TriFin Advisors’s newest (and first) high conviction short idea; The Middleby Corp (NASDAQ:MIDD).

The report is a bit lengthy, but here are a few quick bullets:

- Very abrupt departure of long-time CEO in Feb.

- gave him a massive $10.0 million consulting agreement for two years requiring no more than 25/hours a month of work + >50K a month retirement for life.

- CEO had been meaningfully divesting shares while stock was soaring.

- Roll-up of commercial foodservice and residential kitchen equipment.

- M&A quality has been getting worse for years. Bigger and more expensive deals for slower growing and less profitable targets.

- Organic growth has been relatively non-existent, profitability has been under pressure too but Co. still trades over 20.0x FY 19 P/E and over 13.5x EV/EBITDA.

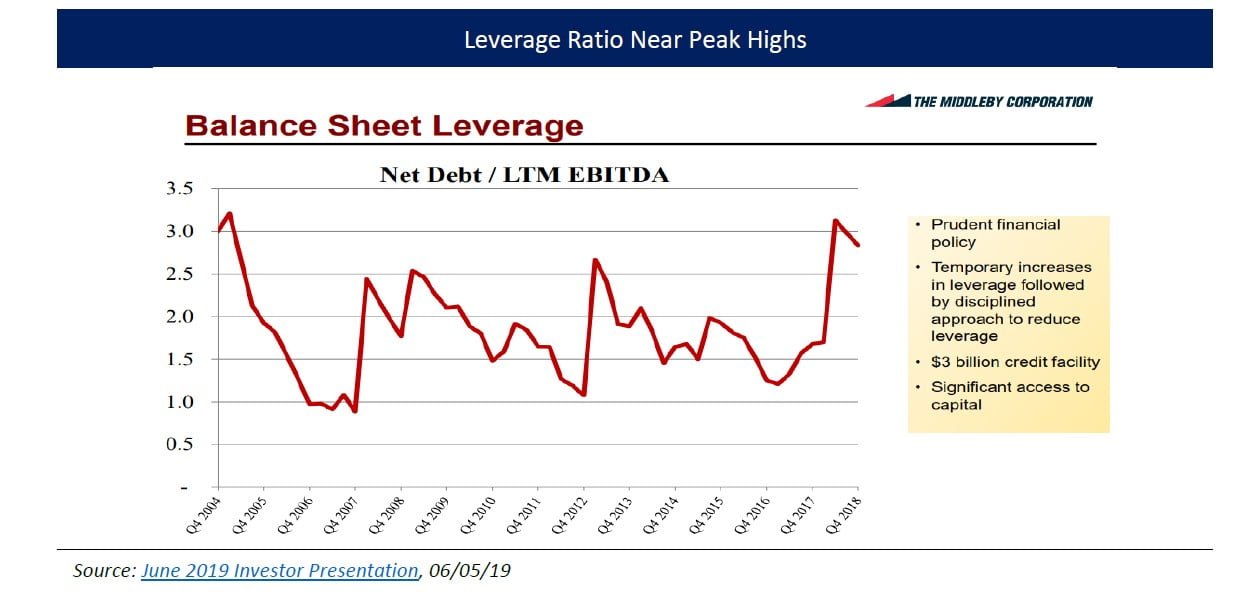

- Leverage is near all-time highs.

- annualized their largest and most expensive acquisition in Q2 19 (should report Q2 #’s next week) making for very difficult base rate comps while the street expects double-digit growth.

- Only recently (Q3 18) started to provide GAAP to non-GAAP reconciliations even though “adjusted” EBITDA has been the Co.’s core performance metric for years.

- Adjusted earnings in the Earnings Releases don’t agree with the reconciliations provided in the Co.’s investor decks.

Q2 hedge fund letters, conference, scoops etc

Executive Summary

We are concerned The Middleby Corp (“Middleby” or “the Company”) is significantly overvalued; we believe shares could fall more than 25.0%.

Middleby primarily provides cooking and warming equipment used in commercial kitchen and foodservice operations in addition to cold-side and beverage dispensing equipment. Customers include quick-service (i.e. fast food) restaurants, full-service restaurants, convenience stores, retail outlets, and hotels, among others. The Company also manufactures, sells, and distributes kitchen equipment for the residential market and provides food processing equipment and packing technology systems for protein and bakery production for retail and food service applications.

Middleby’s story starts with former CEO Mr. Selim Bassoul. Mr. Bassoul joined Middleby in the mid-1990’s and helped turnaround one of the Company’s floundering core divisions. In 2001, Mr. Bassoul was promoted to CEO; Middleby had a market capitalization of $40.0 million. Over the next two decades, Mr. Bassoul was instrumental to Middleby’s continued turnaround and meteoric share price appreciation driven by M&A. Today, Middleby’s market capitalization is ~$7.5 billion.

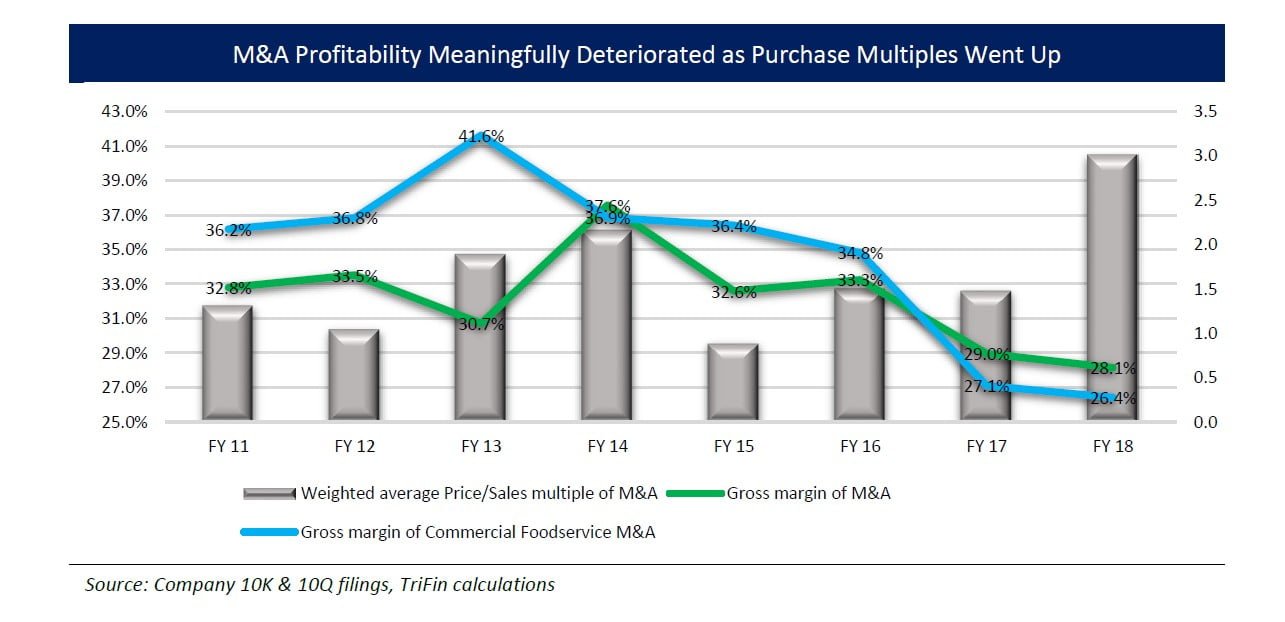

In the last ten years, Middleby Corp acquired over 50 companies for an aggregate of $3.2 billion. Beginning in late FY 13/early FY 14, we started to notice a concerning trend; acquisitions were getting progressively larger and more expensive but had slower revenue growth and were less profitable. This coincided with several other red flags: (1) organic revenue growth started to diverge significantly from reported growth, (2) adjusted free cash flow went negative and got progressively worse, (3) executive compensation targets were changed from return on equity (ROE) and share price metrics to absolute EBITDA and earnings growth, and (4) insiders (including Mr. Bassoul) meaningfully divested shares and beneficial ownership reached decade lows. Despite these red flags, shares continued to rise and are near all-time highs as the Company has been able to show “strong” reported revenue and “consistent” free cash flow growth.

However, we believe FY 19 is shaping up to be one of the most challenging years yet. Specifically:

- “Premier” customer capex peaked last year and is now expected to decline at the fastest rate in over a decade followed by further declines in FY 20 and FY 21.

- Capital goods new orders and restaurant sales data have continued to decelerate rapidly, exacerbating demand headwinds.

- Middleby Corp annualized its largest and most expensive acquisition to date in Q2 19 (Taylor was acquired for $1.0 billion and 3.2x price/sales in Q2 18) and will lap one of the most difficult base rate/comp sets over the next four quarters.

- The Company’s leverage ratio is near all-time highs which may limit additional material M&A.

- M&A gross margin profile continued to decline and reached the lowest level since FY 11.

- Organic and pro forma growth over the last two years have been low-single-digits at best.

- Newly added GAAP-to-non-GAAP reconciliations are inconsistent with Earnings Release commentary and potentially obfuscate weaker adjusted earnings growth.

- Record inventory levels and DSI in Q1 19 provided an unsustainable benefit to margins and will be a headwind as inventory normalizes.

- Long-tenured CEO Mr. Bassoul abruptly resigned effective immediately in February 2019, only one year after signing a new three-year contract.

Consequently, we are concerned FY 19 consensus expectations for low-double-digit revenue growth and reacceleration of EBITDA margin expansion to near peak levels is overly optimistic. Based on Middleby’s current valuation, FY 19 P/E of 20.8x and EV/EBITDA of 13.7x, we believe there is significant downside risk. Using conservative estimates that assume revenue will grow mid-single-digits and EBITDA margin will expand with slight multiple contraction to be in-line with peers (but still above market averages), we believe shares could fall more than 25.0%.

Company Background

Commercial Foodservice accounts for ~two-thirds of revenue/gross profit and nearly three-fourths of EBITDA

Middleby Corp operates its business in three segments. Commercial Foodservice is the largest segment and accounts for over 60.0% of revenue and gross profit and over 70.0% of EBITDA. Residential Kitchen is the second largest segment and accounts for approximately 20.0% of revenue and gross profit and 15.0% of EBITDA. Food Processing is the smallest segment and accounts for less than 15.0% of revenue, gross profit, and EBITDA.1

Commercial Foodservice

The Commercial Foodservice segment provides cooking and warming equipment used in commercial kitchen and foodservice operations, as well as cold-side and beverage dispensing equipment.

- Customers: quick-service restaurants, full-service restaurants, convenience stores, retail outlets, and hotels, among others.

- Brands: TurboChef, Blodgett, Pitco, Taylor, CookTek, Lincat, Middleby Marshall, Desmon, Doyon, Frifri, and Follett, among others.

- Products: ovens, ranges, fryers, steam cooking equipment, food warming equipment, catering equipment, heated cabinets, charbroilers, ventless cooking systems, kitchen ventilation, induction cooking equipment, countertop cooking equipment, charcoal grills, professional mixers, professional refrigerators, coldrooms, ice machines, freezers, and soft serve, ice cream, coffee, and beverage dispensing equipment, among others.

Residential Kitchen

The Residential Kitchen segment manufactures, sells, and distributes kitchen equipment for the residential market.

- Customers: residential consumers.

- Brands: AGA, Brigade, Fired Earth, Heartland, La Cornue, Leisure Sinks, Lynx, Marvel, Mercury, Rangemaster, Rayburn, Redfyre, Sedona, Stanley, TurboChef, U-Line and Viking.

- Products: ranges, cookers, stoves, ovens, refrigerators, dishwashers, microwaves, cooktops, wine coolers, ice machines, ventilation equipment, and outdoor equipment.

Food Processing

The Food Processing segment provides food processing and packaging technology systems for protein and bakery production for retail and food service applications.

- Customers: producers of pre-cooked meats (e.g. hot dogs, dinner sausages, poultry, and lunchmeats) and baked goods (e.g. muffins, cookies, and bread).

- Brands: Alkar, Maurer-Atmos, Armor Inox, Cozzini, Danfotech, Drake, MP Equipment, Spooner Vicars, and Stewart Systems, among others.

- Products: ovens, frying systems and automated thermal processing systems in addition to food preparation equipment such as grinders, slicers, reduction and emulsion systems, mixers, blenders, battering/breading/seeding equipment, water cutting systems, food presses, food suspension equipment, filling and depositing solutions and forming equipment, food safety, food handling, freezing, defrosting, and packaging equipment.

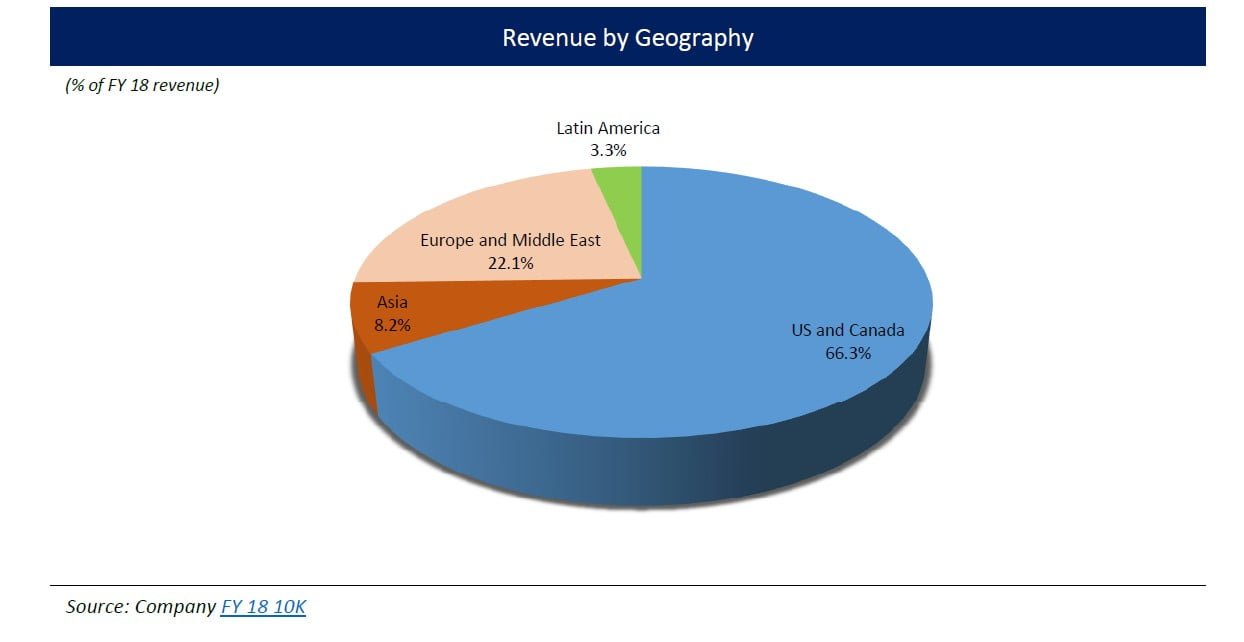

US/Canada/Europe accounts for ~90.0% of revenue

The majority of the Company’s revenue is generated in developed markets (i.e. US, Canada, Europe). Over the last three years, revenue from the US & Canada (Asia, Europe & Middle East, Latin America) was relatively stable at ~67.0% (~33.0%).

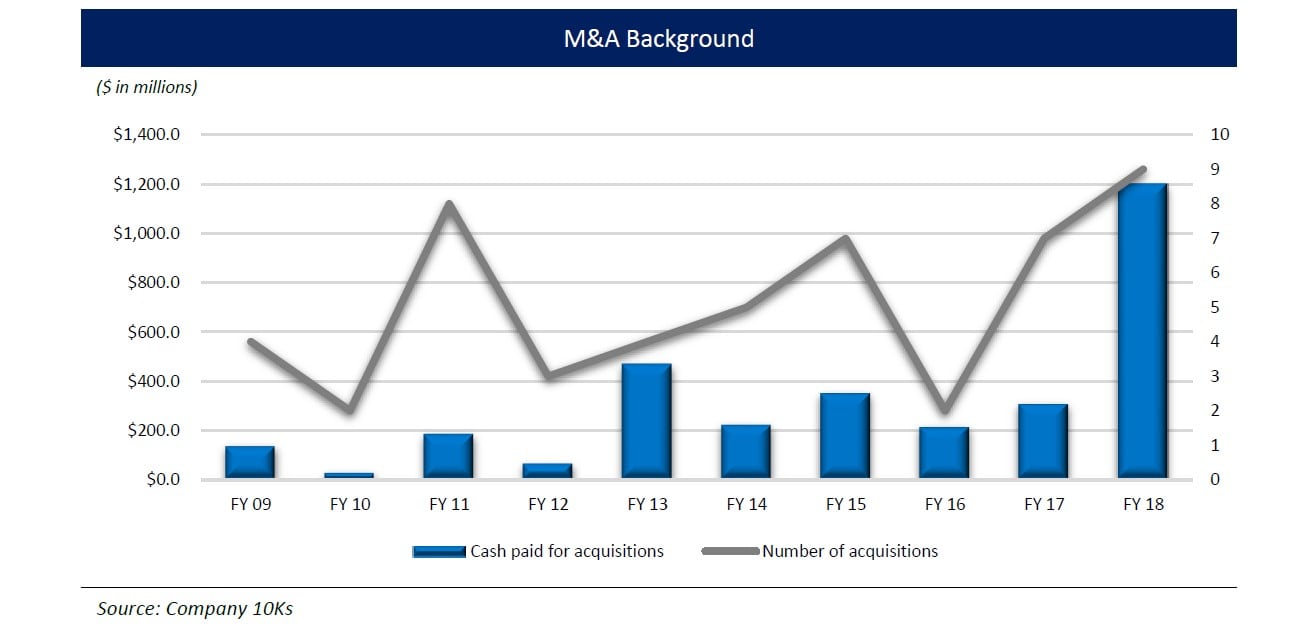

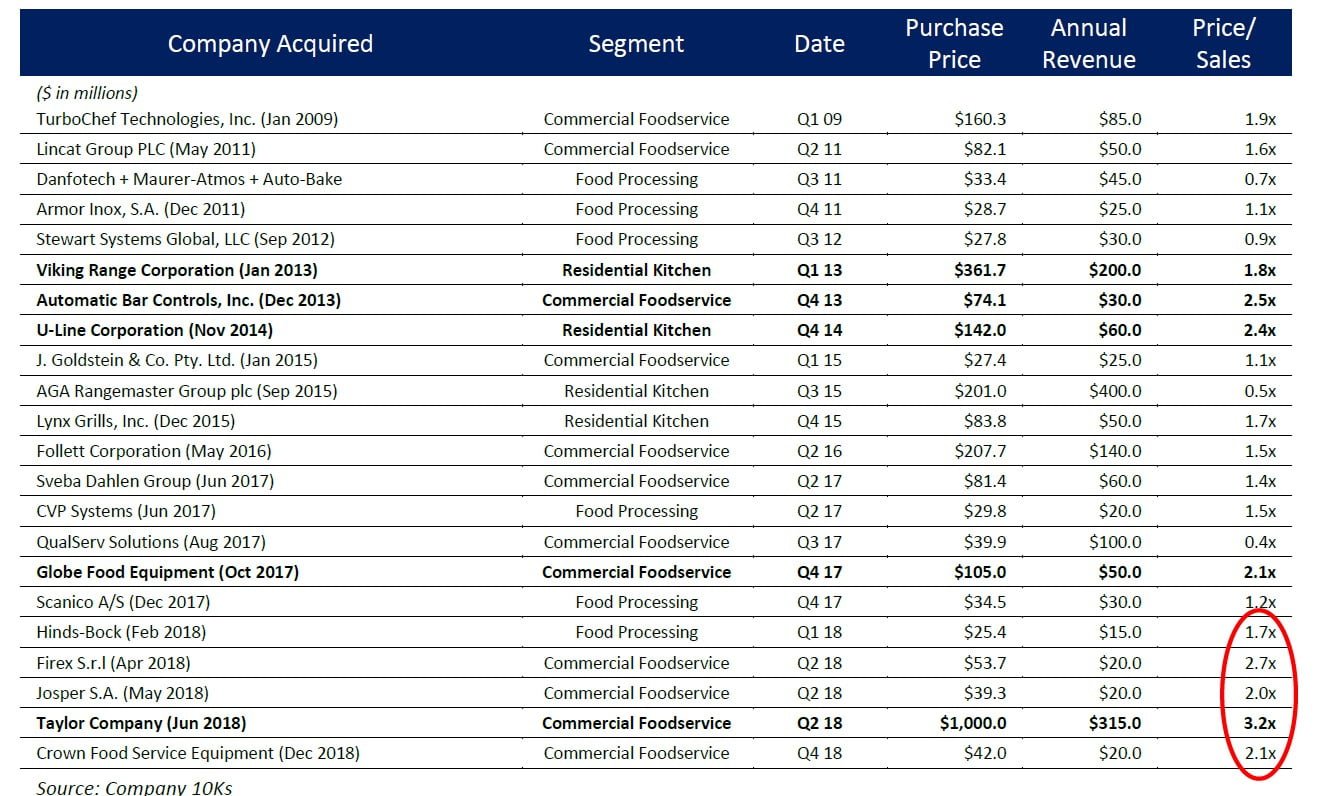

Middleby has made more than 50 acquisitions since FY 09

Since the early 2000’s, shortly after Mr. Selim Bassoul was instituted as CEO, Middleby pursued an acquisition heavy strategy to expand its portfolio of brands and technologies. Typically, acquisitions were made to add complementary products and/or services. Over the last six years, the strategy became increasingly more aggressive in both the size and quantity of acquisitions.3

Majority of M&A financed through debt; leverage ratio near peak levels at just under 3.0x

Since FY 04, Middleby’s leverage ratio ranged from ~1.0x to 3.0x. Currently, the leverage ratio sits just under 3.0x. In its Q1 19 10Q, the Company indicated the terms of its Credit Facility allowed a maximum leverage ratio of 3.5x, which may be adjusted up to 4.0x in connection with a qualified acquisition.

The terms of the Credit Facility…requires, among other things, the company to satisfy certain financial covenants: (i) a minimum Interest Coverage Ratio (as defined in the Credit Facility) of 3.00 to 1.00 and (ii) a maximum Leverage Ratio of Funded Debt less Unrestricted Cash to Pro Forma EBIDTA (each as defined in the Credit Facility) of 3.50 to 1.00, which may be adjusted to 4.00 to 1.00 for a four consecutive fiscal quarter period in connection with certain qualified acquisitions, subject to the terms and conditions contained in the Credit Facility. (Q1 19 10Q)

M&A Quality Deteriorated

Since the early 2000’s, M&A has been an integral part of Middleby Corp’s growth strategy. For context, the Company acquired over 50 companies in the last ten years for an aggregate of $3.2 billion; Middleby’s market capitalization is ~$7.5 billion. Beginning in late FY 13/early FY 14, we started to notice a somewhat concerning trend; acquisitions were getting progressively larger and more expensive but had slower revenue growth and were less profitable. We believe this trend not only extends the time required to achieve similar returns on investment to historical M&A, but also increases the risk of overpayment and/or acquisition underperformance relative to initial expectations. In addition, the largest and most expensive acquisition (the Taylor Company was acquired in Q2 18 from United Technologies) appeared to diverge from Middleby’s historical strategy of acquiring private businesses from founders and/or generational owners. We believe this shift in strategy creates an even more challenging environment to execute sustainable margin expansion opportunities and realize a comparable return on investment relative to prior acquisitions.

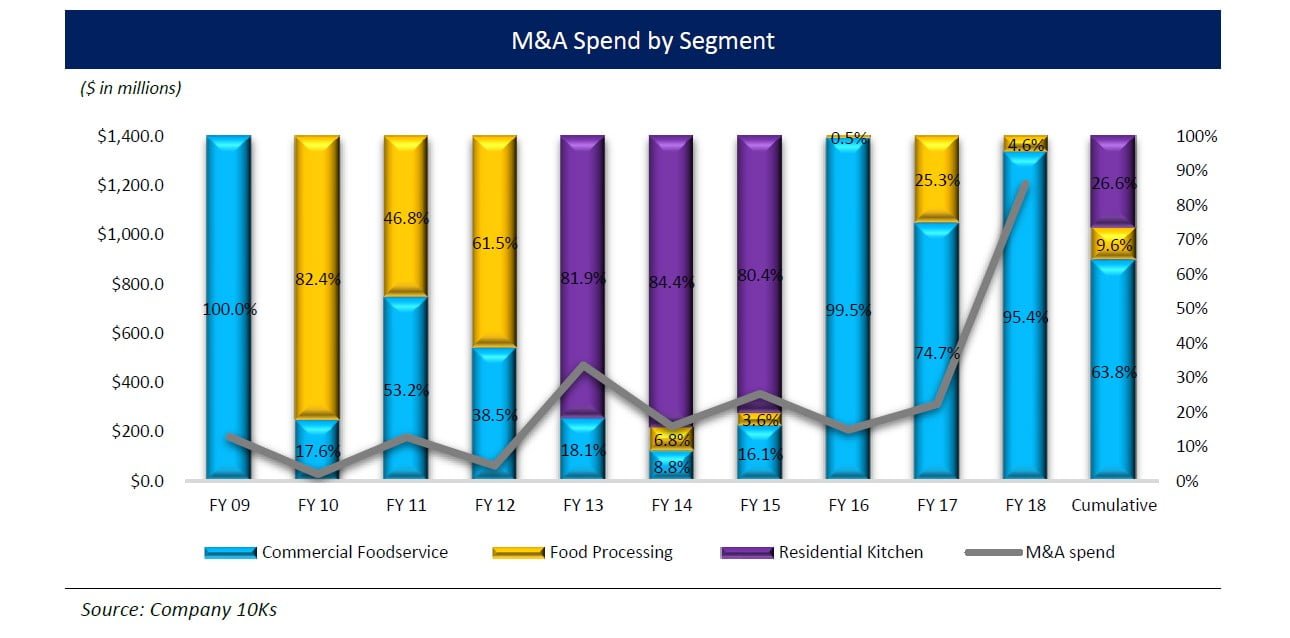

Commercial Foodservice accounted for over 60.0% of M&A; Residential Kitchen for over 25.0%

Since FY 09, Middleby acquired over 50 companies for an aggregate of $3.2 billion. Commercial Foodservice accounted for $2.1 billion (over 60.0%) of the M&A, Residential Kitchen accounted for $0.9 billion (over 25.0%), and Food Processing accounted for $0.3 billion (less than 10.0%).

Most large acquisitions acquired at higher sales multiples; recent M&A multiples well above averages

Since FY 09, 22 targets were acquired for more than $25.0 million. In aggregate, these 22 acquisitions accounted for $2.8 billion and were acquired at an average price/sales multiple of 1.6x. In FY 18, Middleby made five acquisitions over $25.0 million with price/sales multiples ranging from 1.7x to 3.2x, well above the historical average. Moreover, the Taylor Company (Taylor) was acquired at 3.2x price/sales, making it the largest and most expensive acquisition to date.

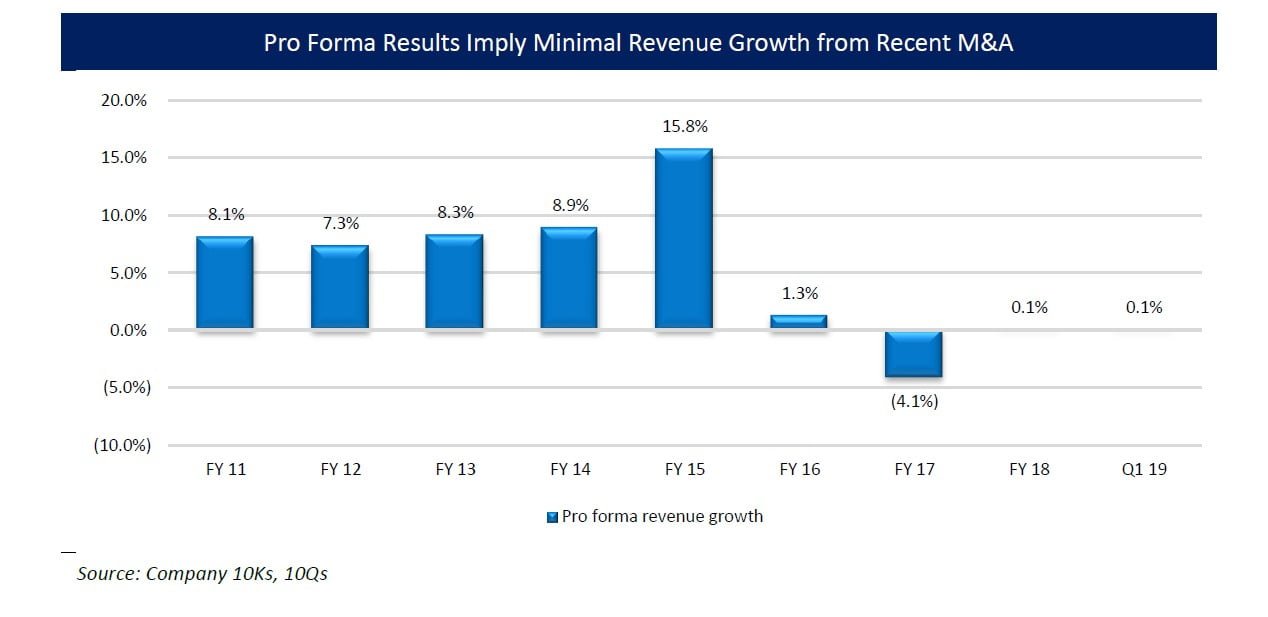

Weak pro forma revenue growth suggests soft growth rates from recently acquired targets

The Company’s pro forma results assume acquisitions made in the current and prior year were all completed on the first day of the prior fiscal year. For example, pro forma results for FY 18 assumed the 2017 acquisitions of Burford, CVP Systems, Sveba Dahlen, QualServ, L2F, Globe, and Scanico and the 2018 acquisitions of Hinds-Bock, Ve.Ma.C, Josper, Firex, Taylor, M-TEK, and Crown were all completed on January 1, 2017 (the first day of FY 17).

In accordance with ASC 805 Business Combinations, the following unaudited pro forma results of operations for the twelve months ended December 29, 2018 and December 30, 2017, assumes the 2017 acquisitions of Burford, CVP Systems, Sveba Dahlen, QualServ, L2F, Globe and Scanico and the 2018 acquisitions of Hinds-Bock, Ve.Ma.C, Josper, Firex, Taylor, M-TEK and Crown were completed on January 1, 2017 (first day of fiscal year 2017). (FY 18 10K)

Historically, Middleby Corp provided limited information/commentary about post-acquisition revenue growth rates at individual companies. However, given pro forma growth over the last three years tracked relatively in-line with organic growth (discussed herein), we believe revenue growth rates at recent acquisitions were flat-to-down at best and definitively lower than acquisitions before FY 15.

Historically, Middleby Corp provided limited information/commentary about post-acquisition revenue growth rates at individual companies. However, given pro forma growth over the last three years tracked relatively in-line with organic growth (discussed herein), we believe revenue growth rates at recent acquisitions were flat-to-down at best and definitively lower than acquisitions before FY 15.

Taylor acquisition appeared to be acquired from UTX via unsolicited bid; UTX sold because it was a “good price point”

In its Press Release on 05/18/18, Middleby announced it would acquire the Taylor Company from UTC Climate, Controls, & Security, a unit of United Technologies Corporation (UTX) for $1.0 billion. Taylor provides beverage solutions, soft serve and ice cream dispensing equipment, frozen drink machines, and automated double-sided grills. Middleby highlighted the acquisition was “highly strategic” and would bolster Middleby’s overall position as an industry leader in commercial foodservice.

The acquisition of Taylor is highly strategic for Middleby and bolsters Middleby’s overall position as an industry leader in commercial foodservice. Taylor is a unique and premium brand in the commercial foodservice industry with leading positions in beverage, frozen dessert and grilling that are highly complementary to our existing offerings. Taylor products are well represented across the top restaurant chains and have significant presence across all foodservice segments including quick serve, casual dining, retail, convenience stores, and institutional foodservice establishments. (Press Release, 05/18/18)

At its Investor and Analyst meeting on 03/16/18, United Technologies indicated it would begin a strategic review of its portfolio during the summer (after the Rockwell Collins acquisition closed) to decide whether to spin into three companies; standalone Otis, standalone Climate, Controls, and Security (CCS), and an aerospace business.

However, at the Electrical Products Group Conference on 05/22/18, United Technologies highlighted the Taylor divestiture was not the portfolio optimization it had previously been thinking about, but it was a “good price point” to sell.

CEO Mr. Gregory J. Hayes: After the first quarter call, we said we're not going to really talk about this because our focus for the intermediate term, of course, is closing Rockwell, right? So while we are doing work in the background on portfolio and looking at that, the real focus of the company is today, and will be for the next several months, getting Rockwell closed and getting the integration underway. Having said that, we will undertake with the board a thorough investigation of the overall portfolio. Now I think some of you may have seen over the weekend, we closed on a deal to sell our Taylor equipment business to Middleby Corp for $1 billion. That was not the portfolio optimization we were thinking about, but...

JP Morgan Chase Analyst: It’s an optimal price point.

CEO Mr. Gregory J. Hayes: Exactly, yes, good price point though. (Electrical Products Group Conference, 05/22/18) [emphasis added]

Consequently, we believe Middleby Corp may have made an unsolicited bid to acquire Taylor. This is somewhat of a departure from Middleby’s historical M&A strategy. For the most part, Middleby has acquired privately held businesses. We believe this shift in strategy is significant for a few reasons.

First, United Technologies has publicly discussed portfolio optimization in addition to receiving pressure from large activist investors. Based on our research and commentary from United Technologies, we believe it did not intend to divest Taylor. So, United Technologies had no reason to sell unless the price point was ideal; which we believe to be the case given United Technologies’ commentary. Second, in our experience, there are typically more margin expansion opportunities by acquiring privately held businesses from founders and/or generational owners than from public companies (and/or private equity). The level of scrutiny on public company performance, whether it be from the Board of Directors, analysts, shareholders, activist investors, etc. is significantly higher than that of a privately held company. We are concerned both these factors coupled with Taylor being the largest and most expensive acquisition to date significantly increases the risk of acquisition overpayment and/or ability to generate sustainable margin expansion.

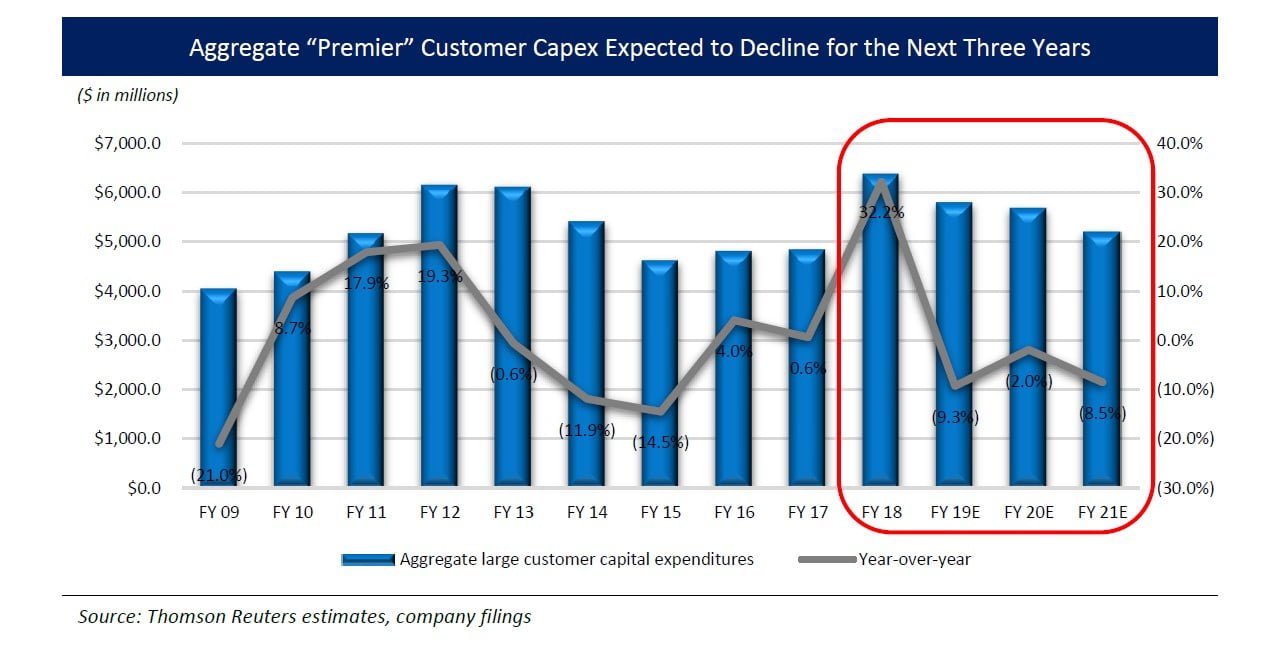

Customer Capex/Demand Expected to Decline Sharply

Middleby Corp does not disclose revenue by customer given its customer base is relatively large with minimal concentration. However, in its Investor Presentations the Company regularly includes a slide with its “Premier” Commercial Foodservice (the largest segment) customers of which many are publicly traded companies. Aggregate public “Premier” customer capex ebbed and flowed over the last decade; since FY 15 capex consistently trended upward reaching peak levels in FY 18. Currently, consensus estimates anticipate a severe drop in FY 19 capex followed by two more years of declines in FY 20 and FY 21. In fact, the FY 19 rate of change decline is the largest in over a decade. In addition, capital goods new orders and restaurant sales data from the US Census Bureau continued to rapidly decelerate over the last year. We believe these dynamics put Middleby and overall demand in a precarious situation that isn’t currently accounted for in revenue expectations.

“Premier” customer capex expected to decline sharply over the next three years

In its Investor Presentations, Middleby Corp regularly included a slide with its “Premier” Commercial Foodservice customers; which included a number of publicly listed US companies.5 Accordingly, we aggregated historical and future (based on consensus estimates) capital expenditures (capex) for this subset of Middleby’s “Premier” customers. In FY 18, aggregate “Premier” customer capex increased 32.2% year-over-year to ~$6,380.0 million, the highest level and fastest growth rate since at least FY 09. However, current consensus estimates expect “Premier” customer capex to decline in each of the next three years. More importantly, the expected FY 19 decline of 9.3% would result in the fastest rate of change decline in over ten years (32.2% increase + 9.3% decline = 41.5% rate of change).

See the full report below.