Is gold entering a D wave correction before it begins its next rise? The FED are restarting the printing presses and expanding the balance sheet ‘soon’ in response to funding issues. Silver detaches from gold, has a reversal begun in the white metals?

Is gold entering a D wave correction? Silver price detaches – Golden Rule Radio

Q3 2019 hedge fund letters, conferences and more

D wave correction for gold?

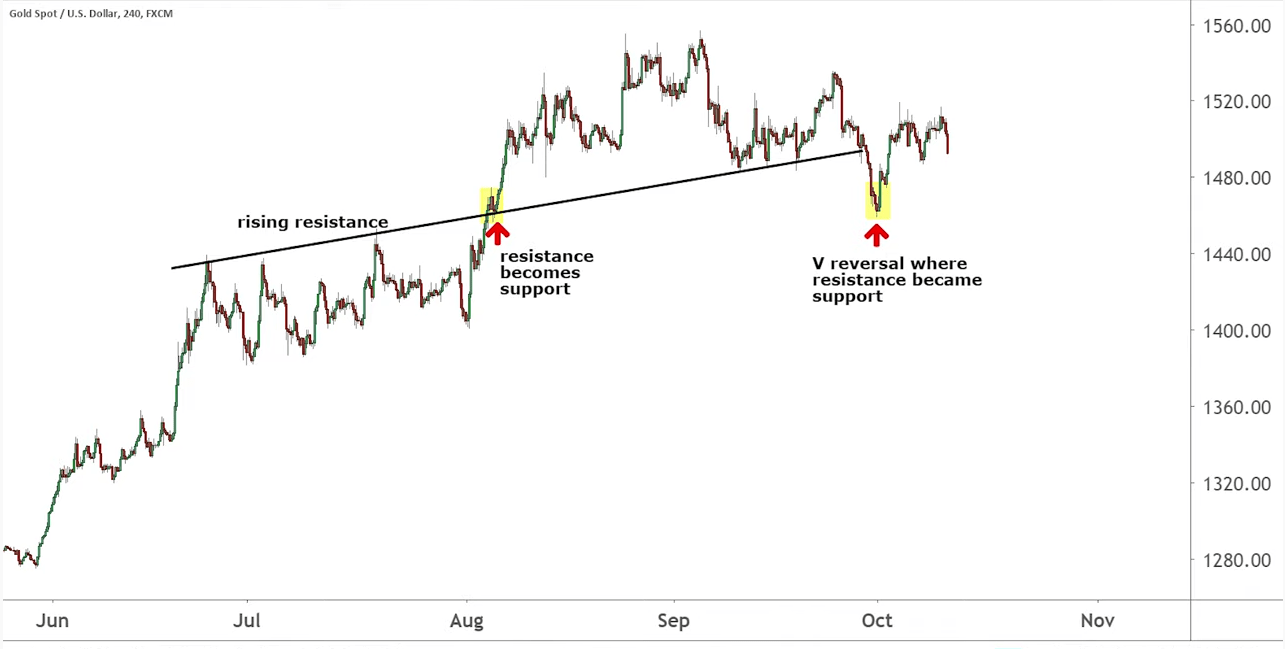

Welcome back to Golden Rule radio, your weekly recap of the precious metals markets and the news that moves the markets. And we are going to start out with those markets, specifically the gold market. As we saw a great bounce come in this past week after coming off that 1550-1560. Hi, we dropped pretty deep into the 1400s, low v turn around. So the question is, was that a reversal? Or are we going to see a continuation back down? Now that Gold's back up in the low 15s.

Now we're sitting at 1505. Today, you know, two days ago, we're at 1490 or so. And it is bullish that it's sitting here, but quite frankly, I just can't buy into it yet. Till we start flirting with that previous high, I'm expecting there to be a little bit of a downturn, and that's healthy. The only indication that would steer me in other direction is if some major piece of news comes out because gold and silver have definitely gotten more sensitive to major news. Whereas for while it seemed like for years, we're almost numb.

Fed policy

It's all right, we got a piece of news yesterday from the Fed. And again, a little bit of news today, but they're going to go ahead and expand their balance sheet moving into some more QE. So you know, we didn't have a pop yesterday from that, but as we know long term that will have a large effect on the price of gold, and we're not seeing a heck of a lot of response from the equities market.

Thanks to all this new quantitative easing programme over the last couple weeks, the equity spike down pretty aggressively, I think about five and a half 5.7% off the recent high which was a lower high than the past one.

So the equities market to me is starting to potentially put in a top while all indications argue still bullish in the Dow, we will need to see a substantial lower low coinciding with this recent lower high so it's certainly possible we could see gold doing a little reversal here off that like 1460 ish number. But again, I don't buy it quite yet. Cuz you go back to Elliott D wave correction and ABC the past theory.

And there's a very good argument, we're in a D wave correction pattern. And we could see lower pricing, lower opportunity in the gold price.

Gold support levels

Yeah, I agree. I mean, 1480s held pretty firmly here. 1516 was sort of a flash, but we've been sitting on the lower end of this channel, silver has to that gold silver ratio has hovered around 84, even 85 to 1. So still a lot of weakness in silver, you know, the white metals in general, because Platinum have come down a little bit to palladium is the one anomaly in the group of four metals. And you know, what we're watching here again, though, too, is the initiation of post fourth quarter fiscal year for the federal government as we start to get news coming in budgetary from them.

But also news coming in in terms of corporate earnings is you get into the quarterly reports, whether people lived up to expectations or came short of expectations, those are kind of things that can create that snowball effect in the equities weakness or reverse it, because we did see in the daoists, 1100 point reversal from from peak to trough. And quite honestly, I think we're also coming into a season here where we tend to get strength in the metals, and weakness in the equities markets.

Sure. And I do think it's important to say when we're talking about weakness, this is a weekly show, we're talking about weekly market moves in the show.

Bull market in metals?

So I don't think anyone at this table thinks that the precious metals market hasn't started at least that first phase of the bull market, which we talked about phasing in markets last week. And so what we're talking about here is what do we see gold doing over the next couple of weeks, not over the next two years, and miles just to touch on silver again, you know, before we came in the studio today I was watching you look at your charts like you're always doing and you pulled up the silver chart and just said Oh, what was what was the other four?

Well, the Oh, it's kind of funny the uh oh was because silver actually looks like it is reversing.

So as I finished up my conversation here about how I think gold should be inching back down, I flip over to the silver chart, and I see us putting in a sideways rising channel, higher highs, higher lows, you know, we came into that 50% line on silver, and I had this moment of walking in Okay, the Dow's down Gold's probably going to take another leg down D wave correction.