Car insurance is calculated by these four categories:

- What you drive: how old your car is, how many miles it has

- How you drive: if you have any violations or accidents

- Who you are: your age, gender, marital status, credit score

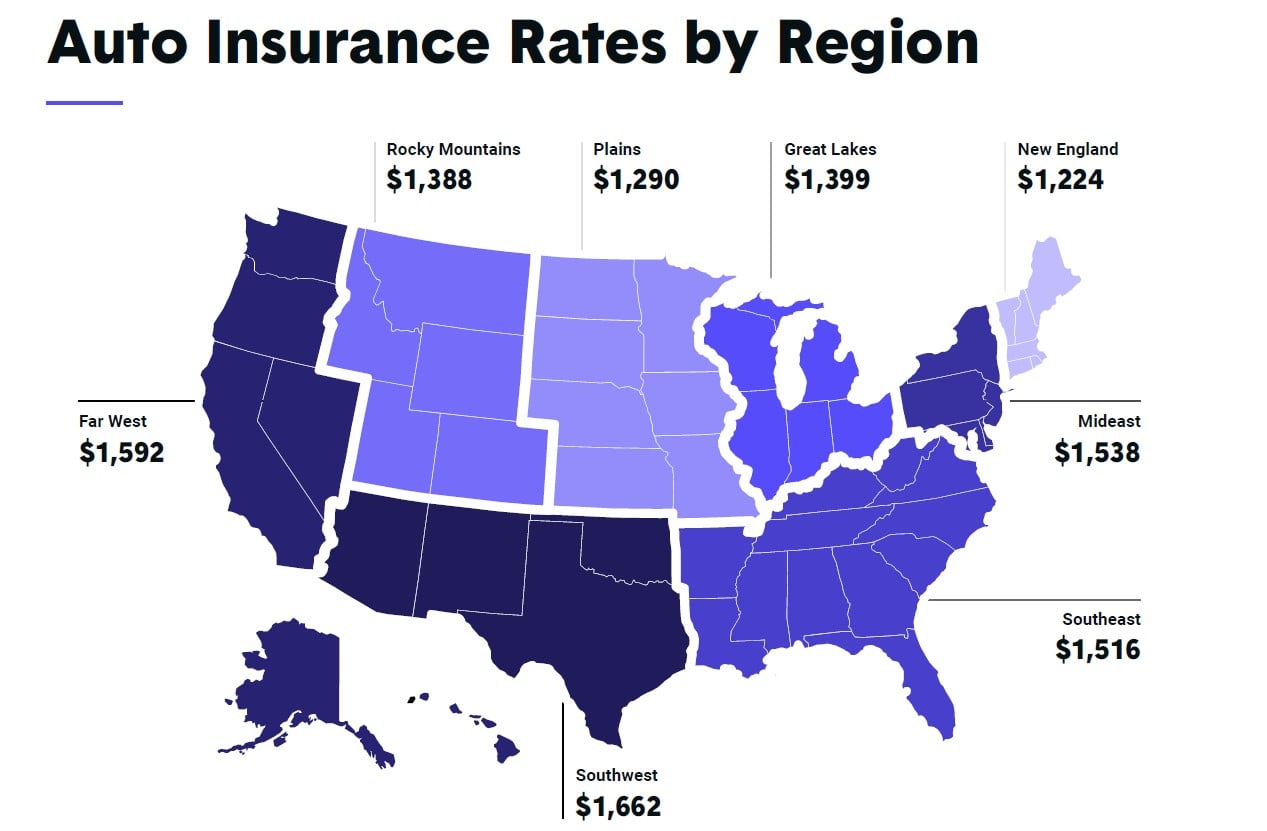

- Where you are: car insurance changes ZIP code by ZIP code

Q4 hedge fund letters, conference, scoops etc

Cities where insurance is higher are areas where there is more risk. When anyone files a car insurance claim, they’re taking from the “pot” of insurance. The more people that take from the pot, the more rates will go up to fill the pot back up.

Rates are high in Michigan cities since there is an enormous rate of uninsured drivers and legislation issues making insurance there very expensive. Rates are expensive in more congested cities since there are more people on the roads leading to more accidents. Rates are expensive in areas prone to bad weather like hurricanes or hail, as these events lead to an increase in claims. Each city has their own unique mix of risk (weather, crime, congestion, legislation) that affects its prices. What all drivers can do to save is make sure they always have insurance with no lapses in coverage, and that they shop around ever 6 – 12 months since insurance prices are always changing.