It’s hardly a secret these days that most Americans love craft beer. The craft beer industry has been booming for the better part of a decade now and is showing no signs of slowing down in the near future. To try and learn more about the top factors driving craft beer growth in 2019, a market research firm named C+R Research recently surveyed 2,000 Americans over the age of 21 who identify themselves as regular alcohol drinkers.

Q1 hedge fund letters, conference, scoops etc

The survey found that 49% of surveyed respondents drink craft beer at lease once a week. Of those drinkers, the most preferred style of craft beer is IPA. 41% of respondents said they visit a brewpub or brewery at least once per month.

C+R researched asked about the top factor’s consumers look for in craft beer. Listed below are the top 12 factors:

- Taste

- Style

- Price

- Brewery

- Alcohol percentage

- Brewery location

- Packaging/branding

- Available in bottles

- Pairs with food

- Available on draft

- Sizing

- Available in cans

One surprising takeaway from the study is that 76% of consumers said that price does not influence whether they purchase craft beer. Consumers do spend on average $59 dollars a month on craft beer. Men spent $66 dollars on average where women only spent $50 dollars. 49% of respondents believe that craft beer’s popularity has increased within the last few years. 94% of consumers are drinking more craft beer than they were at this time last year. 91% prefer craft beer over big brand beer. These data points show just how much Americans enjoy craft beer growth over traditional big brand beer.

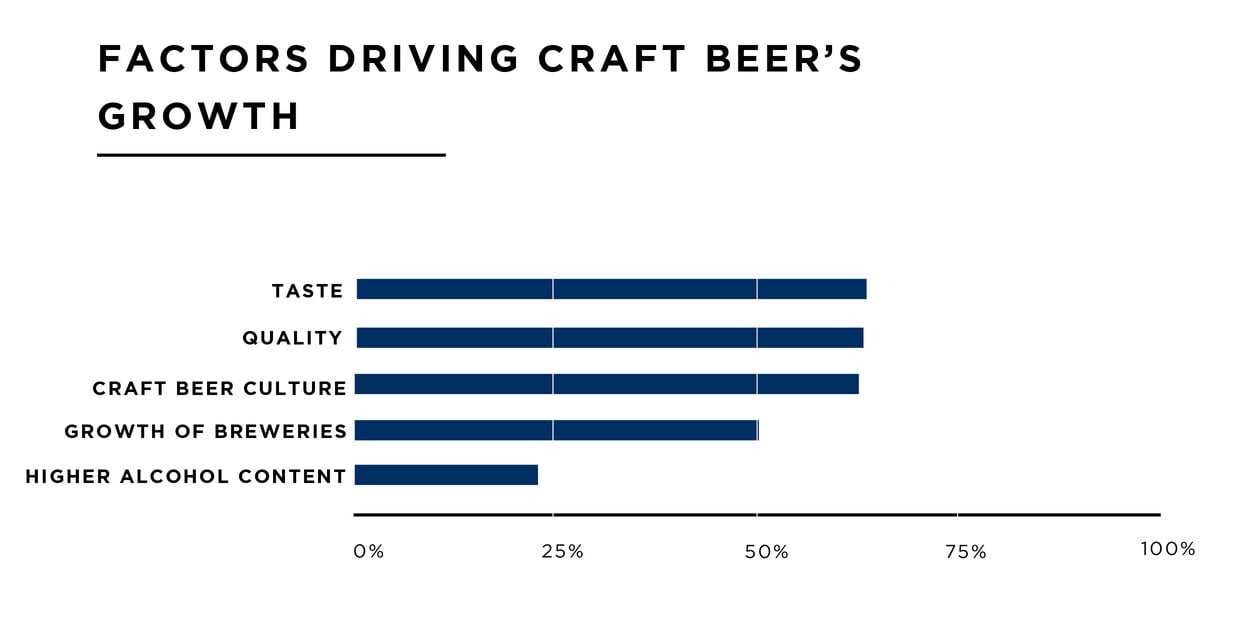

The survey also asked about the factor’s consumers believe are the top drivers for craft beer growth. Consumers listed Taste as the top factor behind craft beer growth. This was followed by quality, craft beer culture, the growth in the number of breweries nationwide as well as higher alcohol content in beers.

The survey also looked at whether or not seasonality played a factor in craft beer enjoyment. Summer was the only season that showed a strong preference among consumers. 50% of respondents said they preferred craft beer growth most in the summer. This was followed by consumers having no preference and Fall, Winter and the Spring all basically the same at under 10%.

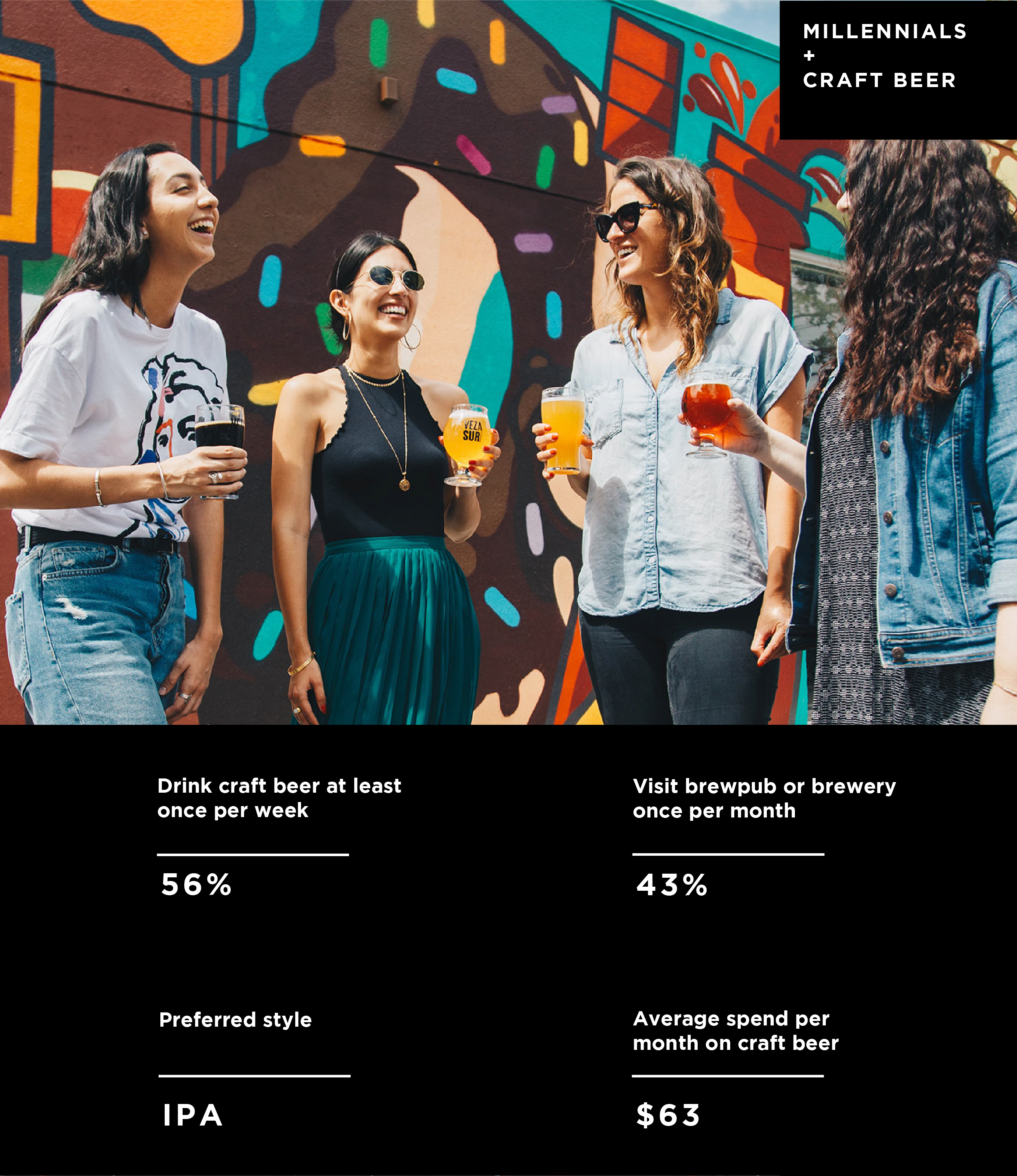

One target market for craft beer sellers is Millennials. The survey specifically looked at Millennials to their outlook on craft beer and whether or not they would pay more for craft beer if cheaper options were available since so much is paid about how little money Millennials have saved. Millennials on average spend $63 a month on craft beer tend to prefer IPA as a style. 56% of Millennials said they drink craft beer at least once a week.

The full analysis from C+R research can be seen below.