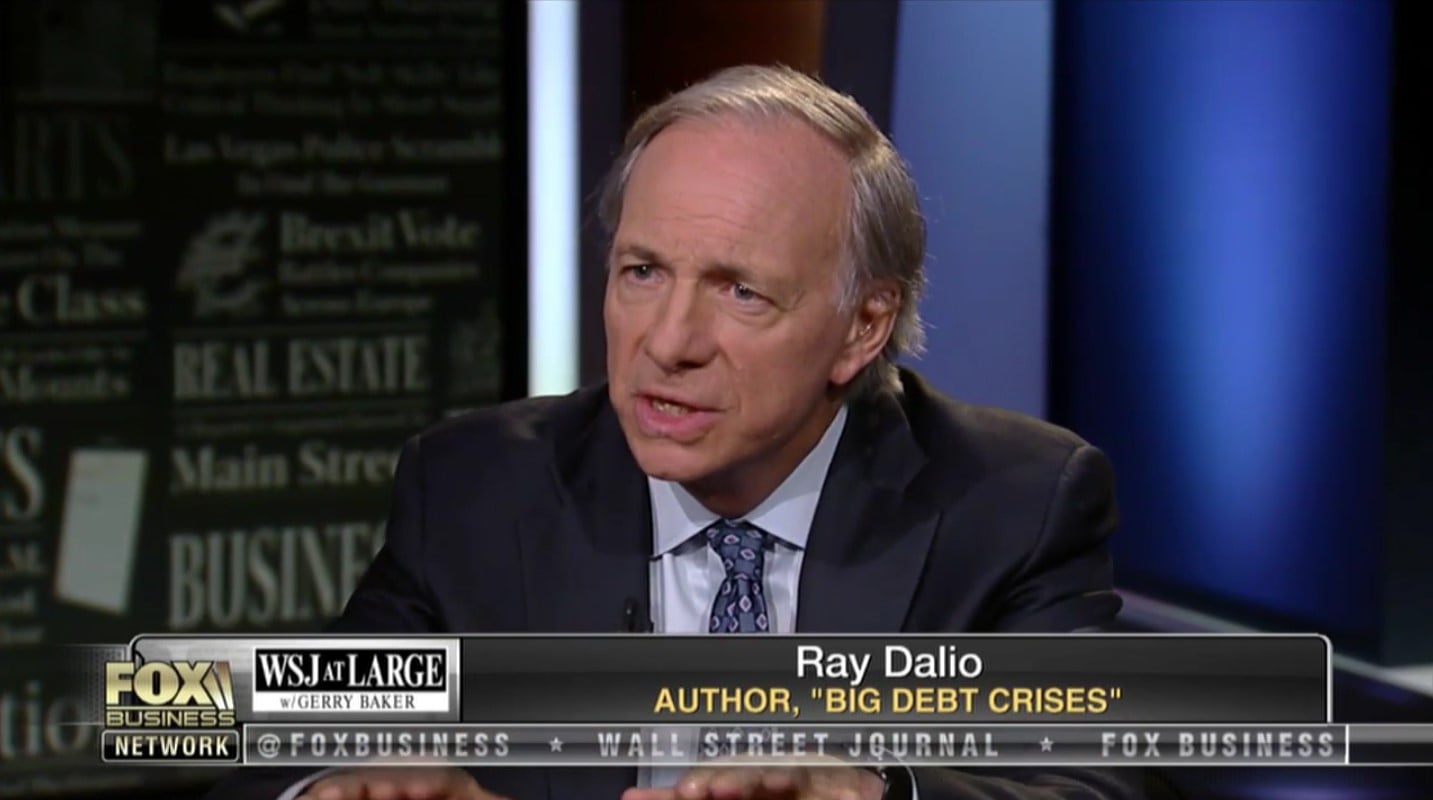

Bridgewater Associates founder Ray Dalio discusses the historic nature of debt cycles.

Ray Dalio: We Are Very Late In The Long-Term Debt Cycle

Q1 hedge fund letters, conference, scoops etc

Transcript

And this week my guest is one of the world's most successful investors. Ray Dalio founder co-chairman and co chief investment officer of Bridgewater Associates he's also one of most thoughtful and intellectually independent the business leaders and he's worried about a number of critical issues that confront the US. He recently published a book a big book called appropriately enough principles for navigating big debt crises. And now to talk about that and much more. He joins me right down here. Thank you very much indeed for being here. Ray let me start with this principles for navigating debt crises you're very big on principles. You think the world works according to principles and it's a kind of mechanistic way. Tell us if you would. And you've looked at the history of debt crises in many many examples of it tell us if you would how debt how debt cycles unfold and he would wear what you think we are in the current debt cycle.

Well first of all I think that there's productivity that we evolved and we learn how to do things better and raise our living standards. And then I think there are two major debt cycles around that. So the Wiggles that we see are mostly driven by debt cycles and they're cyclical because when you give credit you give buying power. So it's a net gain. When you take back and you have to pay it's cyclical. And so there's a short term debt cycle which we call a business cycle we're used to that you don't have a recession central banks stimulate monetary policy and then you go up and then when the economy becomes too hot you put on the brakes and you have that cycle. We're well acquainted with that cycle although I think it's interesting to talk about how it might be a little bit different this time. But anyway you know it's interesting. Then there's the long-term debt cycle which is the accumulation of that and as debts rise relative to incomes and in order to reverse that interest rates keep going down. You hit zero interest rates. And when you had zero interest rates the first type of monetary policy what I call monetary policy one doesn't work and you go to the second type of monetary policy. And that is central banks printing money and buying financial assets. Which causes financial asset prices to rise. And credit to go out quantitative easing. Right. And when that ceases to work you go into a new type of monetary policy which I'll call monetary policy. Three will talk about what that looks like but we are. It's important to then say where are we right exactly where are we. Is we are relatively late in the shorter debt cycle. We can tell by operating rates and unemployment rates and so on fairly well along in there and we are very late in the long-term debt cycle meaning the capacity of central banks to ease monetary policy is live.

So what is the historical record tells us when we get to this converging end of the short term debt cycle in the long-term debt cycle. I mean are we in for another debt crisis. The period.

And now there were no analogous periods the most recent analogous periods of the 1930s. And it's analogous in a number of ways. OK. So the parallel 1929 to 30 to debt crisis. Interest rates at zero. 2008 to 2009 debt crisis. Interest rates at zero. The only two times when central banks printed money and bought financial assets and caused the recovery was from that 1932 to 1937 and the expansion that we've been in during that period. We also as a result of this condition had a widening wealth gap and a widening opportunity gap. And we had populism very much like to dairy Simpson.

But so history doesn't always repeat itself precisely but are you suggesting that we could see something unfold both in economic and in sort of political terms. Populism. What we saw in the 1930s and with all that followed from that.

Yes I'd just like to take a second and show the parallels. And and it's correct that history doesn't necessarily repeat itself but the cause effect relationships are the important things to understand and they are analogous. So on monetary policy the question is what happens when you hit zero interest rates and quantitative easing doesn't work as well. Europe is there right. Japan's been there. Yeah OK maybe even now the U.S. is growing but it also has very low inflation. But we have a downturn. Let's just play with that because someday the dollar will come right. When you have a downturn the average amount of stimulation was 500 basis points of interest rate. We got about half of that to come to what we can do. And then you do quantitative easing so you can measure the difference between where we are by those measures. Yeah yeah okay. Now let's just go beyond and say what happens next. I'm not saying it's going to happen I know but I'm saying well man well he's is still. Yeah. What I'm trying to have us look at how the machine work. I understand and then put some tell us what. So what happens next. So what happens next is.