Sven Carlin explains how REITs work and the gives you the pros and cons of investing in REITs. REIT dividends are taxes as personal income as REITs don’t pay corporate income tax so see how that fits your portfolio and perhaps hold them in a non-taxable retirement account 401k/roth IRA.

- 0:00 REITs offer 10% investment returns

- 3:41 Why did REITs do 10% per year since 1982?

- 6:28 Key REIT investment factors

- 7:44 FFO – Funds from operations

- 9:06 Pros of investing in REITs

- 11:25 Cons of invest in REITs

How To Invest In REITs (Pros and Cons of Real Estate Investment Trusts)

[REITs]Q1 hedge fund letters, conference, scoops etc

Transcript

Good day fellow investors. One of the most requested asset classes for me to look into have been Greece. And that is because Greeks have been the best performing asset class over the past. 20 years delivering double the return of the S&P 500 and quadruple the return the average investor.

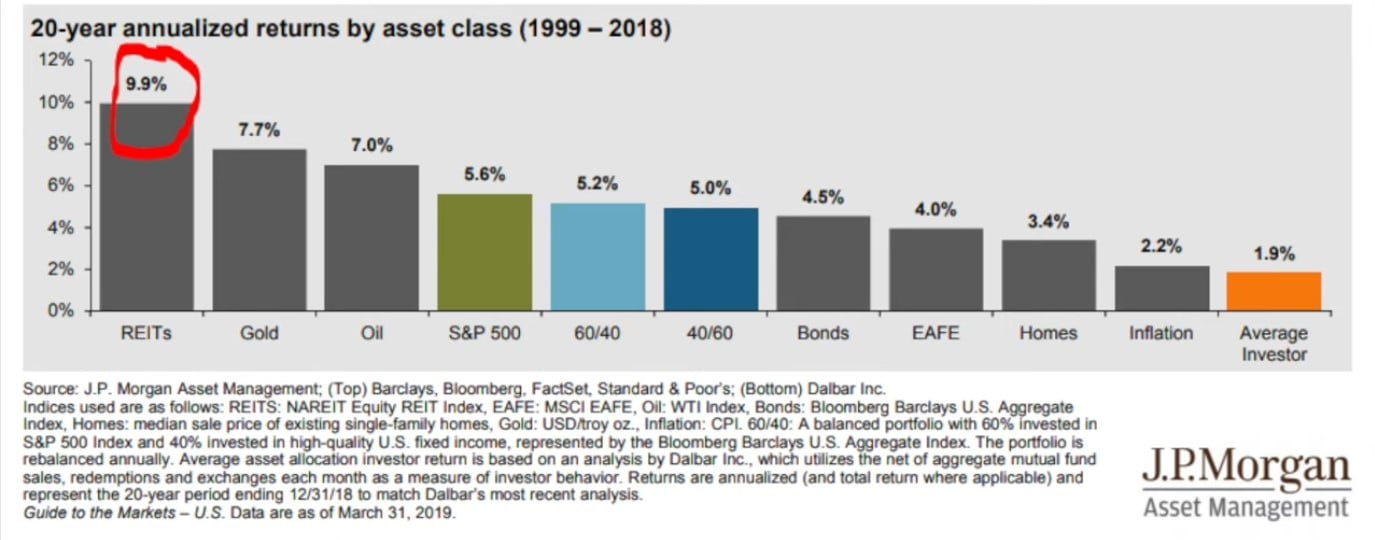

Has obtained. If we look at this 20 year annualized returns chart from J.P. Morgan we can see that’s read to deliver nine point nine percent over the last 20 years. That is very clear. The S&P five hundred five point six percent and the average investor one point nine percent. This is extremely important because it emphasizes Benjamin Graham‘s growth that the investors chief problem and even his worst enemy is likely to be himself. Why did the average investor achieve only one point nine percent while the S&P 500 almost 6 percent and reached 10 percent. Well the average investor usually buys high in exuberance and sells in panic.

I know a lot of people that bought in 2007 sold in 2009 and some never got back in the market. Some boats back in 2014 2015 2017. That is really really opposite of what you should do but that’s how the average investor does things. So don’t be an average investor and we are going to look at reads to see whether in the long term we can still expect a 10 percent average return.

We’re going to look at the pros and cons of investing in REITs. I’m going to explain how things work and I’m going to look not in this video but probably on Sunday I’ll discuss Simon Property Group the largest mall outlet in the United States and the company offers actually a potential 10 percent long term return in line with what we have delivered over the past 20 40 years. So I looked at it I looked at it deeply you’ll see that in the other video but there is actually something to look at and something to look forward to because 10 percent is a great return plastic of real estate inflation protection and all of the things that go alongside real estate and reads and Simon Property Group has only Class A malls and outlets which means high quality real estate but that in the coming video on probably Sunday or even tomorrow I cannot know yet. Let’s start with what we’ll discuss today. Why did we do that good over the past 20 40 years. Then we’re going to discuss what impacts read as investments from interest rates and then it’s not just about the dividend. It’s also about the capital appreciation the increase in prices if inflation is 2 percent you can increase your rents 2 percent your revenue goes up to 2 percent which is also something that many investors overlook when it comes to investing and looking at REITs. And then I’m going to give you a few. For I think pros of investing in REITs and 8 cons just to give you a perspective on what best fits you as a personal investor in individual investor when it comes to investing in REITs. It’s always about personal preferences. You see how something fits your portfolio your long term investment goes and I really believe that many of you will be appealed by readers because it might fit your long time horizon risk reward investment strategy. Let’s start. So why the dream to do that good over the past 20 years.

The main reason REITs did good are interest rates in 1999 from where the chart on performance measured the performance from J.P. Morgan. Interest rates have gone mostly down. If you can one hundred thousand dollars in a savings account in nineteen ninety nine you would get six thousand dollars in interest. Since then the interest on savings accounts really declined from six thousand to the car in 2000. But for the majority of the last decades it was below 500 dollars below zero point five percent. Now as interest rates have increased a little bit and you can get 2 percent one point five on savings accounts also REITs have. Suffered. If we look at the REIT ETF just a good proxy to look at the performance we can see that rates then do that good from 2016 to the beginning of this year when the Fed was hiking interest rates because people then compared the dividend yield to other interest rates options like Treasuries. But since the Fed capitulated since Powell.