We discuss the car industry, taxi, autonomous driving, solar, semi, Tesla Y, the probabilistic valuation. Tesla Inc (NASDAQ:TSLA) stock crash might continue so keep that in mind.

Tesla Stock Can 10x – A Realistic Probabilistic Investment Scenario

Q1 hedge fund letters, conference, scoops etc

Transcript

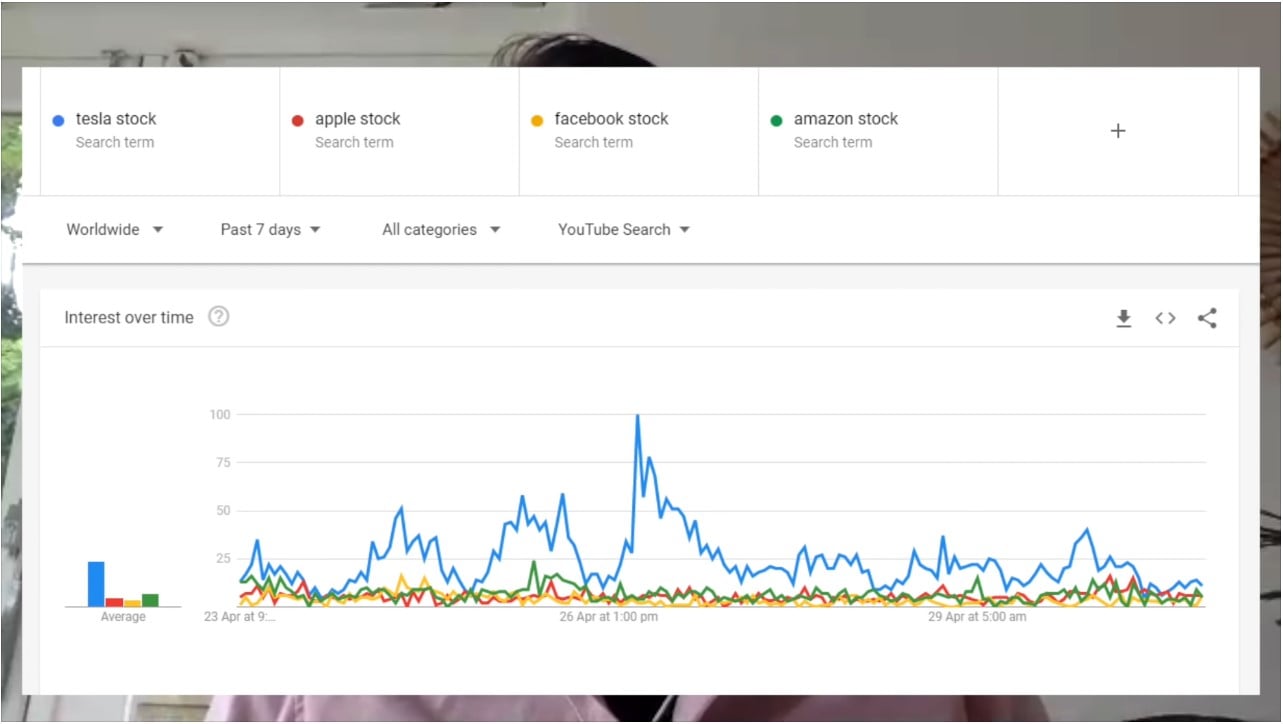

Good day fellow investors. Tesla has been the most famous notorious stock on YouTube over the last weeks and therefore I'm here with our guy today and we're going to try to put realistic probabilistic perspective on the company. Yaokai who is a notorious short on test line has been making a lot of money in the last month. So he will he. I will force him to be the bull on Tesla. So really that we are eliminating any cognitive biases from the investment. I will be the bear and I will try to counter his ideas. He is bullish these days. And then at the end we'll try to put a realistic probabilistic investment scenario accounting in both the bull and the bear thesis. Hi. Okay.

Hi. I. My name is Yaokai and I love Tesla.

All right. So as we said there has been a lot of talk on YouTube especially on the channel the financial education. He is also very positive on Tesla but I think we should go here back to Kahneman with his book Thinking Fast and thinking slow where there are two systems that that affect our mind system one that the thinking that seeks a coherent story above all else and often leads us to jump to conclusions. So it seeks to quickly create a coherent plausible story and explanation for what is happening and it really affects our pattern matching assumptions. And this is what you have to be very careful when it best investing and especially when it comes to investing in companies are stocks like Tesla which are all about stories in first place. So let's start with the outcry and let's discuss the bull thesis. What is so positive and we have seen this slides from. The financial education talking about Maxwell insurance and all the things that are going on for Tesla. And. How can that be approached from a bullish perspective. So I'll pass the word to you. Okay. And you can start with the first bullish topics.

Okay. Okay. So first on this topic is EV is going to take over the world, EV is cleaner to use drives faster. Last Lane as you don't go to the gas station it's cheaper. So EV is going to replace all passenger cars for transportation like ice internal combustion engine will go to zero and Tesla being the market leader in that space would capture I don't know I'm making some numbers.

You have to say will not would your goal.

Yes. Tesla will capture as much market share as they have now was in the future in terms of Evie's but it's going to be the entire car market so they will capture Item thirty five percent of all the entire planet's auto sales.

So entire planet auto sales. We have 18 million sales in the US. I think we are to 90 million cars over the world 30 percent of that would be 30 million cars.

So that's a 30 percent cars percent 30 million cars a year and they will maintain their margin at 25 percent however they define it by 25 percent margin over the average sale selling price is going to be at I don't know. Let's say 50 thousand.

So that's ten thousand per car times 30 million cars.

So that's a lot of money so that's 30 billion in the 30 billion in gross margin every gross profit every year.

So in such a positive scenario 40 billion in gross profit lets say they are some.

There are some costs marketing distribution 10 billion 10 10 billion in profits campaign and profits just from the cars 10 billion in profit.