Arquitos Capital Management letter to investors for the third quarter ended Septmeber 30, 2019.

The stock market is a device for transferring money from the impatient to the patient. – Warren Buffett

Q3 2019 hedge fund letters, conferences and more

Dear Partner:

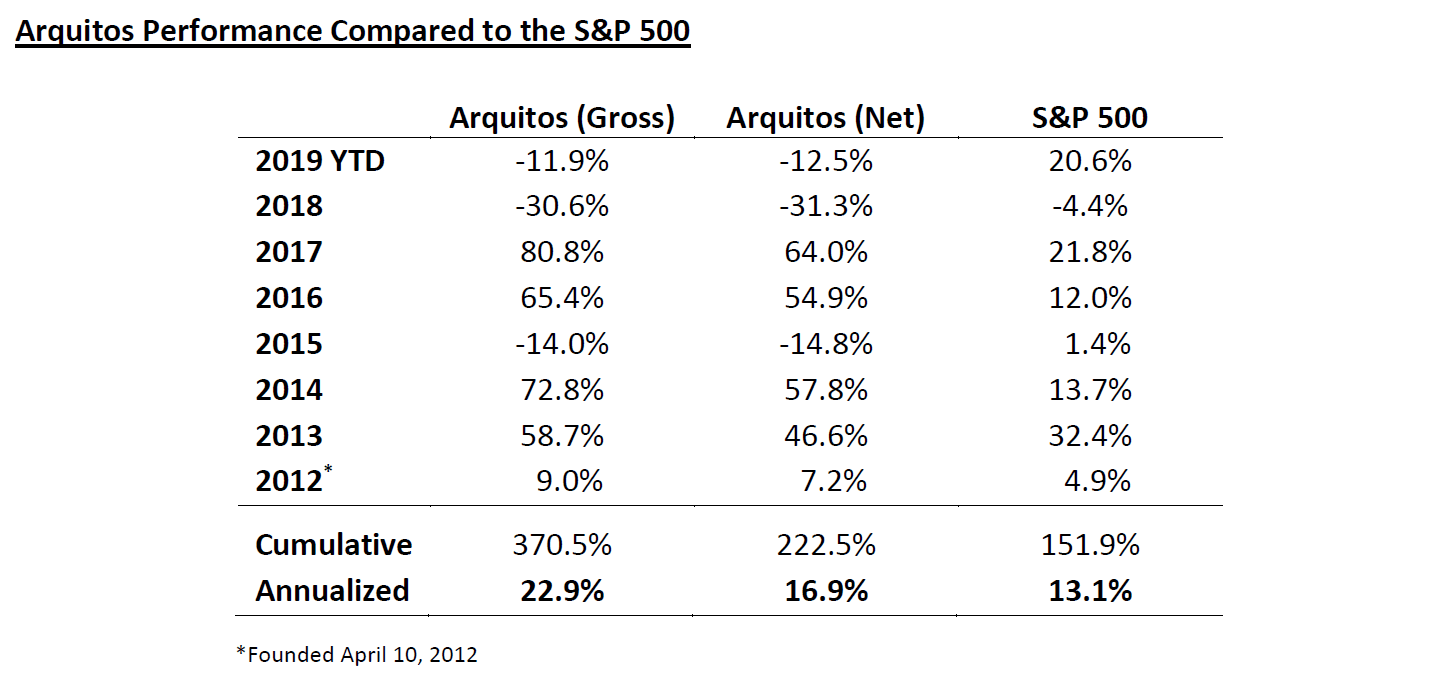

Arquitos returned -12.6% net of fees in the third quarter of 2019, bringing the year-to-date return to -12.5%. Our annualized net return since the April 10, 2012, launch is 16.9%. Before fees, Arquitos has returned 370% cumulatively and 22.9% annually since our launch seven and a half years ago. Please see page four for more detailed performance information.

The operations of our primary positions continue to be strong. Their share price performance, unfortunately, has continued to be challenged. Patience is key right now.

Today is the largest discrepancy between share price and intrinsic value for the portfolio since I launched the fund. We are fully invested with significant reinvestment opportunities for new cash coming into the fund.

There is no better example of this opportunity than our largest position, MMA Capital Management (MMAC). MMAC recently announced a hugely positive piece of news. The company is borrowing up to $175 million at current interest rates below 5%. These proceeds will primarily be invested in MMAC’s solar lending portfolio where the company has generated better-than-mid-teen annualized returns over the past several years.

MMAC suspended its ongoing buyback program during the loan negotiation period. Now that it is complete, the company announced a new buyback program. They may buy back up to 100,000 shares at prices below book value through December 31, 2019. Book value currently sits at $36.46 per share. The stock price ended the third quarter at $30.00. MMAC has been buying back 8-10% of its outstanding shares annually over the past six years, always below book value. These buybacks have provided a tremendous return to MMAC shareholders.

MMAC’s short-term stock price continues to defy logic. The company was added to the Russell 3000 index earlier this year. It just telegraphed an additional $2+ per share of annual earnings. It continues to buy back shares far below book value. And senior management and all major shareholders continue to be wildly enthusiastic about the company’s prospects. The only thing to do in situations like this is to hold tight and let the market come to its senses. If we could add to our position, we would do so aggressively.

Westaim (WED.V) is in a similar situation. I won’t rehash the details about the company from previous letters since not much has changed; but I will note that the share price ended the third quarter at C$2.50 per share. Book value is C$3.34. There have been significant recent insider purchases by company executives.

Again, the market will come to its senses at some point and the share prices for these companies will match their intrinsic value. If this doesn’t happen in a reasonable time period, the companies themselves will do something about it. Each of these companies has smart allocators at the helm, and they know the true value of their own companies.

We would love to own MMA Capital, Westaim, and Enterprise Diversified over the next decade even if there were no share price quoted. The operations for each of them will provide for exponential increases in value.

I have previously written about why I believe having a concentrated portfolio is the best approach and will provide for the highest returns over the long-term. A by-product of a concentrated approach can be volatility. Volatility is our friend. It may lead to some periods of underperformance such as now, but over time we will have better returns because of our ability to take advantage of these mispricings.

We held our Arquitos annual investor meeting on September 17. If you were not able to attend or have not yet viewed the video, please send a note to Jessica Greer and she would be happy to share it with you. It was great to see everyone there.

I presented our annual Arquitos update at the event. Attendees also heard from Alluvial Fund and Bonhoeffer Fund. As a reminder, Arquitos controls Enterprise Diversified (SYTE) where I am the chairman. Enterprise Diversified has an asset management subsidiary named Willow Oak Asset Management. Willow Oak Asset Management handles operations and investor relations for Arquitos. Willow Oak also holds a seed investment in Alluvial Fund and has an ownership stake in Bonhoeffer Fund.

Willow Oak recently announced a new partnership with Geoff Gannon and Andrew Kuhn at a firm named Focused Compounding. Willow Oak will help Focused Compounding launch a new fund on January 1, 2020, and will assist the firm with its operations. Focused Compounding also has a strategy specific to managed accounts that will continue. Willow Oak took an ownership stake in Focused Compounding and will earn a fee share from the fees generated by the managed accounts and the forthcoming fund.

I have followed Geoff Gannon for more than a decade and have always been impressed with his research and approach. Andrew Kuhn has been working with Geoff for a few years. They make a great team. I am certain their new fund will be a success. They have already garnered significant commitments from investors for the fund launch. That success will benefit Willow Oak and Enterprise Diversified and will ultimately provide positive returns to Arquitos.

If you would like to learn more about Focused Compounding, Alluvial Fund, or Bonhoeffer Fund, Jessica would be happy to provide information.

Companies fall in and out of favor just as industries do and just as investment styles do. Ben Graham-style value investing has been out of favor for quite some time. Companies with strong balance sheets have not gotten the appreciation they deserve during this decade-long period of market appreciation. The markets will be challenged in the future again, and these strong balance sheet types of companies will be a safe haven for stock investors.

Arquitos has done very well during this time of stock market appreciation, but we have done it by owning select, value-oriented companies in a concentrated way. Our holdings clearly have not “worked” over the past 18 months, as market participants have shunned our largest positions. Their current cheapness is our opportunity.

Thank you again for your investment in Arquitos and for your patience and commitment.

Best regards,

Steven L. Kiel