ValueWalk’s interview with Paul Espinosa, Portfolio Manager at Seafarer Capital Partners, LLC. In this interview, Paul discusses his and his company’s background, their valuation process, managing a diversified portfolio, investing in emerging markets, an abiding rule not to invest in Argentina, risk associated with EM currencies, corporate governance, lucrative investment retruns from SOEs, the top contributor to Seafarer Overseas Value Fund’s performance, investing in Vietnamese and Middle Eastern companies, his opinion on Greece and Russia, and value opportunities in the emerging markets.

Can you tell us about your background?

Q2 hedge fund letters, conference, scoops etc

I got hooked on equity research and emerging markets at J.P. Morgan Investment in New York following my first job working in corporate finance at Salomon Brothers. The idea of living with the consequences of one’s investment decisions over time appealed to me more than the transactional nature of investment banking. Investing over long periods of time, as opposed to “pitching” a corporate action, required a level of understanding of a company and the industry it operated in that I found intellectually rewarding. The heterogeneous nature of emerging markets added a level of complexity that forced an understanding of economic development and the world in general that few other jobs could match. Most of all, what is unique about making investment decisions – as opposed to other professions such as academia that offer similarly rewarding opportunities in terms of studying a subject matter – is that one literally “puts his money where his mouth is.” An investment mistake is the mother of all teachers, and investing is ultimately a learning practice.

I continued to pursue this practice with the people I worked with at J.P. Morgan Investment as they moved to Citigroup Asset Management, and subsequently at Legg Mason when it acquired Citigroup Asset Management.

I lived approximately seven years in New York and London, respectively, and then moved to the Bay Area, where I was fortunate to meet and work with an investment soulmate, Andrew Foster, founder and CIO of Seafarer Capital Partners.

What about Seafarer?

Seafarer Capital Partners is unique not because it is a boutique asset manager, or because it specializes in emerging markets, or because it is employee-owned; rather, it’s different because those attributes enable it to pursue its own distinctive investment vision without constraint. At Seafarer, unlike the larger investment firms that focus on benchmark-oriented approaches, the starting point for making an investment decision is not whether to overweight or underweight a stock that is part of the index, but rather to define the underpinnings of long-term investment returns and then look for those attributes in the entire emerging market universe, unconstrained by third-party definitions of what constitutes a benchmark.

I cannot stress enough the importance of this difference in thought process, the result of which is that Seafarer will only sponsor and advise strategies that are themselves differentiated. At present, Seafarer advises the Seafarer Overseas Growth and Income Fund and the Seafarer Overseas Value Fund. Both strategies fall outside of the beaten path of growth funds in the emerging markets. And even when compared to the few other funds that pursue similar strategies, I think the reader would find Seafarer’s portfolios to be unique, in terms of a high degree of active share and the way the Funds generate investment returns.

What is your valuation process at Seafarer?

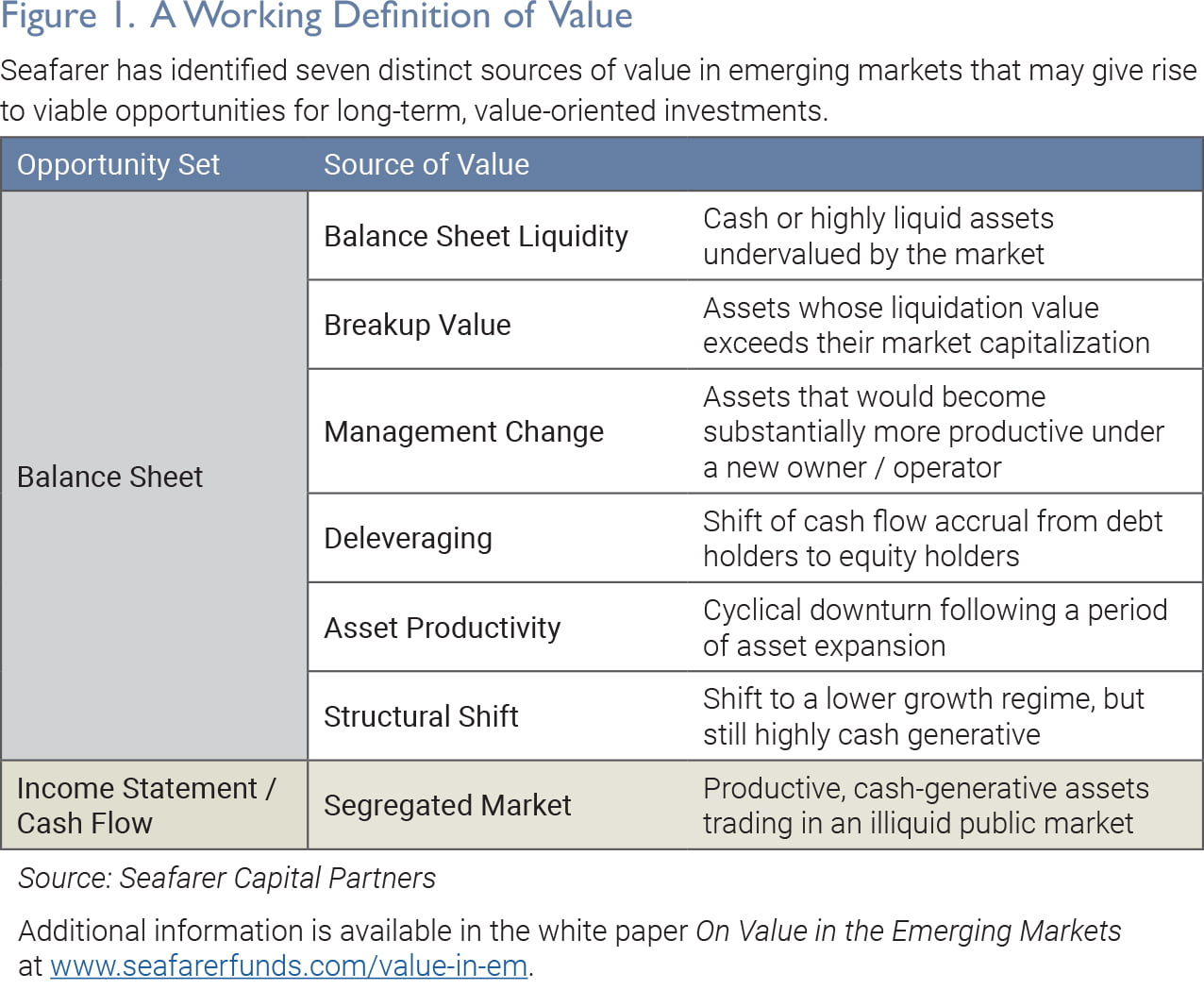

The valuation process is always tailored to the company in question. I do not define value in the traditional manner of low multiples, whether P/E (Price to Earnings) or P/BV (Price to Book Value), or a high dividend yield. A low multiple is simply a signal of potential value, not a driver of investment return. Thus, my valuation process starts by defining the source of a potential investment return. Figure 1: A Working Definition of Value below illustrates the point by defining seven categories of value.

In addition to defining the source of investment return, the framework in Figure 1 also guides the company research process by focusing the analysis on why a stock is presumably cheap to begin with, and what will drive the realization of the potential investment return.

Depending on the category of value, the valuation work will rely more heavily on the balance sheet than the cash flows, and vice versa. However, what is common to all categories of value is the focus on cash flow to equity holders over accounting earnings.

The reader may find a more extensive explanation of the valuation work in Seafarer’s white paper On Value in the Emerging Markets.

Are you concentrated or diversified at Seafarer?

I aim to manage the Seafarer Overseas Value Fund in a manner that is “diversified,” according to the regulatory definition of that term. That said, within the parameters of a diversified fund, the Value Fund is fairly concentrated with 34 holdings as of June 30, 2019.

Do you use any checklists, why or why not?

No. Checklists are not a substitute for thinking. An investor using a checklist repeatedly runs the risk of believing that investing can be an automated process. The world and the companies that operate within it are fluid. Reality does not conform to a checklist. Furthermore, checklists detract from creativity, which I find essential to sourcing and validating investment ideas in a market increasingly dominated by passive funds.

Each company is its own universe and requires its own tailored analysis.

What is your mandate? Can you invest locally or just EM? What definition do you use for EM?

The objective of the Seafarer Overseas Value Fund is long-term capital appreciation.

The Fund invests in emerging markets, which Seafarer defines as most nations in Africa, East and South Asia, Emerging Europe, Central and South America, and the Middle East. The Fund may also invest in selected foreign developed markets, which in Seafarer’s opinion have significant economic and financial linkages to developing countries. Currently, and solely with respect to the geographical scope of the Fund, these markets include, but are not limited to, Hong Kong and Singapore.

Many investors got blown up (yet again) in Argentina - do you avoid any EMs like there?

Yes. Seafarer invests on a bottom-up basis, which means it does not make investment decisions by allocating capital to countries. The only way in which Seafarer engages in macro analysis is on a risk basis, and on that front, Seafarer has long identified Argentina as a country in which it would not invest as an abiding rule. In fact, since the inception of the firm, Seafarer has never owned any Argentine securities, and this will continue to be the case for the foreseeable future.

How big of a factor is currency for Seafarer when investing in EM?

Currency is not only a factor when investing in the emerging markets – it is a crucial factor for any investment regardless of location. The proper way to interpret the Seafarer Overseas Value Fund’s objective of long-term capital appreciation is to think of this mandate as growing the future purchasing power of the savings the investor has entrusted to the Fund. As such, one should think in terms of real rates of return, after the detrimental impact of inflation.

As it stands, the U.S. dollar is the most stable of the fiat currencies around the world, and Seafarer’s investor base is located in the U.S. (thus, the use of the nomenclature “overseas” in the naming of the Seafarer Funds). This is why Seafarer measures the performance of the funds it advises in U.S. dollars. Therefore, when investing overseas in a different currency, Seafarer accounts for the risk associated with that currency as it relates to prospective investment returns measured in U.S. dollars.

In Seafarer’s view, the most efficient approach to mitigating foreign exchange risk is to hold investments for a long horizon and to diversify currency exposure, as opposed to hedging currency risk. There are several reasons supporting this approach:

- Equities are a long duration asset whose associated currency risk cannot be hedged with a currency swap of equal or even similar duration.

- While one could roll-over short-duration currency hedges, any sharp foreign exchange movement will be priced into future hedge rollovers, thus negating a potential short-term gain from an unexpected change in a foreign exchange pair.

- The conclusion of a Seafarer study, which measured the performance of the MSCI Emerging Market Index from 2008 to 2018 in local currency and in U.S. dollars, is that exposure to the emerging market currency basket as represented by the benchmark had a negative impact on U.S. dollar returns, but that currency drag was not terribly large, and was manageable in the context of the expected returns from investing in a well-diversified portfolio of emerging market equities. As is the case with inflation, this headwind to U.S. dollar-denominated real returns from exposure to emerging market foreign exchange can be more than compensated for by being disciplined in terms of the required rate of return prior to making an investment.

What about corporate governance?

Corporate governance is integral to an investment return over the long-term. Shareholders exercise limited control of a corporation by voting on key measures once a year at the Annual General Meeting. However, the company’s control party and management are responsible for the great majority of decisions on a day-to-day basis. Therefore, having trust in management – and by extension a company’s corporate governance – is crucial when holding an investment over a long horizon. Seafarer establishes this trust by meeting the management of every portfolio holding.

It is important to note that corporate governance obviously extends beyond the concept of capital allocation and its impact on shareholder returns to the wider concept of an enterprise’s sustainability. Most enterprises aim to be ongoing concerns. As such, the well-being of all stakeholders – be they customers, management, employees, or shareholders – is embedded in the corporation’s mandate to remain an ongoing concern. Properly understood, good corporate governance is largely consistent with ESG-investment mandates that have gained popularity in recent years.

You look for catalysts such as when a state-owned enterprise (SOE) privatizes or a management change, can you expand on this?

The most concise way to summarize the Management Change category of value (please refer to Figure 1 above) is to relate it to the discussion of corporate governance in the preceding question. Generally, state-owned enterprises (SOEs) suffer from a perverse incentive structure where state ownership negates the property rights of the corporation over the assets on its balance sheet and abrogates management responsibility to customers and shareholders. To confuse matters further, employees know they work for the government, not the company, and certainly not customers. The historical consequence of this deficient corporate governance structure is the lack of marketplace competitiveness and poor return of equity that SOEs are infamous for.

The opportunity in this category of value arises from the fact that the share price of these enterprises more than likely recognizes the historically misaligned corporate governance structure, as reflected in a track record of poor financial results. The reason investment returns are potentially lucrative in this value category relates to the difficulty of valuing the future financial impact of redressing a SOE’s corporate governance structure via privatization. Investors tend to forecast future financial performance by extrapolating from the historical record. It is impossible to make this type of forecast with a SOE or a private company that has suffered from poor corporate governance in the past and is undergoing a control party or management change. Thus, the investor temptation is to simply ignore such companies – therein lies the opportunity.

Your Seafarer mutual fund is up a lot YTD while EM is barely positive. What do you attribute that to?

I am pleased with the 14.98% appreciation for the Seafarer Overseas Value Fund’s Institutional share class (SIVLX) year to date as of August 31, 2019 not only because it is a strong figure in absolute terms, but also because the drivers of said performance reflect the nature of the Fund, which is markedly different from that of the benchmark.

The strategy approaches security selection through a bottom-up research process. The Value Fund’s sharp differences in sector and country allocation versus the benchmark, and its active share score of 98% as of June 30, 2019 (according to Seafarer’s internal estimate), speak to Seafarer’s investment approach beyond the conventional meaning of “bottom-up,” an admittedly over-used term.

A series of stock-specific factors drove the Fund’s performance year to date as of August 31. The common thread among the examples highlighted below is that each represents a value-unlocking event that supported a stock performance detached from the rest of the market.

Indeed, the top contributor to the Fund’s performance is Asia Satellite Telecommunications Holdings (Deleveraging source of value as defined in Figure 1; the source of value for a Fund holding is hereafter referenced in parenthesis). The controlling shareholders of this satellite owner and operator instructed the Board of Directors to implement a tender offer for the publicly-listed shares of the company, which supported a share price appreciation of 104.58% from the beginning of the year to August 31. The privatization of this company in September permanently locked in the stock’s advance.

Following the theme of an event-driven unlocking of value, Wilmar International (Asset Productivity source of value), a Singapore-listed, vertically integrated processor of edible oils, proved a top contributor to Fund performance as it becomes increasingly likely that the company will list its China business in Shenzhen. It is worth noting that the meaningful negative performance of Hong Kong and Singapore-listed stocks in general during 2019 failed to dent the expectations surrounding this potential value-unlocking event.

The last notable contributor to the Fund’s net asset value (NAV) appreciation year to date as of August 31 is another holding whose stock price rise was detached from the performance of the rest of the market. The share price of Qualicorp (Structural Shift source of value), a Brazilian life insurance broker, appreciated 122.82% over this time period following its weak performance during the second half of 2018. The stock’s recovery appears to relate to an improvement in sentiment toward the company’s corporate governance after a questionable one-time cash payment to the CEO was reinvested into shares of the company. There are also signs that Qualicorp may engage in a capital reduction as the business continues to generate cash flow well in excess of its reinvestment requirements, and as the company generates high rates of return on capital despite difficult operating conditions in Brazil.

Is Vietnam a macro play or do you simply like some of the companies there?

Seafarer invests in companies, not in countries. The Value Fund’s two Vietnamese holdings, PetroVietnam Technical Services and PetroVietnam Fertilizer and Chemical, fall under the Management Change category of value and capture the spirit of the preceding SOE discussion. Indeed, among the many attributes that underpin the Fund’s investment in these companies is the expectation that the government will reduce its stake in them with a concomitant increase in private ownership. Management action is already showing signs of gearing the companies to deliver improved financial results for the long-term.

What about Qatar and UAE, how big of an issue is the Gulf Cooperation Council (GCC) feud in your opinion?

The Fund’s holding in the United Arab Emirates (UAE), Tabreed (Deleveraging source of value), owns and operates a unique district water-cooling business for the supply of chilled water for air conditioning systems throughout the Middle East, not just the UAE. The Value Fund owns this company for its unique combination of an uncharacteristically high revenue visibility into the future, cash generation, and growing dividend yield. The company happens to be headquartered in Abu Dhabi.

The Fund’s holding in Qatar, Qatar Gas Transport (a.k.a. Nakilat) (Deleveraging source of value), owns and operates a fleet of liquefied natural gas (LNG) transport vessels. As such, its business is truly a global one. This holding relates to Qatar as a country only to the extent that natural gas is Qatar’s primary national asset. The financial performance of Nakilat bears little relation to the growth of the Qatari economy per se.

Furthermore, and in demonstration of the fact that stock price performance often defies expectation, Nakilat is among the Fund’s top contributors to performance year to date despite the Gulf Cooperation Council (GCC) feud. I wrote extensively about my thoughts on the subject and my decision to add to the Value Fund’s holding in the stock in my Second Quarter 2017 Portfolio Review. To summarize, I expected the embargo of Qatar to exclude energy transportation and for it to actually add to the impetus for Nakilat to accelerate its fleet expansion. The Fund increased its position in the stock due to the disparity between the lower price that followed the announcement of the embargo and the probable higher value of the company’s future asset base.

Is the above just an oil and gas play?

No, as explained above. In fact, the Value Fund tends to shy away from commodity-related businesses as the management of companies in this space tends to have little control over its financial fortune. The few companies the Value Fund does own which operate in commodity-related industries benefit from latent value unrelated to the price of the commodity itself.

What other countries do you like at Seafarer?

To reiterate, the Seafarer Overseas Value Fund invests in companies, not countries. The strategy screens for potential investments globally, not on a country basis. The only macro-related consideration that enters the stock research process is the functional currency or currencies of the business and the currency the stock price is denominated in.

Furthermore, the Value strategy does not search for value based on what countries have sold off. The strategy seeks specific attributes in stocks based on the seven categories of value in Figure 1. Ideally, these attributes should be as unrelated to the country as possible.

The Seafarer Overseas Value Fund is a value strategy first and foremost. It simply chooses to search for value in the emerging markets, Seafarer’s domain of expertise.

Greece and Russia have been big EM value traps for years until the past few months when they have started delivering strong returns--what are your opinions going forward?

As is the case in Argentina, the operating and financial performance of Greek companies is hampered by a bankrupt government. As a matter of policy, Seafarer does not invest valuable research time pursuing ideas in these countries until the corporate governance at the country level becomes less pernicious, even in the face of strong short-term stock performance. Seafarer invests for the long-term. It is happy to miss on short-term gains unsupported by a fundamental and enduring improvement in corporate governance.

Russia is a more interesting case. Like other oil-dependent economies of the Middle East, the country is in the process of diversifying its economy from crude, which theoretically raises the prospect of finding interesting companies minimally exposed to the vagaries of the oil price. In addition, the Central Bank of the Russian Federation is one of the few around the world that pursues orthodox monetary policy, which significantly lowers the risk associated with the currency, the ruble. Finally, there are a number of well-run companies in the country whose business does not depend on ties to the government or the oil price.

What will be the next big EM country or company in 5-10 years which investors are overlooking?

I have no idea – not for a lack of candidates, but because I recognize the highly speculative nature of the question. Furthermore, the Value Fund seeks to derive returns from a diversity of factors as contemplated in the seven categories of value – only one of which, Asset Productivity, relates directly to growth. In other words, the Fund derives returns from sources other than growth, and by extension, it does not seek to identify “the next big EM country or company.”

Final thoughts?

It is important to reiterate that the Seafarer Overseas Value Fund should be thought of as a value strategy that happens to pursue its mandate in the emerging markets. It should not be thought of as a traditional emerging markets fund. Furthermore, the choice of emerging markets is not only because this is Seafarer’s area of expertise, but precisely because most emerging market funds pursue growth as their sole objective. In contrast, the Value Fund derives investment returns from a diversity of factors (the seven categories of value), only one of which relates directly to growth. Furthermore, in Seafarer’s opinion, value opportunities in the emerging markets are abundant because few investors pursue a value discipline within the universe. The reader may find a more detailed explanation of the opportunity for a value discipline in the emerging markets in Seafarer’s white paper On Value in the Emerging Markets.

The performance data quoted represents past performance and does not guarantee future results. Future returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. View the Fund’s most recent month-end performance at www.seafarerfunds.com/performance.

The MSCI Emerging Markets Total Return Index, Standard (Large+Mid Cap) Core, Gross (dividends reinvested), USD is a free float-adjusted market capitalization index designed to measure equity market performance of emerging markets. Index code: GDUEEGF. It is not possible to invest directly in an index.

The views and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect Seafarer’s current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the portfolios or any securities or any sectors mentioned herein. The subject matter contained herein has been derived from several sources believed to be reliable and accurate at the time of compilation. Seafarer does not accept any liability for losses either direct or consequential caused by the use of this information.

As of June 30, 2019, Asia Satellite Telecommunications Holdings, Ltd. comprised 6.1% of the Seafarer Overseas Value Fund, Wilmar International, Ltd. comprised 4.1% of the Fund, Qualicorp Consultoria e Corretora de Seguros SA comprised 5.0% of the Fund, Petrovietnam Technical Services Corp. comprised 3.5% of the Fund, Petrovietnam Fertilizer & Chemicals JSC comprised 1.8% of the Fund, National Central Cooling Co. PJSC (Tabreed) comprised 4.0% of the Fund, and Qatar Gas Transport Co., Ltd. comprised 5.0% of the Fund. View the Fund’s Top 10 Holdings at www.seafarerfunds.com/funds/ovl/composition. Holdings are subject to change.

ALPS Distributors, Inc. is the distributor for the Seafarer Funds.

Investors should consider the investment objectives, risks, charges, and expenses carefully before making an investment decision. This and other information about the Funds are contained in the Prospectus, which may be obtained by calling (855) 732-9220. Please read the Prospectus carefully before you invest or send money.

Important Risks: An investment in the Funds involves risk, including possible loss of principal. International investing involves additional risks, including social and political instability, market and currency volatility, market illiquidity, and reduced regulation. Emerging markets are often more volatile than developed markets, and investing in emerging markets involves greater risks. Fixed income investments are subject to additional risks, including but not limited to interest rate, credit, and inflation risks. Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market. An investment in the Funds should be considered a long-term investment.