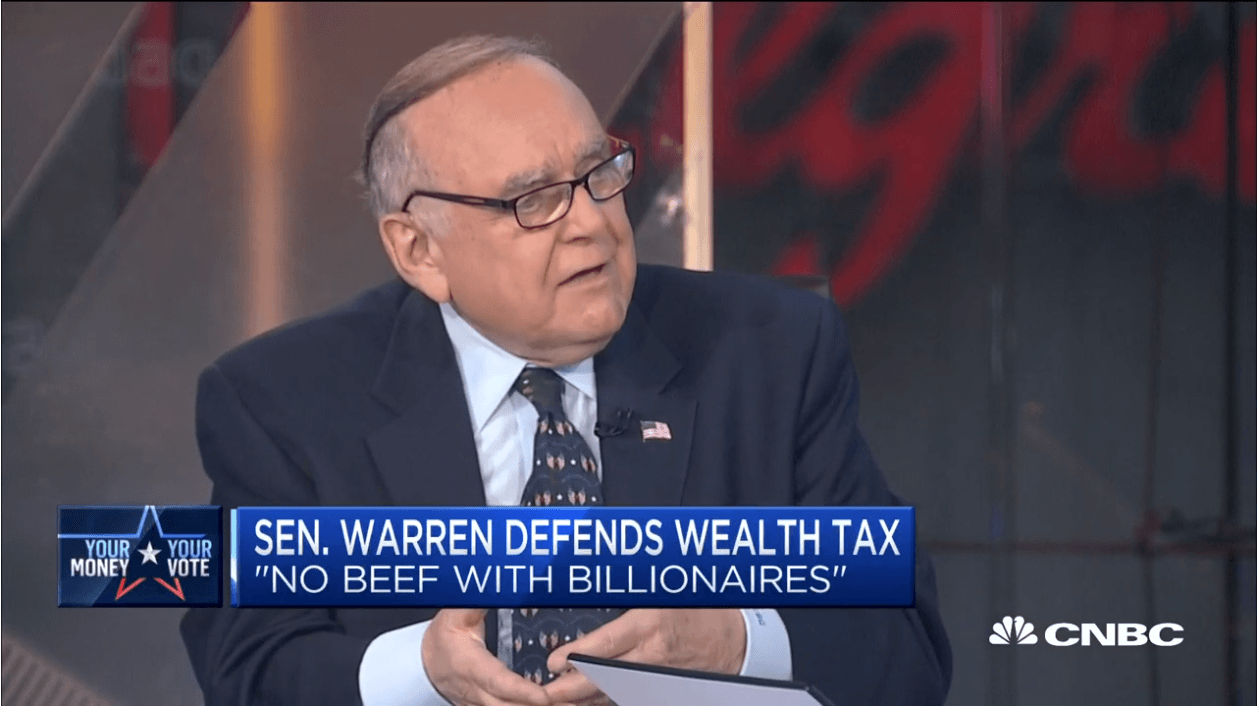

CNBC Excerpts: Omega Advisors Chairman and CEO and Billionaire Leon Cooperman Speaks with CNBC’s “Squawk Box” Today

WHEN: Today, Wednesday, October 16, 2019

WHERE: CNBC’s “Squawk Box”

The following is the unofficial transcript of excerpts from Omega Advisors Chairman and CEO Leon Cooperman on CNBC’s “Squawk Box” (M-F 6AM – 9AM) today, Wednesday, October 16th. The following are links to video from the interview on CNBC.com:

Q3 2019 hedge fund letters, conferences and more

Leon Cooperman: The stock market would drop 25% if Warren or Sanders is elected

Billionaire Leon Cooperman: There's one more leg left in the bull market

Billionaire investor Leon Cooperman: Stop portraying billionaires as criminals

All references must be sourced to CNBC.

Leon Cooperman On Carried Interest:

But you don’t do it through a wealth tax. Just get rid of the loopholes. Seven years ago, seven years ago, on this show, I said if we're serious about dealing with taxes, get rid of the carried interest. Yes. Seven years ago. We had Democrats controlled Congress in the government, the Republicans. We still have carried interest. Section 1031 of the IRS code allows these real estate guys to disrupt. Get rid of it. Okay? Let's decide what the maximum tax rate should be.

Leon Cooperman On The Bull Market:

LEON COOPERMAN: And I keep coming back to a great, great observation by John Templeton. I only wish I was smart enough and articulate enough to generate it myself. He said, ‘Bull markets are born in pessimism, they grow in skepticism and they mature in optimism and they die in euphoria.’ I don't see euphoria other than the IPO market and that's already been corrected.

ANDREW ROSS SORKIN: Where are we then? In your -- in your—

LEON COOPERMAN: I think there's one more leg left in the market and—

ANDREW ROSS SORKIN: We haven’t hit euphoria. But that could be a big spike then. Euphoria is usually--

LEON COOPERMAN: It could be -- it could be 10%. You know, but –

ANDREW ROSS SORKIN: 10% up still?

LEON COOPERMAN: Yeah, it could be 10% up over the next six months. Don't forget the market has a capital market line. So, on average, it should rise five six percent a year. So, if we –

ANDREW ROSS SORKIN: But to the extent that everyone's talking about a recession -- if you go up 10%, are we talking about a recession coming down 10% or are you talking about a –

LEON COOPERMAN: Recessions generally -- look every economic expansion creates the seeds for the next recession. every recession sews the seeds for the next economic recovery. If you're a student of economic and market history, recessions last about a year and the market goes down 25%.

JOE KERNEN: Market expansions usually cause an overheating, which causes rates that go up, which causes the recession. And those are garden-variety. This is totally different, right?

LEON COOPERMAN: Well, it could ultimately happen but it's not happening now which is a good thing.

JOE KERNEN: In a totally different way though. And I don't know -- I don't know whether that makes it deeper, or—

LEON COOPERMAN: You’ve seen the General Motors strike, you haven't seen that labor strike for quite some time. I think the two things to watch carefully, okay: one is Iran. A war with Iran would spike the price of oil which would be very negative.

JOE KERNEN: Very negative. Yeah, we’ve talked about that.

BILLIONAIRE Leon Cooperman On The Stock Market If Warren Or Sanders Is Elected:

LEON COOPERMAN: Okay. The second thing to watch is China. If the president resorts to putting on another round the tariffs, that probably increased the probability of recession. And if we have a recession the market drops at least 25%. If Elizabeth Warren is elected President, in my opinion, the market drops 25%. Bernie Sanders, same thing. You know, in my view. As I listened to the debate last night, I kept on thinking of a great statesman by the name of Winston Churchill who said, ‘You don't make poor people rich by making rich people poor.’

He said, ‘The main vice of capitalism is the uneven distribution of prosperity. The main vice of socialism is the equal distribution of misery.’ What is their problem with billionaires? All the billionaires that I know are self-made and give back more to the system they're given themselves. Okay. Bernie Marcus was a depressed dude when

he got fired on Christmas.

JOE KERNEN: A different Bernie. Yep.

BECKY QUICK: Bernie Marcus, Home Depot.

LEON COOPERMAN: Bernie Marcus of Home Depot. Okay, he got fired right in Christmas week. He was very depressed. He called up Ken Langone to express his depression. Ken who is one of the great people in the country in my opinion, okay, says, ‘What the hell are you depressed about? I'll go out and raise you some money and you'll pursue your dream.’ Okay. And his dream was superstores in the hardware -- he says, ‘I'm going to run a hardware store.’ Right? Okay. Today Home Depot's got a two hundred fifty-eight-billion-dollar market cap.

They employ 40,000 people. They have thousands of associates that are millionaires. okay and Bernie is given back a fortune to the economy. It started with the Atlantic Aquarium $250,000,000. Ken Langone is a legendary philanthropist---

JOE KERNEN: He did the show from there. It's amazing.

BILLIONAIRE LEON COOPERMAN: Ken Langone -- I think he's, I can't count his money, giving maybe thirty or fifty million dollars to NYU. Most recently, he led the initiative to provide free medical tuition for the lucky students that get into NYU. Then, you look at Bill Gates, what he’s done. You look at Mike Bloomberg, what he's done. I recently interviewed David Rubenstein. I turned the table on him at New Jersey Performing Arts Center where I did this thing, the Speaker Series.

You know, Rubenstein’s old man was a post office worker, started with nothing and his patriotic philanthropy is legendary. Okay. So, this idea of attacking billionaires is bull, totally bull. So, what they should do -- what we have to do as a nation is to coalesce around the question: what should the maximum tax rate be on wealthy people? Okay.

JOE KERNEN: You can get your message out more if you finish the term bull. Because the more people will pick it up—

LEON COOPERMAN: I can’t. Because then you’ll black me out.

JOE KERNEN: No, we won’t. Not on cable.

BECKY QUICK: We’re on cable.

JOE KERNEN: You can say it. You want me to say it? Bull shih tzu.

LEON COOPERMAN: Okay. Okay. That's up to you. I’m not—

JOE KERNEN: No. I said the dog.

BILLIONAIRE LEON COOPERMAN: I’m a guest here.

JOE KERNEN: I know how to do it.

LEON COOPERMAN: I’m a guest in your home. I conduct myself. But based on – you have to agree upon what the max in tax rate should be on wealthy people. I believe in the progressive income tax structure. I believe rich people should pay more. Okay. I have no problem with that. This wealth tax is baloney.

BILLIONAIRE Leon Cooperan On The Wealth Tax, Billionares:

LEON COOPERMAN: I believe in the progressive income tax structure. I happen to believe I’m my brother's keeper. Okay. That's why I'm doing what I do with my money. I get the greatest pleasure -- I see my children and grandchildren grow old healthy and purposely.

ANDREW ROSS SORKIN: Fair enough. I’m not going to fight that.

LEON COOPERMAN: And giving back to the system. Okay. And -- but I don't need a wealth tax to do it. Just decide what the tax rate should be and stop portraying billionaires as criminals.

ANDREW ROSS SORKIN: That I agree with.

LEON COOPERMAN: Okay. It's counterproductive. The American Dream. I hate talking about myself to be honest with you, because self-praise stinks. okay my father came to America at the age of 13 as a plumber's apprentice. Okay. No formal education.

He died at seventy years of age carrying up a sink a four-story tenement building, from a heart attack. Okay. I grew up the South Bronx. I went to public school in the South Bronx and I went to high school in the South Bronx okay go back to the movie Fort Apache, The Bronx.

Okay. the opening scene is two kids throw a third kid off at sixth floor in a tenement building. I was lucky. I could have been that kid I wasn't. Okay. I then go West, I follow the advice of -- I go West and I go to Hunter college in the West Bronx, now called Lehman. 24 dollars a semester. Got a wonderful wife.

ANDREW ROSS SORKIN: Let me ask you question.

LEON COOPERMAN: Alright, let me finish. I apologize. I’ve got to finish. Okay. I then have a short stint at Columbia Business School, opens the door to Goldman Sachs. I started Goldman Sachs with student loan, a six-month old kid who is 54 years old today, not today but, and a negative net worth.

ANDREW ROSS SORKIN: And god bless you for being part of that generation.

American dream dead?

LEON COOPERMAN: That’s the American dream.

ANDREW ROSS SORKIN: And that dream is not the same today. And so, the question I ask you is a different one. Which is A) do you believe we need to create more revenue? Do you think that the government needs more revenue? Is there enough money? I can tell you by the way –

LEON COOPERMAN: There’s not. We should not be running deficits of –

ANDREW ROSS SORKIN: Right. So, by default we need more money. Okay.

LEON COOPERMAN: Yes.

ANDREW ROSS SORKIN: And then we have to figure out how much money we need and then we have to figure out –

LEON COOPERMAN: You can take all the money away from the wealthy people.

ANDREW ROSS SORKIN: I'm not trying to take it away from the wealthy people. I’m trying to figure what’s the answer.

LEON COOPERMAN: My answer is education. The average lifetime earnings of a college graduate is well in excess of a million dollars more than non college graduate.

ANDREW ROSS SORKIN: One hundred percent.

On education

LEON COOPERMAN: Okay. Educate the kids. Give them an educational opportunity. That's why I have a Cooperman’s College Fund.

ANDREW ROSS SORKIN: Who is paying for that?

LEON COOPERMAN: Well, the government through tax revenues and the private sector.

ANDREW ROSS SORKIN: Right, and we’re spending a trillion dollars --

LEON COOPERMAN: Our economy would be better off if we had more billionaires. Just tax them. Isn't the world a better place because Jeff Bezos? Isn't the world a better place because of Bill Gates? Isn’t the world a better place because of Bernie Marcus and Ken Langone?

ANDREW ROSS SORKIN: I don't – absolutely. I don't disagree with that. The question though is how you're going to tax them. By the way, the people you just mentioned, the majority of them actually – well, actually, I would say Bezos is in a different category. But you look at Warren Buffett and Bill Gates. Because they're giving their money away a lot of most of their fortune will actually never be taxed.

LEON COOPERMAN: -- probably the -- most of the wealthy people that way. I call those guys philanthropist with a capital P. I'm a philanthropist with a small P. Okay. But I've given back I've given away probably close to a billion dollars. Okay.

On tax rates

BECKY QUICK: I don’t know that that’s a loophole. Like, give all your money away and you don’t have to pay taxes on it.

LEON COOPERMAN: For what? The tax rate’s not 100%.

BECKY QUICK: That’s what I mean. I don’t consider that a loophole.

LEON COOPERMAN: Look, I figured out a long time ago there's only four things you could do with money, if you think about it. The first thing you can do with money is you could pleasure yourself: buy, buy planes, buy homes. Okay. I happen to be of the view that material possessions bring you aggravation.

Less is more. I'm not a collector of things. The second thing you do have money is to give it to your kids. But if you have a lot of money leaving all your money to kids is a mistake because it deprives them of self-achievement. The third thing you do with money is you give it a government.

Well, only a schnook gives the government money you don't have to give them. And the fourth thing to do is you recycle the money back into society to make the world a better place. And that's where all my money is going.