Lukasz Tomicki, the founder of Austin, TX-based LRT Capital, had a life-changing moment after he achieved a degree of success. This led him into the hedge fund business where his emerging strategy has outperformed the major stock and hedge fund indices, he told ValueWalk. How the fund outperforms “the markets” speaks to recognizing a long term trend in growing a “moat” and his nimble size.

Tomicki, born in Warsaw, Poland, immigrated to the US as a child, attending high school in Missouri. It was here his entrepreneurial spirit and eye for opportunity was on display started a software company, LobbyAssist, that tracked legislation and campaign finance at the state level. He and his high school buddy partner teamed up with a Midwest lobbyist, patented the process, and scaled the software to cover 50 states in four years. He sold the business in 2010, “at a time before the SAAS (software as a service) business model was popular,” he told ValueWalk, then quipping in true hedge fund fashion: “I should have waited until it became more popular and those companies were selling at 8X revenue.”

Q4 hedge fund letters, conference, scoops etc

After earning enough money to live comfortably the rest of his life, Tomicki traveled the world, then came back to the US where he earned an MBA at Washington University as he began exploring different investing and trading strategies. In college, he experimented with every strategy he could find, including long / short, options, currency and futures trading. Looking back on his life, this was the point the lightbulb went off as he was trying to figure out his next move.

He was significantly influenced by the George Soros book "Alchemy of Finance" and found a particular section that addresses the role of expectations at setting prices fascinating. The insight that expectations move faster than fundamentals explains why stock prices can move so far and fast, and he formed an investment execution strategy largely based on this and other insight on competitive advantage he saw.

In 2012 he launched the fund with 1/3 of the money his own and the balance from his partners at LobbyAssist. The fund doubled its assets under management in 2018 but still falls under the SEC’s exempt manager program for firms with under $25 million under management, which gives him a perceived advantage. “A plethora of research has long shown small hedge fund managers outperform their large counterparts over the long term,” the fund’s website explains.

Tying in both the Soros book and his experience at building a business with a competitive advantage, this led to his love for a value-based investing strategy that is forward-looking based on expectations around a company’s “moat.”

“I really like thinking about businesses more than I like working in them,” he mused, pointing to a love for financial metrics and an eye for a business with a growing competitive advantage.

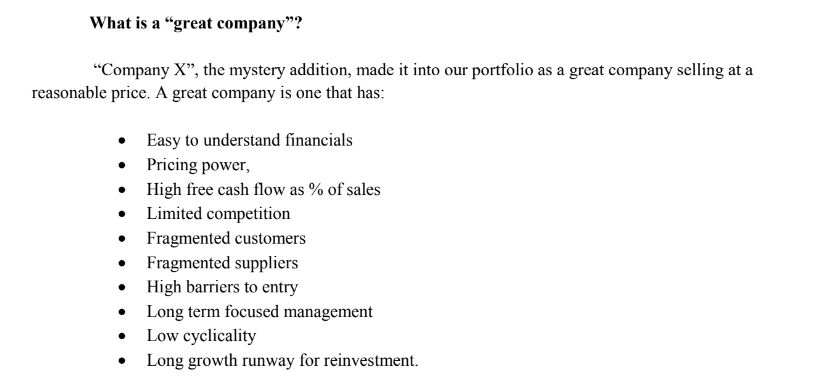

He started to search for companies that had a competitive moat, but importantly one that was growing. A company that has an established moat has that priced into the stock – but a growing moat is where expectations and the stock price rise rapidly. Today he looks at the stock of Apple Computer, for instance, and says that firm’s moat has played out, its innovation cycle is likely to start to slow.

One company he likes is one that few have heard of, Watsco, one of the world’s leading distributor of air conditioning, heating and refrigeration equipment and supplies. The company is not as well-known or “sexy” as Apple – one wouldn’t mention the stock at a party, for instance – and that’s the point. “There is no automated or quantitative process that would lead a person to find Watsco,” he wrote in a letter to investors titled “The vision to see moats.” He said it was the long=term company and industry dynamics that led him to this stock, one of only 25 he keeps in a low turnover, concentrated portfolio.

While he doesn’t think quantitative, computer-driven investing is, by itself, the answer, he relies on quantitative analysis to determine the portfolio composition, while his qualitative mind envisions how a company’s moat will grow over the long term. When the stock price moves and his strategy is rewarded is the point where market expectations see the moat and growth potential. His goal is to get into the stock before that happens.

This article first appeared on ValueWalk Premium