DoubleLine International Fixed Income webcast for the month of April 2019, hosted by portfolio managers Su Fei Koo and Valerie Ho.

TAB I – Macro Outlook

International Fixed Income

Global Macro Drivers

- Global growth uncertainty

- More accommodative Central Banks

- China growth deceleration

- Brexit

Q1 hedge fund letters, conference, scoops etc

International Fixed Income

Falling Global Growth Expectations

Source: International Monetary Fund (IMF), DoubleLine

International Fixed Income

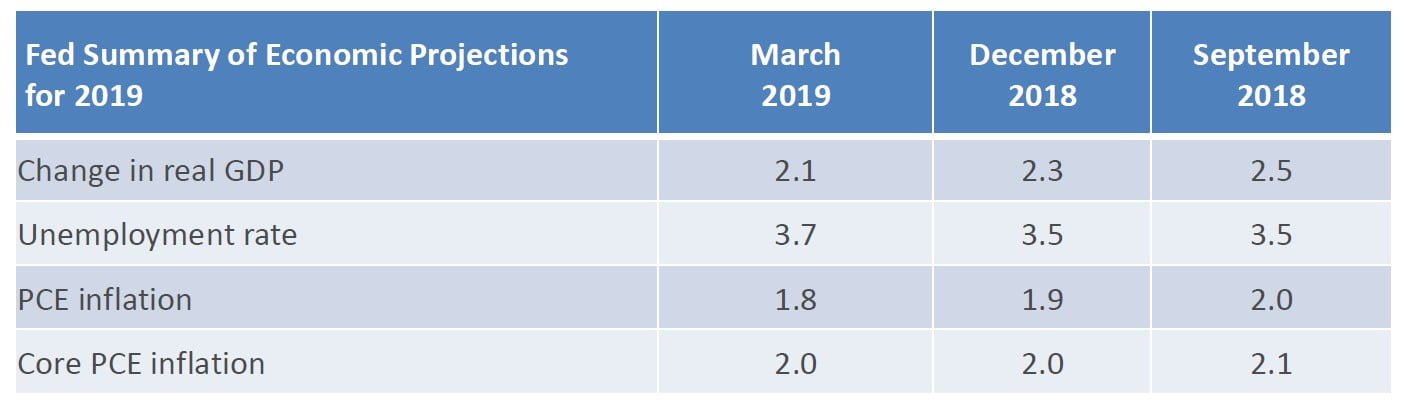

Federal Reserve’s Summary of Economic Projections

Source: Bloomberg, DoubleLine

GDP - Gross Domestic Product, PCE - Personal Consumption Expenditure

International Fixed Income

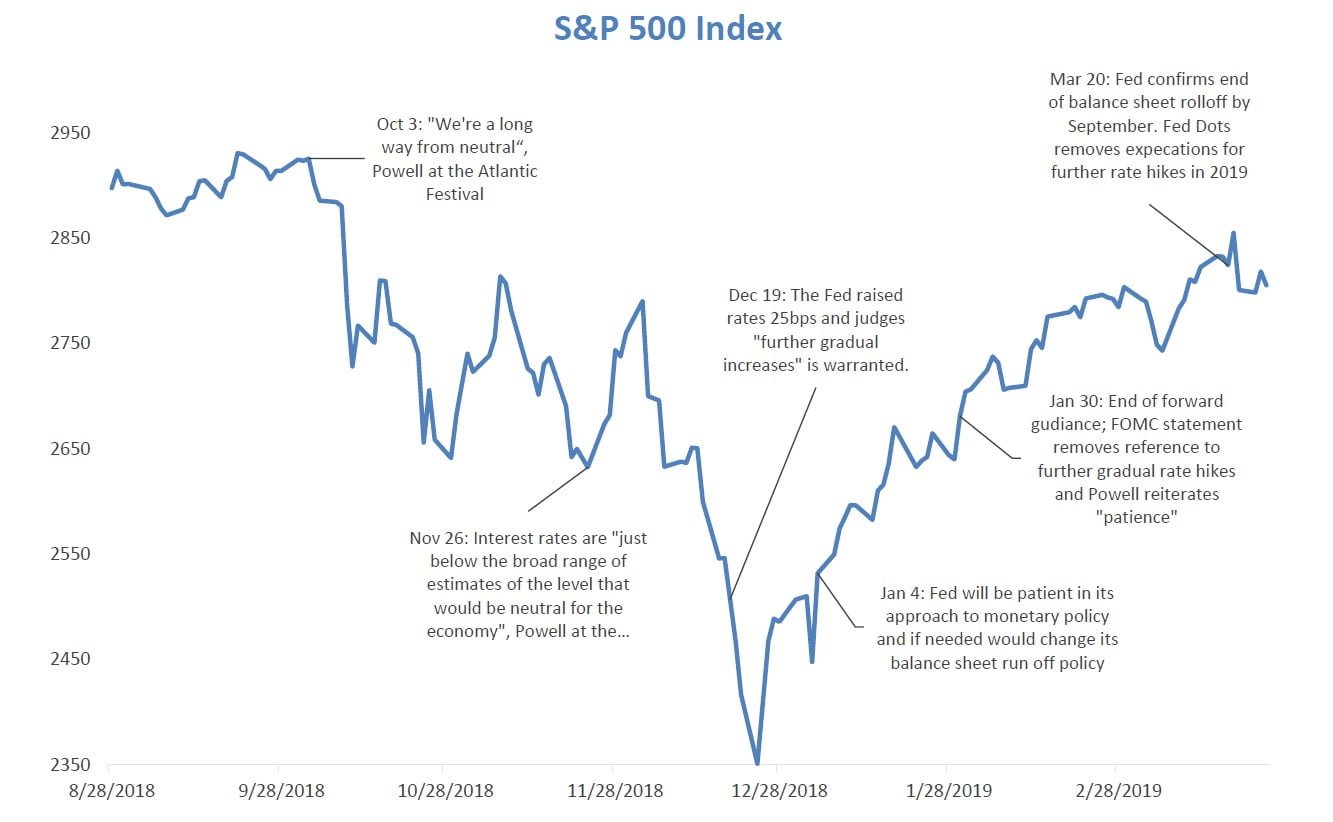

Changing Fed Communication

Source: Bloomberg, DoubleLine

International Fixed Income

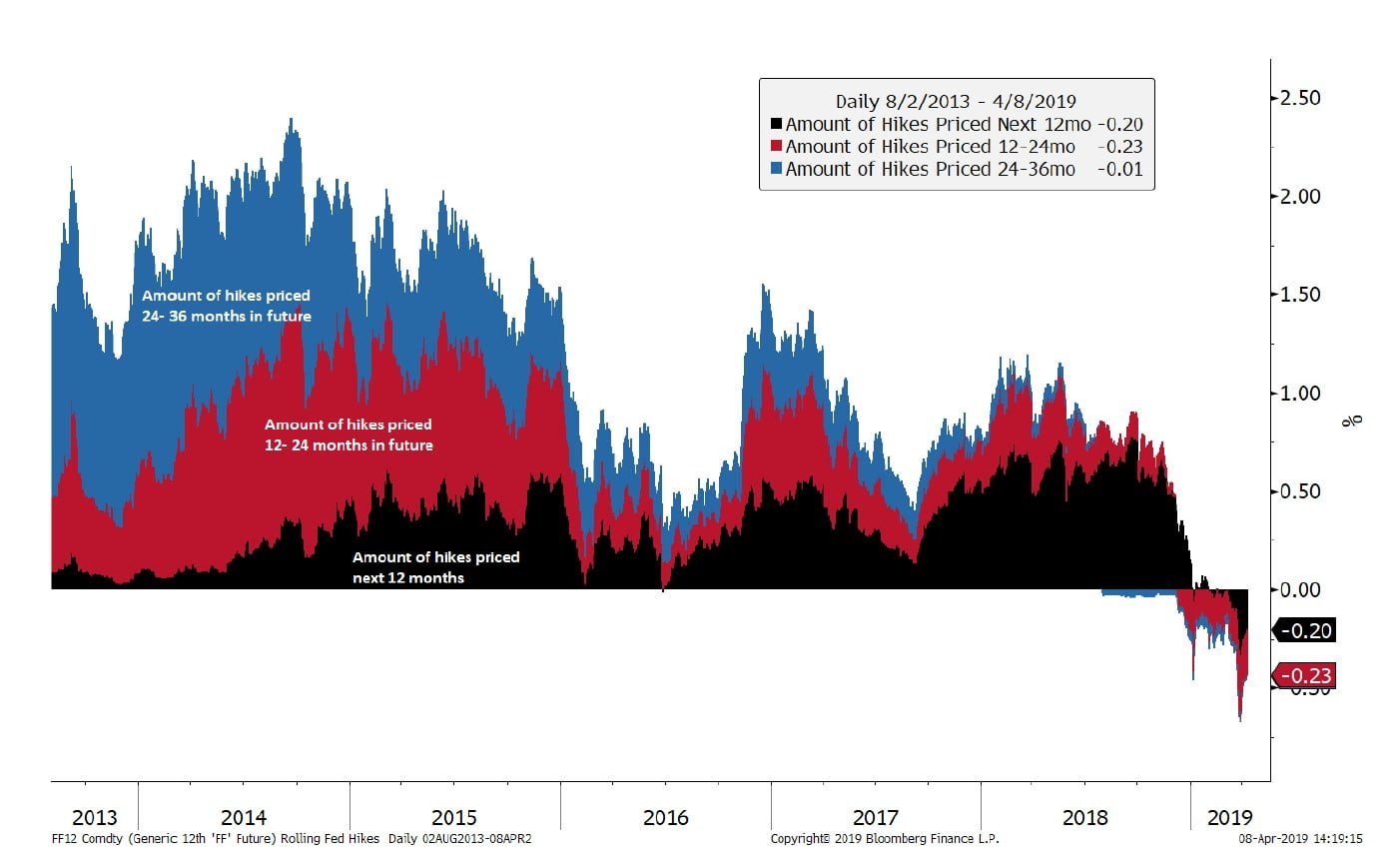

Hikes Implied by Fed Fund Futures

Source: Bloomberg, DoubleLine

International Fixed Income

More Accommodative Central Banks

Developed Market Central Banks Have Turned More Accommodative

ECB - Extended forward guidance stating that interest rates are expected to remain at their present levels at least through the end of 2019, slashed its growth forecast for 2019 to 1.1% from a prior 1.7% estimate, and offered a 2 year liquidity injection for banks through a TLTRO-III.

BoJ - Committed to Yield Curve Control and is unlikely to change its policy course until after the planned October consumption tax hike

BoE - On hold and watching for Brexit risks

BoC - Softened its hiking bias, highlighting a sharper than anticipated slowdown in the 4th quarter. The outlook continues to warrant a policy rate that is below the neutral range, dropping previous guidance that the interest rate would need to rise over time.

RBNZ - Took a dovish turn and stated the more likely direction of the next OCR move is down vs the previous February statement where the bank introduced symmetric forward guidance.

RBA - Turned more dovish, seeing downside risks to the global economy amid trade uncertainty and balancing a weak housing market with a strong labor market.

International Fixed Income

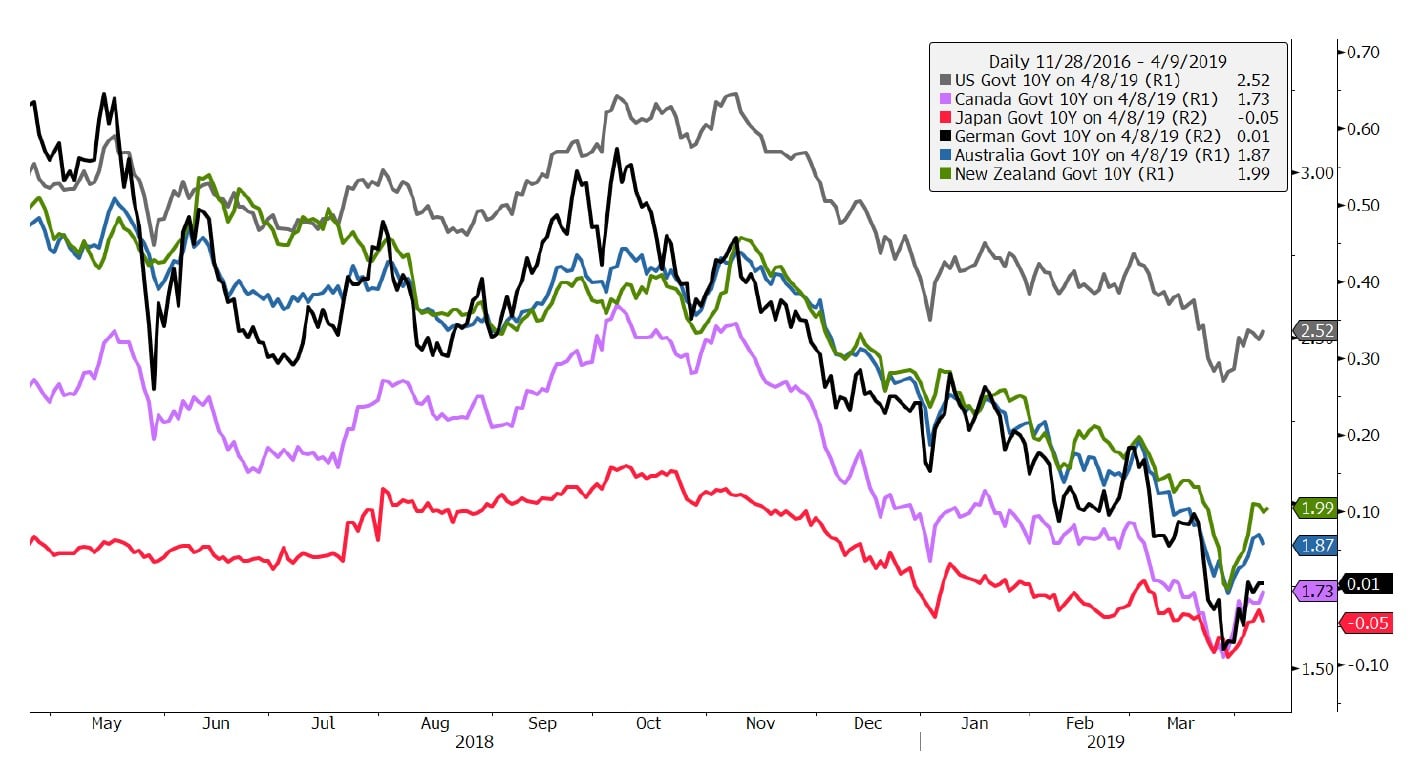

Falling G10 Rates

Source: Bloomberg, DoubleLine

International Fixed Income

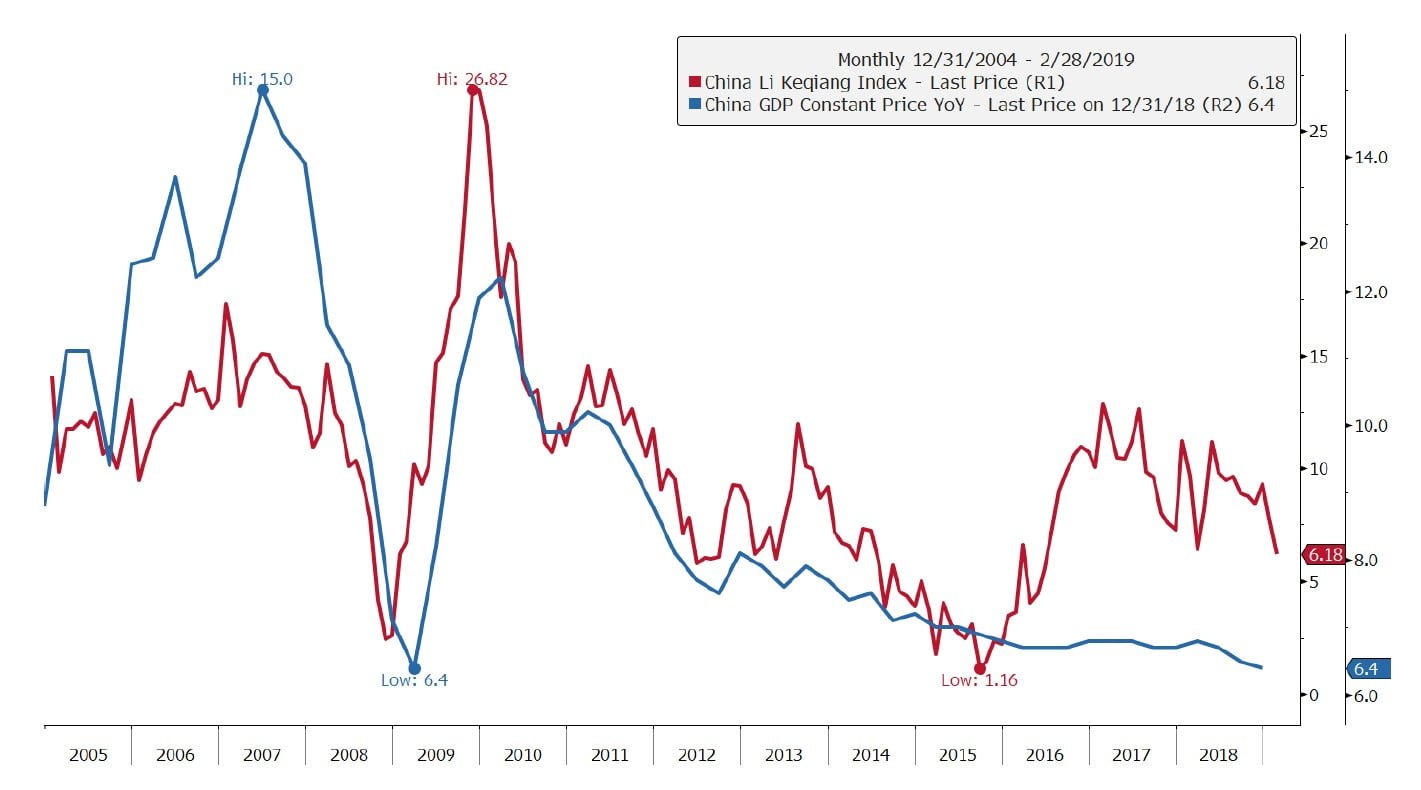

China Economic Activity Slowing

Source: DoubleLine, Bloomberg

China Li Keqiang Index consists of the change in bank lending, rail freight and electricity consumption; China GDP annual percentage change; Eurozone Real GDP year-over-year: Gross domestic product (GDP) measures the final market value of all goods and services produced within a country. It is the most frequently used indicator of economic activity. The GDP by expenditure approach measures total final expenditures (at purchasers' prices), including exports less imports.

See the full slides below.