The bitcoin price rallied over the weekend, climbing to its highest level in months. In fact, the cryptocurrency has just about doubled since the beginning of the year, and some analysts see nowhere else to go but up. The bitcoin price neared $7,600 on Sunday and continued to climb Monday after a very brief pullback.

Pattern recognition for the bitcoin price

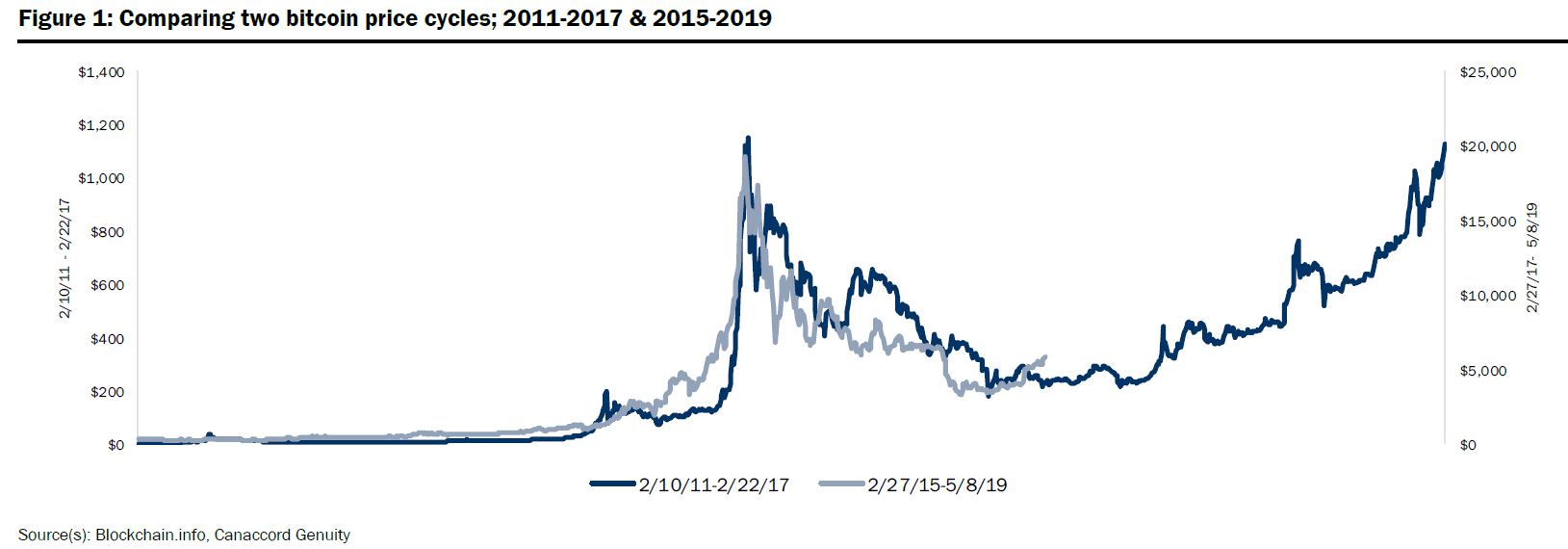

In a note late last week, Canaccord Genuity analyst Michael Graham compared the cryptocurrency‘s recent price action to movements from several years ago. He separated bitcoin’s price history into two sections: 2011-2015 and 2015-2019. Although the comparison between the recent price action and price movements from several years ago have little fundamental basis, he has noticed that the cryptocurrency appears to operate on four-year price cycles. This is in line with the mining reward from bitcoin, which is cut in half about once every four years.

Q1 hedge fund letters, conference, scoops etc

Graham had predicted that this spring would bring a bottom for the bitcoin price, and that appears to have happened, although he believes the recovery could be a bit ahead of itself. He adds that if bitcoin continues following the same trend it did in the previous four-year window, it implies "a slow climb back toward its all-time high of ~$20,000, theoretically reaching that level in March 2021.

Cryptocurrency catalysts

The Canaccord analyst does see a few reasons for the latest bitcoin price rally which go beyond the pattern he identified. One catalyst most enthusiasts have also mentioned has been Fidelity's ongoing push into cryptocurrency space. The firm launched its Fidelity Digital Assets in October, followed by a custody service earlier this year.

Now we're been hearing reports that the firm is planning to launch a digital asset trading business for institutional investors in the coming weeks. Fidelity released a survey of institutional investors it conducted recently, which indicated that 40% say they're open to owning digital assets in the next five years.

Graham also cited Grayscale's "Drop Gold" ad campaign as another potential catalyst for the bitcoin price. The ads target investors who are also digital natives and might prefer bitcoin instead of gold. He also pointed out that Facebook, Nike and other big brands have also been launching their own crypto initiatives. Thus far, he believes bitcoin is "so far one of the best-performing assets of 2019."

Watching the whales

According to Forbes, data from Whale Alert suggests a number of major bitcoin holders, sometimes referred to as whales, sold large numbers of bitcoin over the weekend. Whale Alert tracks significant moves in cryptocurrency prices, and it estimates that the largest whale moved 47,000 bitcoins worth $343 million over the weekend. The data suggests bitcoin whales traded approximately 100,000 bitcoins worth about $670 million over the weekend.

Most of the moves have been shifting cryptocurrency out of major exchanges rather than into them. We have to wonder whether these whale movements had anything to do with the recent hack of Binance, which announced plans to reopen withdrawals and deposits on Tuesday.

Signs of recovery in the bitcoin market

Graham also looked at a number of other metrics to show how the bitcoin market in general has recovered. In May so far the average daily estimated transaction value for bitcoin is up to $801 million. That's a significant increase from April's $743 million and March's $521 million. May's month-to-date reading is the highest number since November.

The number of confirmed transactions per day has also risen to 387,000 this month to date, an increase form April's 366,000 per day. The recent lows were observed in March 2018 at 185,000 transactions per day.

This article first appeared on ValueWalk Premium