About 40 million Americans had a credit card declined in the past year, according to a new report from CompareCards.com, a LendingTree company that helps consumers improve their credit health.

Having a credit card declined can be surprising, embarrassing and frustrating. It can be the result of a big mistake you made – like paying late or maxing out your card. However, in today’s world where credit card fraud is a near-constant threat, our survey showed that a decline doesn’t necessarily mean the cardholder is at fault.

Q2 hedge fund letters, conference, scoops etc

CompareCards asked more than 1,000 cardholders about declined cards and found 22 percent of respondents had a card declined at least once over the past 12 months. Younger Americans were especially vulnerable: 30 percent of millennials and 51 percent of Generation Z had a card declined, compared to 23 percent of Generation X and 6 percent of baby boomers. Men were also more likely than women to say their credit card was declined.

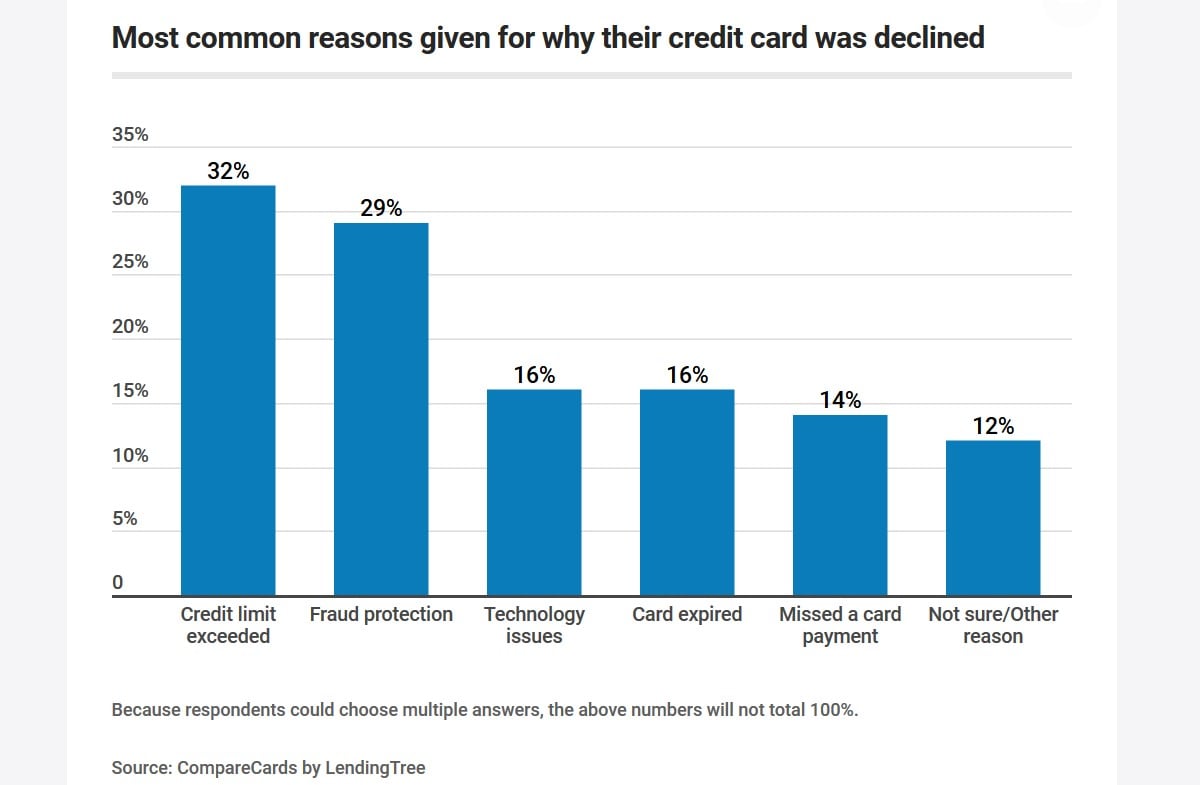

For decades, a card decline felt like a scarlet letter to many people. It was an embarrassing moment, putting an often-public display on a cardholders’ financial struggles to pay their bills on time or to keep their balances low. While many card declines still happen as a result of user error, the report also found many declines occur through no fault of the cardholder. When asked why their card was declined, a variety of reasons were given:

- 32 percent thought they exceeded their credit limit.

- 29 percent cited fraud protection.

- 16 percent blamed technological errors.

- 16 percent blamed an expired card.

- 14 percent blamed a missed payment.

In short, a full 45 percent of declines were cited for reasons beyond the cardholder’s control. However, being blameless didn’t mean they weren’t bothered when the decline happened. Seventy-one percent of those who had been declined felt embarrassed and about 3 in 10 of those (29 percent) said they felt more negatively about their card issuer afterwards. On the other hand, a quarter of those who had experienced a decline felt more positive about their issuer. That’s a clear sign today’s credit cardholder is aware of the threat credit card fraud poses and doesn’t mind being occasionally inconvenienced in the name of fraud protection.

How do you avoid having your card declined? First, pay your bills on time every time and keep your balances low. Beyond that, consider carrying extra cash or a backup credit card, let the card issuer know before any international travel and keep tabs on your card’s expiration date.

Article by By Matt Schulz, CompareCards