Climate inaction risks $23 trillion of global economic losses a year, amounting to permanent economic damage four times greater than the impact of the 2008 financial crisis. What does financial leadership entail as we stand at the brink of climate calamity?

On the Forum Agenda:

- Scaling up climate-friendly innovation

- Closing the climate financing gap

- Addressing the rising cost of insurance

Q2 hedge fund letters, conference, scoops etc

Speakers:

- Jean-Pierre Bourguignon, President, European Research Council, Brussels.

- Daphne Cheng, Founder, Chief Executive Officer and Chef, Superhuman, People's Republic of China; Cultural Leader.

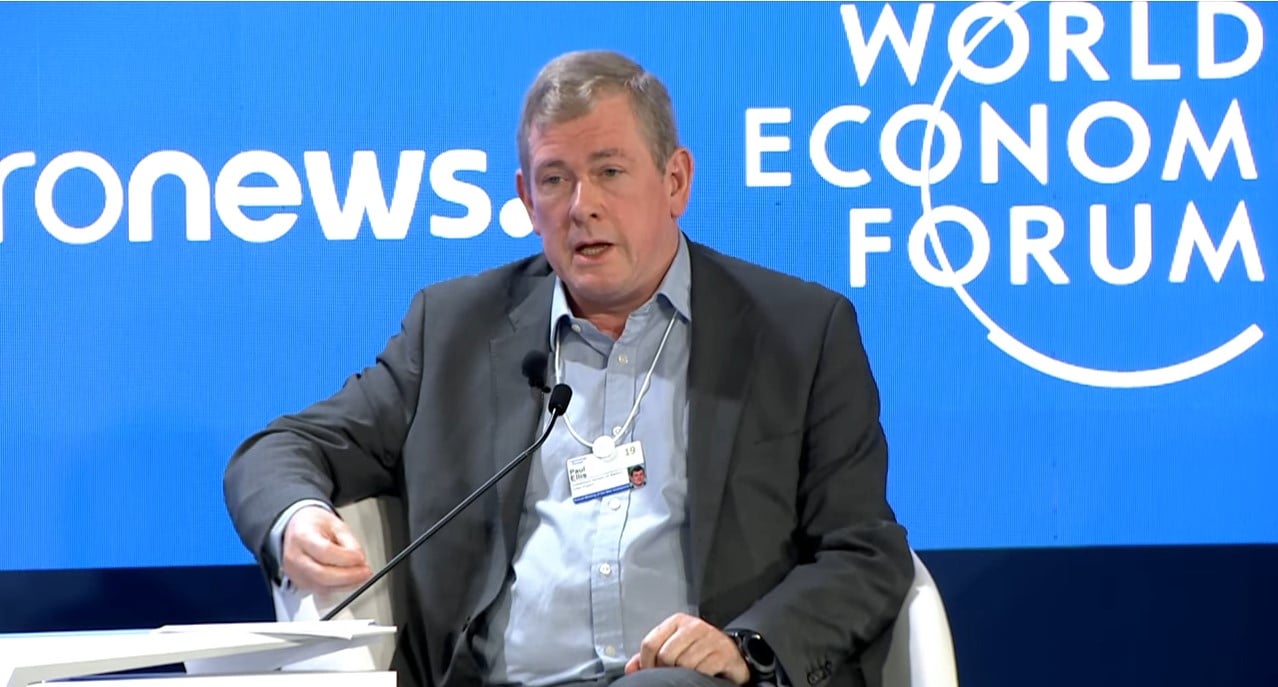

- Paul Ellis, Executive Chairman, Electron, United Kingdom.

- Pradeep Kumar Gyawali, Minister of Foreign Affairs of Nepal.

- Veronica Scotti, Chairperson, Public Sector Solutions, Swiss Re Management, Switzerland.

Moderated by:

- Isabelle Kumar, Journalist and Presenter, Euronews, France.

China 2019 - Climate Change: The Next Financial Crisis?

Transcript

Well I'm gonna work my way in different ways to get you on your toes to pull Alice case that's all you gonna bring to this discussion and Paul Ellis is the executive chairman of the company Electronic.

Yes. Well I think well so our business is focused on integrating distributed energy resources diesels into mainstream energy systems.

And it's really a huge challenge over the last 20 20 30 years we've seen this explosion in driven largely by the falling prices in renewables an explosion in new energy resources renewables attaching to the electricity grid and that has been fantastic to see. I mean there are days now when all of the power being generated is from renewables in certain European countries and that's only going to continue because we're at that tipping point now where that's just going to go further. The problem that we're facing currently is driven by the fact that integrating these kind of new resources into mainstream electricity systems energy systems is really hard because it was built for a different kind of market. So whereas in the past let's say 20 years ago in Germany there was something like a thousand generators. Now there are close to two million generation assets in Germany. So actually allowing these kind of assets to play a full role in the system which is fragmenting in terms of terms of markets is incredibly challenging. So there are some huge opportunities. And if I kind of like to give a couple of simple examples of that money could actually be saved now. That is a problem actually accessing this simply because of the way the markets are set up. So one one really interesting example for us is distributed energy resources connected at the distribution level which effectively are being curtailed off the grid. So you will have let's say renewables such as solar or wind. Once that's connected a decision has to be made whether or not that can be turned off if there's a local constraints on the network. And often the cost of connecting for a firm connection i.e. without the ability to turn that off is dramatically larger than a non firm connection. So not surprisingly many of these assets these renewable assets are being connected to the grid in a non firm way. In other words they can be turned off and the way this is done typically is in the lot. Last in first out basis. So you have the most recently manufactured and installed and probably the most efficient. Renewables are constrained off the grid before the longer term perhaps a diesel generation unit which has a contract that may go back so 20 years or so is being constrained. And clearly that's not good for carbon and it's certainly not good for the economics of the system. So dealing with problems like this is is a very simple way in which we can potentially improve the situation.

And it is ironic that it's not being improved in some respects.

We're trying we're trying. But you know this is you know there are contracts in place existing contracts in place and that's just one example. There are many many other examples and it's not just in the U.K. we have this I was in Tokyo recently and there's a brand new in Tokyo Gas his office has a brand new gas turbine installation that's been put in and that is actually constrained off before a very old TEPCO power station is being turned off.

So we're staying with this issue of innovation and I'm going to keep the women last because we are the most powerful voices. I'd like to say in these type of discussions when it brings when it comes to bringing about deep change. And I'd like to bring a message I'll be logging you from the European Research Council because now we've heard of probably not even innovations we have technology at our fingertips but from your perspective again back to this initial question How linked are climate change and the global economy and what can be in a nutshell. Because we'll be discussing this throughout the throughout our session what can be done to stop mitigating this.

I think there are really two two sides particularly because you want to look at it from the potential financial crisis point of view which is that you get the crisis if you don't anticipate properly. So I think one very key element is to really have enough sort of onshore political action taken a long view which is to really make sure that we are really properly done the diagnosis that is you really have identified the consequences economy recall and societal consequences. And this requires the mobilization of all kinds of research the research.