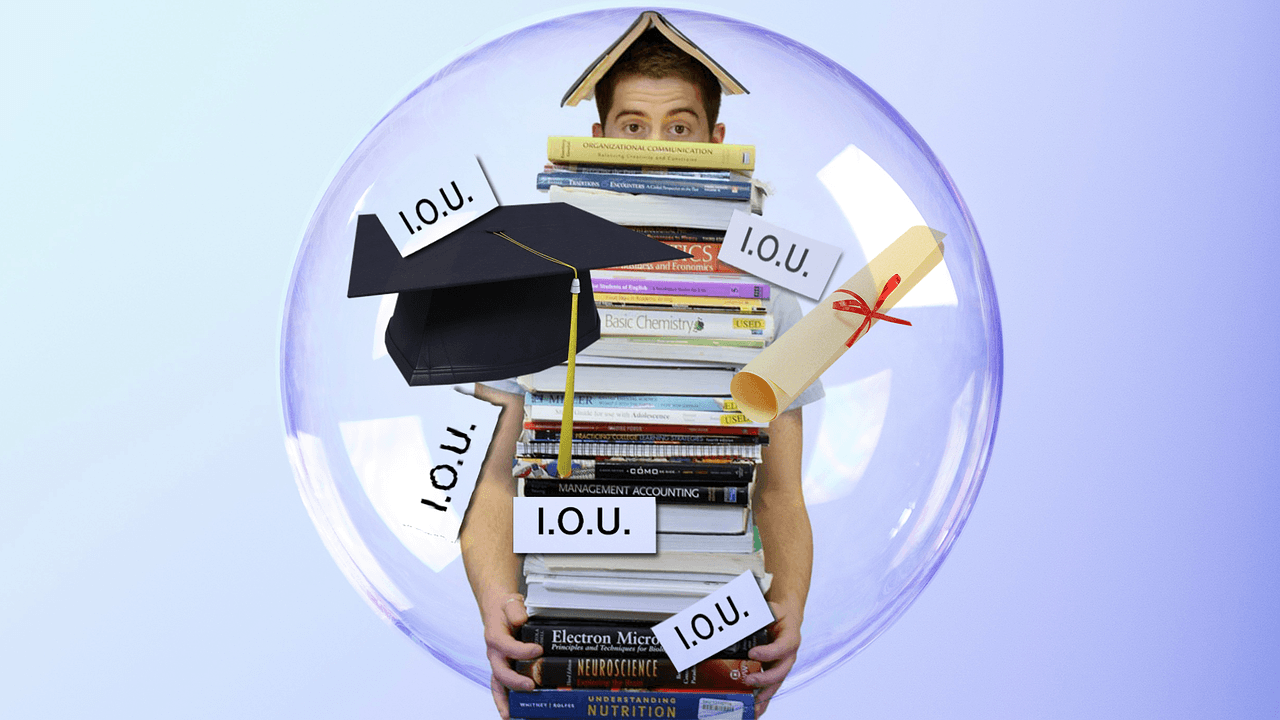

You’ve surely seen the news headlines about student debt in the United States; it’s surpassed the cost of the Iraq War. It’s on track to overtake mortgage debt, and it’s been dubbed a generational catastrophe.

Yet, for students who are about to enter college or who are currently in college, it’s possible to break the cycle of student debt by making strides to reduce the cost of attending college.

Below are the top five strategies you can use to decrease your college debt.

Q3 hedge fund letters, conference, scoops etc

1. Choose a Cheaper College

Because college is an experience that can establish friendships, launch businesses, and start your career path, it’s hard to make a practical decision about which college to attend. However, making an aspirational decision about college could double or triple your tuition costs, causing you to take on significantly more debt than necessary.

On average, the cheapest four-year colleges are in-state public schools, which during the 2018-2019 school year cost $9,716. The most expensive schools are private colleges, which cost $35,676 annually.

When selecting which college to attend, don’t assume that the most expensive college will provide the best education. An analysis of colleges with the best value that incorporates education quality, graduation rates, and post-graduate earnings, showed that many public colleges provide good value while also being low in cost, including several University of California campuses, University of Florida, University of Virginia, and more.

2. Score Big on Financial Aid Packages

For many, the true cost of college isn’t the straight tuition rate. Instead, it’s a matrix of financial aid packages that can include Pell grants, scholarships, tuition assistance programs, and work-study programs.

To assess the true cost of attendance, calculate tuition against each aid packages and cost of living.

Financial aid starts with your FAFSA application. That may seem obvious, but in 2017, 36 percent of high school grads didn’t fill out an application. On average, each Pell Grant-eligible student left $3,583 on the table because he or she didn’t fill out the FAFSA. Plus, having good grades will unlock even more scholarship support.

3. Cut Housing Costs

Room and board costs typically range from $8,660 to $12,680 according to the College Board. After four years of college, that could mean spending $42,680 or more.

In turn, 37 percent of college students are living with family to save on housing costs, most of who are living rent-free.

Alternatively, living off-campus and adding an extra housemate could cut your annual costs by $5,028, as compared to dorms. Off-campus apartments also have the advantage of having a kitchen in which to cook meals, which could save you 45 to 69 percent on food, compared to the dining hall.

4. Earn Money for Things You’re Doing Anyway

The best side hustle doesn’t use much of your time while still adding money to your pocket.

With today’s digital apps, it’s easier than ever to make money for things you’re doing anyway. Consider the health and fitness apps that pay you for tracking steps, sleep, and meal info.

Another side hustle is to capitalize on the fact that you‘re already attending college classes and working hard to get grades. Note-taking platforms such as OneClass let students earn cash rewards for uploading class notes and study guides. Especially during college where knowledge is currency and time is limited, platforms such as OneClass can be a valuable marketplace for students to make money.

5. Get a Straight Job for a Regular Paycheck

Punching a time clock may sound boring, but consider the unglamorous first jobs of the world’s most successful people. Elon Musk worked as a janitor. Jeff Bezos was a cashier at McDonald’s, and Madonna was a cashier at Dunkin’ Donuts.

While work-study jobs will earn students $2,353 per year, on average, many students will make an additional $4,668 each summer from a seasonal job.

Find out how OneClass is helping students hack their college education, with two million student users improving by at least one letter grade.