From Stanphyl Capital’s September letter to investors

We remain short shares of (and long put options and short call options in) Tesla, Inc. (TSLA), which I consider to be the biggest single stock bubble in this whole bubble market—a company so landmine-filled that I think it can implode at any moment regardless of what the broad market does. To reiterate the three core points of our Tesla short position:

1) Tesla has no “moat” of any kind; i.e., nothing meaningfully or sustainably proprietary.

2) Tesla loses a huge amount of money despite relatively light competition but will soon be confronted with massive competition in every aspect of its business.

3) Elon Musk is extremely untrustworthy.

In August Musk posted a completely fictional series of tweets (intended to “burn the shorts”) about a supposed $420/share bid to take Tesla private, and yesterday (September 27th) the SEC sued him for it. We also learned in September that Musk and/or Tesla are the subject of multiple SEC investigations pre-dating that one, and that the DOJ is now involved (perhaps criminally). Additionally, the “420 tweets” triggered an onslaught of lawsuits with a billion-dollar plus liability from investors who bought stock anticipating that buyout. So what did Tesla’s Board do in reaction to this? Absolutely nothing, except to put out a statement offering “Elon” its full support. Are they as crooked as he is, or just incredibly stupid? I have no idea what those dopes are thinking, but it’ll sure be fun watching this play out from the short side, especially as all those investigations are almost certainly preventing Tesla from raising desperately needed capital. Meanwhile, Musk supposedly turned down a sweetheart SEC settlement, perhaps because it only pertained to the “420 tweets” and not the other ongoing investigations, or perhaps because the supposed requirement that he step down for two years left him fearful of what “buried bodies” might be discovered in his absence. We’ll find out soon enough!

More bad news for Tesla in September came with the departure (after just a month on the job!) of the Chief Accounting Officer who was hired to replace the previous CAO who left in March on apparently no notice. Both of those guys left millions of dollars in unvested stock on the table, and one must ask why. Did they assume that stock would wind up worthless (which is, of course, my expected scenario)? Were they asked to do something they were “uncomfortable” doing? Or was Elon Musk just so difficult to work for that it wasn’t worth the millions of dollars they left behind? None of the answers to those questions are favorable to Tesla.

Concurrent with the rapid departure of the CAO was the departure of its head of human resources, yet another exec with a short tenure on the job. And those departures were followed by those of the Vice-President of Worldwide Finance, the Director of Manufacturing Engineering, the Vice President for Global Supply Management, the Senior Vice President of Supply Chain, the Senior Director of Production and Quality and the Director of Logistics For Finished Vehicles. In fact, Tesla’s list of departing executives is so long that Jim Chanos recently said that the only other times he’d seen anything like it was during the waning days of Enron and Valeant. Congratulations, Tesla: you’re a company in great company! Here’s a link to the astounding full list. While a couple of low-level whistleblowers have come forward publicly to report on internal dirty deeds at Tesla, with that many high-level departures I have no doubt that myriad more significant whistleblowers are doing the same; I look forward to hearing them verify many things I already suspect.

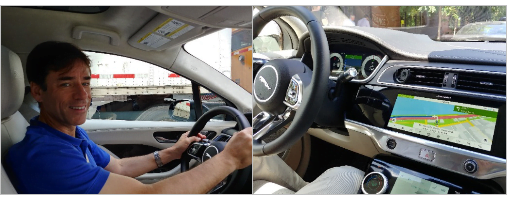

Meanwhile, September was a seminal wake-up month for those unaware of the onslaught of luxury EV competition about to be faced by Tesla. First, the new Jaguar I-Pace electric SUV (which had already received fabulous reviews, handily beating Tesla in comparison tests) became widely available in European showrooms (and does so in November in the U.S.) at a price roughly $13,000 cheaper than the Model X and $7000 less than the Model S, gaps that will widen substantially as Tesla’s tax credits phase out. I drove the Jaguar in August and can assure you that no one who drives it will say it isn’t much nicer than any Tesla.

Also in September came the introduction of the Audi e-tron, an all-electric SUV with roughly the same estimated EPA range as the 237-mile base Model X but with a much nicer interior and a price that’s $8200 lower before the Audi’s tax credit advantage. When the Audi arrives in the U.S. in April (it’ll be in Europe this fall) it will receive a tax credit that’s $3750 better than Tesla’s, thus stretching its price advantage to $11,950, and that advantage will grow to $13,825 in July when Tesla’s credit is reduced to just $1875 vs the full $7500 for the Audi.

Also in September came the introduction of the Mercedes EQC. This all-electric SUV will be available in Europe in mid-2019 and in the U.S. in early 2020, with an EPA range nearly that of the base Tesla Model X (an estimated 225 miles vs. 237 for the Tesla) at a cost that’s approximately $25,000 less, as the Mercedes will sticker at around $65,000 and get a full $7500 tax credit while the Model X starts at $83,000 and will get no tax credit when the Mercedes arrives. (As an aside, by 2022 Mercedes will have ten fully electric models, covering nearly all its model lines.)

Although the Model X is larger than the Mercedes and Audi (and has optional third row seating and for $99,500 can take its range up to 295 miles), it had previously been the only luxury electric SUV, leaving buyers with no choice in that category. Now there are alternatives for those who prefer a smaller, easier-to-park vehicle with a much nicer interior and vastly better service facilities, as well as more practical doors than the Tesla’s oft-malfunctioning “falcon wings” (which prevent the ability to mount a rooftop storage unit, something both the Mercedes and Audi can do). I thus expect buyers will flee en masse from the “X” to the nicer and much less expensive Audi and Mercedes, while the Jaguar—more of a crossover than an SUV—will provide terrific competition for both the Model X and the Model S.

Next in luxury EV competition for Tesla will be the Autobahn and Nürburgring-tested Porsche Taycan, which will be available next year with a base price similar to that of the base Model S, and will likely be less expensive with the advantage of the tax credit Tesla will soon lose. Hmmm, Tesla or Porsche… tough choice!

Perhaps the most important ongoing Tesla story (more important even than the SEC and DOJ investigations) is the evaporation of North American Model 3 backlog. Despite Q3 production averaging just 3900 Model 3s per week (far short of the anticipated 5000 per week and Musk’s goal of 6000), Tesla built up substantial Model 3 inventory and had to hold large lot sales and offer free Supercharging (lifetime for the “Performance” model and a year for the lesser models) to get rid of it. Many people argue that “truly massive” Model 3 demand will be unleashed when Tesla offers a shorter-range, lower-priced version in the second half of 2019; here’s why I think that’s wrong…

First, I can’t see any way that a shorter range (approximately 250-mile) base car can be priced at less than $40,000 vs. Tesla’s original promise of $35,000 (a price which has now been scrubbed from Tesla’s web site). After all, the current base car with a 75 kWh battery sells for $50,000 including a mandatory $5000 premium package. If Tesla cut that battery size by 20% (15 kWh) it would only save around $3000, and if it eliminates the premium package it might save itself another $2000. If Tesla then accepted a 10% cut in gross margin, it would have to price the non-premium, shorter-range car at $40,000. Now let’s put that in perspective…

Tesla currently sits with piles of unwanted long-range (310 miles) rear-wheel drive Model 3 inventory at a net customer price of $42,500 ($50,000 minus a $7500 tax credit). If the shorter-range car costs $40,000 and only comes with an $1875 credit beginning in July (and no credit at all beginning January 2020), why would there be door-busting demand for a $38,175 ($40,000 in January 2020) NON-premium package 250-mile car when there’s a glut of 310-mile premium-package cars at $42,500? When financing a car, who wouldn’t pay an extra $2500 for an extra 60 miles of electric range and a much nicer interior? And yet Tesla’s North American backlog of those buyers is gone. The real mass-market Model 3 demand was at $35,000 with a $7500 tax credit—a fictional product that Musk lied about to do massive capital raises in 2016 and 2017.

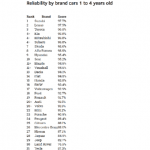

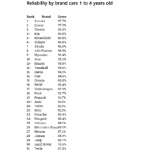

Meanwhile, the Model 3 continues to reveal itself to be a complete lemon; the latest survey from True Delta ranks it dead last among all available vehicles. And in September British magazine What Car? ranked overall Tesla reliability so low that it’s in “a league” of its own:

And many Tesla customers are apparently paying for their cars and net getting them at all, and then when they do get them they need service which they also can’t get! Check out this devastating new overview from the L.A. Times. And remember, almost nothing can be done in the Model 3 without a multi-step process on the touchscreen—not even changing the windshield-wiper speed, adjusting the air vents or opening the glovebox. Thus, operating a Tesla Model 3 may potentially be as dangerous as texting while driving.

Although Tesla’s Q2 earnings release was horrendous (showing a GAAP loss of $717 million and free cash flow of negative $812 million, forcing a major slash in projected 2018 capex for this manufacturing-intensive alleged “hyper-growth company”), Tesla claimed in that same release that that it will be GAAP profitable in Q3 & Q4 and insinuated that these profits would be sustainable. However, I’ve run numbers every which way I can and the best I can come up with for Q3 is a very artificially boosted (via deferred spending and Q4 sales pulled into Q3) GAAP loss of around $50 million before it all falls apart in Q4 as the North American Model 3 backlog is exhausted and deferred costs are realized, and the authors of this terrific new Seeking Alpha article and this one too are in roughly the same ballpark. And it's clear based on hundreds of social media posts about terrible recent Tesla customer service (thanks to Q2 layoffs designed to artificially juice Q3 profits) that the company is now grossly understaffed, and thus Q3 SG&A will be deceptively low relative to what it must be for a sustainable business, as will be the Model 3’s warranty reserve; i.e. for a true picture, add at least $150 million to whatever Tesla claims for those quarterly expenses. Also, look for a fraudulently inflated cash balance, as (as noted above) social media is rife with stories about Tesla taking full payment for cars and then not delivering them!

Meanwhile Tesla continues to downsize its SolarCity division while a civil securities fraud case accusing Musk of using Tesla to bail out his (and his family’s) interests there proceeds; earlier this year Zero Hedge included an excellent summary of the suit by Twitter user @TeslaCharts in this story about SolarCity’s latest retrenchment, which will undoubtedly help fuel that fraud case, as will this later story describing how Tesla sales people have no idea when the solar tiles or PowerWalls used to justify that merger will ever be available. (Remember that when Musk was promoting that merger he used fake solar tiles on a fake house at a movie studio… How appropriate!)

Finally, Tesla is increasingly besieged by a wide variety of lawsuits for securities fraud, labor discrimination, worker safety, union-busting, sudden acceleration and lemon law violations, and new ones appear on a regular basis.

So here is Tesla’s competition in cars (note: these links are continually updated)…

THE NEW ALL-ELECTRIC JAGUAR IPACE

2019 Jaguar XJ to be reborn as high-tech electric flagship

Jaguar Land Rover will boost spending to $18 billion to fund EVs

The e-tron, Audi’s First All-Electric SUV

Audi planning 20 new electric models by 2025

Mercedes unveils the 2019 EQC Electric SUV

Mercedes to launch 10 all-electric models by 2022

Porsche Cross Turismo to be its second EV

301-Mile 2019 Kia Niro EV To Be Priced Well Under $40,000 In U.S.

2019 Hyundai Kona Electric gets 250-mile range rating in the U.S.

14 new EV models by Hyundai-Kia by 2025

Chevrolet Bolt Offers 238 Miles On A Single Charge For $37,495

GM to introduce 3 more electric cars before 2020, battery cells at <$100/kWh

2018 Nissan Leaf: 150 miles for $30,875, 200+ mile model by late 2018

Nissan Leaf-based SUV coming in 2020

Volvo Polestar 2: 350-mile range, £30,000 starting price

Volvo To Start Selling Electric Trucks In 2019, Some Will Hit The Road This Year

Volkswagen launches ELECTRIC FOR ALL campaign

VW ID electric car 2019 to have over 300 miles range and be a Tesla Model 3 rival

Volkswagen I.D. Crozz 311-Mile Electric CUV For $30,000-ish Before Incentives

BMW iX3 electric crossover goes on sale in 2020

BMW to have 25 electrified models by 2025

Ford plans $11 billion investment, 40 electric vehicles by 2022

Toyota, Mazda, Denso create company to roll out electric cars beginning 2019

Toyota to market over 10 battery EV models in early 2020s

Renault aims to remain EV leader in Europe

Infiniti will go mostly electric by 2021

DS 3 Crossback will give PSA's upscale brand an electric boost

ALL-ELECTRIC MINI COOPER COMING IN 2019

Smart Will Electrify Its Entire Line-up By 2020

SEAT's first electric car is due in 2020

Opel will launch full electric Corsa in 2020

2019 Skoda e-Citigo confirmed as brand's first all-electric model

Skoda planning range of hot all-electric eRS models

MG E-Motion confirms new EV sports car on the way by 2020

Fiat Chrysler bets on electrification for Alfa, Jeep and Maserati

Maserati offering three fully electric cars between 2020 and 2022

Rolls-Royce is preparing electric Phantom for 2022

Citroen preparing EV push with 80 per cent electrified range by 2023

Honda will offer full-EV or hybrid tech on every European model by 2025

All-electric Bentley four-door coupe to use EV tech from Porsche Mission E

Subaru to introduce all-electric vehicles by 2021

Ssangyong e-SIV concept previews 2020 EV

Dyson Moves Ahead on $2.6 Billion Electric Car Plan

Lucid Motors closes $1 billion deal with Saudi Arabia to fund electric car production

Borgward BXi7 Electric SUV Flies Under The Radar

Detroit Electric promises 3 cars in 3 years

SF Motors reveals two electric SUVs for 2019 with 300 miles of range

Two new electric cars from Mahindra in India by 2019; Global Tesla rival e-car soon

Saab asset owner NEVS plans electric car production

EVelozcity Raises $1 billion For EV Startup

Flush with new cash, electric-car company Faraday Future hopes for a fresh start

And in China…

Daimler & BYD launch new DENZA electric vehicle for the Chinese market

BAIC and Daimler to Build $1.9 Billion China Plant

Daimler and Baidu to Enhance Strategic Cooperation in Automated Driving

Volkswagen makes €15bn bet on electric cars in China

Volkswagen Group China’s mega-factory in Foshan will strengthen e-mobility strategy in China

VW signs deals for EVs, autonomous driving in China

Audi to launch 7 new energy vehicle models in China by 2020

GM China raises new-energy vehicle target to 20 models through 2023

Nissan & Dongfeng to invest $9.5 billion in China to boost electric vehicles

Toyota to Introduce 10 New Electrified Vehicles in China by 2020

Infiniti bringing EVs to China’s luxury car market

BMW will develop and produce electric Mini in China

Ford ramps up electric vehicle push in China

BYD Refreshes New Song & Qin Pro PHEVs & BEVs: Range Up To 310 Miles

SAIC to spend $2.2 billion on EVs, connectivity, aftersales services

Honda debuts Everus electric car for China

Changan building large scale NEV factory

Mazda and Changan Auto join hands on electric vehicles

WM Motors/Weltmeister EX5 Electric SUV Launched On The Chinese Car Market

NIOS ES8 Electric Crossover debuts with half the Tesla Model X’s price tag

Geely invests $5 billion into new electric car factory in China

Chery Breaks Ground on $240M EV Factory in China

Chery's second EV plant open in Dezhou

Leapmotor’s electric car to hit the market in 2018

Alibaba-backed Xiaopeng Motors to raise US$2.7 billion this year

GAC Trumpchi to launch range-extended EVs

Guangzhou Auto To Launch Four New Electric Cars By 2020

Chinese carmaker Byton unveils its fully autonomous rival to Tesla's electric sedans

Chinese-backed electric car start-up Byton woos CES with model 40% cheaper than a Tesla

Great Wall Launches New EV Brand (ORA) In China

Singulato iS6 Electric SUV Debuts With 249-Mile Range

Singulato, BAIC partner to promote smart new energy vehicles

FAW (Hongqi) to roll out 15 electric models by 2025

JAC’s Electric Car Has A Range Of 500 Kilometers

ICONIQ to build electric cars in Zhaoqing with total investment of RMB 16 billion

Quianu Motor aims to grab share of US electric vehicle market

All-electric NEVS 9-3 sedans (nee Saab) being built in China

Youxia Motors raises $1.25 billion to start 2019 EV production

Wanxiang Gets China Electric Vehicle Permit to Make Karma Cars

Qoros Auto's new owner plans to be an EV power

JMC (Jianling Motor Corp.) Starts New EV Brand In China

Thunder Power electric cars at the Frankfurt motor show

Continental, Didi sign deal on developing EVs for China

Here’s Tesla’s competition in autonomous driving…

Tesla Ranks Last for Automated Driving

A Tesla self-driving blind spot that few are focusing on

Waymo is first to put fully self-driving cars on US roads without a safety driver

Jaguar and Waymo announce an electric, fully autonomous car

Waymo Expands Chrysler Self-Driving Fleet 100-Fold to 62,000

Uber, Waymo in talks about self-driving partnership

Lyft and Waymo Reach Deal to Collaborate on Self-Driving Cars

Cadillac Super Cruise™ Sets the Standard for Hands-Free Highway Driving

GM ride-hailing fleet would ditch steering wheel, pedals in 2019

SoftBank Vision Fund to Invest $2.25 Billion in GM Cruise

An Overview of Audi Piloted Driving

Updated 2017 Mercedes-Benz S-Class - first ride with autonomous technology

Nvidia to test fleet of robotaxis in 2019 with Daimler, Bosch

NVIDIA and Toyota Collaborate to Accelerate Market Introduction of Autonomous Cars

Volkswagen and NVIDIA to Infuse AI into Future Vehicle Lineup

Continental & NVIDIA Partner to Enable Production of Artificial Intelligence Self-Driving Cars

Bosch and Daimler join forces to market fully automated, driverless taxis by 2020

Intel’s Mobileye will have 2 million cars (VW, BMW & Nissan) on roads building HD maps in 2018

Volkswagen Group and Aurora Innovation Announce Strategic Collaboration On Self-Driving Cars

Toyota, Intel and others form big data group for autonomous tech

Toyota Adds $2.8 Billion to Software Push for Self-Driving Cars

Toyota Invests $500 Million in Uber to Get Self-Driving Cars on the Road

Nissan’s Robo-Taxis Will Hit the Road in March

Nissan and Mobileye to generate, share, and utilize vision data for crowdsourced mapping

Magna joins the BMW Group, Intel and Mobileye platform as an Integrator for AVs

Intel collaborates with Waymo on self-driving compute design

Fiat Chrysler to Join BMW, Intel and Mobileye in Developing Autonomous Driving Platform

Ford-Backed Driverless-Car Startup Argo AI Lures Talent

Ford to invest $4 billion in new self-driving vehicle unit

Lyft, Aptiv (formerly Delphi) partner on driverless ride-hailing at 2018 CES in Vegas

Lyft, Magna in Deal to Develop Hardware, Software for Self-Driving Cars

Hyundai, Aurora to release autonomous cars by 2021

Deutsche Post to Deploy Test Fleet Of Fully Autonomous Delivery Trucks This Year

Byton cooperating with Aurora on autonomous vehicles

ZF plans $14 billion autonomous vehicle push

Magna’s new MAX4 self-driving platform offers autonomy up to Level 4

Bosch Creates a Map That Uses Radar Signals for Automated Driving

Honda Targeting Level 3 Automated Driving By 2020, Level 4 by 2025

Groupe PSA’s safe and intuitive autonomous car tested by the general public

Baidu unveils autonomous driving platform backed by 90 global partners

Baidu plans to mass produce Level 4 self-driving cars with BAIC by 2021

BlackBerry and Baidu Partnering to Accelerate Connected and Autonomous Vehicle Technology

Tencent, Changan Auto Announce Autonomous-Vehicle Joint Venture

JD.com Delivers on Self-Driving Electric Trucks

NAVYA Unveils First Fully Autonomous Taxi

Fujitsu and HERE to partner on advanced mobility services and autonomous driving

Lucid Chooses Mobileye as Partner for Autonomous Vehicle Technology

First Look Inside Zoox’s Autonomous Taxi

Apple Is Focusing on Making an Autonomous Car System

Samsung, Harman gear up for self-driving automobiles

Mitsubishi Electric Develops Automated Mapping For Autonomous Driving

Hitachi demonstrates vehicle with 11-function autonomous driving ECU

DENSO and NEC Collaborate on Automated Driving and Manufacturing

Nuro’s Robot Delivery Vans Are Arriving Before Self-Driving Cars

Here’s Tesla’s competition in car batteries…

LG Chem targets electric car battery sales of $6.3 billion in 2020

LG Chem to build $1.8 bln EV battery plant in China

Samsung SDI Unveils Innovative Battery Products at 2018 Detroit Motor Show

SK Innovation building 20GWh of worldwide battery manufacturing capacity

New Toshiba EV Battery Allows 320km Charge in 6 Minutes

Daimler building eight battery factories

Panasonic Opens New Automotive Lithium-Ion Battery Factory in Dalian, China

Panasonic forms battery partnership with Toyota

CATL’s Chinese battery factory will be bigger than Tesla’s Gigafactory

CATL to set up battery cell manufacturing in Germany

BYD to quadruple car battery output with lithium site plants

GM inaugurates battery assembly plant in Shanghai

Honda Partners on General Motors' Next Gen Battery Development

VW Wants to One-Up Tesla With a Next-Generation Battery

Energy Absolute Plots Asian Project Rivaling Musk's Gigafactory

France's Saft plans production of next-gen lithium ion batteries from 2020

ABB teams up with Northvolt on Europe's biggest battery plant

Chinese Battery Maker to Open Factory Next to Swedish EV Plant

Sokon aims to be global provider of battery, electric motor, electric control systems

BMW Group invests 200 million euros in Battery Cell Competence Centre

BMW Brilliance Automotive opens battery factory in Shenyang

BMW announces partnership with solid-state battery company

Toyota promises auto battery 'game-changer'

VW increase stake in solid-state batteries with $100M investment

Hyundai Motor developing solid-state EV batteries

Continental eyes investment in solid-state batteries

Wanxiang is playing to win, even if it takes generations

UK provides millions to help build more electric vehicle batteries

Rimac is going to mass produce batteries and electric motors for OEMs

Elon Musk Has A New Battery Rival (Romeo Power) Packed With His Ex-Employees

Bracing for EV shift, NGK Spark Plug ignites all solid-state battery quest

ProLogium Technology Will Produce First Next Generation Lithium Ceramic Battery For EVs

Here’s Tesla’s competition in storage batteries…

Panasonic

LG

BYD

AES + Siemens (Fluence)

NEC

Hitachi Chemical

ABB

Saft

EnerSys

SOLARWATT

Sharp

Kreisel

Leclanche

Lockheed Martin

UniEnergy Technologies

ENGIE

Blue Planet

Clean Energy Storage Inc.

Swell Energy

Younicos

Powervault

Schmid

Ecoult

And here’s Tesla’s competition in charging networks…

EVgo Installing First 350 kW Ultra Fast Public Charging Station In The US

Tritium’s First 350-kW DC Fast Chargers Coming To U.S.

Porsche plans network of 500 fast chargers for U.S.

BMW, Daimler, Ford, VW, Audi & Porsche form IONITY European 350kw Charging Network

E.ON to have 10,000 150KW TO 350KW EV charging points across Europe by 2020

Enel kicks off the E-VIA FLEX-E project for the installation of European ultra-fast charging stations

Europe’s Allego “Ultra E” ultra-fast charging network now operational

Allego & Fortum Launch MEGA-E High Power Charging network for Europe’s Metropolitan areas

Chargepoint Europe Gets $82 million in new funding from Daimler

ChargePoint - InstaVolt partnership; more than 200 UK rapid charge systems

UK's Podpoint installing 150kW EV rapid chargers this year; 350kW by 2020

UK National Grid plans 350kW EV charge point network

ChargePoint Express Plus Debuts: Offers Industry High 400 kW DC Fast Charging

Fastned building 150kw-350kw chargers in Europe

ABB powers e-mobility with launch of first 150-350 kW high power charger

Shell buys European electric vehicle charging pioneer NewMotion

BP buys UK's largest car charging firm Chargemaster

Total planning EV charging points at its French stations

Yet despite all that deep-pocketed competition, perhaps you want to buy shares of Tesla because you believe in its management team. Really???

Elon Musk, June 2009: “Tesla will cross over into profitability next month”

Tesla SEC Correspondence Shows A Pattern Of Inaccurate, Incomplete & Misleading Disclosures

Tesla: Check Your Full Self-Driving Snake Oil Expiration Date

As Musk Hyped and Happy-Talked Investors, Tesla Kept Quiet About a Year-Long SEC Probe

The Truth Is Catching Up With Tesla

With Misleading Messages And Customer NDAs, Tesla Performs Stealth Recall

Who You Gonna Believe? Elon Musk's Words Or Your Own Lying Eyes?

How Tesla and Elon Musk Exaggerated Safety Claims About Autopilot and Cars

When Is Enough Enough With Elon Musk?

Musk Talked Merger With SolarCity CEO Before Tesla Stock Sale

Tesla Continues To Mislead Consumers

Tesla Misses The Point With Fortune Autopilot Story

Tesla Timeline Shows Musk's Morality Is Highly Convenient

Tesla Scares Customers With Worthless NDAs, The Daily Kanban Talks To Lawyers

Tesla: Contrary To The Official Story, Elon Musk Is Selling To Keep Cash

Tesla: O, What A Tangled Web We Weave When First We Practice To Deceive

I Put 20 Refundable Deposits On The Tesla Model 3

Tesla: A Failure To Communicate

Elon Musk Appears To Have Misled Investors On Tesla's Most Recent Conference Call

Understanding Tesla’s Potemkin Swap Station

Tesla's Amazing Powerwall Reservations

So in summary, Tesla is losing a massive amount of money even before it faces a huge onslaught of competition (and things will only get worse once it does), while its market cap tops that of Ford and nearly equals GM’s despite a $2.8 billion+ annualized net loss selling approximately 200,000 cars while Ford and GM make billions of dollars selling 6.6 million and 9 million cars respectively. Thus this cash-burning Musk vanity project is worth vastly less than its approximately $55 billion fully-diluted enterprise value and—thanks to its roughly $31 billion in debt and purchase obligations—may eventually be worth “zero.”