This is really good stuff folks. I’ve red boxed the applicable sections from Lamberth’s ruling. Discovery clearly has damaged the government’s case as it has shown to the appellate court and now Lamberth that they were saying one thing and behind the scenes doing quite another.

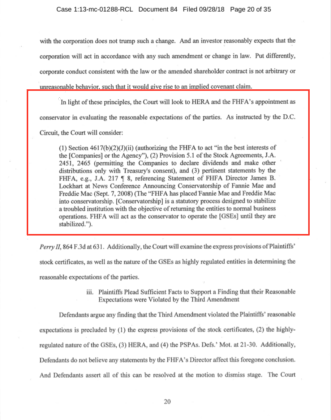

Back in 2014 I was arguing that Lockhart’s statements when the conservatorship was imposed were enough to warrant a trial based on the subsequent actions of FHFA and Treasury and 4 short years later, it seems as though Lamberth agrees (see immediately below).

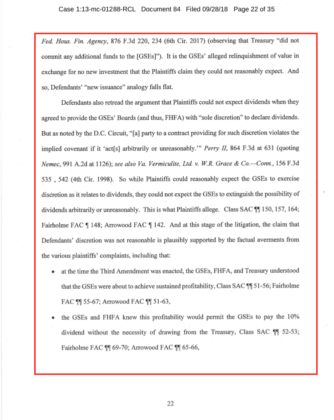

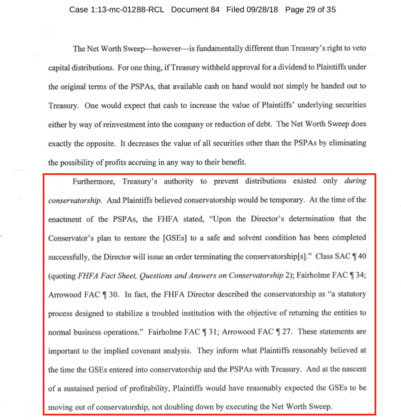

What follows that is a pretty damning discussion as Lamberth detail the deception by the government and how based on their statements, shareholders had “reasonable expectations” no such event as the net worth sweep was coming or even possible. In fact, he states “it does not follow that the plaintiffs could reasonably expect that the GSE’s themselves, through the FHFA, would give away all of their residual rights to dividends and liquidation surplus in exchange for no investment and no meaningful consideration at a time when the GSE’s were highly profitable”.

Q2 hedge fund letters, conference, scoops etc

I am of the opinion this ruling gives Mnuchin the impetus and cover he needs to force an end to the conservatorship in exchange for a settlement. He can easily phrase it a “the possibility of paying back almost $300B to shareholders, or keeping it and selling off our stake for more money over time”. It is a no-brainer. Even should the Dems take the House this fall, as they are fans of FNMA it ought not cause them too much angst to get it done.

John Carney has been silent...

Peter Chapman opines:

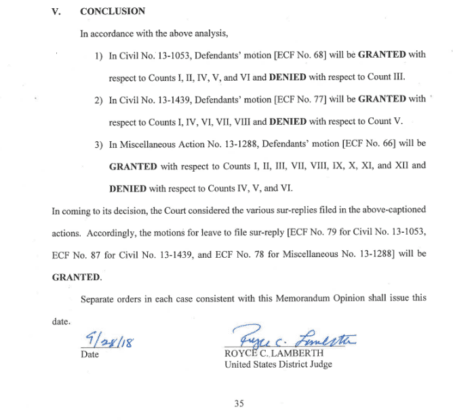

Judge Lamberth’s decision is excellent news for GSE shareholders overall because he blasted a hole in FHFA’s seemingly impenetrable wall that says it can do whatever it wants to do without accountability to anyone. GSE shareholder claims for breach of the covenants of good faith and fair dealing are moving forward. FHFA will, no doubt, attempt to appeal that ruling. That attempt to appeal an interlocutory order should be denied, but is not guaranteed.

But Judge Lamberth has interjected confusion into the marketplace by talking about differences among shareholders based on the dates they acquired their shares and their reasonable expectations. I believe he’s describing a myth with superficial appeal that has no basis in fact, law, or common sense. A shareholder’s rights against the GSEs were fixed when the GSEs issued their securities. When a share of stock is bought and sold in the secondary market, the same bundle of rights attaching to that security at the time of issuance are transferred and delivered. Rights and interests do not mutate based in the identity of the current holder of a security. A current shareholder does not own a fraction of what some prior shareholder owned. James Madison tried in 1789 to unwind the bundle of rights Revolutionary War debt certificate holders owned in order to be, in his view, fairer to more people. He failed.

Alexander Hamilton’s monetary policy paid all principal and accrued interest owed on any certificate to the record holder. This model is followed every day in the resolution of claims against bankrupt companies. There’s nothing in American jurisprudence — except whining — to support the proposition that shareholders or creditors are treated differently based on their subjective qualitative characteristics. Shareholder and creditor rights are based on contractual terms and American courts are agnostic about whether the shareholder or creditor is nice, wealthy, a member of any particular ethnic group, politically active, subscribes to any particular creed, is fat or skinny or fit, or prefers to use pencils rather than pens.