Coming into 2018, investor expectations were high given the strong equity returns experienced in the prior year. After equities had one of the best starts in January in decades, rising interest rates and the White House’s tendency for trade protectionism surfaced to dampen risk appetite. Following a correction, and more volatility, the S&P 500 has risen in a choppy fashion to reclaim the highs of January.

Q2 hedge fund letters, conference, scoops etc

So what drives the market the rest of the year? Investors should watch the following important catalysts for the remainder of the year:

Third-Quarter Peak Earnings Season: October

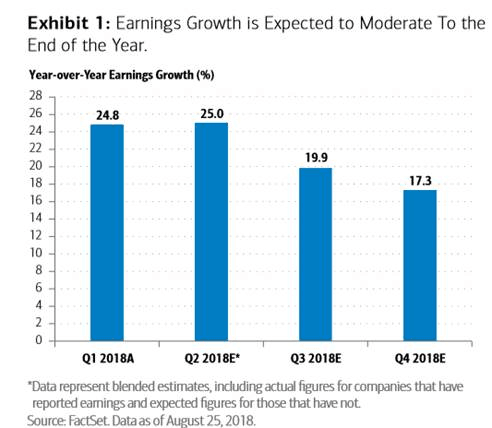

So far for the second quarter, earnings and revenue growth are tracking 25% and 10%, respectively, according to FactSet, a strong follow-up from Q1, suggesting the benefit of tax cuts and strong underlying growth in the economy. The three month earnings estimate revision ratio for the S&P 500 has moderated, but remains solid at 1.36, with companies across most sectors seeing more earnings estimate upgrades than downgrades. Earnings growth is expected to moderate through the rest of the year but remain solid, with third-quarter earnings expected to grow nearly 20% (Exhibit 1), which if realized will reaffirm that, even amid ongoing trade tensions, the fundamentals of corporate America remain intact.

The Q3 earnings numbers will provide more information on the durability of profit margins, amid rising cost pressures, and guidance, especially on the health of the consumer. We continue to believe that strong corporate earnings will remain the foundation for equities to grind higher toward our top-end 3,000 price target for the S&P 500.

Central Banks And Tightening Financial Conditions: September - December

With inflation rising in the U.S. toward the Federal Reserve’s (Fed’s) target and Japan and Europe lagging behind, global central bank policy will be a key development for the rest of the year. The median Federal Open Market Committee (FOMC) forecast for the federal funds rate implies two more hikes for the remainder of 2018, which is in line with market expectations, and another three hikes in 2019. Investors will look for implicit or explicit guidance following the September 25–26, November 7–8 and December 18–19 meetings on future hikes. A pause by the Fed will soften the dollar’s rise, potentially boosting global equities, especially beaten-down EMs.

On the downside, as the Fed continues to raise interest rates, the yield curve could steady or flatten further, and risks for the dollar remain to the upside, while late-cycle pressures on profit margins could push credit spreads higher. A rapid tightening of financial conditions would be a negative catalyst for markets.

While central bank policy outside the U.S. is currently viewed as accommodative, the run-up in U.S. and European bond yields ahead of the latest Bank of Japan (BoJ) meeting shows that markets are sensitive to even the potential for more hawkish actions. Investors will be monitoring developments as the European Central Bank plans to end its asset purchase program at the end of the year while the BoJ remains committed to yield curve control and a negative policy rate. Any hawkish change in forward guidance could be a negative catalyst, causing a pickup in bond yields and downward pressure on equities. Investors should monitor meetings on September 18–19, followed by October 30– 31 and December 19–20 for the BoJ and September 13, followed by October 25 and December 13 for the ECB for developments.

Evolving Trade Discussions

Trade tension has been an overhang for U.S. equities, remaining a source of episodic volatility that we expect to persist through the end of the year. While the announced tariffs are not large enough to offset the positive impact from fiscal stimulus and good underlying growth, the impact on global supply chains is much harder to assess due to their sheer complexity. We believe that any de-escalation of trade hostilities could drive equities higher. Planned meetings between President Trump and President Xi Jinping this November,1 in addition to potential meetings between President Trump and European Commission President Jean-Claude Juncker, will be closely watched for signs of common ground.

Following extensive bilateral negotiations between the U.S. and Mexico on North American Free Trade Agreement (NAFTA), reports now indicate the two sides have reached a preliminary deal; alleviating some of the uncertainty faced by businesses surrounding trade and supply chains between the two countries.2 We feel that the potential for Canada to return to the negotiations would be a positive signal for the prospects of a more comprehensive deal and could support investor sentiment.

U.S. Midterm Elections: November 6

Markets will be closely watching the upcoming midterm elections as shifts in the balance of power in Washington could have meaningful implications for fiscal policy and foreign relations. The president’s party has historically not fared well during midterm elections, and the results could affect the likelihood of certain pro-growth measures such as the so-called Tax Reform 2.0, which could include making individual tax cuts permanent and create new incentives for retirement savings and research and development. But even amid conflict, both sides of the aisle have achieved some consensus on trade, suggesting that Congress may be able to collaborate on ways to alleviate some of the near-term headwinds from protectionism (see August 13 Capital Market Outlook “U.S. Midterms: A Guardrail of Sorts”). Risk assets are usually choppy heading into midterm elections, but tend to rally strongly thereafter.

Political Risk In Italy: September - October

Political risk will bear watching across Europe amid increased populist pressure and anti-European Union (EU) rhetoric. Political developments in Italy moved to the forefront in May following the release of a coalition document between the Five Star Movement and the League, which called for items such as a flat tax and a basic income for the nation’s poor. Given that Italy’s populist government doesn’t share Brussel’s views on supply-side reforms and controlling deficits, discussions are likely to be contentious and move markets.

The government is reportedly set to form its public finance targets in September and submit a drafted budget to the European Union in October. This, along with upcoming credit rating reviews from Fitch, Moody’s and S&P, will be a closely watched market event with downgrades likely to pressure Italian bond yields higher. As the European Union’s fourth largest economy in dollar terms, with government debt standing at 132% of gross domestic product (GDP), tension in Italy remains a negative catalyst for the rest of 2018.

Where Should We Go From Here?

For the rest of the year, a de-escalation in trade rhetoric and an indication that the Fed may pause on its rate hike path could boost beaten-down EM assets as well as underperforming global cyclicals like industrials. On the flip side, a deteriorating trade outlook and more hawkish action by the Fed, along with a further spike in the U.S. dollar, could further pressure EMs and trigger a rotation into defensive equities and bonds. Our base case remains that global equities should continue to outperform fixed income through the balance of 2018. U.S. equities may continue to exhibit volatility as financial conditions tighten, but should grind higher. This bull (market) is old but still fit given positive corporate earnings and a reasonable valuation and sentiment backdrop.

Article by Niladri Mukherjee, Head of CIO Portfolio Strategy

1 “U.S., China Plot Road Map to Resolve Trade Dispute by November,” The Wall Street Journal (August 17, 2018).

2 “U.S. and Mexico Agree to Preliminary Nafta Deal”–The New York Times (August 27,2018).

IMPORTANT DISCLOSURES This material was prepared by the Chief Investment Office (CIO) and is not a publication of BofA Merrill Lynch Global Research. The views expressed are those of the CIO only and are subject to change. This information should not be construed as investment advice. It is presented for information purposes only and is not intended to be either a specific offer by any Merrill Lynch or U.S. Trust entity to sell or provide, or a specific invitation for a consumer to apply for, any particular retail financial product or service that may be available. Global Wealth & Investment Management (GWIM) is a division of Bank of America Corporation. Merrill Lynch Wealth Management, Merrill Edge®, U.S. Trust, and Bank of America Merrill Lynch are affiliated sub-divisions within GWIM. The Chief Investment Office, which provides investment strategies, due diligence, portfolio construction guidance and wealth management solutions for GWIM clients, is part of the Investment Solutions Group (ISG) of GWIM. Investing involves risk, including the possible loss of principal. No investment program is risk-free, and a systematic investing plan does not ensure a profit or protect against a loss in declining markets. Any investment plan should be subject to periodic review for changes in your individual circumstances, including changes in market conditions and your financial ability to continue purchases. Economic or financial forecasts are inherently limited and should not be relied on as indicators of future investment performance. It is not possible to invest directly in an index. Asset allocation, diversification, dollar cost averaging and rebalancing do not ensure a profit or protect against loss in declining markets. Dollar cost averaging involves continual investment in securities regardless of fluctuating price levels; you should consider your willingness to continue purchasing during periods of high or low price levels. Past performance is no guarantee of future results. Investing in fixed-income securities may involve certain risks, including the credit quality of individual issuers, possible prepayments, market or economic developments and yields and share price fluctuations due to changes in interest rates. When interest rates go up, bond prices typically drop, and vice versa. Income from investing in municipal bonds is generally exempt from Federal and state taxes for residents of the issuing state. While the interest income is tax-exempt, any capital gains distributed are taxable to the investor. Income for some investors may be subject to the Federal Alternative Minimum Tax (AMT). Investments focused in a certain industry may pose additional risks due to lack of diversification, industry volatility, economic turmoil, susceptibility to economic, political or regulatory risks and other sector concentration risks. Investments in real estate securities can be subject to fluctuations in the value of the underlying properties, the effect of economic conditions on real estate values, changes in interest rates, and risks related to renting properties, such as rental defaults. Nonfinancial assets, such as closely-held businesses, real estate, oil, gas and mineral properties, and timber, farm and ranch land, are complex in nature and involve risks including total loss of value. Special risk considerations include natural events (for example, earthquakes or fires), complex tax considerations, and lack of liquidity. Nonfinancial assets are not suitable for all investors. Always consult with your independent attorney, tax advisor, investment manager, and insurance agent for final recommendations and before changing or implementing any financial, tax, or estate planning strategy. Investments in tangible assets are highly volatile and are speculative. There are special risks associated with an investment in commodities, including market price fluctuations, regulatory changes, interest rate changes, credit risk, economic changes, and the impact of adverse political or financial factors. Alternative Investments such as private equity funds, can result in higher return potential but also higher loss potential. Changes in economic conditions or other circumstances may adversely affect your investments. Before you invest in alternative investments, you should consider your overall financial situation, how much money you have to invest, your need for liquidity, and your tolerance for risk. Neither Merrill Lynch, U.S. Trust nor any of their affiliates or advisors provide legal, tax or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions. The investments discussed have varying degrees of risk. Some of the risks involved with equities include the possibility that the value of the stocks may fluctuate in response to events specific to the companies or markets, as well as economic, political or social events in the U.S. or abroad. Bonds are subject to interest rate, inflation and credit risks. Investments in high-yield bonds may be subject to greater market fluctuations and risk of loss of income and principal than securities in higher rated categories. Investments in foreign securities involve special risks, including foreign currency risk and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are magnified for investments made in emerging markets. Investments in a certain industry or sector may pose additional risk due to lack of diversification and sector concentration. Investments in real estate securities can be subject to fluctuations in the value of the underlying properties, the effect of economic conditions on real estate values, changes in interest rates, and risk related to renting properties, such as rental defaults. There are special risks associated with an investment in commodities, including market price fluctuations, regulatory changes, interest rate changes, credit risk, economic changes and the impact of adverse political or financial factors. Income from investing in municipal bonds is generally exempt from federal and state taxes for residents of the issuing state. While the interest income is tax exempt, any capital gains distributed are taxable to the investor. Income for some investors may be subject to the federal alternative minimum tax (AMT). © 2018 Bank of America Corporation. All rights reserved.