Spruce Point Capital Management is pleased to announce it has released the contents of a unique research report on Maxar Technologies, Ltd. (Nasdaq / TSX: MAXR) (“MAXR” or “the Company”) with a “Strong Sell” opinion and a long-term price target potential of 100%. Spruce Point has spent months conducting a critical forensic and fundamental analysis of the Company, formed through the acquisitions by MacDonald Dettwiler (“MDA”) of Space Systems Loral (“SSL”) in 2012, and DigitalGlobe (“DGI”) in 2017.

Q2 hedge fund letters, conference, scoops etc

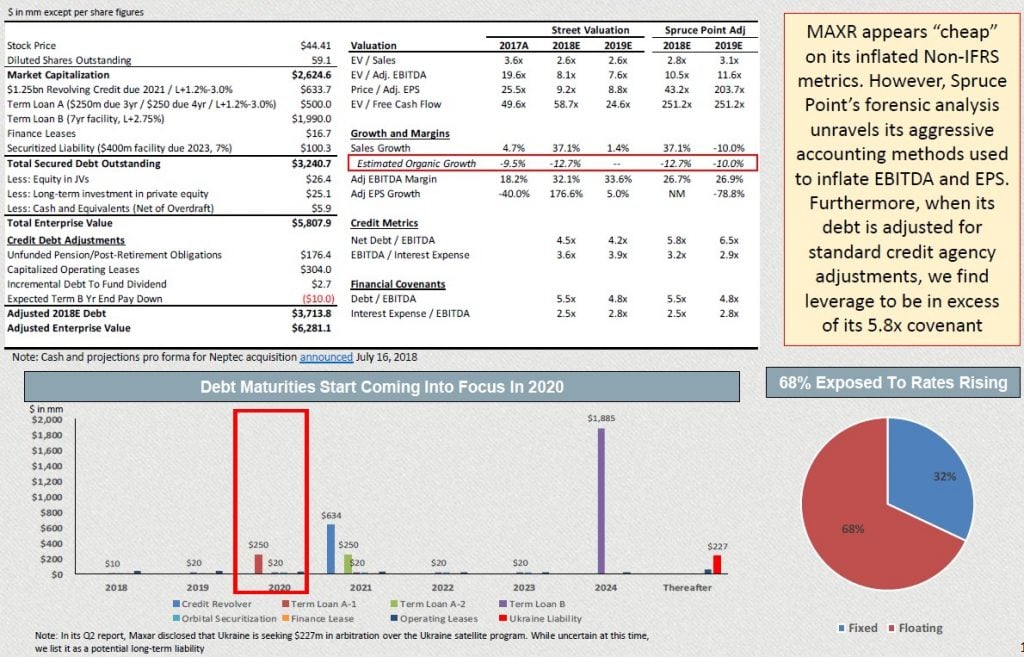

Based on our analysis, we provide compelling evidence that Maxar is out of cash, on a credit-adjusted basis will be in excess of its debt covenant by year end, perpetuating a brazen intangible asset inflation scheme to overstate EBITDA and EPS by approximately 17% and 79%, and must cut its dividend or face digging a hole deeper into debt. Maxar is run by Howard Lance, who came from NCR, a company Spruce Point successfully exposed in 2015, which fell 40% after a failed process run to maximize shareholder value. CEO Lance appears to have embellished his role as COO of the entire company, whereas his role was limited to the Retail and Financial Groups. Furthermore, Lance has obscured from his biography his leadership roles at two companies requiring financial restatement after admitting material financial control weaknesses. As a result, we see up to 100% downside in Maxar's shares, with an intermediate risk to $20.00-$25.00 per share (45%-55% downside)

- Strained by the levered acquisition of Space Systems Loral in 2012 at the cycle peak, MacDonald Dettwiler’s (MDA) acquisition of DigitalGlobe (DGI) in 2017 was done out of necessity to cover-up growing accounting and financial strains. Rebranded Maxar Technologies (MAXR), the combined company has pulled one of the most aggressive accounting schemes Spruce Point has ever seen to inflate Non-IFRS earnings by 79%. However, with end markets weakening, and burdened by $3.7 billion of rising debt with almost no cash and free cash flow, Maxar must eliminate its dividend immediately, or risk wiping out equity holders.

- CEO Howard Lance is a former Group COO/President of NCR, a successful Spruce Point campaign that fell 40% after we highlighted numerous accounting concerns, and it failed to find a buyer after a strategic process. He was also the Chairman of the Board at Change Healthcare Holdings through 2017 and Harris Stratex (Nasdaq: HSTX, now called Aviat Networks (AVNW)). Both companies blindsided investors when informing them that the financial statements could not be relied upon, and material weaknesses of controls existed

- Engaging In A Massive M&A Accounting Scheme To Cover Past Problems: In Feb 2017, management said it didn’t identify any material inconsistencies in DigitalGlobe’s financials between GAAP and IFRS. It then backtracked and revised financials that artificially inflated revenues by 4-6% and EBITDA by double digits. However, this is only the tip of the iceberg. We previously illustrated our concern that MDA appeared to be overcapitalizing costs by inflating intangible asset purchases. Thus, it came as no surprise to us when Maxar used the DigitalGlobe acquisition to inflate intangible assets even further. However, the $1.1 billion inflation was an order of magnitude that shocked us. MDA made reference to DigitalGlobe’s “world leading (satellite) constellation” as a strategic rationale of the acquisition – yet it impaired the satellite assets at deal closing, and inflated its intangible asset accounts by a commensurate $1.1 billion

- Numerous One-Time Gains Being Used, Some In A Non-Transparent Manner: It appears Maxar has accelerated recognition of investment tax credits, and amended its post-retirement benefit plan to book one-time gains. In the case of the benefit plan gain, Maxar booked a $24.6m gain in Q4’17 (flattering EBITDA by 13.5%), which was not fully disclosed across its investor communications, nor do we believe analysts have adjusted their models to account for it. As a result, we believe Maxar will have a large headwind in Q4’18 and disappoint

- Deleveraging Plan Is A Fantasy And The Dividend Must Be Eliminated: Maxar is claiming it will deleverage and drive higher cash flow, but the numbers tell a different story: leverage is rising and it appears it is out of cash by reporting cash overdrafts! In addition to a large interest expense and capex burden (which we believe will remain at $300m+/yr as opposed to declining per management), Maxar is committed to a $68m/yr dividend and must pay down $25m/yr of its Term Loan B. These means it has no excess cash flow to accelerate debt reduction. Maxar is borrowing money to pay the dividend. Maxar should immediately cut or eliminate the dividend and direct capital towards debt reduction

- Up To 100% Long-Term Downside On Normalized Financials: Maxar trades at 10.5x and 43x on our normalized 2018E Adj. EBITDA and EPS for a business we estimate is declining organically 12.7%, and dangerously levered 5.8x. Valued on its free cash flow, expected to produce $0-$50m, Maxar could be viewed as worthless. Using below industry average P/E and EBITDA multiples to reflect Maxar’s distressed state and specious financial statements, we estimate an intermediate trading range of $20.00-$25.00 per share (45%-55% downside)

Executive Summary

Meet Maxar Technologies Lemon + Lime = Lemon Aid

Spruce Point Believes Maxar Technologies (MAXR) Is A “Strong Sell” With 100% Downside Risk

Strained by the levered acquisition of Space Systems Loral in 2012 at the cycle peak, MacDonald Dettwiler’s (MDA) acquisition of DigitalGlobe (DGI) in 2017 was done out of necessity to cover-up growing accounting and financial strains. Rebranded Maxar Technologies (MAXR), the combined company has pulled one of the most aggressive accounting schemes Spruce Point has ever seen to inflate Non-IFRS earnings by 79%. However, with end markets weakening, and burdened by $3.7 billion of rising debt with almost no cash and free cash flow, Maxar must eliminate its dividend immediately, or risk wiping out equity holders.

Prelude To A Disaster: MacDonald Dettwiler’s Failed Levered Acquisition of Space Systems Loral (SSL)

Acquisition of SSL Poorly Timed: Acquired in 2012 when demand for geostationary satellites was robust, industry demand and backlog has dried up as orders decline as a result of new high-throughput satellites and low-earth-orbit (LEO) constellations coming online

Obfuscation of Gross Margins and R&D Costs: MDA never provided clear disclosures about its satellite manufacturing gross margins. R&D costs have been buried as footnotes in its intangible asset account disclosures. Recent disclosure of contract losses tied to engineering costs suggest percentage-of-completion accounting abuse, a common issue in the aerospace and defense industry

Signs To Suggest $50m/yr of Earnings Overstatement Through Aggressive Intangible Asset Capitalization: MDA’s dependency on intangible asset capex grew significantly, and it capitalizes a materially higher % as in-process technology than peers. Capex to depreciation is running at 2x now vs. SSL pre-acquisition by MDA

Cash Flow Issues: From 2012-2017 average adjusted free cash flow was $30m and includes periods where MDA reported bank overdrafts as a result of cash deficiencies. Rising orbital receivables and DSOs, conversion of accounts receivables into notes payable from customers, and a material increase of accounts receivables due past 90 days all signal financial strain

Rapid Management / Director Turnover: MDA’s CEO, audit committee chair, and chief technology officer at SSL all resigned leading up to its eventual hiring of new CEO Howard Lance, who has an unremarkable past in our opinion

Warning: Maxar’s New CEO Howard Lance Associated With Multiple Companies Requiring Financial Restatement

Lance’s Failures: Lance is a former Group COO/President of NCR, a successful Spruce Point campaign that fell 40% after we highlighted numerous accounting concerns, and it failed to find a buyer after a strategic process. He was also the Chairman of the Board at Change Healthcare Holdings through 2017 and Harris Stratex (Nasdaq: HSTX, now called Aviat Networks (AVNW)). Both companies blindsided investors when informing them that the financial statements could not be relied upon, and material weaknesses of controls existed

Dennis Chookaszian (MAXR Audit Chair through Feb 2018): Has served as a Director at Career Education (during FTC inquiry/restatement), Sapient (material weaknesses disclosed), and Prism (formerly Internet Patent Brands, a penny stock promote with delinquent filings)

Insiders Having Nothing At Risk: Ownership by insiders at MDA declined every year to virtually zero. Post the DigitalGlobe acquisition, insiders own a miniscule 0.50% of the stock, and have mislead investors about bonus compensation targets being tied to cash flow

Why MDA/DigitalGlobe > Maxar Technologies Appears To Be Complete Bust:

Already Failing To Hit Projections: MDA historically didn’t give guidance, but projections from the May 2017 proxy statement from the DigitalGlobe acquisition show the combined company has performed miserably, and is missing internal expectations

Engaging In A Massive M&A Accounting Scheme To Cover Past Problems: In Feb 2017, management said it didn’t identify any material inconsistencies in DigitalGlobe’s financials between GAAP and IFRS. It then backtracked and revised financials that artificially inflated revenues by 4-6% and EBITDA by double digits. However, this is only the tip of the iceberg. We previously illustrated our concern that MDA appeared to be overcapitalizing costs by inflating intangible asset purchases. Thus, it came as no surprise to us when Maxar used the DigitalGlobe acquisition to inflate intangible assets even further. However, the $1.1 billion inflation was an order of magnitude that shocked us. MDA made reference to DigitalGlobe’s “world leading (satellite) constellation” as a strategic rationale of the acquisition – yet it impaired the satellite assets at deal closing, and inflated its intangible asset accounts by a commensurate $1.1 billion

Nonsensical Earnings That Conveniently Ignore Acquired Intangible Expenses: By impairing a depreciable asset and inflating intangibles, Maxar claims its Non-IFRS measures should exclude acquired intangibles. In our opinion, MAXR’s 2018 Adj. EPS expectation of $4.75/sh is pure fiction. Maxar has made numerous aggressive accounting choices (now extending depreciable asset lives twice in Q1 and Q2’18 for the same satellites it visibly impaired) which inflate results. We estimate EBITDA and EPS are overstated by 17% and 79%, respectively

Numerous One-Time Gains Being Used, Some In A Non-Transparent Manner: It appears Maxar has accelerated recognition of investment tax credits, and amended its post-retirement benefit plan to book one-time gains. In the case of the benefit plan gain, Maxar booked a $24.6m gain in Q4’17 (flattering EBITDA by 13.5%), which was not fully disclosed across its investor communications, nor do we believe analysts have adjusted their models to account for it. As a result, we believe Maxar will have a large headwind in Q4’18 and disappoint

Abrupt CFO Departure A Bad Omen, New CFO Tainted: In February 2018, CFO William McCombe abruptly resigned less than 10 days before the March 2018 Investor Day. Former MDA CFO Wirasekara was appointed interim CFO until announcing Biggs Porter would join as CFO in July. Biggs is currently the subject of a shareholder lawsuit for his role as CFO at Fluor Corp where it’s claimed he misled investors

DigitalGlobe A Ticking Time Bomb, Bull Case Likely To Disappoint: Maxar’s bull case for DigitalGlobe is predicated on two pillars:

1). Its contract with the National Geospace Agency (NGA) is priced too cheaply and is due for a price increase, and

2). There’s a huge opportunity for DGI outside of the U.S. government. Our work completed to date suggests both pillars seem unrealistic: it appears that DigitalGlobe is more likely to see prices decreases on the NGA contract and opportunities outside of the U.S. government seem limited, and have never lived up to expectations dating back to DigitalGlobe’s IPO

The Case For Maxar Being Worthless And Bankruptcy Bound:

Management Has Lost Credibility With Analysts: The current street consensus projections are well below management’s combined company projections filed in the deal proxy statement a year ago in June 2017. Prior to filing the projections, management touted it had a strong order backlog, and great long-term revenue visibility. Yet, we estimate YTD -12.7% organic revenue decline at MDA

Management Has Lost Credibility With Investors: DigitalGlobe’s U.S. investors received stock in Maxar and owned ~34% at closing. When looking at the pro forma shareholder base today, it is evident that DigitalGlobe investors have not embraced the acquisition and have been heavy sellers of the stock, while Canadian investors remain cheerfully optimistic

Yet Street Analysts Are Still Too Optimistic, Seeing 37% Upside: Hope springs eternal. Not surprisingly, the majority of analysts are “Buy” on Maxar’s stock, even though management’s projections have proven overly optimistic and it has used blatantly aggressive accounting to bolster results. Most of Maxar’s analysts remain legacy Canadian brokers from its days as MDA, and we don’t believe they have an appreciation for DigitalGlobe’s pending struggles. We expect a substantial re-rating lower in the share price once they realize that Maxar’s “earnings” are really just accounting magic

Deleveraging Plan Is A Fantasy And The Dividend Must Be Eliminated: Maxar is claiming it will deleverage and drive higher cash flow, but the numbers tell a different story: leverage is rising and cash overdrafts are being reported! In addition to a large interest expense and capex burden (which we believe will remain at $300m+/yr as opposed to declining per management), Maxar is committed to a $68m/yr dividend and must pay down $25m/yr of its Term Loan B. These means it has no excess cash flow to accelerate debt reduction. Maxar is borrowing money to pay the dividend. Maxar should immediately cut or eliminate the dividend and direct capital towards debt reduction

Covenant Breach Possible, $2bn Goodwill and Intangible Impairment Looms: Based on accepted analytical credit adjustments made by Maxar’s rating agency Moody’s, and reasonable year end projections, we estimate Maxar’s leverage of 5.8x will effectively exceed its leverage of 5.5x covenant by year end. On June 2018, Maxar was downgraded to B1/stable (and is BB negative by S&P)

Newly Disclosed $227m Damages Sought By Ukraine: For the first time in Q2’18, Maxar disclosed a Ukrainian customer filed its statement of claim in connection with an arbitration seeking recovery from the Company under a contract in the amount of approximately $227 million. Given Maxar’s strained liquidity, an adverse judgement could be a material adverse event in a worst case

Up To 100% Long-Term Downside On Normalized Financials: Maxar trades at 10.5x and 43x on our normalized 2018E Adj. EBITDA and EPS for a business we estimate is declining organically 12.7%, and dangerously levered 5.8x. Valued on its free cash flow, expected to produce $0-$50m, Maxar could be viewed as worthless. Using below industry average P/E and EBITDA multiples to reflect Maxar’s distressed state and specious financial statements, we estimate an intermediate trading range of $20.00-$25.00 per share (45%-55% downside)

Adjusted Capital Structure And Valuation of Maxar

Read the full article here by Spruce Point Capital Management