific Seeking Alpha article, and its recently improved performance is highlighted in its Q2 earnings report; what attracted me to JCS is its great balance sheet and how cheap it is on an EV-to-revenue basis. At our average cost of $3.04/share and assuming $62 million in annual revenue, $17.8 million of net cash and 9.32 million shares outstanding, we paid just a bit over 0.17x revenue for this roughly break-even company with a gross margin of 37% and climbing.

We continue to own Aviat Networks, Inc. (ticker: AVNW), a designer and manufacturer of point-to-point microwave systems for telecom companies, which in September booted its perpetually overpromising/under-delivering CEO and gave the job to the COO/CFO credited with stabilizing and turning around the business. In August Aviat reported a solid FY 2019 Q4, with revenue up slightly year-over-year accompanied by a significant improvement in operating income while guiding to a very strong first half of FY 2020 (which began July 1, 2019), with income and cash flow expected to be up substantially year-over-year. Additionally, Aviat has $408 million of U.S. NOLs, $8 million of U.S. tax credit carryforwards, $212 million of foreign NOLs and $2 million of foreign tax credit carryforwards; thus its income will be tax-free for many years so GAAP EBITDA less capex essentially equals “earnings.” Valuation-wise, if we assume $14 million in FY 2020 adjusted EBITDA (first-half guidance is $7.5 million) and remove $1.7 million in stock comp and $5.3 million in capex we get $7 million in earnings multiplied by, say, 14 = approximately $98 million; if we then add in approximately $37 million of expected year-end net cash we get $135 million, and if we divide that by 5.4 million shares we get an earning-based valuation of around $25/share. Alternatively, if we look at Aviat as a buyout candidate its closest pure-play competitor, Ceragon (CRNT) sells at an EV of approximately 0.65x revenue, which for AVNW (assuming $240 million in 2020 revenue) would be 0.65 x $240 million = $156 million + $37 million expected year-end net cash = $193 million. If we value Aviat’s massive NOLs at a modest $10 million (due to change-in-control diminution in their value), the company would be worth $203 million divided by 5.4 million shares = over $37/share.

We continue to own Westell Technologies Inc. (WSTL), which in August replaced its CEO for the umpteenth time (and its CFO left for a larger company) after reporting an awful FY 2020 Q1, with revenue down 31% year-over-year and a drop in gross margin from 45.5% to 36.1% and negative free cash flow of around $1.2 million; about the only good news here is that the company ended the quarter with $24 million in cash and no debt. That said, we continue to own Westell because it now sells at a negative enterprise value, so on that metric it’s dirt cheap (although clearly the business needs to stabilize and grow). Westell also suffers from a dual share class with voting control held by descendants of the founder, yet the company is so cheap on an EV-to-revenue basis that if management can’t start generating meaningful profits it seems primed for a strategic buyer to acquire it. Assuming 15.6 million shares, an acquisition price of just 0.6x run-rate annual revenue of $36 million would (on an EV basis) be nearly $3/share.

We continue to own a small position in the PowerShares DB Agriculture ETF (ticker: DBA), as agricultural products remain the most beaten-down sector I can find that isn’t a “buggy whip” (something on the way to obsolescence) or cyclical from a demand standpoint; however, I reduced this position size considerably in July when near-term hopes for a trade deal with China fell apart and terrible weather in the farm belt was unable to move prices meaningfully higher.

Thanks and regards,

Mark Spiegel