The number of U.S.-based oil and gas companies publicly subjected to activist demands by dedicated activists could be on course for a record high in 2019 if the current pace keeps up.

Dedicated activists (those with a primary or partial focus on activist investing) have publicly targeted 11 U.S.-based oil and gas companies so far in 2019, a record at this point in the year and two-thirds of the way to a new high.

Q1 hedge fund letters, conference, scoops etc

Although the last six years have seen relatively stable levels of activity from dedicated activists, the number of companies publicly subjected to activist demands is up from seven at this point last year and the previous high of nine year-to-date in 2014, before the oil price crash.

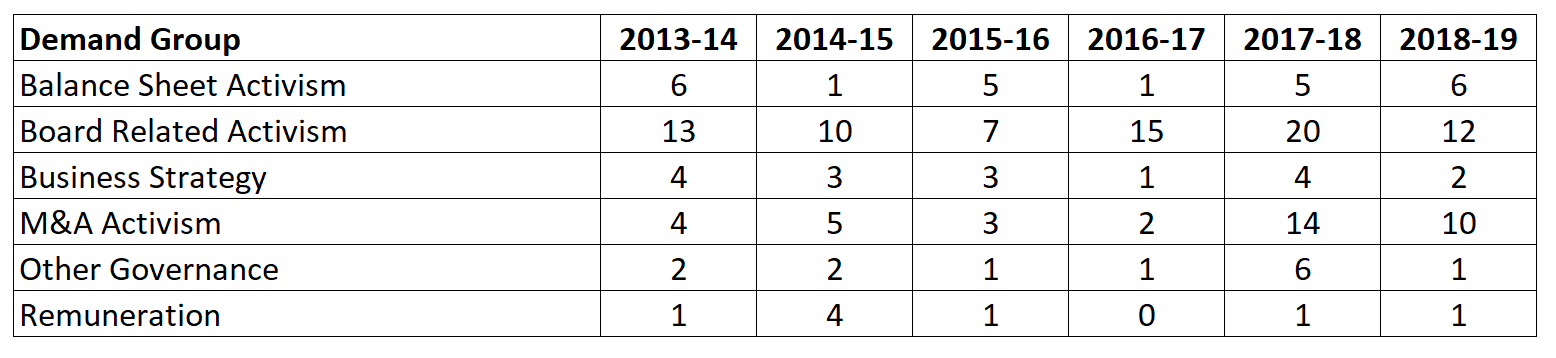

U.S. oil and gas companies publicly subjected to activist demands by activist focus

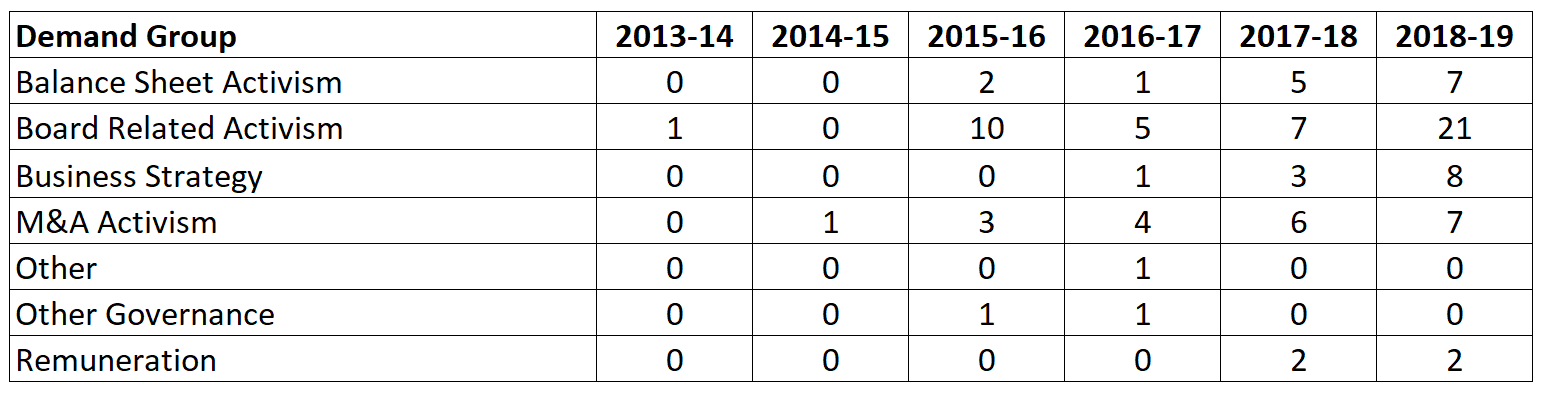

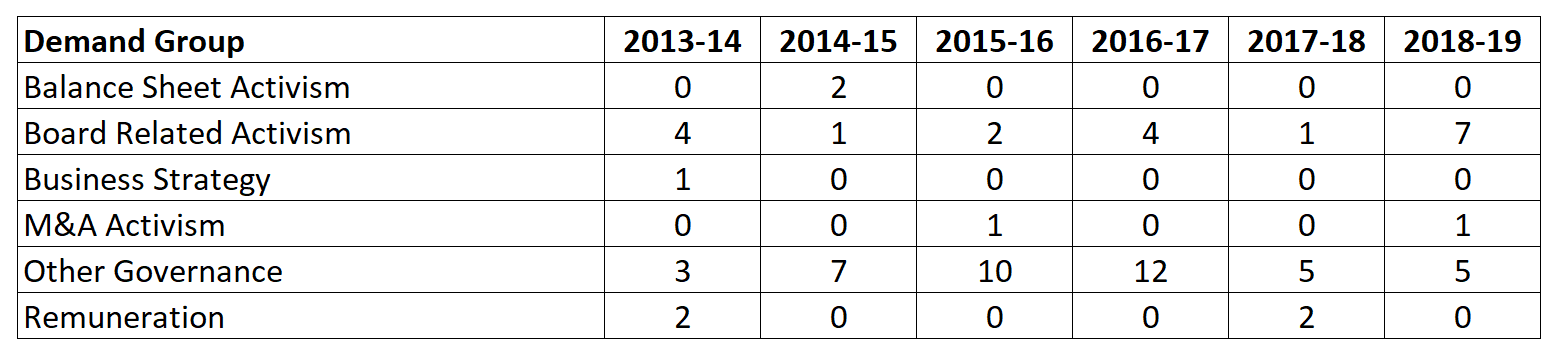

Note: Year-to-date is as of May 13, overlap between companies publicly subjected to demands in each activist focus level groups may mean the total number of companies subjected to demands is less than the sum of each column in the tables above and below.

Activist Insight Online data show theses for dedicated activists in U.S. oil and gas may be driven more by M&A than other investors. In the 12 months ending May 13, dedicated activists made ten public M&A-related demands (31% of the total), the second highest after board-related (38%). Occasional and concerned shareholders made more public demands related to board composition (48%) and business strategy (18%) than M&A, which was joint-third with balance sheet activism (16%).

Engagement activists focused on board composition and governance. T. Rowe Price’s opposition to Occidental Petroleum’s purchase of Anadarko Petroleum marked the first M&A-related public demand in the sector on record by an institutional investor in Activist Insight’s engagement category (one previous demand in the category in 2015-16 was by an individual filing a shareholder proposal at ExxonMobil).

In the past three months, Lion Point Capital, SailingStone Capital Partners, and Fir Tree Partners have pushed U.S. energy companies to sell themselves, while PDC Energy and EQT are facing two of the year’s biggest proxy fights

Public demands made at U.S. oil and gas companies by primary and partial focus activists by demand group in the 12 months ending May 13*

Public demands made at U.S. oil and gas companies by occasional and concerned shareholder focus activists by demand group in the 12 months ending May 13*

Public demands made at U.S. oil and gas companies by engagement focus activists by demand group in the 12 months ending May 13*

Notes

Primary focus activists are defined by Activist Insight as investors who proactively and systematically identify and target underperforming companies, attempting to enhance shareholder value through the execution of shareholder activism, and for whom activist investments typically form a significant majority of their investment portfolios. Primary focus activists are typically but not exclusively hedge funds.

Partial focus activists also proactively and systematically target underperforming companies as part of an established activist investment strategy. However, they differ from primary focus activists in that activist investments will tend to comprise only a portion of their investment portfolios alongside assets acquired through the employment of other investment strategies.

Occasional focus activists are defined by Activist Insight as those investors for whom activist investing does not typically comprise a frequently-used strategy within their broader investment philosophies. Rather than proactively targeting underperforming companies with the goal of improving shareholder value, these otherwise typically passive shareholders often react instead with demands for change to the underperformance of portfolio companies, in a bid to protect their existing investments.

Engagement focus activists are those investors that have escalated their otherwise typical investment stewardship responsibilities in order to protect and enhance shareholder value. These activists will adopt or otherwise publicly support activist strategies with the objective of achieving or maintaining for their portfolio companies best-in-class ESG characteristics. Engagement focus activists are typically but not exclusively mutual fund managers who often operate through the submission of shareholder proposals.

Concerned shareholders are defined by Activist Insight as individual shareholders, or groups of shareholders, who attempt to enforce change typically at a single company in response to poor performance or other grievances. Typically, these one-off situations are advanced by former directors or management, or related parties.

About Activist Insight

Since 2012, Activist Insight has provided its diverse range of clients with the most comprehensive information on activist investing worldwide. Regularly quoted in the financial press, Activist Insight is the trusted source for data in this evolving space. Activist Insight offers five industry-leading products: Activist Insight Online, Activist Insight Governance, Activist Insight Vulnerability – a tool for identifying potential activist targets – Activist Insight Shorts, and Activist Insight Monthly – the world's only magazine dedicated to activist investing.