Whitney Tilson‘s email to investors discussing Zillow Group Inc (NASDAQ:ZG); Hudson Bay; Billionaire pays off Morehouse grads’ student loans; Thousands of Taxi Drivers Were Trapped in Loans; Tony Robbins Berated Abuse Victims [and made] Sexual Advances.

1) My “blink” reactions generally serve me well, but sometimes they’re wrong.

Q1 hedge fund letters, conference, scoops etc

In my May 8 e-mail, I wrote that Zillow's (ZG) "instant home buying" program was "one of the dumbest ideas I've ever heard." I take it back. Now that I've spoken with some bulls on the stock and done some more work on it, I think – if done cautiously and cleverly (a big if, but this is an outstanding management team) – the program could be a profitable growth driver for the company. That said, I'm not recommending the stock – just retracting my bearish view on it.

2) One of my readers sent me this e-mail last week and gave me permission to share it:

I've been a long time follower and just thought to reach out to get some of your valuable insight. Hudson Bay is undergoing a turnaround in a very challenging industry, the apparel industry. The CEO has been very decisive and bold in the actions she has taken since becoming the CEO about a year ago. Among these are selling off the European retail business while still having control over the underlying real estate, selling the Lord and Taylor building (used the proceeds to pay down some of the debt), and recently, exploring the sale of the Lord and Taylor brand. While her actions have resulted in positive operational cash flow, there still remains significant challenges such as the deteriorating sales at Off Hudson Bay and Off Saks 5th Avenue and many others.

I purchased my position at $8.98/share and it is currently trading at $5.28/share. Does it make sense to wait for Wall Street to recognize the changes? Perhaps it will take much longer for her to turnaround the business, considering the segment is very challenging? Are you familiar with this company?

Would be great to hear some of your thoughts.

Here was my reply (remember, I'm not allowed to give individual investment advice):

I've never looked at it, but high debt and big losses (during a strong economy no less!) are a toxic combination.

I cannot see the turnaround you refer to in the numbers. The chart below shows operating cash flow and capex over the past 10 years – a horrible downward cash flow trend.

To own this, you must be VERY sure that something significant is going to change for the better.

3) Cheers of the day: Morehouse College Graduates' Student Loans to Be Paid Off by Billionaire. Excerpt:

Robert F. Smith, the billionaire investor who founded Vista Equity Partners... told the crowd that he and his family would pay off the entire graduating class's student debt, freeing them to begin their next chapter, whether it was a master's program, a position with Teach for America or an internship at Goldman Sachs, without loan payments to worry about.

The announcement came at a time of growing calls across the country to do something about the mounting burden of student loan debt, which has more than doubled in the past decade.

4) Jeers of the day: As Thousands of Taxi Drivers Were Trapped in Loans, Top Officials Counted the Money. What an absolute disgrace. Excerpt:

They were not the only ones worried about taxi medallions. In Albany, state inspectors gave a presentation to top officials showing that medallion owners were not making enough money to support their loans. And in Washington, D.C., federal examiners repeatedly noted that banks were increasing profits by steering cabbies into risky loans.

They were all ignored.

Medallion prices rose above $1 million before crashing in late 2014, wiping out the futures of thousands of immigrant drivers and creating a crisis that has continued to ravage the industry today. Despite years of warning signs, at least seven government agencies did little to stop the collapse, the New York Times found.

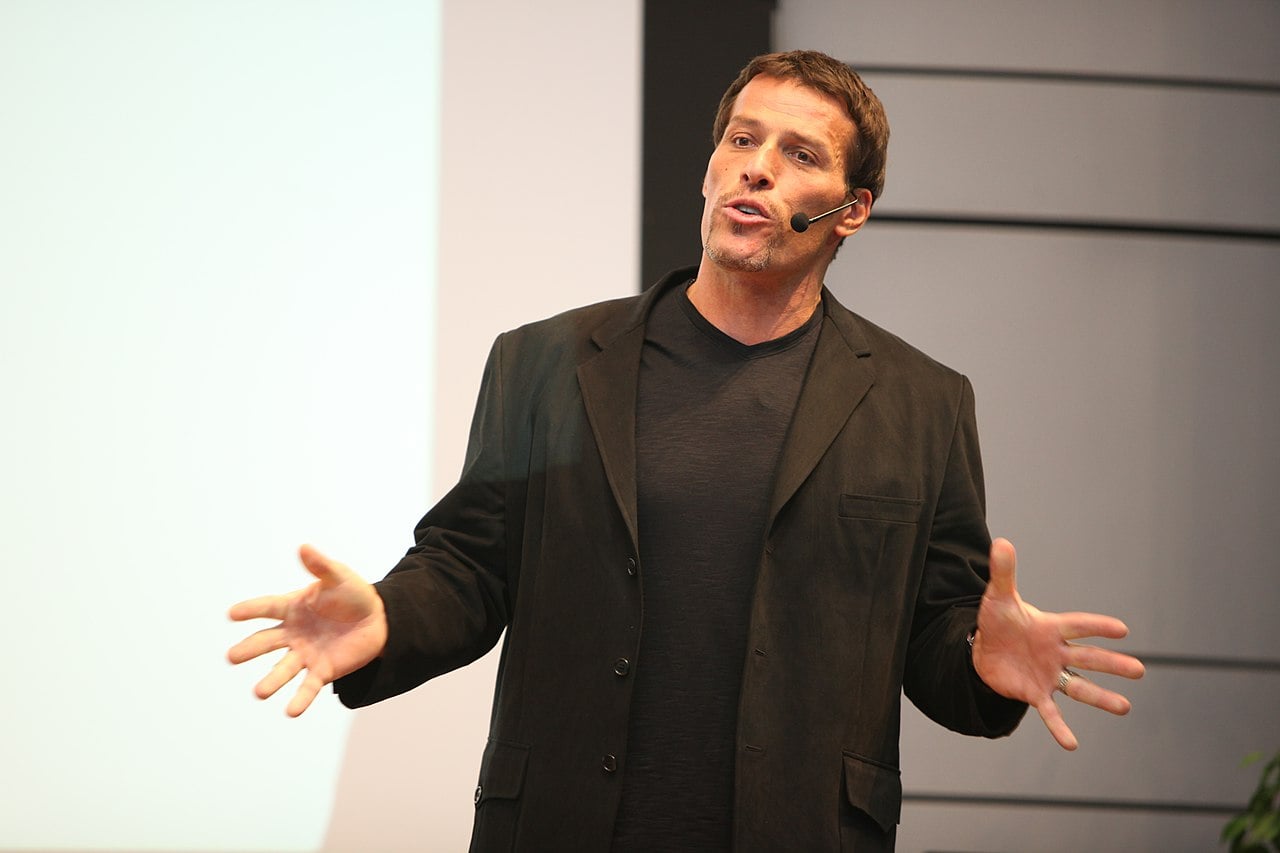

5) I'm including this exposé about Tony Robbins in my investing e-mail because he's not just a generic self-help guru... He often works with businesspeople and investors, both one-on-one and with certain programs like the four-day Business Mastery program I attended in Las Vegas last August. (To get a sense of the energy among the 2,000-plus people in the auditorium, see my video clips here and here.)

I enjoyed it and got some good ideas out of it for my business. But I didn't drink the Kool-Aid, as many did. There are definitely some cult-like aspects of what he does, and I can easily see him doing pretty much everything that's reported in this story. But I've also seen him make a real, positive difference in many peoples' lives. Leaked Records Reveal Tony Robbins Berated Abuse Victims, and Former Followers Accuse Him of Sexual Advances - BuzzFeed. Excerpt:

But behind that dazzling veneer, Robbins guards his empire with intense secrecy. Employees are bound by strict confidentiality agreements, and audiences who attend his multiday coaching camps must sign contracts forbidding them from recording what goes on inside.

...........

Secret recordings and transcripts from inside his events reveal Robbins has unleashed expletive-laden tirades on survivors of rape and domestic violence after inviting them to share their stories in front of a vast audience. "She's [expletive] using all this stuff to try and control men," he said after one woman said she had been raped. When, in 2018, another woman said her husband was physically violent and emotionally abusive, Robbins accused her of "lying" and asked: "Does he put up with you when you've been a crazy [expletive]?"

Best regards,

Whitney