Black Cypress Capital Management’s letter to investors for the first quarter ended March 2019, titled, “Sometimes Discipline Is Quickly Rewarded.”

Letter Highlights

- Black Cypress’s long-only strategy returned over 18% in the first quarter

- Investor panic in Q4 2018 allowed us to buy a few high growth businesses at value prices

- We think our portfolio is valued to deliver a mid-teen (per year) return over the next few years

Q4 hedge fund letters, conference, scoops etc

Our long-only equity strategy returned over 18% in the first quarter of 2019.

During the market turmoil in mid-December, we emailed you, noting, “we’ve added new companies, materially raising our portfolio’s long-term return potential. The positive spread between our expected return and the broad stock market’s hasn’t been wider, and that gives us great confidence in our positioning…we think now is a time to put new money to work, not batten down the hatches.”

Our discipline and new commitments made during last year’s drawdown were rewarded this quarter. Last year’s large market decline allowed us to buy new positions in businesses trading at a significant discount to their intrinsic worth. One of these companies is growing its topline at more than 20% per year and has a decade-long runway of double-digit growth opportunities via store expansion, and yet we were able to pay less than 15x 2021 earnings and half our estimate of the value of the business. Another new position traded for less than 13x (ex-cash) our 2021 estimates and was 40% below our valuation of the business, even though it’s likely to grow its topline 14% per year for the next several years. Investor panic in Q4 2018 allowed us to buy these high growth companies at value prices. And we were pleased that these two new positions were among our best performers in the first quarter of 2019.

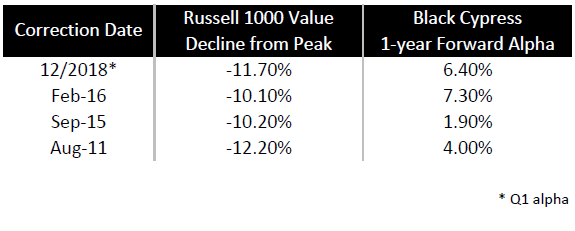

We welcome large drawdowns, as we strive to use them to our long-term benefit, and our historical record doing so has been good. We wish there had been a lot more volatility during this bull market!

Table 1: Drawdowns and Black Cypress’s 1-Year Forward Alpha

Source: Russell; Black Cypress Capital Management

Our positions in financials were our worst performing positions in Q1 2019. However, our conviction continues to run deep. Our bank holdings are extremely well-capitalized, offer multiple avenues for long-term growth, have strong sustainable competitive advantages, and most importantly, currently trade for less than 9x forward normalized earnings. We think it is highly likely that these positions will deliver an excess of 15% per year over the next few years. Plus, we view the downside risk of these holdings over the medium term as negligible. While our positions in large banks may not be our best performers in the years ahead, we do think they remain a relatively low risk way to achieve double-digit returns.

In aggregate, we continue to view our portfolio as valued to generate average annual returns in the mid-teens over the next several years. This is in stark contrast with broad stock market indices, which appear priced to return a mid-to-high single digit figure at best.

Today, over 80% of our portfolio is invested in 13 companies. We are now finding excellent value in industrial, energy, and financial companies, the traditional bastions of “value” that have been largely ignored over the last couple of years. Investor neglect has left these businesses priced in such a way that handsome returns should follow even if business operating performance is middling.

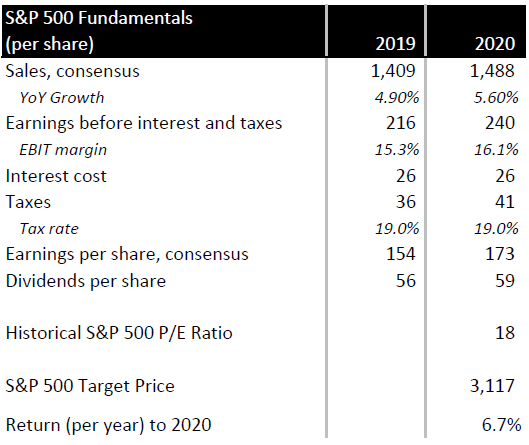

Broad stocks markets like the S&P 500, on the other hand, are priced for perfection. Consensus forward earnings estimates sneakily assume a march to peak profitability.

S&P 500 consensus estimates for 2020 have pre-tax, pre-interest margins rising above 16%, something that has only occurred a handful of quarters over the last 20 years, and only at the heights of the last two bubbles. And even if margins do make their way up above 16% (for math wonks, that’s +2 standard deviations above the mean which occurs less than 5% of the time), it’ll take an above average multiple to generate returns north of 7% per year.

Table 2: S&P 500 Consensus Estimates Imply Peak Margins

Source: S&P; Black Cypress Capital Management

Based on the S&P 500’s current valuation, peak profitability must materialize, or investors will soon discover their “cheap,” “fair,” “average” forward valuation metrics are based on overenthusiastic margins, or at the very least likely fleeting ones.

Not only is our small collection of carefully chosen businesses a key differentiator, but even the underlying valuation dynamics favors our positioning.

Thank you for your continued trust.

Alan R. Hartley, CFA