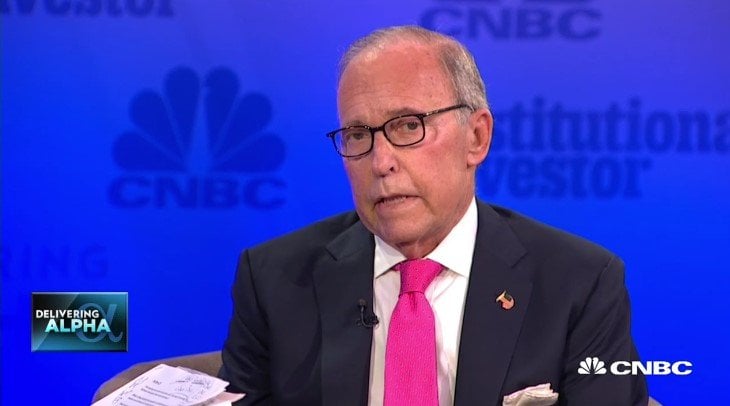

CNBC Transcript: National Economic Council Director Larry Kudlow speaks with CNBC’s Scott Wapner on CNBC’s “Fast Money Halftime Report” Today

WHEN: Today, Friday, October 12, 2018

WHERE: CNBC’s “Fast Money Halftime Report”

The following is the unofficial transcript of a CNBC interview with National Economic Council Director Larry Kudlow on CNBC’s “Fast Money Halftime Report” (M-F 12PM – 1PM) today, Friday, October 12th. The following is a link to video of the full interview on CNBC.com:

Q3 hedge fund letters, conference, scoops etc

All references must be sourced to CNBC.

SCOTT WAPNER: LET’S NOW WELCOME IN THE PRESIDENT’S TOP ECONOMIC ADVISER, LARRY KUDLOW JOINING US TODAY AT THE WHITE HOUSE. LARRY, WELCOME TO "THE HALFTIME REPORT." IT’S GOOD TO HAVE YOU ON.

LARRY KUDLOW: THANKS, SCOTTY. I APPRECIATE IT VERY MUCH.

WAPNER: YOU TOLD THE GANG YESTERDAY, QUOTE, “CORRECTIONS COME AND GO.” DOES IT FEEL GOOD AS THIS ONE HAS COME AND GONE?

KUDLOW: I WOULDN’T DARE MAKE A FORECAST. LIZ ANN SONDERS KNOWS TONS MORE ABOUT THIS THAN I EVER WILL. ALL I’LL SAY IS WE’RE IN A HOT ECONOMIC BOOM. THERE’S NO END IN SIGHT IN MY JUDGMENT. THE U.S. ECONOMY AND THE ENTREPRENEURS AND THE BLUE COLLAR WORKERS ARE KILLING IT. AND THEREFORE, I THINK THE STOCK MARKET WILL GET BACK ON TRACK. NOT MY WAY TO FORECAST. BUT YEAH, CORRECTIONS COME AND GO.

WAPNER: YEAH, THERE ARE SOME THOUGH WHO WORRY, SPEAKING OF KILLING IT, THAT THE FED WILL KILL THE ECONOMY THAT YOU JUST SAID WAS RED-HOT. ARE YOU WORRIED ABOUT THAT?

KUDLOW: NO. I’M NOT REALLY WORRIED ABOUT IT ALL. I THINK THIS ECONOMY HAS LEGS, IT HAS STAYING POWER. I THINK PRESIDENTIAL -- PRESIDENT TRUMP’S POLICIES HAVE COMPLETELY REJIGGERED THE INCENTIVE SYSTEM IN THE ECONOMY TO PROMOTE GROWTH AND INVESTMENT, THE DEREGULATION IS KICKING IN. YOU KNOW, IT’S INTERESTING -- THESE ARE NOT PUBLIC COMPANIES BUT THE REAL FACE OF THE TRUMP ECONOMY, IN MY VIEW AT LEAST, OTHERS MAY DISAGREE, THE REAL FACE ARE PEOPLE, MEN AND WOMEN, WHO OWN SMALL BUSINESSES BECAUSE NOW THEY ARE BEING REWARDED FOR THEIR EFFORT AND THE SUCCESS, NOT PUNISHED AND REMOVED THE RED TAPE. PEOPLE WHO OWN AND OPERATE THEIR OWN SMALL BUSINESSES AND LET ME JUST ADD TO THAT IN TERMS OF EARNING POWER, THIS IS THE BIGGEST BLUE COLLAR EMPLOYMENT BOOM SINCE THE MID-1980s. I THINK THAT’S THE NEW FACE OF THE TRUMP ECONOMY AND, AS I SAID, IT HAS STRONG LEGS.

WAPNER: WHY THE DISCONNECT, THOUGH, LARRY? I HEAR WHAT YOU’RE SAYING. THE DATA HAS BEEN WHAT IT IS, VERY GOOD. CHARLES EVANS ON OUR AIR THIS MORNING TALKED ABOUT HIS PROJECTION, 3.2% THIS YEAR. I’M SURE YOU WOULD TAKE THAT 2.5% NEXT YEAR. MAYBE 2% AFTER THAT. THE FED’S OWN PROJECTION 2019 IS 2.5%, 2020 IT GOES TO 2% AND IT KEEPS FALLING AFTER THAT. WHERE IS THIS DISCONNECT COMING FROM?

KUDLOW: WHICH DISCONNECT, SCOTT?

WAPNER: THE FACT THAT YOU SAY THIS HAS A LOT OF STAYING POWER, THAT IT’S JUST GETTING STARTED, YET THE FED AND OTHERS ARE TAKING DOWN THEIR OWN PROJECTIONS AS EARLY AS NEXT YEAR.

KUDLOW: WELL, LOOK IF YOU LOOK AT THE FED NUMBERS THEY’VE ACTUALLY RAISED THEIR PROJECTIONS AND I WOULD LIKE TO SEE THEM RAISE IS MORE. OUR OWN ESTIMATES WHEN OUR BUDGET COMES OUT WILL LIKELY STAY WITH A 3% GROWTH PATH AND WE’RE GONNA DO BETTER THAN THAT IN 2018 AND MY GUESS IS 2019 – WHAT DO WE GET -- 3.2% IN THE FIRST HALF. 4.2% IN THE SECOND QUARTER. THE ATLANTA FED HAS IT, I THINK, 4.1% IN Q3. WE’D BE PLEASED WITH 3, 3.5%. SO I DON’T SEE A DISCONNECT. LOOK, CHAIRMAN JAY POWELL HAS HIMSELF GONE OUT THERE AND SAID HOW STRONG THE ECONOMY IS. AND ALSO MR. POWELL HAS SAID, AND I REALLY LIKE THIS, THAT STRONG ECONOMIC GROWTH DOES NOT CAUSE INFLATION. AND I THINK THAT’S ABSOLUTELY CRITICAL THAT THE FED KNOWS THAT AND THAT THEY’RE PUSHING AWAY A LOT OF THESE OLD MODELS. I MEAN LOW UNEMPLOYMENT IS A GOOD THING. RISING WAGES IS A GOOD THING. MORE PEOPLE WORKING AND PROSPERING IS A GOOD THING. SO I THINK THE CHAIRMAN HAS GOT THE STORY EXACTLY RIGHT.

WAPNER: RIGHT BUT THE DISCONNECT, LARRY, SEEMS TO BE THAT THERE ARE A GROWING NUMBER OF PEOPLE WHO DON’T THINK THAT IT IS AS SUSTAINABLE FOR AS LONG AS YOU GUYS DO.

KUDLOW: WELL, ONE OF THE GREAT PARTS OF THE STORY IN 2018 IS THAT WE HAVE ENTERED AN ECONOMIC BOOM, AGAIN, IN MY VIEW, WE’VE ENTERED AN ECONOMIC VIEW THAT VIRTUALLY EVERYONE SAID WOULD BE IMPOSSIBLE. SO SCOTT, THIS IS NOT NEW INFORMATION. ALRIGHT? PEOPLE HAVE BADMOUTHED IT, SAID IT CAN’T WORK. LOWER TAX RATES WON’T WORK. DEREGULATION WON’T WORK. UNLEASHING ENERGY WON’T WORK. TELLING THE BUSINESS COMMUNITY TO TAKE A GOOD RIP AT THE BALL, BRINGING PEOPLE BACK INTO THE LABOR FORCE. I LIKE THE SKEPTICISM. OKAY? ME -- I’M TAKING THE OVER. BUT I LOVE SKEPTICISM. AND WE’LL SEE. SO FAR I THINK WE’VE PROVED THE SKEPTICS TO BE QUITE WRONG. I DON’T THINK THAT WILL CHANGE.

WAPNER: YEAH, THE BIG STORY, AS YOU KNOW, LARRY, THIS WEEK WAS THE PRESIDENT CALLING OUT THE FED AS SHARPLY AS HE DID. WHO SHOULD WE LISTEN TO? WHO SHOULD THE MARKETS LISTEN TO ON ISSUES LIKE THE FED AND THE DOLLAR? IS IT THE PRESIDENT OR IS IT YOU? BECAUSE THERE HAS BEEN CERTAINLY A DIFFERENCE OF STATEMENT. YOU YESTERDAY SAID, “I DON’T WANT TO SECOND-GUESS THE FED.” THE PRESIDENT CALLED THE FED – HE SAID IT’S GOING CRAZY. EVEN WHEN IT COMES TO THE DOLLAR. I WANT TO READ YOU WHAT THE PRESIDENT SAID THIS WEEK: “THE DOLLAR HAS BECOME VERY STRONG, WHICH FRANKLY PEOPLE CAN DEBATE WHETHER OR NOT THEY LIKE A STRONG DOLLAR OR NOT.” YOU’VE MADE NO SECRET THAT YOU LIKE A STRONG DOLLAR.

KUDLOW: WELL, LOOK, THE PRESIDENT IS VERY -- FIRST OF ALL, THE PRESIDENT’S STATEMENTS ARE MUCH MORE SIGNIFICANT THAN MINE. THE SECOND POINT, HE’S A VERY SUCCESSFUL BUSINESSMAN AND HE’S A VERY SAVVY, KNOWLEDGEABLE INVESTOR AND HAS HIS OPINIONS ABOUT THESE THINGS. AND HE’S ENTITLED TO IT. THERE’S NO LAW AGAINST IT. NOW, THE PRESIDENT HAS NOT SAID THAT THE FED SHOULD CHANGE ITS PLAN OR ITS STRATEGY. HE KNOWS THE FED IS INDEPENDENT. HE’S JUST COMMENTING ON HOW THESE THINGS PLAY OUT. I MEAN, ONE OF THE ISSUES HERE, JUST THINK ABOUT THIS FOR A MINUTE, THE PRESIDENT HIMSELF IS ARGUING THAT STRONG ECONOMIC GROWTH DOES NOT CAUSE INFLATION. AND RIGHT NOW THE INFLATION RATE IS A VERY, VERY MODEST 2% OR LESS. I HAPPEN TO BELIEVE THAT. BUT JAY POWELL IS BASICALLY SAYING THE SAME THING. THEY ARE REALLY MORE IN AGREEMENT THAN DISAGREEMENT. MR. POWELL HAS SAID STRONG GROWTH DOESN’T CAUSE INFLATION, AND WE HAVE STRONG GROWTH. I THINK THERE’S A CONDOMINIUM HERE OF THINKING. AND I’M NOT SURE THEY’RE VERY FAR APART. BUT REGARDING THE STORY, THE FED IS INDEPENDENT. THE PRESIDENT KNOWS THAT. HE’S NEVER SAID OTHERWISE. HE HAS HIS VIEWS ON INTEREST RATES. WE ALL HAVE OUR VIEWS. I USED TO HAVE VIEWS ON INTEREST RATES, SCOTT.

WAPNER: YOU STILL HAVE CONFIDENCE IN THE FED. DOES THE PRESIDENT HAVE CONFIDENCE IN JAY POWELL?

KUDLOW: I BELIEVE HE DOES. I ABSOLUTELY BELIEVE HE DOES. HE APPOINTED HIM. I THINK IT WAS AN EXCELLENT APPOINTMENT. I THINK MR. POWELL HAS TURNED OUT TO BE, IN MANY WAYS, MUCH MORE OF A REFORMER AT THE FED THAN FOLKS MIGHT HAVE THOUGHT AT THE BEGINNING. I MEAN, AGAIN, HE IS NOT USING THE FED MODELS, YOU KNOW, WRIT LARGE, WRIT SPECIFICALLY. HE DOESN’T KNOW ABOUT R STAR, WHETHER THAT WORKS OR NOT, OR U STAR, WHETHER THAT WORKS OR NOT, OR P STAR INFLATION, WHETHER THAT WORKS OR NOT. HE’S NOT RELYING ON THOSE MODELS. HE HAS A LOT OF REAL WORLD EXPERIENCE IN BANKING AND BUSINESS, AS WELL AS THE GOVERNMENT, AND HE’S SAYING THIS CAN ALL FIT TOGETHER VERY NICELY. THAT IS BASICALLY WHAT PRESIDENT TRUMP IS SAYING. THIS CAN ALL FIT TOGETHER NICELY.

WAPNER: -- WELL, HE DID SAY THE FED IS GOING CRAZY. I MEAN, HE STRAIGHT UP CRITICIZED WHAT THE FED IS ATTEMPTING TO DO. THAT DOES NOT SOUND IN ANY WAY THAT HE IS ON THE SAME PAGE AS WHAT JAY POWELL AND COMPANY ARE DOING.

KUDLOW: THE PRESIDENT RESPECTS THE INDEPENDENCE OF THE FED. THAT’S ALL I’LL SAY.

WAPNER: YEAH, YOU TRULY THINK THE FED IS INDEPENDENT?

KUDLOW: I DO. I DO. I ABSOLUTELY DO. I COME FROM THE FED. THE FIRST JOB I EVER HAD -- NEW YORK FED OPEN MARKET OPERATIONS. I’M NOT GOING TO TELL WHAT YOU YEAR, BECAUSE THEN YOU’LL KNOW HOW OLD I AM.

WAPNER: I WON’T TELL ANYBODY. DON’T WORRY. BUT WHY DO YOU THINK WE’VE HAD THIS CORRECTION, LARRY? IS IT FED INDUCED? IS IT WORRIED ABOUT -- IS IT WORRY ABOUT SOME OF THE ADMINISTRATION’S OWN TRADE POLICIES?

KUDLOW: YOU KNOW, I DON’T WANT TO SPECULATE ON THAT, SCOTT. I REALLY DON’T. LOOK, AS I SAID BEFORE, CORRECTIONS COME AND GO. AND THERE MAY BE A MILLION REASONS FOR IT AND WE ALL SEARCH FOR THOSE REASONS, I UNDERSTAND THAT. I WAS ON YOUR SIDE OF THE STREET FOR A LONG TIME. I DON’T KNOW. I HONESTLY DON’T KNOW. WHAT I’M TRYING TO SAY IS WE’RE IN SUCH A GOOD SPOT IN THE ECONOMY AND THE OUTLOOK FOR ECONOMIC GROWTH WITH VERY LOW INFLATION IS SO POSITIVE THAT I BELIEVE THIS WILL TURN OUT TO BE A CORRECTION AND NOTHING WORSE. MAYBE I’LL BE WRONG. OKAY? WE ALL HAVE A LOT OF HUMILITY IN THIS. BUT I’M JUST SAYING THE FUNDAMENTALS ARE SO GOOD ACROSS THE BOARD. AGAIN, LOOK AT THE CONFIDENCE NUMBERS. LOOK AT THE BUSINESS INVESTMENT CAPEX NUMBERS. LOOK AT THE BLUE COLLAR NUMBERS. LOOK AT THE WAGE NUMBERS. ALL OF THESE THINGS ARE COMING TOGETHER. AND AGAIN, A LOT OF PEOPLE SAID IT COULDN’T HAPPEN BUT IT IS HAPPENING. SO IF YOU HAVE A STRONG AND SOUND ECONOMY, I DON’T KNOW WHY OVER TIME MARKETS WON’T BEHAVE VERY WELL.

WAPNER: HOW ARE WE SUPPOSED TO RECONCILE WHAT YOU TELL US ABOUT THE ECONOMY WITH THE FACT WHAT WE’RE HEARING FROM SOME BIG PLAYERS IN CORPORATE AMERICA? AND THE LIST, LARRY, AS YOU KNOW IS GROWING LONGER BY THE DAY, WHETHER IT’S PPG OR FASTENAL OR FORD OR MACY’S OR FEDEX. THEY ARE ALL, AND MANY OTHERS, ARE TALKING ABOUT THE NEGATIVE EFFECTS OF THIS TRADE SKIRMISH, WAR, BATTLE, HOWEVER YOU GUYS WANT TO CHARACTERIZE IT, AND WHAT IT IS DOING TO INFLATION?

KUDLOW: WELL, THERE’S A LOT OF CEOs THAT COME HERE AND I VISIT WITH WHO ARE VERY POSITIVE AND OPTIMISTIC ABOUT THE ECONOMY. SO, I GUESS WE COULD COUNT UP CEOs. LOOK --

WAPNER: I’M NOT SUGGESTING THEY’RE NOT OPTIMISTIC NOW, BECAUSE THEY ARE. INCLUDING JAMIE DIMON TODAY ON THEIR OWN -- OR JPMORGAN’S OWN EARNING CALL.

KUDLOW: JAMIE’S BEEN GREAT. JAMIE IS AN OPTIMIST. HE WAS IN MY OFFICE OF A COUPLE DAYS AGO. TIM COOK IS AN OPTIMIST. HE’S IN TOUCH WITH US CONSTANTLY. I COULD GO THROUGH A LONG LITANY. LET ME SAY A COUPLE OF THINGS. NUMBER ONE: YOU’VE GOT A STEADY DOLLAR, LOW COMMODITY PRICES, LOW GOLD PRICES. THE ACTUAL INFLATION NUMBERS ARE 2% OR LESS. MOST OF THE INCREASE IN LONG-TERM RATES, THE TEN YEARS AND SO FORTH, IS THE GROWTH FACTOR. IT’S THE REAL INTEREST RATE THAT’S RISING. SO THAT’S INDICATIVE OF A GOOD BOOM THAT’S GONNA GO FOR A WHILE. REGARDING TRADE, SCOTT, OKAY, LET ME MAKE A POINT HERE. THE PRESIDENT’S VIEW IS TO REPLACE THE UNFAIR AND NONRECIPROCAL TRADING PRACTICES WHICH HAVE PROLIFERATED AROUND THE WORLD, INCLUDING CHINA. NOT ONLY, BUT INCLUDING CHINA. HIS VIEW IS WE NEED A WORLD OF ZERO TARIFFS, ZERO NONTARIFF BARRIERS, ZERO SUBSIDIES, AND PLAY BY THE RULES OF THE WTO, WHICH ITSELF IS GOING TO REQUIRE REFORM. NOW, THAT’S GOING TO TAKE A LOT OF HARD WORK. WE’RE INVOLVED IN IT. IT’S A TRADE REFORM EFFORT THAT, I THINK, WILL PAY OFF HUGE ECONOMIC GROWTH DIVIDENDS DOWN THE ROAD. THERE ARE STRUCTURAL ISSUES WITH CHINA, RIGHT. IP THEFT, FORCED TECHNOLOGY TRANSFERS, A LACK OF OWNERSHIP THEY SEEM TO BE HACKING INTO AMERICAN COMPANIES IN CHINA TO GET SECRET INFORMATION. THAT IS NOT GOOD AND THAT’S GOING TO HAVE TO CHANGE. PRESIDENT TRUMP IS THE FIRST PRESIDENT IN, WHAT, 20 YEARS TO REALLY MAKE THAT CASE AND STAY WITH IT, AND HE’S GOING TO USE ALL THE TOOLS THAT HE CAN WITH RESPECT TO NEGOTIATIONS. I FAVOR THAT. I THINK IT’S RIGHT. THE TRADING SYSTEM IS BROKEN. IT’S TIME TO FIX IT. I THINK HIS GOALS ARE TERRIFIC. I’VE SIGNED ON FROM DAY ONE. WE’LL SEE HOW IT TURNS OUT. IT LOOKS LIKE THERE WILL BE A MEETING IN BUENOS AIRES AT THE G20. WE’RE LOOKING AT IT. THE CHINESE ARE LOOKING AT IT. PREPARATIONS ARE BEING MADE. I CAN’T SAY 100% CERTAINTY, BUT THERE’S NO QUESTION EVERYBODY IS LOOKING AT IT. THAT MAY BEAR FRUIT OR IT MAY NOT. THUS FAR UNFORTUNATELY CHINA’S RESPONSE TO OUR ASKS HAVE BEEN RATHER UNSATISFACTORY. SO WE’LL SEE. MAYBE NEGOTIATIONS BETWEEN THE TWO HEADS OF STATE WILL BEAR FRUIT.

WAPNER: ANY WORRY THE CHINESE ARE IN NO IMMEDIATE -- HAVE NO IMMEDIATE DESIRE TO MAKE A DEAL AND WILL WAIT IT OUT AS LONG AS THEY CAN?

KUDLOW: WELL, I DON’T KNOW. I MEAN, I CAN’T GET INTO THEIR HEADS. I’VE MET WITH THEM. I WAS IN BEIJING AND HERE IN WASHINGTON AND SO FORTH AND SO ON. I’M NOT A CHINA EXPERT. I’M NOT A CHINA HAND. THEY KNOW WHAT WE ARE ASKING. AND I THINK WHAT WE ARE ASKING IS FAIR AND PROPER. WE WANT TO BE TREATED FAIRLY AND PROPERLY. THE PRESIDENT TALKS ABOUT RECIPROCITY. THAT’S A VERY IMPORTANT PRINCIPLE IN INTERNATIONAL TRADE. IT NEEDS TO BE RESTORED. WE ARE TALKING, HOWEVER, PROMISING TALKS WITH THE EUROPEAN UNION, PROMISING TALKS WITH JAPAN, AND WE JUST COMPLETED A NORTH AMERICAN TRADE DEAL WHICH IS VERY FAVORABLE. THE U.S. MCA DEAL WHICH IS FAVORABLE. MARKETS WERE OPENED, OUR FARMERS BENEFITED, OUR BLUE COLLAR WORKERS BENEFITED, WE’RE GOING TO HAVE MORE DOMESTIC CONTENT AND SO FORTH. THAT’S A BIG PLUS. AND, AS I SAY, WE’RE MOVING AHEAD WITH EUROPE. WE’RE MOVING AHEAD WITH JAPAN. AND ALL THESE COUNTRIES AGREE WITH US THAT THE NONMARKET CHINA ECONOMY HAS GOT TO BE CHANGED. THAT THEIR TRADING LAWS HAVE TO BE CHANGED. THAT THEIR STRUCTURAL ISSUES HAVE TO BE CHANGED. THERE IS WIDESPREAD AGREEMENT ACROSS THE WORLD ON THIS POINT. AND THE PRESIDENT IS GOING TO STAY ON TRACK AND TRY TO MAKE THESE CHANGES TO HELP AMERICAN WORKERS, TO HELP OUR ECONOMY, TO HELP RANCHERS AND FARMERS. WHAT HE SHOULD DO.

WAPNER: ARE YOU NOT AT ALL WORRIED, THOUGH, THAT THERE HAVE BEEN SOME UNINTENDED CONSEQUENCES OR SELF-INFLICTED WOUNDS FROM THIS TRADE BATTLE IN THE WAY OF HIGHER PRICES, HIGHER INPUT COSTS FOR SOME OF THE VERY COMPANIES I TALKED ABOUT THAT THEY ARE NOW TRYING TO PASS ON TO CONSUMERS, AND WE’RE GOING TO FIND OUT IF THERE’S STICKING POWER IN THAT OR NOT?

KUDLOW: WELL, LOOK, THE BULK OF THE TARIFF ON CHINA -- NOW THERE’S $250 BILLION IN TARIFFS. THE $200 BILLION, WHICH I THINK KICKED IN FORMALLY LAST WEEK, WE DON’T HAVE ENOUGH EVIDENCE, WE DON’T HAVE ENOUGH DATA TO SEE. PRICES MAY BE CUT IN ORDER TO DEAL WITH THE TARIFFS. PEOPLE MAY SHOP ELSEWHERE. WE DON’T KNOW. I’M HEARING CERTAIN COMPANIES BLAMING TARIFFS FOR BAD EARNINGS GUIDANCE. ALLOW ME TO EXPRESS MY SKEPTICISM BECAUSE THEY DON’T KNOW. AND THEY LOVE TO BLAME TARIFFS OR OTHER FACTORS OUTSIDE PERHAPS TO COVER THEIR OWN EXECUTION PROBLEMS. I DON’T WANT TO GET INTO THAT. THAT’S FOR BUSINESS. ALL I’M SAYING IS LET’S WAIT AND SEE. WE HAVE SUCH A STRONG ECONOMY, WE’RE GROWING OVER 3%, MAYBE AS MUCH AS 4%, WITH VERY LITTLE INFLATION. HISTORICALLY LOW INTEREST RATES. I JUST THINK THIS STORY IS A WINNING STORY. IT’S A STRONG STORY. AMERICA’S OPTIMISTIC. IT’S CONFIDENT. LET’S SEE HOW IT PLAYS OUT. I’M GOING TO PLAY -- I WANT TO PLAY THIS FROM THE OVER NOT THE UNDER.

WAPNER: YOU DON’T BELIEVE, THOUGH, A FORD, FOR EXAMPLE, WHEN THEY SAY THAT TARIFFS ARE GOING TO COST AT A BILLION DOLLARS OR A PPG WHICH SAYS INPUT COSTS ARE RISING AND DEMAND IS FALLING AND IT’S BECAUSE OF TARIFFS? YOU DON’T BELIEVE THOSE CEOs, LARRY?

KUDLOW: I’M GOING TO TAKE A WAIT AND SEE POSITION, SCOTT. I DON’T WANT TO COMMENT ON THE INDIVIDUAL COMPANIES. I KNOW A LOT OF THOSE FOLKS AND SO FORTH. I’M JUST GOING TO TAKE A WAIT AND SEE POSITION. HERE IS WHAT I KNOW. PROFITS GREW AT, WHAT, 20% YEAR ON YEAR FIRST HALF. PROFITS EXPECTED TO GROW, WHAT, OVER 20% IN THE THIRD QUARTER YEAR ON YEAR. THOSE ARE BIG NUMBERS. AND EVEN THOUGH INTEREST RATES HAVE CREPT UP A BIT AND THERE’S SOME VALUATION ADJUSTMENTS, IT’S VERY MINOR, THE PROFIT STORY LOOKS TERRIFIC. PRODUCTIVITY, BECAUSE OF MORE CAPITAL, YOU KNOW, LOWER TAX RATES ON BUSINESS IS PRODUCING CAPITAL. MONEY IS FLOWING INTO THE UNITED STATES FROM ALL ACROSS THE WORLD. WE ARE THE HOTTEST ECONOMY BY FAR. THAT’S GOING TO LEND PRODUCTIVITY INCREASES WHICH IS THE KEY TO ECONOMIC GROWTH AND PROFITS AND WAGES. I MEAN, I THINK THIS STUFF IS GONNA PLAY OUT VERY, VERY POSITIVELY.

WAPNER: LARRY, I APPRECIATE YOUR TIME AS ALWAYS. HAVE A GOOD WEEKEND. WE WILL SEE YOU AGAIN SOON, I AM SURE.

KUDLOW: THANK YOU.