Forge First Asset Management commentary for the month ended August 31, 2018.

The Sui Generis Canada Partners LP fund was down -0.69% for the Class A Lead Series during August 2018, resulting in a year-to-date net return of 1.45% and since inception (March 1, 2015) cumulative net return of 10.98% (3.02% annualized).

Q2 hedge fund letters, conference, scoops etc

Forge First Asset Management August 2018 Commentary

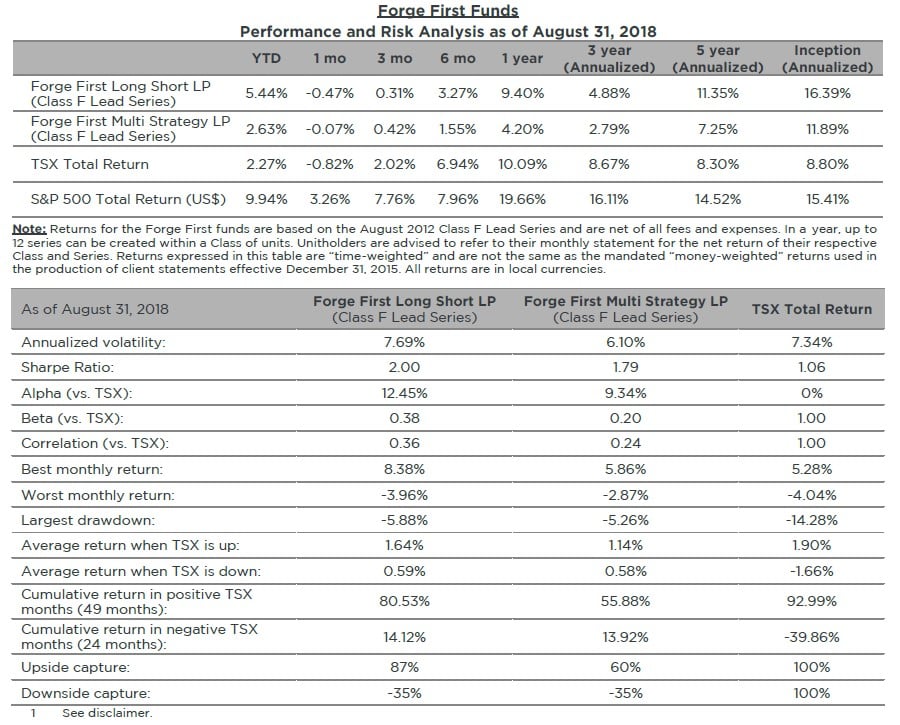

We like consistent performance at Forge First Asset Management, steadily growing client capital over time, featuring the occasional substantial up months but avoiding big down months. Delivering on that goal explains why our funds feature the solid risk metrics and Sharpe ratios shown in the table below that covers their 6+ year track record.

Our funds enjoyed several wins during the month in core long positions such as Parkland Industries (PKI.CA), Alphabet Inc. (GOOG.US), VISA Inc. (V.US), Enviva Partners LP (EVA.US), and GoEasy Ltd (GSY.CA) plus short positions that included CI Financial (CIX.CA) & Saputo Inc. (SAP.CA). However, losses in Parex Resources Inc. (PXT.CA) and Pure Multi-Family REIT LP (RUF-U.CA), combined with the impact on the portfolio of the Trans Mountain ruling on the 2nd last day of the month overwhelmed the positives, hence the modest losses that we posted. The 0.47% net loss in the Forge First Long Short LP Class F Lead Series (FFLSLP) cut the year to date & rolling 12 month net return for the lead series to 5.44% and 9.40% respectively. Our lower volatility fund, the Forge First Multi Strategy LP fell 0.07% net during August for the Class F Lead Series (FFMSLP), serving to trim the year to date and rolling 12 month net return to 2.63% and 4.20% respectively. Meanwhile, the total return for TSX fell 0.82% while the tech-heavy S&P 500 enjoyed a 3.26% return.

While we wrote about Parkland Industries last month, in the past we've also explained our rationale for featuring Parex Resources Inc. (“Parex”) as a top five holding in our funds. A consistent 20% year-over-year grower of production per share, this Brent-price-based, Canadian-domiciled but Columbian-focused oil producer continues to enjoy per barrel all-in netbacks comfortably in excess of US$40, explaining why we expect the company's net cash position to grow from its current US$125M to more than US$600M by the end of 2019.During the month of July, management initiated a process to review 'strategic repositioning alternatives', including a sale of the Company’s long life production assets and the retention of its exploration assets, as well as a potential corporate sale. Since the announcement, Parex shares have declined 20% as investors have questioned the timing and structure of the strategic review process. Parex is now trading at 2X taxed 2019 cash flow. Combined with the Company’s superb fundamentals, we believe the current price represents a buying opportunity. Of course it was management's decision to cease a strategic alternatives process at Pure Multi REIT LP (“Pure Multi”) that caused its shares to decline during August, however in our books this 'alternatives' saga is far from over. And just as we see great value in Parex, the shares of Pure Multi are trading below the intrinsic value implied by the solid fundamental outlook for their apartment holdings in Texas. Lastly, I must make mention of the decision that for now, has nixed the proposed expansion of the Trans Mountain oil pipeline.

While the Federal Court of Appeal's decision was a surprise to us, our funds held no securities whose outlook was directly dependent on a positive ruling. Our funds, did however own shares in natural gas oriented securities for reasons discussed in our April commentary from earlier this year and given the swift negative reaction in the price of natural gas-related securities, there's little question that investors extrapolated the negative Trans Mountain decision to the view that LNG Canada's project won't be going ahead either. At this juncture we believe this is a pretty aggressive assumption to conclude on LNG Canada. Anyway, in aggregate, for the FFLSLP for example, these puts and takes meant that our Energy book lost 158 bps during the month versus gains of 121 bps for the rest of our book. Viewed differently, the long book for the FFLSLP fell less than 1 bp, the opportunity cost of our index put spreads was 13 bps, and the short book cost generated a decline of 24 bps.

Looking ahead the principal macro driver of markets will continue to be the policy divergence between the U.S. & China. All else being equal, populist fiscal stimulus in America and ongoing structural reforms in China should combine to continue to generate less correlated patterns of global growth and a bid in the US dollar. This explains why U.S. stocks have outperformed all other equity markets. In turn, despite recent and modest style & sector rotations in North American equities, it's difficult to envision a significant shift from existing trends in the immediate future. Of course all bets are off if the U.S. mid-terms in November conclude with either the Democrats or the G.O.P. taking absolute control of Congress or if the current turmoil in specific emerging markets causes Chairman Powell of the FOMC to blink dovishly. In addition it goes without saying that a 'no NAFTA' deal or a full-on trade war with China would not be helpful for the pricing of risk assets.

However, while these events have served to hurt the price of grains and metals, the price of oil has continued to be strong. Strong demand for oil, affirmed by crack spreads, together with various supply challenges should keep oil in the high 60s, low 70s, in US dollars, as sour crude oil, the key crude for the countries that are driving marginal demand is in tight supply. Our homework suggests that all countries, except for Saudi Arabia which could add ~250,000 to its daily production, have exhausted their near term spare capacity. Meanwhile, based on trends seen during August, exports from Iran are on track to fall by approximately 1.6M/day during 2018, towards 1.2M/day by year end.

Amidst this macro noise, which makes it difficult for an investor to feel entirely comfortable, the continued strength in U.S. stocks appears to have put a 'floor' in the pricing of other developed market equity indices. Beyond growth & still supportive monetary policy, there's little question that earnings have been good in the U.S. and the forecast US$1T of buybacks is keeping a bid in stocks for now. But looking into 2019, I continue to maintain that the Federal Reserve will either make a policy mistake or the 'sugar high' driven growth and profit numbers will slow down. On that point, I'm noting a marked increase in the number of conversations I'm having with investors and advisors who are looking to add some defence to their portfolios, as they tell me that they don't believe the next few years in markets will be anything like the last few. That's why they're looking to incorporate alternative strategies in to their investment solutions at this point in the economic cycle. Specifically, funds that have a history of generating positive returns in down markets (negative downside capture ratios), low correlation, and lower volatility will serve investors well.

Please do not hesitate to reach out to us if you wish to learn more about how our strategies can complement and lower volatility in your investment portfolio. As always, we welcome any feedback, and for more information please visit our website at www.forgefirst.com.

Thank you,

Daniel Lloyd

Portfolio Manager

Andrew McCreath, CFA

President and CEO