Summary. Throughout 2017, 2018 and 2019, my best performing strategy has been that of repeatedly buying the dips on a small number of oversold Bricks and Mortar Retailers (“BaMR”s or “Bammers”). There are clear reasons why this trade keeps working over and over again. In fact, with each of Dillard’s (DDS), Revlon (REV) and Restoration Hardware (RH), each single ticker provided multiple opportunities to buy the dip just ahead of quick rebounds of roughly 40-60%. These would often occur within around 3-8 weeks. Links to my past reports on those names and commentary is included at the bottom of this report.

Right now I am long Children’s Place (PLCE) and Shoe Carnival (SCVL). As with those other “Bammer” rebound trades above, I suspect I might be in these trades for up to 3-8 weeks, and I am hoping for a similar price bounce of roughly 40-60%. Among other things, I observe that from a trading standpoint, the run up into the Thanksgiving and Christmas holidays has often been a good time to be long on some of the lower float higher short interest names.

Q3 2019 hedge fund letters, conferences and more

Double Whammy becomes Triple Whammy (why these rebounds are often so sharp). There are recurring themes among many of these Bammer rebound trades: they are low float, heavily shorted and being pushed higher as a result of aggressive company buybacks. Certainly those are “technical” themes that are worth paying attention to. But there is a bigger picture concept to understand with these trades, and it is more fundamental in nature. When sentiment towards a stock (or a sector) becomes too bearish, it only takes a slight “surprise” improvement to see an extremely sharp rebound in the share price. First comes the re-evaluation of the stronger-than-expected business results. That part is easy. But then any inherent upside also gets further amplified based on “multiple expansion” once investors re-rate stronger future prospects on the visibly stronger (current) business. It is this “double whammy” which often causes such price rebounds to be larger and sharper than even the bulls had expected. And when we then look specifically at stocks with a high short vs. low float and an aggressive buyback, these factors quickly combine into a “triple whammy”. These are the reasons why I often expect such large potential price moves on such trades, and this is why I search for this specific combination when screening for trade ideas.

Methodology across “Bammer” stocks. Children’s Place and Shoe Carnival are generally classified as “specialty retailers” who operate in niche segments within “Bricks and Mortar Retail/Apparel”. But I apply a fairly consistent methodology across different niches, regardless if the company makes lipstick, home furnishings, shoes or whatever. Below are how some of my usual criteria apply to Children’s Place and Shoe Carnival.

A (partly accurate) perception of “blood in the streets”. A well known investing adage tells us that the right time to buy is often when there is “blood in the streets”. For each of Children’s Place and Shoe Carnival, competitors bankruptcies have soured investor sentiment toward all stocks within their respective niches. In addition, when competitors go bankrupt, the real world impact on survivors extends beyond just “negative sentiment”. When distressed competitors flood the market with discounts and liquidations, it ends up causing a genuine financial hit to the P&L’s of stronger players like Children’s Place and Shoe Carnival. And we have certainly seen the impact of competitor liquidations have a negative impact on each.

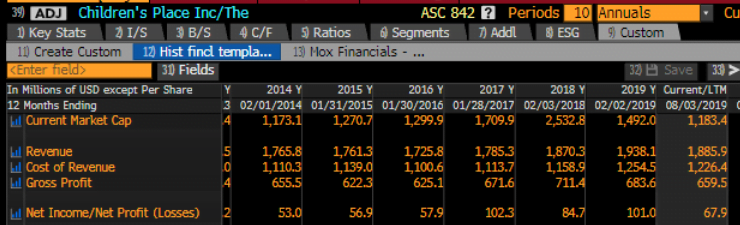

With Children’s Place, it was competitors Gymboree and Crazy 8 that shut down towards the end of 2018, flooding the market with inventory. This is what sparked a plunge in the the share price from $160 to briefly below $70. But because the company has a strong footprint and low leverage, they were able to capitalize on the demise of their competitors, buying up not just product but also the IP for their soon-to-be defunct brands. Children’s Place was therefore often buying out its only local competition and was doing so at pennies on the dollar. All of this activity resulted in a near term hit to earnings which should have come as no surprise to anyone. I published my notes on Children’s Place on August 1, 2019, because I assumed that the company had already had enough time to “chew through” that overhang of competitor inventory and acquisition related expenses. But I was clearly too early in my call. When earnings were announced in late August, they were still fairly weak, meaning that the “chewing” was not yet done. I see little change to my overall thesis with Children’s Place, except that now the stock is a good bit cheaper then even before. So that is a good thing. The only real question mark for me is when can they start to monetize the benefit of a far less competitive environment. I expect we will have much better clarity when earnings are released in around 4 weeks.

- Long PLCE. Children’s Place could quickly spike back to $160 (Moxreports, 01-Aug-2019)

Shoe Carnival. Within the footwear space, there was similar trauma at roughly the same time. In February 2019, Payless Inc. announced that it was closing 2,500 stores in North America within months. This was the company’s second time going into bankruptcy court in two years. The effect of such a large bankruptcy had a predictable effect on competitors of Payless. Shoe Carnival steadily declined from the $40s down to the $20s, before beginning the current rebound.

- Payless files for bankruptcy. It’s shutting all its North American shoe stores (LA Times, 19-Feb-2019)

But actually, both companies have visibly resilient businesses along with very strong management teams. During 2019, revenue at Children’s Place saw visible headwinds, but certainly was not decimated. Competitor liquidations and discounts caused pressure on margins which was visible, but which should also have been entirely predictable. CEO Jane Elfers has a good track record of being very shareholder friendly with, using dividends and buybacks in a way that has been effective without being overly aggressive. She has also been strict in avoiding the biggest pitfall of her competitors: leverage. My point is this: even though there was some real world pressure on P&L, the true seems quite moderate relative to the 50% collapse in the share price. As such, that decline seems significantly overdone.

Likewise, at Shoe Carnival, key metrics have seen some headwinds, but the overall performance is certainly not terrible. Cliff Sifford recently transitioned from CEO into the role of Executive Chairman. Like Elfers, he has a long history of making long term decisions that have worked well for the company and its shareholders, including a very deliberate avoidance of debt. Like Children’s Place, this is what has left Shoe Carnival “winning the war of attrition”. Even with his move into a different role, I see no reason to expect changes to their conservative practices.

- How This Billion-Dollar Shoe Store Has Secretly Sidestepped the Retail Apocalypse (Footwear News24-Sep-2018)

Both Children’s Place and Shoe Carnival are “winning the war of attrition”. This is a key factor to the thesis on these names and one that is consistently being missed. What the market often misses is that the extinction of competition ends up being a tremendous boon to those few players who are left standing. I describe this benefit as “winning the war of attrition”. Companies like Children’s Place and Shoe Carnival are strong enough to weather the storm, and when they emerge, they then enjoy drastically reduced competition and drastically improved pricing power, just as their customers now have few (if any) remaining local alternatives.

With Children’s Place, analysts and management estimated that there would be the closure of roughly 1,000 “competitor doors”, which has become a very useful metric for trying to map out the rebound potential. There is also potential for further benefit from their cooperation with Amazon. It is not easy to be precise on that, but in any event, having an unquantified positive is fine by me.

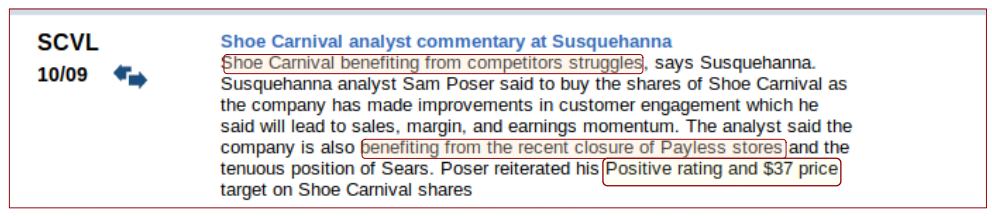

With Shoe Carnival, sell side analysts have already begun expressing a similar view on how the company will benefit from the demise of competitors. The ongoing dividend and the aggressive share buyback have then amplified that positive sentiment further. Last week Susquehanna reiterated a positive rating and a $37 target. But I suspect this could be revised upward around upcoming earnings in November.

- Analyst Favorites With Strong Buyback Activity: Shoe Carnival Ranks As a Top Pick (Forbes.com, 16-Sep-2019)

With all of these trades, direction seems fairly easy to predict. But timing and trajectory are not. Timing is always the toughest part to guess. I have been bullish on both Children’s Place and Shoe Carnival since July, buy I was clearly too early on each of them. I assumed that by the August quarter, both of these companies would have fulled “chewed through” the overhang which had resulted from competitor bankruptcies, and that the rebound in the P&L would become visible in their August quarters. The rebounds were not yet fully visible in August, but I feel there is ample reason to maintain that expectation, just that it happens a quarter later, in November instead of August. Children’s Place is expected to report around November 21 and Shoe Carnival is expected to report around November 26.

It feels to me like the sell side is already starting to bake in much what I am suggesting here as well. So there is some possibility that possible that we start to see the stocks begin an earlier upward run as more people start to anticipate in advance a “surprise” rebound in P&L.

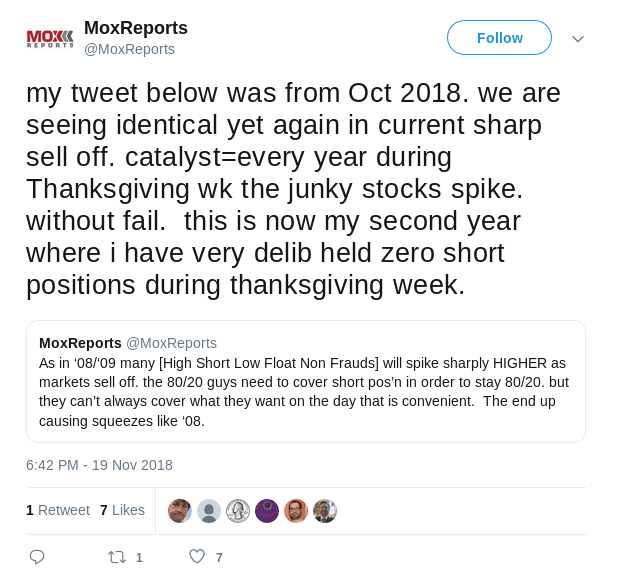

In addition, there is an observable phenomenon where heavily shorted low float stocks tend to rise in the weeks leading into holiday weeks like Thanksgiving and Christmas. There have been a number of possible explanations for why this happens so consistently. Regardless of the reason, I like the tail wind that it may provide for these stocks, even in addition to any anticipation for earnings rebound in 4-5 weeks. Below was what I tweeted last year heading into Thanksgiving regarding some other beaten down “junky” stocks that I had been following.

I generally tend to approach these trades with a very simplified outlook. For me, a holding period of roughly 3-8 weeks is consistently what has worked out best and I leave out limit orders at different levels so i don’t need to sit and watch the share prices so much. There may be times when the trades work out sooner than expected, which is always nice. But it probably should not be counted on. Likewise, if my thesis hasn’t largely borne out within perhaps 10 weeks or so, I need to acknowledge that I might be missing something. Given our late stage in a bull market, I prefer to not stay married to any given thesis for much more than 8-10 weeks. When I do, I often end up feeling foolish.

Looking at my past Bammer rebound trades.

Dillards (DDS). Each time Dillard’s (DDS) has dipped into the $50s, it has been a clear opportunity to buy, and within a few weeks there were easy opportunities to sell into the $70s or $80s. I have played this rebound in each of 2017, 2018 and 2019, and if it dips into the $50s again I will buy it again. My most recent report on Dillards’ was just 6 weeks ago when the price was at $54.98. I finally fully exited Dillard’s this week at prices around $71. In theory, Dillard’s would be justified trading at much higher prices than the $70s or $80s. But in practice, I am trying to limit my holding periods to less than 8-10 weeks where possible.

- Long DDS. Watch for the (as usual) violent rebound. Here’s the catalyst. (Moxreports, 28-Aug-2019)

- Dillard’s (DDS) could quickly double on “upside perfect storm” (LONG DDS) (Moxreports, 24-Jun-2019)

- LONG DDS. Long Dillard’s on potential “infinity squeeze” (Moxreports, 25-Jun-2017)

Revlon (REV). The swings on Revlon (REV) have been even bigger on Dillard’s. When Revlon occasionally dipped to the mid teens, it was frequently a great opportunity to buy into a 40-60% rebound to the mid-high $20’s. As with Dillard’s, my ideal expectation has been for expected rebounds to unfold over a period of several weeks, and ideally I do not stay in them for more than 8-10 weeks before taking a breather to re-evaluate. I was a bit too skittish on Revlon’s most recent dip into the teens, so I missed the most recent 50% rally. If it dips again, I will re-evaluate at that time.

- Long REV. Missed disclosure changes point to Revlon buyout (Moxreports, 07-Jun-2018)

- Long REV. Revlon’s short vs. float setup just became tighter than Tilray(TLRY) (Moxreports, 19-Sep-2018)

- Update on Revlon long thesis (Moxreports, 17-Jun-2019)

Restoration Hardware (RH). When RH was still below $50, I was generally bearish on things like the business prospects, the financials, and various aspects of management. Ironically, when the price hit $89, I started viewing RH as a far better long than when it was below $50. The share price recently hit $180. Like Dillard’s and Revlon, the moves in RH tended to unfold over a period of multiple weeks. And it also provided repeated opportunities to get back in on the dips.

- Long RH. RH Will Spike Much, Much Higher Very, Very Soon (Moxreports, 03-Nov-2017)

Reminder about the impact of outside traders on heavily shorted stocks. As the float dries up on these over-shorted names, there is often volatile action around their share prices. Short term traders may get more vocal on social media and market activity may become quite peculiar. For stocks which I am involved in, I tend to watch and document closely such peculiarities when I see them. I encourage others to do the same where practicable.

This report is the opinion of the author. The author is long PLCE and SCVL. See disclosures and disclaimers.

Article by Mox Reports