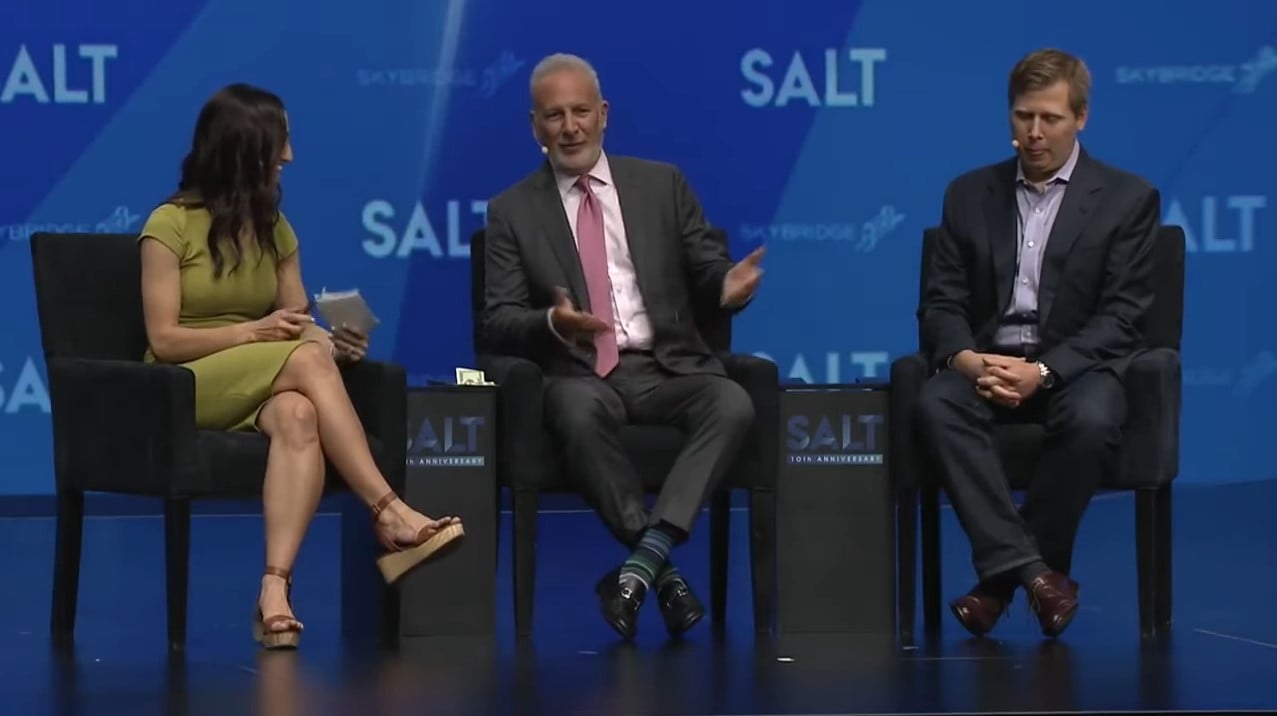

A debate between Peter Schiff and Barry Silbert about Bitcoin from the 2019 SALT Conference, he argues that gold is a legal tender and bitcoin is not.

Peter Schiff Debates Barry Silbert: Bitcoin Isn’t Legal Tender

Q1 hedge fund letters, conference, scoops etc

Transcript

All right I wanted to hit you with some numbers since early 2009 when Bitcoin first began trading gold has returned 47 percent Bitcoin over its entire 10 year history has returned more than 60 million percent. So it's off the charts. Peter why would you still want to own gold.

Well first of all that's irrelevant. I mean every bubble you know starts out low. I mean the peak time you know the people who are making money in bitcoin are the people who are taking advantage of that and selling and you know there's still a lot of air that's going to come out of this out of this bubble. But you know look looking at his commercial I realize we're getting free commercials I should have had one but you know he picks all these people are carrying around these lugging around these big heavy bricks of gold. I mean those would be multimillion dollar bars of gold that they even made them that big I mean most people that have gold he can carry all their gold in their pocket. You won't even know it was there.

You have some in your pocket right. Yeah I do. I brought I brought this is this this is real money this is this is a. This is gold but it does it doesn't weigh a lot. But you know. As long as we're. No I should do a little history though to understand that people understand that between money and currency. Because I also brought here. This is a 20 right. And this most will think this is 20 dollars right. It's not 20 dollars. Right I mean it says 20 dollars on it over here. But it also says Jackson on it. I mean I'm not holding an Jackson in my hand and I'm also not holding twenty dollars. So what is this. You can read right here it tells you what it is. It says this note is legal tender for all debts public and private. So it's a note right. It's a note of the Federal Reserve and a note is an obligation to pay something. Well what is the Federal Reserve obligated to pay me because I have one of their notes nothing. But once upon a time when the Federal Reserve first started in 1913 that the 20 looked different because over here it said this note is legal tender and is redeemable in lawful money. And then here it said paid to the bearer on demand twenty dollars. So what was the 20 dollars. This this is what you got. So this was currency right. It was a IOU for real money. And gold is the real money. Gold has been money for thousands of years. Our founding fathers made gold legal tender in the United States. But the reason that Gold became money in Barry's video. He says that while gold doesn't have any utility gold is the most useful metal there is. I heard was it Novogratz was up here yesterday saying that gold is the only metal that has no use gold has more used than any metal out there. Anybody who has a cell phone has gold. It's in the cell phone. So a lot of people should raise their hands if you have a cell phone you've got gold. Right. It's in all the computer chips that make. Bitcoin you know and it's a store of value. You see these cufflinks here. They're made they're made of 24 karat gold. There's 50 grams of gold in each one of these cufflinks. And the reason why gold is a store of value is you can melt these cufflinks down in a thousand years and then you can take that gold and use it to make a computer chip or cell phone or a gold does not lose any of its properties over time. Right.

Gold is the most liquid commodity. That's why it's money right. It became money because it satisfied the qualities of money better than any other commodity. Now what Bitcoin is like is like fiat money because in 1971 right when we went off the gold standard we just had this piece of paper. And since there's no gold backing this up what gives this value. Why does this have any value. Well one reason is because there is a tradition of using it. I mean there's prices denominated in these and contracts and bonds and insurance policies but also. You know this is all the government accepts in payment of taxes. They only accept Federal Reserve Note. So if you're in America and you don't want to go to jail you need to accumulate these. But what really gives it value is confidence faith that in the future people will accept this. In exchange for goods and services. But history if history is any guide all fiat currencies ultimately collapse because the confidence is lost. Bitcoin has a lot more in common with this than with this. We will money except Bitcoin isn't legal tender. You can't use bitcoin to pay taxes. The only thing giving bitcoin value is because somebody thinks a greater fool is going to pay a higher price. It's all the idea that it's going to go up and you'll be able to sell it. But confidence is going to be lost. And bitcoin is going to collapse along with all the other crypto currencies.

I think Peter's strategy for this debate is just to talk for 30 minutes.

So far I've got 25 more. Yes. All right. So I guess I brought up a prop as well. So this is this is where I store money and I think most of you do as well. You're equating gold to money at this point in its history. It is ridiculous.