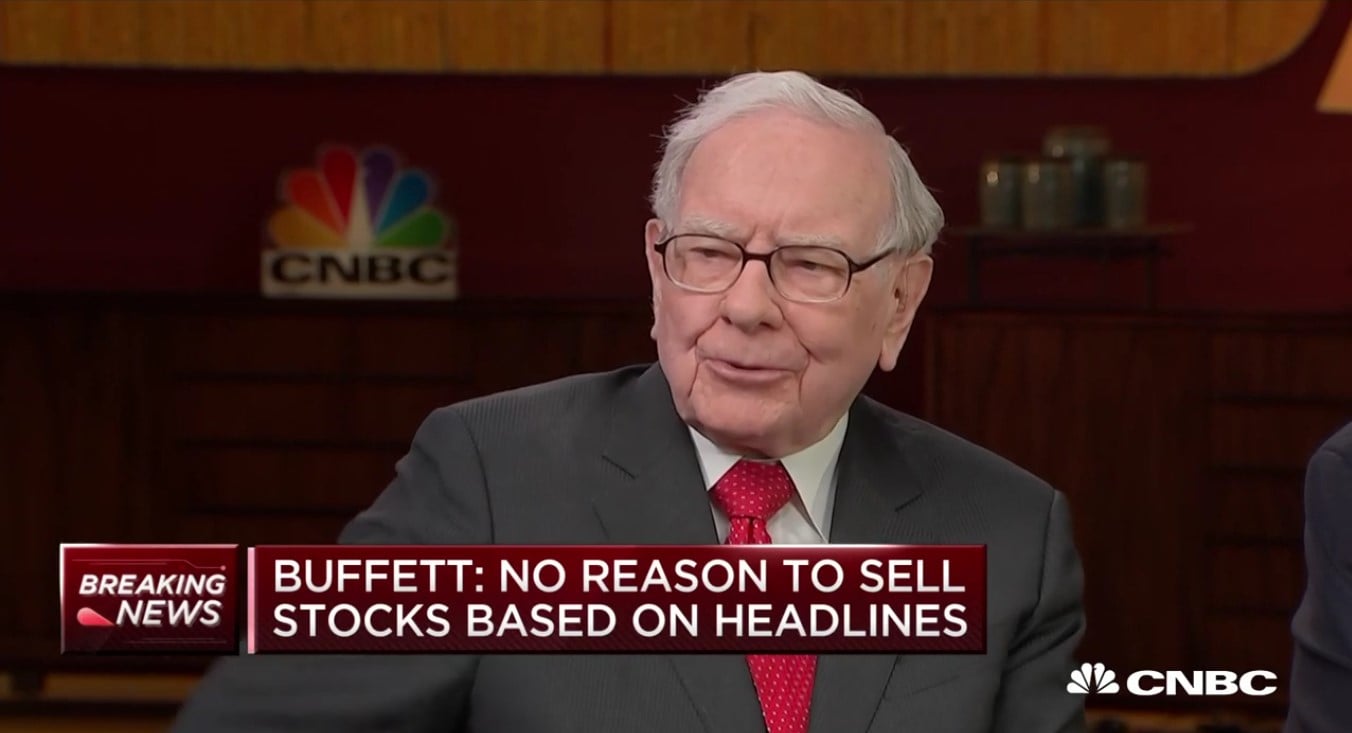

Full Transcript: Billionaire Investor Warren Buffett Speaks With CNBC‘s Becky Quick On “Squawk Box” Today

WHEN: Today, Monday, May 6th

WHERE: CNBC’s “Squawk Box”

Following is the full unofficial transcript of a CNBC interview with Berkshire Hathaway Chairman & CEO Warren Buffett, Microsoft Founder & Co-Chair of the Bill & Melinda Gates Foundation Bill Gates and Vice Chairman of Berkshire Hathaway Charlie Munger, on CNBC’s “Squawk Box” (M-F, 6AM-9AM ET) today, Monday, May 6th. Video clips from the interview are available on CNBC.com and the full interview will be available on the Warren Buffett Archive.

Q1 hedge fund letters, conference, scoops etc

BECKY QUICK: Andrew, thank you. Thank you very much. This was the 54th annual shareholder meeting for Berkshire Hathaway. And while shareholder meetings are known for being lightly attended, stayed and downright boring this was anything but. More than 40,000 people attended here including business leaders like Activision Blizzard CEO Bobby Kotick, Quicken Loans founder Dan Gilbert and Spanx founder Sara Blakely. And for the first time Apple CEO Tim Cook was in attendance. Apple is now Berkshire's largest equity holding and Berkshire is Apple's third largest shareholder. We caught up with Cook this weekend and asked him what he thought about it all.

TIM COOK: I think it's incredible. I've never been to an annual meeting like this before. You know, I thought ours was-- it's lively but there's 40 plus thousand people here. And I love the fact that-- Warren and Charlie take every question. And of course-- through all of it, not just the wisdom the exude but you can feel the integrity and the humility-- coming out. And I think it's a great learning experience for me and for everybody in the audience I'm sure.

BECKY QUICK: Joining us now is Berkshire's chairman and CEO Warren Buffett. And-- Warren, what's it mean to you to have gone through this weekend?

WARREN BUFFETT: It's a lotta fun. I mean, you see who you're working for and they see you and you interact with 'em. And-- they come in sort of a Mardi Gras spirit. I would say in the last ten years was-- maybe 40-- well, from out of town not 40,000. But--- a great many from around the world. I just never get a letter of complaint. I mean, I know that somebody missed his plane or has a car rental- that isn’t available or hotel room. But they just come in the spirit of enjoying it. And-- the people in Omaha welcome them that way. So people go around with smiles on their faces. I mean, we have 600 of our own people that come in from our various subsidiaries. And I think we work-- after a couple of days and-- I never see anything but smiles on their faces.

BECKY QUICK: But there-- unfortunately we're not gonna allow you to rest on your laurels this week because we have some major news that's breaking this morning. You see the markets already down by almost 500 points. The future's here for the DOW. What do you think about the potential for trade tariffs coming back on and what that might mean for the trade talk?

WARREN BUFFETT: Well, II can't gauge how both sides will play the game and they're always-- some people negotiate different ways. And-- if we actually have a trade war it will be bad for the whole world-- and-- could be very bad depending on the extent of the war. But there's times in negotiations when you talk tough. The one thing you can't do though is you can't-- you can't shake your fist first and then shake your finger later on. I mean, that-- it-- is not a technique that works well. So when you do push ahead-- you don't know exactly what the outcome's gonna be.

BECKY QUICK: What-- you can't shake your fist first and then shake which finger later? What are you talking about--

WARREN BUFFETT: You're-- more advanced on this than I am actually. But the-- well, that-- that's what you're worried about is you get the other finger back. And-- you have to mean it after a while otherwise it doesn't mean anything obviously when you do that. And you're gauging a response from someone else that also has their own calculus and has their own--internal political considerations and so and so. It's-- dangerous game. Doesn't mean it's a game that shouldn't be engaged in. But it's a dangerous game.

BECKY QUICK: You negotiate a lotta deals too. Would this be your tactic?

WARREN BUFFETT: Well, it-- isn't mine at all. But-- you know, we can talk about the Occidental deal later on but--I've got a consistent way of negotiating and that has its advantages. Probably has its disadvantage too. But---- I just say what I'll do. And---- I don't do anything else. So-- people really know that's what I mean and-- they can decide whether what I've said is acceptable or not. But they know that I don't go through it-- a game now they are lots of people in acquisitions that really like to play games. And-- they're used to it in their own business. And-- and it-- it's their way of doing it. And-- that's fine. But it doesn't work with me. And I don't wanna-- I can't afford to spend the time on it. I mean, it, you know, you don't know whether you're ever gonna get there. And you spend weeks and months and-- it-- it's just-- it would be a huge time waster if we didn’t.

BECKY QUICK: You know, I don't know that this is bluster coming from President Trump though. He's already put the tariffs on. And-- you know, I-- don't know that I would take this lightly and think that we're not going to be seeing--

WARREN BUFFETT: No, I--

BECKY QUICK: --25% tariffs on Friday.

WARREN BUFFETT: --you can't because you're playing-- playing the game you have to sound that way. I mean, it-- if you-- it-- with some people in negotiations-- the best technique is to act half crazy. I mean, that-- with your kids you see how it works. Even negotiating techniques with-- your children all the time. You count to three if you don't do this then that there-- they know you're not gonna shoot 'em in the end they've really got the edge. And- that goes on all the time. And-- it's interesting kinda with the reputation in industry, we bought a very large-- auto dealership operation a few years ago. And-- we did make more or less our kind of deal, winning the price. And-- probably 20 times since then people come out, they say, "We wanna do something." And they just-- we've never once thought we-- could do it the same way. I mean, it used-- it's just part of our lives to negotiate and it's part of my life not to negotiate, so.

BECKY QUICK: You need to come in with a high offer and expect--

WARREN BUFFETT: Oh sure.

BECKY QUICK: --that you're going to negotiate--

WARREN BUFFETT: Yeah, anything you say. They-- and-- I understand that. I mean, that's the way a lot of things take place. But-- probably a majority of transactions-- and-- but it's nice to have a reputation for not doing it 'cause it makes it a lot easier. You save a lotta time

BECKY QUICK: Well, let's talk about what it would mean if tariffs on Chinese goods rose to 25% from 10% on that $200 billion worth of goods at the end of the week. How significant is that? What would it mean for Berkshire's businesses?

WARREN BUFFETT: Well, it would mean a lot to the world. It-- isn't just a country is involved because, you know, they take the dollars they receive from us and that-- and they buy goods in other places. I mean, their trade surplus is considerably-- less overall than their trade surplus with us. So everything is-- everything intersects in the world. And-- it depends on who gets retaliatory with us or with them. And -- it's easier to start it than it is to stop it. And-- the effects would be huge if conducted on a major scale over time. Just-- imagine, Becky, that our constitution was set up differently and that states could erect tariffs. And Michigan would put a tariff in on-- you know, that-- on cars and there-- we would run accord and that-- you'd agree to which trade would contract in this country. But mislocated plans, they-- the migration of workers that would, I mean, it would be, well, it-- sounds ridiculous to talk about it 'cause it is ridiculous. But you've got countries where-- you would have similar effects if you-- if you get country after country after country. 'Cause you can't just have it between two countries. It-- will-- it will spread. The very fact that it's sort of a nuclear threat is what brings people to the table. So I mean, that-- that's the way to-- many play the game. But you don't wanna have too many-- nuclear threats out there because some day somebody may feel they have to fulfill one.

BECKY QUICK: Right. I-- obviously that's why the global markets are under pressure. Not just Chinese markets that are down. You saw that Korea Kospi-- was down by about 3%. Markets down-- just about everywhere at--

WARREN BUFFETT: It--

BECKY QUICK: --this point.

WARREN BUFFETT: --affects everything.

BECKY QUICK: So that's-- you're-- saying the market's reaction is the right one. It's not an overreaction.

WARREN BUFFETT: It's-- rational. And-- then we'll see what happens next. But obviously if-- you went to bed a week ago and you thought there was a 1% chance of a trade war. And--subsequent events makes you think there's a 10%. Markets reflect that very quickly.

BECKY QUICK: What would you put in terms of, I mean, you're an actuarial mind, in terms of these things. What kind of odds would you put on it?

WARREN BUFFETT: Well, you talk about two leaders of the two major economic powers in the world-- that's not the sort of thing I can lay odds on. I mean, you were talking about two personalities who are very much used to getting their way and in politics. And you're talking about-- how they would be perceived in their own country-- in terms of their behavior. And it gets very complicated. It-- there's no way I know how to predict that.

BECKY QUICK: Although you've written insurance contracts on weirder things than this. What-- would you-- what would it take for you to ensure that there was a deal done at the end of this?

WARREN BUFFETT: It--would take a big premium. Yeah. This would not be the kinda thing I would look to ensure, frankly.

BECKY QUICK: Because it's so unknowable?

WARREN BUFFETT: It-- yeah. And--you would-- you-- would have a hard time the-- planning the risk precisely because if they lasted for a month then they'd-- so you-- get into the duration of how long it-- you'd have a lot of trouble writing the contract. And-- but it is the sorta thing-- not-- not precisely identical but we do take on unusual risk. But this is a very big one.

BECKY QUICK: What-- will it mean for Berkshire businesses specifically? And I just think on Friday we spoke with Jim Weber who's the head of Brooks Running. They've already relocated and moved a lot their operations to Vietnam because of this concern. They've been in the process of doing that since these trade talks first kind of appeared.

WARREN BUFFETT: Well, we've seen it in the-- in our rail—cargo intermodal that arrives on the west coast. I mean, everybody stocks up ahead of time. And it-- distorts things just thinking about it. You can imagine the distortion if you get into it. And you really can't predict the speed or the degree of effect because it spreads. You-- can't do something between U.S. and China in a big way without it affecting all the major markets that they go around. And--- you're starting a game that you don't know the ending of but you know it isn't a good game.

BECKY QUICK: You said--

WARREN BUFFETT: Like I say, it may be necessary to play another game to avoid that sort of thing. I mean, that-- it's-- that's what mutually assured destruction was. I mean, you felt as long as you had mutually assured destruction nobody would actually launch it-- a missile. And-- this is a similar-- can be a similar type game. A little bit of chicken at--

BECKY QUICK: You say that intermodal rail loadings-- were affected by it. Meaning that you saw an increase in-- in rail car loadings--

WARREN BUFFETT: Months ago.

BECKY QUICK: Months ago because people were trying to stock up--

WARREN BUFFETT: Yeah, people loaded up on inventory that they thought might, I mean, you thought there's a good 25%, I mean, if I thought there was a good 25% tax on Coca-Cola next week I would have my house filled with Coca-Cola. It would look very good. Sales would look terrific. And guys who transported to my house would be doing great and everything, boom, it'll all end.

BECKY QUICK: Well, that's a big concern, I mean, if we've been looking at this great economy and thinking things are wonderful but it was really just pulling things forward. And then you get into a situation where it stops down, does that concern you just about--

WARREN BUFFETT: Yeah, and it pulls things forward I think. And in the GDP figures there was-- a big inventory adjustment. And-- - no, you-- if you think the flow of something is going to either stop or get more expensive and you need it you're gonna load up ahead of time.

BECKY QUICK: Well, the-- will this change your behavior in any way when it comes to purchasing securities or making deals?

WARREN BUFFETT: No we will buy the same stocks today we were buying last week. It's just I won't tell you their names.

BECKY QUICK: But would you buy more if you get 'em down—500 points

WARREN BUFFETT: --the cheaper they get the more I buy.

BECKY QUICK: But it doesn't mean that you don't think markets could go down further--

WARREN BUFFETT: No I'm not buying them 'cause I think they're gonna go up the next day or the next week.

BECKY QUICK: Yeah so it's something you're watching very closely?

WARREN BUFFETT: Yeah. Oh-- yeah. But we watch the prices of things we do more than current events. Because in the end-- we aren't buyin' 'em because what's gonna happen next month or next quarter. You know,we're really buying 'em because we think they'll be good businesses ten years from now. If somebody came to us with a good business today, we'd buy it. And we'd buy it regardless of what's going on in the tariff situation. We might this wouldn’t be the case. But you might-- we're more likely perhaps to get something when other people are-- fearful. You see that in a big way instantly in the market, you know, in the market for businesses. It's-- but it's--still there in people's minds.

BECKY QUICK: We-- have much more to talk about this morning including the Occidental deal that you already referred to. But if you don't mind we'll slip in a quick commercial break first and come back and talk more about that?

WARREN BUFFETT: Gotta pay the bills.

BECKY QUICK: We do. All right, Joe and Andrew, I'll send it back to you in New York.

ANDREW: Thank you, Becky. We'll be back to you in just a moment. We are all over this morning's big market move. But when we come back we're gonna take a closer look at some stocks with China exposure getting hit hard this morning. Meantime, as we head into a break, here's a look at the biggest pre-market winners and losers in the DOW. Back in a moment with Mr. Buffett.

BECKY QUICK: All right, welcome back, everybody. We are here and news is breaking. There's an SEC filing that came out from Kraft Heinz. That's obviously a big Berkshire Hathaway holding. Kraft Heinz says that it will restate earnings for 2016 and 2017 due to misstatements in the original filings. It does not, however, believe that the misstatements are what they call quantitatively material to any individual reporting period. It says that the impact on adjusting earnings is expected to be less than 2% for each year. Kraft Heinz says that it has now completed an investigation that shows several employees in its procurement operation engaged in misconduct. But none of those were members of senior management. Our guest today, again, is Warren Buffett. He's the chairman of Berkshire Hathaway which owns a major portion of Kraft Heinz. And-- Warren, what do you think of this? This news just hitting while we're sitting here.

WARREN BUFFETT: Well, that's more or less what I've heard. I'm-- not the board anymore. But-- Greg-- Abel and Tracy Britt Cool are on and so I've heard from them. And--this is an update that I heard last night-- that-- and they can't-- issue the-- first quarter reports until the 10K is filed. And they can't file the 10K 'till Price Waterhouse-- signs off on it. And-- that apparently is going to require a restatement of a few years. And we could not report any earnings from Kraft Heinz in the first quarter because if we get a dividend from-- Bank of America that dividend goes into earnings. But because we have over 20% of Kraft Heinz we don't report the dividends. We report the earnings. So we received a dividend of about $130 million in the first quarter. But that-- we don't report that. And-- we expected to get the earnings before we issued our own report. But when the time came to issue our report and we didn't have anything we just-- we put a zero in there and explained it in our release last Saturday. And-- this is just a further-- indication of the facts, as they stand now. At some point-- Price Waterhouse-- will need to be happy with the figures they're-- reporting. And that evidently involves restatement. And-- at that time I guess that the quarterly figures become quite current and that we keep picking up our share of the earnings.

BECKY QUICK: I mean, this has been a long standoff period between PWC and the company if they've missed-- the deadline to get the numbers to you at that point. What--

WARREN BUFFETT: Yeah, we--didn't expect it. And-- I thought that we would have the earnings on time. And--Kraft announced their earnings for last year. But they had not been signed off on by their auditors. So while they released them publicly they couldn't file the 10K with the SEC. Subsequently. That's not unusual for companies to announce the earnings before they've actually gotten signed off. But-- in any event, it's just-- you know, we thought we were gonna get 'em this week or next week, whatever it might me and-- then last Saturday came and that's our time for releasing quarterly earnings. We did not have them. So we stuck-- nothing in there. And a footnote and we put it in our press release as well that-- we just didn't have the figures.

BECKY QUICK: If they're restating their earnings does that mean Berkshire Hathaway will also have to restate its earnings?

WARREN BUFFETT: No. it would be so immaterial by the time-- you take just our share. We're a much larger company. So-- that-- I don't know exactly what we do when we get-- if it gets into the second quarter. I don’t know whether we pick up two quarters in one quarter or exactly how that works.

BECKY QUICK: They-- said that this is the-- they've wrapped up this investigation. Are you satisfied with what you've heard from that-- part of the investigation or do you know the details?

WARREN BUFFETT: I don't know about that. I do know that-- because I've been kept abreast of some of the things that-- I-- don't listen in on director's calls or anything like that. But-- Greg tells me what's the high points and what are the low points of what's happened. And-- we have a terrific head of the audit committee, Jack Pulp ( He's an independent director-- he-- knows this sort of thing. And he-- and he's put in the hours on it. And-- so I feel very good about-- the fact that Jack is-- he's really in charge of things from the standpoint of the directors.

BECKY QUICK: Does the company have your confidence?

WARREN BUFFETT: Company has my confidence.

BECKY QUICK: You have-- talked about it over the weekend where you said that what you paid for Kraft was too much in hindsight.

WARREN BUFFETT: Exactly.

BECKY QUICK: Not what you paid for Heinz.

WARREN BUFFETT: That's correct. We just bought Heinz we it'd be a better investment. And we'd own-- we'd own 50-- just over 50% of it-- of this business. We'd doing fine in relation to the-- what we paid for it.

BECKY QUICK: But in-- in a situation where you determine that you've now paid too much, what do you do?

WARREN BUFFETT: I paid too much for stocks, I paid too much for a lotta thing. Time usually works it out. But it-- means that capital could of been better deployed in other-- in other areas. You-- could always pay too much for a business. It-- and I've done it with stocks many times. I've done it with businesses. We've got-- at Berkshire we have at least a half a dozen businesses. And I can't even use a we there. I gotta say I paid too much. So-- and-- if we make the next ten deals we make and then-- there will be a couple where it turns out that I paid too much.

BECKY QUICK: This-- kicks up for-- sets us up for a much bigger discussion on where market valuations are right now, why you think you've been having-- a tough time-- finding something that you think is a fair value. And-- I'd like to talk to you about some of these purchases-- but we have to take another break. When we come back we will have much more from Warren Buffett. We're gonna talk about more of his major holdings. We're gonna talk about his new investment in Occidental Petroleum. And we will talk about all of these valuations, what it means for markets right here, what it means for business prices right here. Right now though as we head to break take a look at the U.S. Equity Futures. Again-- under pressure severely because of the announcement that-- President Trump says he's going to be putting-- or raising the tariffs on those $200 billion worth of-- Chinese goods from 10% to 25% on Friday. This is the week that it's supposed to be heavily negotiated with the Chinese. Now there are questions about whether the Chinese will even send that delegation here to continue those talks. As a result DOW Future's down by 487 points, S&P's off by over 50 points, the NASDAQ's down by 156. And Squawk Box will be right back.

JOE KERNEN: Good morning. If you're just waking up, brace yourself. U.S. stock futures indicating a pretty big sell off – sell off in points percentage-wise, it's not like we're seeing in some of the other indices around the world. But down 481 points this morning on the DOW. This comes after President Trump's tweets yesterday threatening to hike tariffs on $200 billion worth of Chinese goods that are currently at 10% to go to 25%. But then the nuclear option that we’ve talked about all along, he's also threatening to impose a 25% tariff on an additional $325 billion of Chinese goods shortly. I think if you add 325 to 200 that's, like, everything basically. This was the reaction in China markets overnight. So figure ours, if we're – what is ours? What is that, 1.5% or something? It's not that big a deal for us at this point. But look at that 7.3% on the Shenzhen. Figure out what that would be here. That would be a real drop in U.S. equity. And we're coming off a recent series of new highs and you saw that, all the headlines after Friday's jobs number, a 50-year low, and we're the envy of the world. And everything else. Sunday it's, like, all right, things are going pretty good. I got a little room to work with, to put some pressure on China. I mean, you can sort of see how that happened.

ANDREW ROSS SORKIN: One view of the world. In the meantime, we're gonna get back out to Omaha this morning where Becky Quick is with the one and only Warren Buffett. Becky.

BECKY QUICK: Hey, Andrew, hey, Joe. Let's get back to Warren Buffett. We've been talking with him all morning long about the news of the day, things that have been happening that affect the Berkshire portfolio as well. And Warren, there was other news to cross the wires just last night in another deal that you're involved in. That would be backing up Occidental in its bid to try and take over Anadarko which is also engaged in talks with Chevron who's also got a bid out there. Last night Occidental put out its own statement and said that it's going to be revising its proposal. It's now talking about a deal, still $76 a share offer, but 78% cash and 22% stock. By increasing that cash portion it allows what they call significant immediate value, greater closing certainty, enhanced creation because with this they no longer have their ask their shareholders for permission on this. What are your thoughts about where the deal stands and what this latest update says?

WARREN BUFFETT: Yeah, I got a call yesterday evening. First on my – I’ve talked to Occidental actually since a week ago yesterday, Sunday. And they told me that they were going in this direction which I like. But I have nothing to do with it. I mean, we committed $10 billion and it had nothing to do with their – how they frame their offer, how much they offered or anything else. All they knew was that they were sure they could get $10 billion from us if they complete the deal with Anadarko.

BECKY QUICK: One of the pieces of the letter that Vicki Hollub, the president and CEO of Occidental, put out in its letter back to Anadarko surprised me a little bit with just how it still seems like this was a hostile bid. There's not good faith talks that seem to be taking place between them. Based on her letter, she said this, "We remain perplexed at your apparent resistance to obtaining far more value for Anadarko shareholders which has been expressed clearly through our interactions over the last week." Sounds to me like that is still kind of a hostile bid. What—

WARREN BUFFETT: Well, it's my understanding, and bear in mind, first thing I heard about this was a week ago Friday when Brian Moynihan called and said the people at Occidental would like to talk to you. And I talked to them on Sunday a week ago yesterday. My understanding is Anadarko and Occidental had talked much earlier, well before the Chevron bid, and were talking about a transaction. And then Chevron made an offer which Anadarko accepted. But Anadarko was for sale. I mean, and so it had held talks about selling itself to Occidental. That is my understanding. And so they were talking. Maybe they were talking to more than two parties for that matter. I wouldn't know that. But they decided that they were willing to sell, I’m sure subject to price obviously, and they accepted an offer. And Occidental felt they had a better offer. And that's apparently where things still stand. But I don't know all of the details.

BECKY QUICK: Part of the idea behind it had been that, well, would Occidental be able to get approval from its shareholders because its stock was under pressure. Some of the shareholders obviously didn't like the deal. By using your cash instead of issuing as much stock as they had anticipated originally, that will keep them from having to go to their shareholders to ask permission for this and as they're saying in their own letter, that certainly increases the certainty of this deal taking place and removes some of that uncertainty.

WARREN BUFFETT: Yeah, I would also think that the shareholder – if you own Occidental, you're bullish on oil over the years. And you've probably been bullish on the Permian Basin because they have such a significant portion of their assets there. So the idea that they will reduce – use less stock and more cash as part of the deal, although they're getting the cash from us, but I would think net it if I'd been a holder of Occidental over time I probably would like that kind of a deal. At Berkshire I hate to issue stock. So generally speaking if any company we own is buying something we like it better when they buy it for cash than they do stock because we like their stock. So we'll see what the reaction is to this. But I would just imagine there'd been an all-stock offer to begin with. I would think people would net their shareholders. But their shareholders will be speaking out. But I would net their shareholders would like the shift.

BECKY QUICK: Andrew's got a question from back in studio too. Andrew?

ANDREW ROSS SORKIN: Hey, Warren, I was just curious whether you were surprised that Anadarko hadn't engaged with Occidental and this at this price. And also if there was a price at which you would think that Anadarko – or rather that Occidental shouldn't pay. Meaning, if Chevron were to come back and they're at you know, five times the size of Occidental. They could just write a check and this could be over with if they wanted to. But if the price were to go up – I know you get preferred shares ultimately – is there a price at which you wouldn't look at this favorably?

WARREN BUFFETT: Well, we committed to $10 billion. 100%. We do not have any control nor did we want any control over what Occidental did with our $10 billion and the terms and everything. There's nothing in our deal that provides that they have to come back to us and request permission really to do anything. It's a remarkable deal. But that's the way we do them in that respect. And so they get our $10 billion if and when they close the deal with Anadarko. And they don't have to consult us. They certainly don't need our go – they don't – as a matter of courtesy I got the call yesterday, but it was not a matter of necessity on their part. And that's one of the advantages of dealing with Berkshire. I mean, we can do things that other people don't like to do or their lawyers don't like them to do. And this is not a deal that our lawyers would've written.

BECKY QUICK: Is this deal a bet on the Permian Basin and on oil prices or is this just a bet on hey, it's great to have an 8% preferred?

WARREN BUFFETT: Well it’s great to have an 8% preferred if there's any oil there. No it's a bet on oil prices over the long term more than anything else. It's also a bet on the fact that the Permian Basin is what it's cracked up to be and all that sort of thing. But oil prices will determine whether almost any oil stock is a good investment over time, whether it's Exxon or some wild cat grower. If oil goes way down, you don't solve that by hardly anything. If it goes way up, you make a lot of money. And it's not what it does next week or next month or next year. You're buying reserves that go far out into the future. So you have to have a view on oil over time. And Charlie and I have got some views on that, not too specific because they are not that well-informed. But they are – we feel good about doing the financing.

BECKY QUICK: Why don't you just buy it yourself? It's only a $35 billion deal and you've got $110 billion in cash sitting around.

WARREN BUFFETT: Well, that might've happened if Anadarko had come to us, but we wouldn't jump into some other deal that we just heard about through somebody coming down sort of seeking financing. No we hope people come to us on businesses. But I have no idea that this transaction was going to happen. I mean, a week ago Friday when I got the call from Brain Moynihan, well, I had read in the paper about the deal. But I've never had any contact with Anadarko of any sort.

BECKY QUICK: David Faber reported last week that you had said you would offer up to $20 billion, double the $10 billion that you did do on this deal. Is that the case?

WARREN BUFFETT: If they needed it. But I think they, I mean, they have an arrangement obviously with the Bank of America who called us. I don't know anything about that deal. I just know that BofA has arranged that financing. If there were a different sort of thing – what I meant to some extent with that was I'd be very happy if somebody calls tomorrow and needs $20 billion. Occidental just needed the $10 billion.

BECKY QUICK: Okay, but you like doing these deals of bigger sizes, not smaller sizes?

WARREN BUFFETT: Exactly.

BECKY QUICK: Okay. Back to Andrew's point, this is there for forever. Doesn't matter if the bids go up, doesn't matter what happens along the way. Your $10 billion is in this deal for whatever happens?

WARREN BUFFETT: Yeah, there is. The lawyers don't like deals like this. But we tell them to. There's no material adverse change. There's no – if the stock market closes, but this deal closes, we're there. We're there under all circumstances. And we don't—we have not written any outs into it. But that's part of the attraction of doing business with Berkshire. And besides that, we do it all ourselves. So it isn't something that's parceled out among ten parties and each one comes in and has to get their permission to make changes and all that. When they came to my office at 10:00 on Sunday –

BECKY QUICK: Occidental, right.

WARREN BUFFETT: A week ago Sunday, they knew that if we agreed, which we did by 11:00, they knew Berkshire was 100% in. Now they had their own board of directors meeting the following evening. But they could say to their board, "You're going to get $10 billion from Berkshire when this closes.” You don't need to give a thought to it.

BECKY QUICK: Okay, when we come back we're going to talk more about the prices you see in the markets and whether you think prices are fair at these levels, whether you think they're too much. But again, our guest is Warren Buffett. And Andrew, I'll send it back to you.

ANDREW ROSS SORKIN: Hey, thank you, Becky. When we come back we're going to talk a lot more to Warren Buffett this morning about the big market sell off. We're gonna wrap up all the big headlines from the Berkshire Hathaway annual meeting. We'll be back in a moment.

ANDREW ROSS SORKIN: Welcome back to “Squawk Box.” take a look at U.S. equity futures this hour. DOW off almost 500 points, NASDAQ down 167 points, S&P 500 off 50 points. All of this on the back of some news that the China trade negotiations may not be solidifying as quickly as we thought. Right now, let's get back to Omaha where Becky Quick is with Warren Buffett. Becky.

BECKY QUICK: Hey, Andrew, thank you very much. Obviously many stocks are under some pressure from what they were seeing from these Chinese trade talks, what the implications are from all of that. One share – one stock that is under pressure today shares of Apple. If you want to take a look at the chart, closed on Friday at 211.75. This morning the bid's at 204.91. The ask is at 205.10. And that's because China has been such a huge component for Apple. Tim Cook talked in the last earnings last week about how things seem to be really improving there. Tim Cook also traveled to Omaha this weekend. He was here for the Berkshire Hathaway annual meeting. It's his first time coming here. But for Berkshire, Apple is now the biggest investment that they have in their equity portfolio. Berkshire's also the third largest investor in shares of Apple. So when we sat down with Tim Cook this weekend I got the chance to ask him what he thought and how he found out that Berkshire was first buying into shares of Apple. Listen in.

TIM COOK: I found out probably like you did, which is the 13F gets filed and somebody tells me about it. And then, “oh this is really cool. Warren Buffett is investing in Apple.” You know, we welcome all shareholders. But we run the company for the long-term. And so the fact that we've got the ultimate long-term investor in the stock is incredible because our interests are aligned. And then, but I knew Warren before then. But we had no idea they were looking at the company. They deal with that obviously secretly and have their own method of doing that. And it's been a privilege. And I'm super happy they've been accumulating.

BECKY QUICK: What happened when you found out? Was there talk around the office? Were there any high-fives or was it a oh boy, now what? What—

TIM COOK: It seemed like – it seemed like recognition in a way. And like an honor and a privilege. And I don't mean that in a light-hearted kind of way. I mean, wow, it's Warren Buffett is investing in the company. And yeah, and so it felt great. And I think for the whole company because we knew that he didn't – he's been very clear. He didn't invest in technology companies and companies he didn't understand. He's been totally clear with that. And so he obviously views Apple as a consumer company. And in a different kind of way. I think that's really special.

BECKY QUICK: Warren, what did you think hearing this? Because when I told you we were going to tell how he found out you said, "Oh good I'd like to hear the story." You never talked to him about that?

WARREN BUFFETT: I didn't. Not about that specifically. No. I've known Tim a little over the years. And seen him maybe at least once a year. Maybe twice a year. And I’ve talked to him on the phone a few times. And sent him a letter. I sent him a Martin Luther King speech some years ago that was kind of lost to history that was terrific and I thought he'd enjoy it. But no I didn't call him up while we were buying. I try to keep as quiet as I can when we're buying anything.

BECKY QUICK: China though is a huge issue for Apple. It’s why the stock had been under pressure earlier this – or at the end of last year. Last week on the earnings call it certainly sounded like they thought China and the situation there was improving. What does this news today mean for you?

WARREN BUFFETT: Well, the important thing is really that the relationship is with China three years, five years, ten years, 20 years from now. I mean, this all enters in and certainly it's hard for me to imagine that the two most important countries in the world would do dumb things over a long period of time. But they could. I mean, the possibility always exists that you get miscalculations or egos or national pride or whatever it may be. And that things do escalate. I don't think that'll happen. Well, I know it shouldn't happen. I think it's a low probability. But that would be bad, it would be bad for everything Berkshire owns. I mean, it isn't a question of Apple or – it would have a very negative effect on our economy, on the world economies and there's a chain reaction of sorts, that type of thing. So I don't think it'll happen. But I don't it’s zero, the probability.

BECKY QUICK: You say it would be bad for virtually all of the businesses that Berkshire owns, but Apple’s in a pretty unique position, because it is so front and center, because it’s already come up as a potential target for some of these things. Do you think Apple runs a special risk or not?

WARREN BUFFETT: Well, it would have -- I mean, obviously in terms of our electric utility in Iowa, it’s going to -- it would have a very minor effect relative to other types of businesses. But the ripple effect -- if you’re in a recession and -- it hits everything, almost, eventually, so I think it’s very unwise. It’s kind of like having – if you have a nuclear war, you don’t want to say, "Ha, ha, ha," you know, if you’re in Canada, because they’re only attacking the United States or something. It’s impossible to contain it if you have two superpowers and trade involved. And you can’t predict exactly how it spreads.

BECKY QUICK: Apple shares are down 3% this morning, just looking at the chart.

WARREN BUFFETT: That’s good. Yeah.

BECKY QUICK: That’s good, why?

WARREN BUFFETT: Well, because they’re repurchasing shares, and when they are repurchase shares, our interest goes up and we don’t lay out a dime. I love it, you know. And obviously, it’s better to buy it at x than 2x.

BECKY QUICK: They say they’ve reauthorized up to $75 billion in additional shares. You are behind that? You’re in favor of that, I should say.

WARREN BUFFETT: Wildly in favor of it.

BECKY QUICK: We’re going to talk a little bit more about share repurchases, not just with Apple, but more broadly, because it is a question that came up pretty frequently this weekend at the Annual Meeting, too.

WARREN BUFFETT: Repurchases can be the dumbest thing in the world or the smartest thing in the world. and I’ve seen both but they’re just -- repurchases by the company are just like purchases to us, they’re dumb a one price and smart at another price. And I like it when companies -- I like it when we’re invested in companies where they understand that. Many companies just repurchase and repurchase, you know, it’s the thing to do, and they’re encouraged to by some shareholders and by their brokers. Repurchases can be dumb. They can be smart. At Apple, they’ve been smart.

BECKY QUICK: We will talk more about this and much more with Warren Buffett when we come back after a quick break. Then at 8:00 a.m. Eastern Time, we will be convening our summit with Warren Buffett, Charlie Munger and Bill Gates. We’ll be joined by Berkshire Vice Chairman Charlie Munger, Microsoft Founder Bill Gates. All of that coming up later this morning. "Squawk Box" will be right back.

JOE KERNEN: Good morning, and welcome back to "Squawk Box" here on CNBC. I’m Joe Kernen along with Andrew Ross Sorkin. We’re back in New Jersey. Becky, though, is in Omaha this morning with a very special guest: Warren Buffett joins us fresh off the Berkshire Hathaway Annual Meeting. We’re going to hear from Becky in just a minute, but first, take a look at the futures. Big move this morning in U.S. equity futures at this hour, tumbling after President Trump threatened China with some new tariffs. We have the perfect guest this morning for the market move. Let’s get right to Becky Quick and Warren Buffett. Hey, Becks.

BECKY QUICK: Hey, Joe. Thank you very much. Again, picking up with Warren Buffett where we left off. Warren, we did talk at the top of last hour about what the China tariffs potentially mean for business and what they mean for Berkshire. But you’re looking at the market’s down almost 500 points this morning. And for people who are just waking up and just kind of trying to figure out what this means for them, for their portfolios, for their businesses today, I’m sure they’ve got some questions. What can you tell them? What do you say when you look at the markets, I guess down 460 points right now for the Dow?

WARREN BUFFETT: Well, I’m saying, if you own a farm and you’re worried about selling your farm because you read the newspaper this morning, or you own a perfectly decent business in your town, and you’re worried about selling you -- think you should worry about selling your business today because of -- then you should think about -- worry about thinking about selling stocks. But if you look at stocks as businesses that you own little pieces of, why in the world should you sell it based on headlines of any sort? I mean, if you expect a business-- if you expect a farm to be a good investment over ten years, if you expect an apartment house to be a good investment over ten years, and if you own a marketable security, which is an interest in a business, and you expect that business to be a good business over ten years, it’s nonsense to get feeling good or bad about what stock prices do in a day, unless you have extra money and they go down and then you feel better because you can buy more of them cheaper. Just like if you could buy the farm right next to you cheaper, you’d love that if you were a farmer.

BECKY QUICK: You know, usually that’s an analogy that I understand and agree with, but this time around, a farm in particular, I would be pretty worried if I was a farmer, trying to figure out if I should be planting soybeans or if I think I’m going to be able to make enough money to get things back this time around. Tariffs have hit the farmers particularly hard, and a lot of them have said they’re behind the President, they want to see us get to a better situation, but many of them are also in a position where, look, they’ve already been asked to give a lot. They thought we were about to reach a deal, and they’re hoping that when they’re making decisions for this planting season, they have some clarity.

WARREN BUFFETT: Well, it is true that business generally has improved, markets have improved and everything, and the farmer has not participated in that. So, this has been a very good economy, for a long time I mean, we’ve been coming back for eight or nine years, and businesses kept getting better. Interest rates have been low for business. Stocks have gone up. And the farmer has not participated-- the same way. So maybe I shouldn't have used that example. But they-- if you have a decent business, I mean, you-- you buy into a business. You don't buy a stock that wiggles around, you know? And people understand that. But then they behave as if it's bad news when the business-- the price goes down. If you had a half-interest in a wonderful business and then the person that owned the other half came in, and they were depressed by these headlines today, and they said, ‘I'll sell to you my-- my share of the business a lot cheaper than yesterday because I think this whole thing is going to just end the world," you just say, ‘Hey, I wish you weren't so depressed. But if you're selling it to me cheaper—’ you know, the business is going to be here five years from now and ten years from now. And all headlines-- you don't know what the world's going to look like in three years, or five years, or ten years. What you do know is that the United States is going to grow over time and that businesses are going to generally do well. And if you own decent businesses, you'll make money.

BECKY QUICK: That's a great long-term perspective. But for the shorter term, not just for stock prices, even for companies that are trying to think about their quarterly earnings, or trying to figure out how they're going to be able to pay for some items, or figuring out how the relationship with the supplier is going to work at this point, it could be an impact-- pretty-- that's fairly large in the short to midterm.

WARREN BUFFETT: Well you have to remember, I mean -- our own subsidiaries, obviously, where they thought that tariffs could be increased, they’ve loaded up more on inventory. I mean-- you-- you-- you make business decisions, but you don't make a decision about whether to buy or sell the business if you've got a good business. And you've got to-- if you're going to own a business for ten years, you're going to see a lot of terrible headlines. You know, I bought into my first business in 1942 and you know, they didn’t notice that I did, but just imagine all those headlines at that time. And the world-- you know, the-- the Philippines were falling. I mean, we were losing the war. And-- but the United States is going-- your kids are going to live better than you did. And your grandchildren are going to live better than they do. And generally speaking, productive assets are going to be worth more in this country. And if you own a diversified group of productive assets, you'll do fine as long as you don't read the papers.

BECKY QUICK: Although you did say an hour ago that the sell-off when the Dow was down by about 500 points was not an undue sell-off, was not overdone at that point if we actually get into raising tariffs by 12%--

WARREN BUFFETT: Well, it may be-- it may not be undue. I mean, it-- in the day or the week-- but-- shouldn't-- I don't have the faintest idea how to buy and sell stocks for a day, or a week, or a month. I know how to buy businesses for a long period of time. I'll be wrong on some of them. You won't be wrong on America.

BECKY QUICK: In terms of that, when you look at the markets today, if you see cheaper prices, would that mean that you would buy more of a stock that you might have bought last week?

WARREN BUFFETT: Yeah, some of them will hit levels that-- might have been below. I will always react well do declining prices. That-- that-- if I like-- if I like to buy a business, you know, if I could buy this hotel we're in and they dropped the price, is that good news or bad news for me? I mean, if I like to buy hotels. So, but the fundamental point, and some people get it, some don't, but when you are buying a stock, you're not buying something that wiggles around, or is on a chart, or has a target price, you're buying part of a business. If you're right about the business, you don't pay a crazy price, you could be right about the stock, as long as you don't do dumb things yourself.

BECKY QUICK: Over the weekend though, a lot of questions came up about share buybacks. People were asking specifically about Berkshire. Why don't you buy back more shares of Berkshire, especially when you have $110 billion in cash on hand? What's your answer to that?

WARREN BUFFETT: Well, we want to buy-- we will only buy Berkshire if we think that the shareholder the next day is-- or that same day-- is wealthier after we bought the stock. In other words, we bought it for a shade less or maybe a lot less, but at least a shade less than it's actually worth. And we don't set out to buy any given amount. We set out to buy stock at prices below intrinsic value per share. Now, intrinsic value per share is not something that is precise to the penny or anything. It's probably a band of 10% or something like that. And my partner, Charlie Munger, if you asked us to give you a slip of paper with intrinsic value per share on it, it would not be the same figure. But it'd be close. And we both would-- have a band or something of the sort. If you're buying at below that figure-- you know, if we've each got a dollar you'll sell me and we put it on the table -- and you can't reach for it a while, you say, "Well, I can't reach it. So, I'll sell you my share for 95 cents," I'll give you 95 cents, you know. You know? No dice. So, it's not complicated. Maybe-- it may be beyond my ability to figure out the intrinsic value of certain kinds of businesses. But with Berkshire, I've got a reasonable idea. And I try to give the shareholders the same information that I regard as important in calculating that. Now, it can change. Presumably, you want it to change up and over time because we retain earnings and we should be building more value. But that's the equation. First of all, you have to have the cash you need to run the business. I mean, that's-- Steve Jobs called me one time. I mean, he called me I don't know how many years ago. But-- he was thinking about repurchasing shares. And I said, ‘Steve, there’s just two questions.’ I said, you know, ‘A) Do you have all the business-- all the money that you need to develop the kind of business that you've got in your head for the next five to ten years?’ And, "Oh," he says, ‘We've got plenty of money.’ And then I said, ‘Then the second question is: Is your stock selling for less than it's worth?’ And he said, ‘It's, oh yeah, selling for a lot less than it's worth.’ And I said, ‘Well, you've answered your own question.’ And-- but if we answered, we need-- we need the money we've got here actually before we develop our business. And we've got opportunities to do it. I'd say forget about it, you know? Build the new plants, and do that, and maybe the cash will come in later where you can buy stock. And secondly, if he said the stock isn't really cheap, what's the reason for buying it in?

BECKY QUICK: Did he buy back shares after that?

WARREN BUFFETT: He didn't like buying back shares. He-- I think he was hoping I was going to give him a different answer. He didn't argue with the logic of it. But, I think maybe-- I think he was hoping for a different answer.

BECKY QUICK: It's interesting that you say that because Tim Cook, the current CEO of Apple, was here this weekend. And we got the chance to ask him about share buybacks, too, because share buybacks have been such a big deal for Apple. They've deployed so much cash doing that and just announced last week at the earnings that they'd be buying back an additional $75 billion worth of Apple shares or least they've authorized the repurchase of that much. Again, we sat down with Tim Cook this weekend. And here's what he had to say about that, too. Listen in, Warren.

TIM COOK: This is a funny story a bit, is back in 2012-- I-- I'd been in the CEO spot maybe a year or so. We w-- we had-- a growing-- amount of cash. I think we had just crossed the $100 billion kind of mark if my memory is correct. And I was -- and I was getting lots of input from a lot of different people, as you can guess. And-- when I-- don't have experience in something, I always make a list of the people that I think are the smartest people that I can contact to talk to them and get advice. And, Warren was on the top of the list, as you can imagine. I had never met Warren before. And so. I get his number. I call out in-- to Omaha. And I'm -- I wasn't sure he'd take the call. You know, I'm sort of calling out of the blue. He doesn't know me from Adam. And-- but he took the call, and I had a great conversation with him. And that was the first time that I'd met Warren. And he was very clear to me. I still remember. He said-- he goes, ‘Let me just cut through it. If you believe your stock is undervalued, you should buy your stock.’ And I thought that was just the simplest way of looking at it. So, here's what we do, is we first and foremost take care of our people and we take care of the company and the future of the company. And we've been investing a ton in both this country and some others. We're going to spend $350 billion in the United States in building new sites. And we just announced a new expansion in Austin, and so forth. So, all of that is number one, right? And then if we had money left over, we'd look to see what else we'd do.

BECKY QUICK: Part of what else they'd do, he said, is to make acquisitions. And what I didn't realize is he said they're-- they're making an acquisition every week or two.

WARREN BUFFETT: Yeah, they-- they make a lot of small acquisitions.

BECKY QUICK: He said they've made 20-30 acquisitions over the last six months. Small acquisitions that they don't really talk about and don't tell people things about—

WARREN BUFFETT: Yeah, yeah.

BECKY QUICK: You knew that?

WARREN BUFFETT: If-- if you look at the 10-Q, and-- you know, you can see it. But they-- they-- they-- they make a lot of acquisitions. Yeah. And-- I hope Berkshire makes a lot of acquisitions. And I'd rather buy an attractive business than buy our own stock at its intrinsic business value. If our stock gets well below that, I've still got this strong-- and I could do both fortunately. But-- but why-- how an executive-- can pay-- say we're going to spend $10 billion buying stock and then not pay any attention to the price at which they buy it. They wouldn't buy any other business that way. And-- and so we're price sensitive on it. On the other hand, when the price is right, there’s no easier way to make money for your shareholders.

BECKY QUICK: You say you like Apple buying back shares. So, you think the price is right there.

WARREN BUFFETT: They've done a terrific job of it. They've done a terrific job. They've made their shareholders a lot wealthier because Tim has done that aggressively when the price is right.

BECKY QUICK: What-- I mean, how do you know in hindsight-- do you know in-- how can you tell when a company's doing a bad job repurchasing? You have to be able to figure out how to value the business properly. It's-- it's easier than you're making it sound.

WARREN BUFFETT: Yeah. The t-- the truth is if you look back-- and I was director of the company, but Coca-Cola kept repurchasing their shares at a time when it didn't make sense if you look at it, in the years here. They just-- they had a terrifically good idea of repurchasing when the company only had a market value of-- you know, in the-- in-- less than $10 billion. And-- and they bought a lot of stock. And they were aggressive about it. And-- but-- they fell in love with the idea. And-- and I was-- a director-- at the time. And-- but they're one of many. I mean, you know, same thing happened to Gillette, to a degree. It-- it's interesting. Sometimes it's difficult for CEOs to be objective about their own stock price. And they think the -- they think the higher it sells, the better, you know? And it's a fine way to feel except if you're repurchasing and you purchase at a price that's up to the sky.

BECKY QUICK: When Coca-Cola was buying back shares, and it turned out it was at too high of a price, and you were a director, did you know that at the time?

WARREN BUFFETT: I had a pretty good idea.

BECKY QUICK: Why didn't you say something?

WARREN BUFFETT: Well, I may-- I may have made some comments. But the-- the management had done a sensational job. I mean, that's one of the reasons it got so high. They'd done a terrific job. They made me as ton of money. And-- and-- if you belch too often at the dinner table, you don't get invited to parties anymore.

BECKY QUICK: Which is the difficulty I think with probably any board.

WARREN BUFFETT: It-- it just-- you don't get to be a director if you-- unless maybe you're an activist or something. But, you know, people don't like it if you speak -- and some-- some CEOs like it a whole lot less than others. Some CEOs actually encourage a fair amount of dialogue. And others, you know, make sure that all the important stuff comes at five of 12:00 when you have to leave at 12:00 to catch your plane and the next plane is sitting six hours later.

BECKY QUICK: Huh, that's interesting.

WARREN BUFFETT: Boards are managed in different ways.

BECKY QUICK: Have you known every board you've been on which has been managed well and which has not?

WARREN BUFFETT: Well, some were managed well in some respects and they could be dumb financially. I mean-- you have some-- some managements that really have a money sense. And then you've got others that they're very good managers but-- but they're not good at-- I always love it when I hear a management, you know, and I ask a guy what he's doing with his own money, and he says, ‘Oh, I couldn't possibly, you know, evaluate stocks and everything. I turn that over to somebody else.’ And-- and then he goes out and makes a $5 billion acquisition of something he doesn't really know anything about where he's just buying a whole lot of stock. Some are good at it. Some aren't. That's true of our managers. We have terrific managers. Some of them are good at bolt-on acquisitions, and some of them-- would be terrible.

BECKY QUICK: Do you let the ones who would be terrible at it go ahead and make a bolt-on acquisition?

WARREN BUFFETT: Not very often. Yeah, some of them-- some of them don't have-- they have great operational sense. They don't have a money sense exactly. They-- you know, they-- a lot of -- you talk to a lot of managers, CEOs, and-- they don't want to run their own stock portfolio. Well, those are-- those are decisions and those are capital allocation decisions. And they know a lot-- they know a lot about businesses and they know how to value things. You'd think they'd be good investors, but-- I used-- we had one fellow who was a big partner -- back when I was running a partnership a long, long time ago. And he had stock options in this place. And he would regularly exercise, and take the money, and buy Berkshire. Well, he actually wasn't so dumb, but it wasn't exactly what the options were supposed to incent.

BECKY QUICK: Yeah, but-- but that's unique, to have somebody who understands both operations and the money side of things—

WARREN BUFFETT: Yeah, some-- some-- some really do. And--

BECKY QUICK: I'm thinking—

WARREN BUFFETT: I would-- I would say Tim Cook, for example, does. He has a real grasp-- of-- I mean, he has-- he has a operational mind, and he has a money mind as well.

BECKY QUICK: What about Greg Abel and Ajit Jain?

WARREN BUFFETT: Well, I don't want to get into going through the alphabet on this.

BECKY QUICK: No, I ask it because-- you know, Berkshire's in a unique position. And you have people who are doing all kinds of things. Some who are managing money, some who are managing operations.

WARREN BUFFETT: Yeah.

BECKY QUICK: Can somebody—

WARREN BUFFETT: Well, both of—

BECKY QUICK: --do all of it?

WARREN BUFFETT: --both of those guys have to have extreme m-- money sense. But I don't want to get started going through the list.

BECKY QUICK: Understood. Understood. Can't help but try.

WARREN BUFFETT: Yeah. Well, you got-- you got the answer for the two important ones.

BECKY QUICK: Warren Buffett is our guest. When we come back, we're going to talk a lot more, Joe, about the economy and what he sees after those great jobs numbers that we got on Friday, the-- stronger-than-expected GDP numbers that we've gotten recently, too. We'll talk about what that means, especially with China and all the things we're hearing today.

JOE KERNEN: Great. All right. Thanks, Becky. Coming up, much more from Warren Buffett. Then at the top of the 8:00 hour, a billionaire roundtable right here on Squawk Box. Berkshire Hathaway Vice Chairman Charlie Munger, Microsoft co-founder Bill Gates are going to join Warren. We're not in that roundtable, I guess, are we?

ANDREW ROSS SORKIN: I mean, we don't have the money for it.

JOE KERNEN: What if we--

ANDREW ROSS SORKIN: But hopefully, we might have a question or two.

JOE KERNEN: We'll pool our resources. Maybe still.

ANDREW ROSS SORKIN: Even with a credit cards. Even with a credit cards. If we get a loan. If we get a loan, does that count?

JOE KERNEN: Tap them out. Big hour coming up, only on Squawk Box.

JOE KERNEN: Welcome back to Squawk Box. President Trump tweeting just minutes ago, "The United States has been losing for many years, 600-800 billion dollars a year on trade. With China we lose 500 billion dollars. Sorry, we're not going to be doing that anymore." Take a quick look at the futures: continue to be down, close to 500 points. 471 points -- 472. NASDAQ down 161. S&P down 50. I guess, Becky, if I were to pose a question to Warren, it would just be that those trade deficit numbers you can-- you know, we get bogged down in talking about whether they're good or bad or how to fix them. And it's a symptom of really what-- it's a symptom more than a cause of what happens with China. I'm just wondering, Warren, you've done great over the years with the status quo, with how the United States has approached China and China trade. Berkshire's done great. We've all done great. Everything's fine. Do you wish that Trump hadn't confronted China at all and we just said-- aren't addressing any of these long-term problems with intellectual property or-- you know, take your pick of which issue we're trying to solve. But do you just wish he had left it alone and-- and just let Berkshire-- do its business the way it's been doing? Or do you think there's some rationale to confronting China?

WARREN BUFFETT: China and the United States for the next hundred years, I can tell you two facts about it. They'll be the two superpowers of the world. And we'll always have some tensions with them. And, it can well be about intellectual property. It certainly has over the last, you know, 20 years or thereabouts. Thirty years. And it will be about trade. It will be about policies that they're carrying out, you know, in terms of their neighbors or we're-- there's no way you can have two countries so dominant in the world without them having conflicts. You-- you just don't-- you know, you-- there can be tensions. There can be negotiations. And sometimes we'll both come away thinking we lost. But it's inevitable. So, I-- I-- and how you play the game if you're negotiating with some people that are tough negotiators on the other side-- I mean, it's not-- those are not easy decisions to make. I mean, if you're dealing with a labor union-- nobody really wants to strike. It's bad for both sides. But it's-- sometimes things develop to that point. So, I think-- I think you should get very used to the fact that if you're a young person, you're going to see a lot-- a lot of different tensions over time. And it will depend on the individuals involved. It will depend on the specifics of the situation. But every time we sit down, you know, it won't be like a garden party.

BECKY QUICK: Warren, you-- you mentioned that there are going to be times where both sides walk away and feel like they lose. Are there times that both sides could walk away and feel like they win? Because that's usually the sign of a successful—

WARREN BUFFETT: You want to—

BECKY QUICK: --negotiation.

WARREN BUFFETT: You want both sides to feel like they've won at the end. And, you know, the idea of a negotiation is to take something that you have the other person needs and-- in a sense trade that for something that they have that you need. And, it's-- it's going to be constant. And there's time when it's going to be tense. It's just the nature of things. You have that-- you have that on a much different level when you're n-- when you're negotiating nuclear arms reductions or something of the sort. I mean, we know it's in the interest to get the nuclear stockpiles down and all of that. But that doesn't mean it's easy. And you try to come up with deals that are good for both sides, but that's not always easy.

BECKY QUICK: I mean, I try and think about that in this scenario. And-- it may be particularly differ-- difficult in this scenario because, for a long time we've been dealing with China as if they were still not a superpower, as if they were still-- and so we've been giving them better sides of deals. It's really hard to all of a sudden say, "We're taking some of that back." What-- what do they get out of this deal when we are trying to change a negotiation that we think has been unfair to this—

WARREN BUFFETT: Well, it's difficult for us to accept the fact. And it was difficult for us to accept the fact after World War II that-- that Soviet was a superpower in terms of military power. And they were-- I mean, you know obviously-- there were all kinds of tensions involved in that. And negotiations. And it's still a worry that you have two-- we have the two big nuclear stockpiles in the world. And you worry in terms of mistakes being made. I mean, it-- it-- it's a big game. And with China, it's overwhelmingly an economic game. And it's an economic game we-- game we didn't think we'd be in 40 or 50 years ago. I mean, the Chinese, the rise of their economy has been extraordinary. And they do some things we don't like in connection with that. And, sometimes you have to get tough to make changes. And we do some things they don't like. But it-- but it's a reality now. And it's going to be a bigger reality as the years go buy. And it-- it's very easy for it to become a huge political issue. I mean, it-- so you'll have people fanning the flames for their own pers-- interest in politics or their own interest in-- in business. And it-- it's not easy to navigate. But leadership has-- that's the job of leadership, is to take on the tough problems.

BECKY QUICK: Having said that-- the economy has held up very well in the face of any tensions that we've seen to this point. Jobs report, incredibly strong on Friday. The last GDP report was very strong, too. So--

WARREN BUFFETT: Sure. Yeah. You can't stop America. You can't stop China though either. But you can't stop America. I mean, we're-- we live as a country-- it's extraordinary what we have compared to 30 or 40 years ago. It-- even in agriculture. It makes it tough to make it tough in agriculture because we get more productive all the time. And-- and-- and that-- that-- that tends to depress prices. But this-- this country is going to move forward. I mean, there's no question about that. But China's going to move forward. And the way to try to do it is to do it that maximizes what both countries can do well. And more trade is better. But trade in specific industries can hurt specific industries here. And that-- that's a huge problem that the-- the president-- the heads of both countries have to be the educators in chief. And they have to explain why trade is good for the populace as a whole and it can be terrible for people in certain industries and that a rich country takes care of those people that become road kill in the process of producing a better life for 330 million Americans.

BECKY QUICK: Lots of people on Wall Street are not going to be as sanguine about this news today. I've been reading some reports last night. Goldman Sachs saying that this is-- not only rapidly increases the odds that we don't get a trade pact with China but also increases the odds that you could see Trump announce that he's going to pull out of NAFTA or that he's going to put auto tariffs on European imports. What do you think of that? And what would that mean?

WARREN BUFFETT: It’s the problem of escalation in-- in anything. We had the problem of that with-- with nuclear weapons. I mean the escalation. And it gets more and more dangerous as people become feeling more and more threatened and their own local political situation demands more and more action. I mean, that-- that's the dynamic that you are facing anytime you get to these major problems between countries. And that requires the wisdom of the leaders. But to some extent it requires-- requires the wisdom of the people and how the leaders convey it and how they conduct themselves. But we will have this sort of thing happen. We've had it happen obviously, and it occasionally would turn into wars in the past. We can't do that anymore. In a nuclear world-- you can't get to that point. And-- and any sane person realizes it, but you don't want to -- you don't want to get too close to that tinderbox.

BECKY QUICK: USMCA, also-- better known as "New NAFTA," that deal-- is out there. But now I think Pelosi is saying that they're not going to bring it for a vote at this point. What-- are you in favor of the New NAFTA deal?

WARREN BUFFETT: Well, I was in favor of the original one. I-- we-- we are very, very lucky to have Canada and Mexico bordering us. I mean, it-- and then oceans on the other side. I mean, it geographically is-- a very attractive position compared to how countries are situated around the world. And we've got lots, and lots, and lots of common interests. And, we are the big guy in the game. And as the big guy in the game, we should-- we should do more than our share of making sure that our neighbors are growing and prospering at a rate that's consistent with our-- doesn't mean they're equal but that the-- when we live better, they live better. And trade with Mexico and Canada is enormously important. And-- we should treat them as neighbors and not-- not adversaries.

BECKY QUICK: Warren Buffett is our guest again this morning. The Chairman and CEO of Berkshire Hathaway. We’ve spent the last hour and a half speaking with him. And we've got more to come. When we return, we've got other issues to talk about with Warren. We still haven't gotten to Wells Fargo. And Charlie Munger is here, too. He-- he's here early, so we may put him on set early.

WARREN BUFFETT: Good. Good. Give him the Wells Fargo questions.

BECKY QUICK: Andrew, we'll send it back over to you.

ANDREW ROSS SORKIN: Okay. Thank you, Becky. And thank you, Warren. Coming up, a lot more from Warren Buffett on this morning's market sell-off, which has people concerned. As we head to break, take a look at how concerned folks are right now. The Dow looks like it would open down 452 points. NASDAQ looking to open off about 150 points. And the S&P 500 looking to open down about 47 points. We're back with Becky in Omaha with Warren Buffett in just a moment.

ANDREW ROSS SORKIN: Still to come on Squawk Box this morning, a very big morning. We are counting down to a huge hour. A billionaire’s roundtable. You can't afford to miss it. Berkshire Hathaway Vice Chairman Charlie Munger, Microsoft co-founder Bill Gates, and Warren Buffett all joining Becky Quick live from Omaha fresh off the Berkshire Hathaway Annual Shareholder Meeting. And so much to discuss with them. This morning, the futures are plunging as President Trump threatens new China tariffs. We're going to get their thoughts on trade, the markets, and the state of the global economy. Your European markets right now. We want to show them to you. Squawk Box returns with all that and more in just a moment.

ANDREW ROSS SORKIN: Welcome back to Squawk Box this morning. We are looking at a lot of red arrows, after the news overnight that-- President Trump is threatening to reapply tariffs as the negotiations seem to have stalled. Or, at least, they're now being renegotiated. Take a look at the Dow right now. Looks like we would open off about 452 points. Nasdaq off about 150 points. And the S&P 500 off about 47 points. We'll also show you what's going on in Europe. We're looking at red arrows there across the board with the-- CAC and the-- the FTSE in Italy-- off close 2%. DAX as well. Spain as well. And then, let's also show you what's going on in Asia, because that's getting hit in a very big way. These tweets-- roiling these markets. Shanghai Composite down over 5%. The Shenzhen Composite over-- down over 7%. Then let's also take a quick look at oil right now because WTI crude is trading at $61.56. In the meantime, we want to get back to Becky Quick, who's in Omaha with some very special people who, I imagine, have some opinions on what's going on right now in these markets. Becky.

BECKY QUICK: Andrew, they do. Thank you very much. Again, we are live in Omaha where we've been talking for the last hour and a half plus with Warren Buffett, who's the chairman and CEO of Berkshire Hathaway. Right now, we're joined by Charlie Munger, who's the Vice Chairman of Berkshire Hathaway. He is also the Chairman of the Good Samaritan Hospital in Los Angeles, Chairman of The Daily Journal, and he's on the board at Costco. And, Charlie, thank you very much for being here with us this morning.

CHARLIE MUNGER: Glad to be here.

BECKY QUICK: It's great to see you. We are coming off of the Annual Shareholders Meeting. And-- obviously we're going to talk to you guys about the news of the day. But first, I'd like to take the opportunity, while I have the two of you here together, just to talk a little bit about-- what your partnership has meant to each other. How many years, Warren, have you been partners with Charlie?

WARREN BUFFETT: I met him in 1959. And we instantly became partners in thinking. And then over the years we developed all these financial relationships. But, I knew immediately upon meeting Charlie that we were going to be-- we were in sync. And we've lasted a lot longer than I thought we would, but—

CHARLIE MUNGER: Yeah.

WARREN BUFFETT: But, we have had incredible fun together. We've done all kinds of things. Some have worked. Some haven't worked. And we've never had an argument. We disagree on things sometimes, but we've never -- we've never had an argument. And—he’s never second guessed me. I try not to second guess him. But, it's a great relationship.

BECKY QUICK: Charlie, 60 years. Did you know at that first meeting, that you'd have a partnership with him?

CHARLIE MUNGER: Well, I knew that we were on the same page. But it's been very lucky that our little company became as big as it did and that we've had the run we've had.

BECKY QUICK: What's it like—

CHARLIE MUNGER: I think we're very talented and all that. But we've also had a tailwind of good luck.

BECKY QUICK: What's it like in terms of-- how-- how you all kind of use each other as sounding boards? How does that work?

CHARLIE MUNGER: Well, I think it-- if two people collaborate in their own way, they're better off. Einstein would not have been able to do what he did if he didn't have various people to talk to.

WARREN BUFFETT: It's more fun, too.

CHARLIE MUNGER: Yeah.

WARREN BUFFETT: The ideas are better net, but it's also more fun. And when we disagree, Charlie says, "Well, you'll end up agreeing with me because you're smart and I'm right." Very simple. And he is right. That's the hell of it.

CHARLIE MUNGER: Not always.

BECKY QUICK: You're both pretty-- you both act pretty unilaterally though. You both kind of do your own things and then come each other after the fact a lot of time.

WARREN BUFFETT: Sure. Sure. He knows what I'm thinking. I know what he's thinking. And neither one of us would ever do anything we really felt the other was opposed to. We might-- we might feel we have a little selling to do. But we are in sync.

BECKY QUICK: Well, let's about a deal you did recently. Occidental.

WARREN BUFFETT: Right.

BECKY QUICK: Where you agreed to back them up. You cut that deal, and then you called Charlie. But you knew what he was thinking already?

WARREN BUFFETT: I didn’t want to wake him up. I didn’t want to wake him up. He’s -- I’m Pacific Coast Time. I thought it would be very unfair if I –

CHARLIE MUNGER: Warren knew I’d be for that deal.

WARREN BUFFETT: Sure. I knew it.

BECKY QUICK: How did you know that? How do you know so much about each other and how you think?

CHARLIE MUNGER: Well, Occidental’s in my part of the world, and of course, I’ve followed to some extent the developments that are interesting.

BECKY QUICK: And what do you think of the Occidental deal? Why do you like it?

CHARLIE MUNGER: I like it.

BECKY QUICK: Why?

CHARLIE MUNGER: I think it’s got potential.

BECKY QUICK: Because?

CHARLIE MUNGER: Well, because I think that Occidental is right to want to do it.

BECKY QUICK: To buy into the Permian Basin, to get more assets?

CHARLIE MUNGER: Absolutely.

BECKY QUICK: And what is it about the Permian Basin that you like?

CHARLIE MUNGER: it’s got a lot of oil in it, and gas. I don’t like a desert just for its own sake.

BECKY QUICK: I asked Warren this earlier today -- if it’s such a great deal, the Permian Basin is such a great deal, why didn’t you just buy Anadarko?

CHARLIE MUNGER: Nobody asked us to.

WARREN BUFFETT: Yeah. Well, and that may sound strange, but who knows if they’d come to us. We knew -- we do usually wait until people come to us. So, it isn’t like we -- if we wanted to buy in the field, we necessarily then, you know, would start dialing and flying around and everything that –

CHARLIE MUNGER: Occidental knows a lot about the Basin, and we don’t. Of course, we like having somebody with us that knows something about it.

WARREN BUFFETT: Yeah, when we were at Solomon, we had something called Anglo American that some promotional --

CHARLIE MUNGER: Anglo Persian.

WARREN BUFFETT: What?

CHARLIE MUNGER: Isn’t it Anglo Persian?

WARREN BUFFETT: Something like that. Anyway –

CHARLIE MUNGER: Yeah, Anglo-British or something. Whatever it was, it was neither.

WARREN BUFFETT: It was neither. Yeah. Anglo Swiss, actually.

CHARLIE MUNGER: Anglo Swiss. That was it.

WARREN BUFFETT: They came to the directors and had a big plan for drilling in Russia and we were going to put up a lot of money and send it to Siberia and hope that we got oil back. And Charlie said, you ‘You know, who’s Anglo and –

CHARLIE MUNGER: Who’s Swiss?