Realty Trusts (or REIT’s) continue to remain popular among investors. Over 90% of REIT’s have higher dividend yields compared to the average S&P 500 company.

Realty Trusts to follow in 2018

Similar to stocks, REIT’s need to be held over a long period of time for them to generate substantial returns. Here are 10 REITs that gained 10% in 2018.

[REITs]Q2 hedge fund letters, conference, scoops etc

1. Arbor Realty Trust [ABR]

Arbor Realty Trust [ABR] is a REIT that engages in the provision of loan origination and servicing across senior housing, healthcare, multifamily, and commercial asset verticals.

ABR has a market cap of $2.4B and has gained over 50% in 2018, primarily driven by robust sales and earnings growth.

Which no doubt puts a smile on CEO Ivan Kaufman’s (pictured) face.

Dividend Yield: 9.5%

Total Gain: $800M

2018 % Gain: 50%

2. Apollo Commercial Real Estate Finance [ARI]

A mortgage REIT, ARI acquires and invests in commercial real estate mortgage loans, subordinate financings, and other real-estate debt instruments. ARI has a market cap of $2.4B and has gained 10.3% in 2018.

Even better, ARI has beaten analyst estimates in two of the last four quarters.

Dividend Yield: 9.5%

Total Gain: $225M

2018 % Gain: 10.3%

3. Blackstone Mortgage Trust [BXMT]

The Blackstone Mortgage Trust engages in originating senior loans collateralized by commercial real estate. This REIT aims to protect shareholder value and produce risk-adjusted returns through dividends.

BXMT has a market cap of $4B and has gained close to 11% in 2018. The share price has been driven upwards as BXMT managed to beat earnings estimates coupled with robust revenue growth.

Dividend Yield: 7.2%

Total Gain: $360M

2018 Return: 10.8%

4. Chesapeake Lodging Trust [CHSP]

The Chesapeake Lodging Trust manages and operates hotels. It has an enviable portfolio including The Royal Palm, Hyatt Regency, Le Meridien, JW Marriott, Hotel Adagio, Ace Hotel, Hilton Checkers, Homewood Suites, and Hotel Indigo.

In July 2018, CHSP closed the sale on the Hyatt Centric Santa Barbara, a 200-room hotel, for $90M. CHSP’s gained over 24% in market value in 2018 alone. It currently has a market cap of $2.02B (and growing).

Dividend Yield: 4.8%

Total Gain: $380M

2018 % Gain: 24.2%

5. CyrusOne [CONE]

CyrusOne owns, develops and operates enterprise-class, carrier-neutral, multi-tenant data center properties. This REIT provides mission-critical data center facilities to ensure continuous operations of IT infrastructure companies.

CONE has a market cap of $6.4B and has risen 15% in 2018. Last month, CONE closed the $440M purchase of Europe-based Zenium Data Centers. This expansion into Europe is expected to positively impact revenue for CONE.

Analysts expect CONE’s revenue to grow 22.4% in 2018 and 19% in 2019.

Dividend Yield: 2.8%

Total Gain: $830M

2018 % Gain: 15%

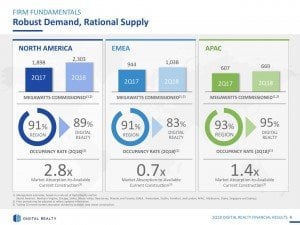

6. Digital Realty Trust [DLR]

Digital Realty Trust owns, acquires and manages technology-related real estate. It provides data center, colocation, and interconnection solutions. DLR is one of the largest REIT companies with a market cap of $26.4B.

DLR has gained close to 11% in 2018 and is expected to benefit from the global boom in cloud capital spending.

Dividend Yield: 3.3%

Total Gain: $2.4B

2018 % Gain: 10.9%

7. Education Realty Trust [EDR]

Education Realty Trust focuses on the acquisition and development of housing communities near university campuses.

It has a market cap of $3.3B and has risen 21.5% in 2018. EDR has an impressive earnings history that has driven shares of the REIT upwards.

In fact, EDR has beaten earnings estimates by 270% in Q2, 121% in Q1, a “slow” 28% in Q4’17 and 80% in Q3 2017. Growth spurt, anyone?

Dividend Yield: 3.8%

Total Gain: $591M

2018 % Gain: 21.5%

8. EastGroup Properties [EGP]

EastGroup Properties [EGP] acquires and operates industrial properties in the United States.

It currently has a market value $3.45B and is up 11.1% in 2018.

Its portfolio consists of distribution facilities in Florida, California, Texas, Arizona, and North Carolina.

Large dividend payouts from REIT’s continue to entice investors and EGP raised dividends by 12.5% in its latest quarter. EGP has in fact increased dividends for seven consecutive years now.

Dividend Yield: 2.6%

Total Gain: $341M

2018 % Gain: 11.1%

9. EPR Properties [EPR]

EPR Properties engages in the development and leasing of theatres and entertainment centers. With a market cap of $5.2B, EPS has risen almost 12% in 2018.

EPR’s revenue is estimated to rise 13.3% in 2018 and 5.4% in 2019. The stock is currently trading at $69.84, with a high analyst target estimate of $71—meaning there’s still room for growth.

Dividend Yield: 6.1%

Total Gain: $552M

2018 % Gain: 12%

10.Granite Point Mortgage Trust [GPMT]

Another mortgage REIT, Granite Point Mortgage Trust focuses on originating, investing and managing senior commercial mortgage loans and other debt for CRE investments.

Close to billionaire status, GPMT has a market cap of $828M and has seen 12.3% jump in 2018 to date.

Similar to other REITs in this list, GPMT has benefitted from encouraging revenue growth in 2018. Analysts expect revenue to rise 24% in 2018 and 18.5% in 2019.

Dividend Yield: 8.3%

Total Gain: $155M

2018 Gain: 12.3%

Follow WealthLAB on Facebook, Twitter and Instagram.