RGA Investment Advisors commentary for the second quarter ended June 30, 2019.

The second quarter was a little choppier than the first quarter, with an upward bias in the end. Markets largely spent time digesting the magnitude of the moves from the fourth quarter of 2018 and first quarter of 2019. Amidst the choppiness there was indeed one notable happening of market consequence:

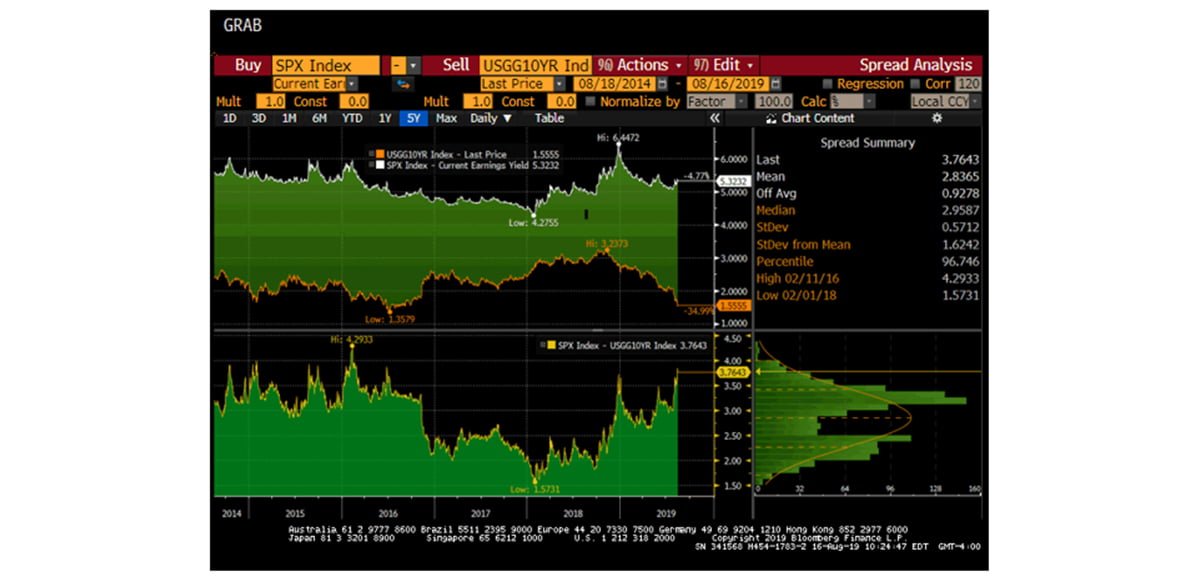

The chart above shows the spread between the S&P’s equity risk premium as measured by the S&P’s current earnings yield (in other words, E/P, the inverse of the market’s P/E ratio) minus the 10-year Treasury Yield. Although “the market” as measured by the S&P traded pretty sideways during the quarter, during the brief June selloff, the market’s equity risk premium hit its second highest level in the past three years and reached levels seen mainly in the wake of the Great Recession. As the third quarter is now underway, this rise in the equity risk premium has only gotten more extreme, measuring near the highest levels in the past five years.

Q2 hedge fund letters, conference, scoops etc

With the market trading sideways, it is clear that one variable alone drove the majority of the rise in the equity risk premium: The 10 Year Treasury Yield. The 10 Year Treasury yield started the quarter at around 2.4% and reached a low of 1.95% in June. As Charlie Munger once observed: “Finding a single investment that will return 20% per year for 40 years tends to happen only in dreamland. In the real world, you uncover an opportunity, and then you compare other opportunities with that. And you only invest in the most attractive opportunities. That’s your opportunity cost. That’s what you learn in freshman economics.” Since all of us investors exist and operate in the real world, we constantly must weigh various investment options. When the equity risk premium is high, the opportunity cost of bonds relative to stocks is high and thus investors in aggregate are incentivized to put money to work in equities. This will be especially notable come quarterly rebalance when the huge pool of assets in 60/40 strategies kick in the self-calibrating trade of selling bonds to buy equities and restore equilibrium. Approximately 7% of bond exposure in such strategies must be sold in order to buy 4% more stocks.

It is important to emphasize that our investment decisions are made on a bottoms-up basis. In other words, we do not look at the market on the whole and say “are stocks in aggregate cheap? If so, let’s invest.” Our process is on a security-by-security basis, whereby we deeply analyze a business’ management, industry, moat and valuation in order to come up with an investment thesis. That said, we always like being conscious of our environment. When the equity risk premium is high, we are far more sanguine on the broader opportunity set than when it is low.

A thought from Elliot:

With baseball season in full swing now seems like an opportune time to visit one of my favorite setups in the market. In fantasy baseball there is this category of player called “the post-hype sleeper” that I find appealing. A post hype sleeper is defined as a “player with minor league pedigree who [has] failed in limited major league time.”[1] When the player is called up, fantasy baseball players draft him with enthusiasm, paying for value that is expected to be realized instantly. Instead, as often happens, there is a developmental curve and many players take a little extra time to mature into big league readiness. In a rut (whether an instant slump or a “sophomore slump”) the player’s value in the eyes of the fantasy baseball community erodes.

While some players ultimately never live up to their pedigree, there are others who make meaningful improvements in their true skill level and build a foundation for enduring success in the Major Leagues. Fantasy baseball players can draft these truly skilled players for far less in the wake up the slump than beforehand and are thus called sleepers for how the new Major Leaguer holds the potential to surprise expectations to the upside. There is an analogous setup we look for in equity markets that takes shape in an individual asset, as follows:

- A big following and a lot of momentum based on what could be in the future.

- Internal metrics of the company’s performance all continue to move in a positive direction.

- Despite the company’s intrinsic value rising, the pace of advance is slower than what investors were looking for, or some kind of headwind emerges.

- Momentum evaporates and leads to a sharp, rapid plunge in the company’s share price.

- The momentum overshoots to the downside, while business performance continues moving forward.

- The stock is not cheap enough to be a deep value investment, and it too recently burnt momentum/growth investors to regain their interest.

- The stock price has leveled off into a range of apathy for an extended period of time.

A good friend loves explaining how “the market has a problem with accelerating revenue” because people simply do not know how to value such companies. This is why Mr. Market tends to overshoot to the upside when things are giddy. The post-hype sleeper is a corollary of this idea, because accelerating revenue does not level off at a plateau, but rather drops off and must find a new range or equilibrium. The process is sloppy and just as the market overshoots to the upside, so too does it overshoot to the downside.

Post-hype sleepers come in many forms in the stock market, but busted IPOs are perhaps the most fertile hunting grounds to seek out such opportunities. IPOs tend to be sold to the market amidst a drumbeat of positive momentum and news that results in a high multiple on the stock. The problem with a high multiple is how challenging it becomes for the company to meet expectations. When an inevitable disappointment hits the market, the stock drops considerably and the multiple contracts accordingly.

Just like in fantasy baseball, it is important to figure out which of these busted stocks has the potential to forge a sustainable future of value creation. To that point, we look to operate in situations that are nuanced in contrast to those that are binary. In other words, we are not looking for situations where the company will either be wildly successful or flame out, but instead we want situations where the question the market is grappling with is “to what extent will this company succeed?” This is a key distinction and part of what we rely on as our “margin of safety” alongside our qualitative analysis of the business, the industry and the management team.

Number three in our list above is thus crucial and what could be called the essence of the entire setup. If intrinsic value is not increasing, we will not give the company our time of day—such a company would be a turnaround, not a post-hype sleeper. The ideal company in this setup also tends to be an asset in its own right, whereby at least a portion of the value can be attributable to strategic value in an industry or vertical. From the perspective of analyzing the distribution of possible returns, strategic asset value provides both a put option and call option to the holder. If the nuanced question about growth rate is not answered quickly and the stock price drops, strategic buyers might step in quickly. Should the market experience a drawdown with little change to the company’s specific fortune, opportunistic buyers would enthusiastically swoop in. Therein lies the put. On the call side, strategic buyers are often willing to pay a significant premium to the outright earnings power of the asset. This can pull forward returns and enhance IRRs in the process. We do not bank on M&A and often prefer the opportunity to hold such companies for the long run; however, we appreciate the role that the M&A option plays in assessing the range of possible outcomes.

Often the pivotal question in such companies is surrounding the mid-term growth outlook, as a company’s 20+% revenue growth rate heading into IPO slows to the high single digits or low teens. We can apply our suite of valuation tools and triangulate what we think is a fair price for the company, analyze the likelihood of a growth re-acceleration and think about what a worst case would look like amidst a longer-term stagnation in the growth outlook. If a growth re-acceleration does not arrive, we should have a decent IRR; however, if it does we might end up owning something very special. To date, all our five best returns have emerged from this exact stock market setup.

Elliot recently had the privilege to present at the MOI Global Wide Moat Investing Summit. This year’s presentation was on Grubhub and introduced with the post-hype sleeper setup. You can watch the presentation here (https://moiglobal.com/elliot-turner-201906/) and see the slides at this link (https://moiglobal.com/wp-content/uploads/moat19-elliot-turner.pdf). As of this writing, we own nine positions that we regarded as post-hype sleepers at the time of our entry. Several on this list are no longer sleepers with the market appropriately recognizing the value, while for the rest the verdict remains out.

Thank you for your trust and confidence, and for selecting us to be your advisor of choice. Please call us directly to discuss this commentary in more detail – we are always happy to address any specific questions you may have. You can reach Jason or Elliot directly at 516-665-1945. Alternatively, we’ve included our direct dial numbers with our names, below.

Warm personal regards,

Jason Gilbert, CPA/PFS, CFF, CGMA

Managing Partner, President

Elliot Turner, CFA

Managing Partner, Chief Investment Officer

Past performance is not necessarily indicative of future results. The views expressed above are those of RGA Investment Advisors LLC (RGA). These views are subject to change at any time based on market and other conditions, and RGA disclaims any responsibility to update such views. Past performance is no guarantee of future results. No forecasts can be guaranteed. These views may not be relied upon as investment advice. The investment process may change over time. The characteristics set forth above are intended as a general illustration of some of the criteria the team considers in selecting securities for the portfolio. Not all investments meet such criteria. In the event that a recommendation for the purchase or sale of any security is presented herein, RGA shall furnish to any person upon request a tabular presentation of: (i) The total number of shares or other units of the security held by RGA or its investment adviser representatives for its own account or for the account of officers, directors, trustees, partners or affiliates of RGA or for discretionary accounts of RGA or its investment adviser representatives, as maintained for clients. (ii) The price or price range at which the securities listed.

[1] https://www.espn.com/fantasy/baseball/story/_/id/26054216/fantasy-baseball-post-hype-sleepers-2019