Last week, we introduced the topic of the Trump administration’s decision to implement sanctions on Iran and covered two potential responses from Iran, which were restarting its nuclear program and projecting power. This week, we will discuss the threat to the Strait of Hormuz.

Q2 hedge fund letters, conference, scoops etc

Response #3: Closing the Strait of Hormuz

On its face, it seems somewhat illogical for Iran to close the Strait of Hormuz to oil traffic because it would not only prevent the Gulf States and Iraq from exporting oil, but it would prevent Iran from doing so as well. As a result, we believe that Iran would only take this step if sanctions were so effective as to nearly end Iranian oil exports. Thus, Iran would have to be in dire “straits” before taking this step.

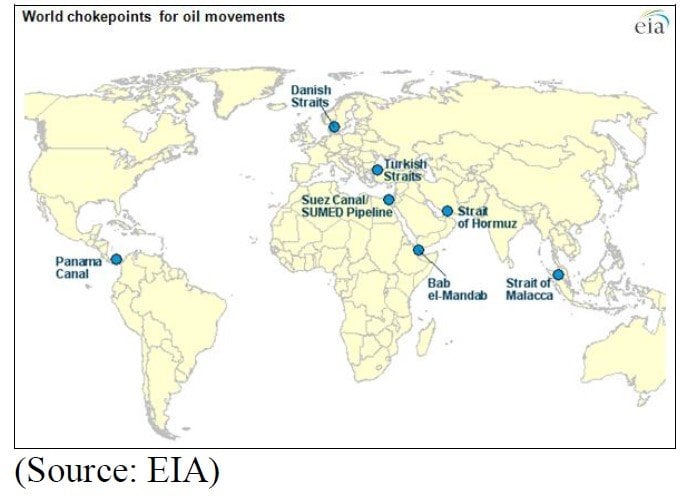

The world has several recognized oil flow “chokepoints” where there is the potential for a disruption of oil flows.

As the global superpower, one responsibility of the U.S. is to secure the world’s sea lanes to support global trade. As this map shows, there are numerous points where oil trade could be affected by blockades. In terms of volume, the two most critical are the Strait of Hormuz, through which about 18.5 mbpd and products pass, and the Strait of Malacca, which sees about 16.0 mbpd of energy traffic. Much of the oil, refined product and LNG produced in the Middle East passes through the Strait of Hormuz. Energy destined for the Far East moves through the Strait of Malacca, while flows to the Western Hemisphere and Europe either pass through the Suez Canal and the SUMED pipeline or the Cape of Good Hope.1 Disruptions to the latter group would tend to have more severe regional effects, whereas disruption to the Strait of Hormuz would affect global energy supplies.

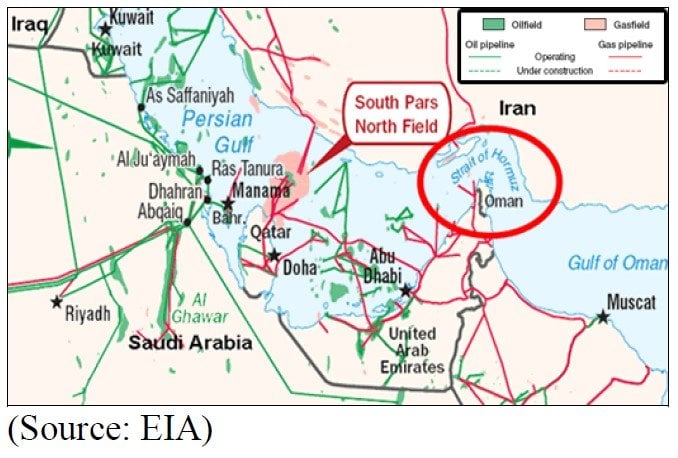

The northeast shore of the Strait of Hormuz is Iranian territory. Iran has the proximity to impede shipping through this strait. As the map below shows, the strait is narrow; at its narrowest point, it is a mere 21 miles across. The shipping lane is even narrower; it is only two miles wide in each direction, with a two-mile buffer separating the shipping lanes.

There are three ways in which Iran can affect shipping in the Strait of Hormuz. First, Iran has a small navy which includes three Kilo-class diesel submarines, four frigates, two corvettes, 32 missile boats and a large number of small patrol-type boats. Although most of these vessels are under the command of the Iranian Navy, some of the missile boats and smaller craft are part of the Iranian Republican Guard Corps Navy.2

These vessels could attack Persian Gulf shipping but would be no match for the U.S. 5th Fleet, whose area of operations includes the Middle East. Iran’s traditional navy does not possess any capital ships. Capital ships are large naval assets; the current example is an aircraft carrier. Pre-WWII, battleships fulfilled that role. Due to these limitations, the Iranian navy generally operates in the Persian Gulf and the Gulf of Oman.

Since the Iranian Revolution, Iran’s power projection has mostly used asymmetric tactics. Iran realizes that it will never have a powerful enough regular military to take on the United States in a conventional war. Instead, it has focused on projecting power through guerrilla tactics, terrorist acts and cyberattacks, all using irregular and paramilitary forces. Its naval activities follow a similar doctrine. For example, in the past Iran has executed attacks using “swarms” of small boats equipped with machine guns and small missiles. Such vessels can harass commercial and military ships in the close quarters of the Strait of Hormuz and act as an obstacle for traffic.

The second way Iran can disrupt shipping is through naval mining. It is estimated that Iran possesses between 2,000 and 3,000 naval mines. The range of sophistication is rather broad; some were manufactured by North Korea using Russian designs from 1908 or 1926.3 Both are moored mines that explode on contact with a ship. At least half may be of a more modern vintage that can detonate based on acoustics, magnetics or water pressure.4 The older mines cannot be laid by submarines, but the newer ones can.

Mining the Strait of Hormuz could be very effective in closing off shipping in the Persian Gulf. However, the U.S. is also acutely aware of this threat. Therefore, if Iran wanted to deploy mines it would be difficult to hide that fact. Accordingly, if Iran were to decide to mine the strait it would need to move quickly and decisively because once the U.S. 5th Fleet discovers Iran using mine-laying tactics the U.S. would likely view it as an act of war and respond accordingly.

Caitlin Talmadge,5 a professor at George Washington University, wrote a seminal paper on Iran’s options for closing the Strait of Hormuz.6 She estimates that if Iran uses an aggressive program of mine-laying and is willing to accept losses from American attacks, it could probably drop around 700 mines.7 Her analysis estimates that it would take about a month to clear enough mines for full shipping to resume.8 However, that estimate assumes minesweeping assets can operate without being attacked by Iran. If the U.S. cannot protect minesweeping vessels and aircraft, the time required to secure the strait would increase.

Third, Iran has anti-ship cruise missiles (ASCM), which it can launch from its cruisers, aircraft or land-based mobile platforms from shore. Because of the wide variety of missiles, it is difficult to know for sure what Iran’s inventories look like but a conservative estimate is that the country possesses several hundred ASCMs and a few dozen batteries.9 Iran also has other land-based anti-ship missiles10 and may have Russian-designed ship-launched cruise missiles11 acquired from Ukraine.

There are generally two types of guidance systems for the missiles Iran has in its inventory. The first is “line of sight” radar, which means the shooter can only hit what it can see.12 Essentially, such guidance systems use radio waves that move in straight lines. They cannot follow the curvature of the earth so this limits the distance from their target where they can be deployed. For such guidance systems, the ability to strike at shipping in the strait is a calculation of height and distance. For example, at sea level, assuming a target of 10 meters high (32.8 feet), a shooter can only see a target 10 kilometers (6.6 miles) away. At 30 meters high, the line of sight rises to 35 kilometers (21.7 miles). Iran’s topography does reduce the potential effectiveness of line of sight radar. The coastal areas are too flat to provide enough elevation for distance attacks and the elevated areas are also craggy, reducing the targeting width.13

Iran could overcome some of the deficiencies of line of sight targeting by using spotters to “paint” a target. Any surface vessel could perform this task; so, an Iranian fishing boat could be used for this purpose. However, using spotters does require a good deal of coordination between the targeting vessel and the missile’s fire control.14 There is always a risk that these spotters could be compromised.

Iran’s over-the-horizon capabilities are somewhat constrained because cruise missiles fly low to the ground and ground clutter and uneven terrain can interfere with flight. The problem is known as “clobbering.”15 The U.S. overcomes this obstacle by using detailed topography maps in the guidance system. It is unlikely that Iran has developed such data and thus may not be able to use the full radius of the missiles within its arsenal.16

Still, with all these obstacles, Iran does have enough missiles to threaten shipping in the strait…for a while. However, each time a missile battery turns on its radar to target a ship, the U.S. military will home in on that battery and attempt to destroy it. Thus, Iran can fire often, cutting off shipping in the strait for a week or two, or it can fire sporadically, keeping fear levels elevated but not hitting every ship trying to “run the blockade.” The latter tactic would extend the life of the threat. Although Iran does have some mobile launchers, the land area around the Strait of Hormuz isn’t well developed, meaning there aren’t many roads to use. In addition, the U.S. has increased its drone fleet and space reconnaissance assets, which will improve targeting response.

The key unknown is how long it would take the U.S. to reduce the threat of cruise missiles to shipping. As noted above, much of the targeting information is dependent upon how often Iran would launch against vessels in the strait. Talmadge estimates that if Iran deploys 36 batteries, launching once daily, and the U.S. has a 50% success rate in striking these batteries, then Iran would have the capability to disrupt shipping for 72 days.

However, shipping in the strait would not be without defenses from missiles. The Aegis weapons system allows U.S. cruisers and destroyers to track and respond to multiple threats simultaneously.17 The system includes missiles (SM-218) designed to destroy incoming anti-ship missiles. These vessels are also equipped with electronic jamming devices and a close-quarters machine gun system (the Phalanx system19), which fires a wall of lead at the incoming missile.

The last element within Iran’s potential arsenal to threaten shipping in the Strait of Hormuz is the country’s air force. Part of the U.S. ability to clear mines and eliminate the threat of missile attacks requires some degree of air superiority. Although Iran’s aging air fleet isn’t a significant threat to U.S. warplanes, Iran reportedly has the S-300 anti-aircraft system. This is a formidable system, built by Russia. Although this system is a significant upgrade, it isn’t known whether Iran has developed the ability to integrate this system into a workable air defense. In addition, it appears that the S-300 may be less effective against stealth aircraft, such as the F-35 and F-22. Having this system may introduce some caution into U.S. war planning but it probably will do no more than slow America’s ability to dominate the airspace.

In summary, if Iran decides to try to close the Strait of Hormuz and is able to mine the area relatively unimpeded and is judicious with its use of anti-ship missiles, it is conceivable that shipping could be adversely affected for, at most, one to two months. That doesn’t mean that no tankers will make it through, but there will almost certainly be reduced traffic. Pipelines would offset some of the lost shipping. Saudi Arabia and the UAE have built pipelines that send oil around the Strait of Hormuz or to the Red Sea, which would avoid the bottleneck caused by the Strait of Hormuz.

The capacity of these pipelines is 7.1 mbpd, of which about 4.0 mbpd is unused. That unused capacity still pales in comparison to the roughly 18.5 mbpd of normal shipping that passes through the strait, but it does mean that not all oil flows would be completely impeded. In addition, with time, demining and reducing the threat from missiles would allow for a gradual recovery in flows. Of course, to encourage shippers to take such risks, higher prices will almost certainly follow.

There are two other additional risks to blocking the Strait of Hormuz. First, anytime military actions occur, the potential for escalation rises. If Iran were to successfully damage or sink a U.S. warship, the calls for a wider war against Iran would intensify. This risk is elevated under the current administration. National Security Advisor John Bolton, Secretary of State Michael Pompeo and Secretary of Defense James Mattis are all well-known Iran hawks. Bolton and Pompeo are on the record pressing for regime change in Iran. It is likely they would be predisposed to escalation. A broader war in the region would tend to lift prices.

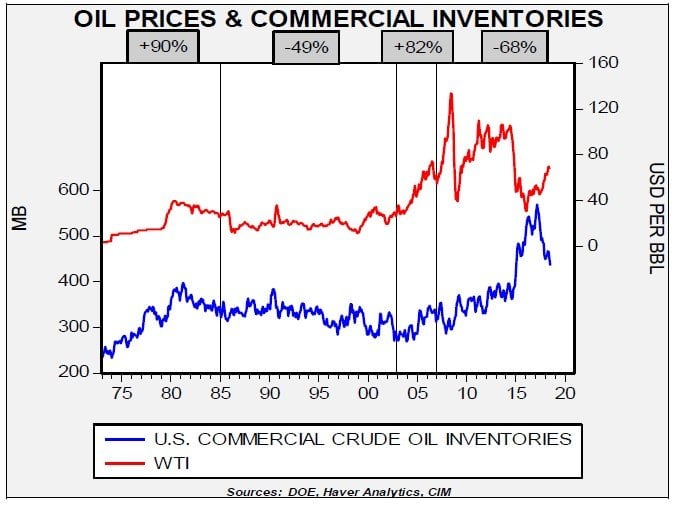

The second issue is hoarding. Although the usual relationship between oil prices and inventories is inverse, buyers search for security of supply under conditions of perceived scarcity and will bid up the price in order to acquire oil.

This chart shows the relationship between U.S. commercial crude oil inventories and West Texas Intermediate crude oil prices. We have put the correlation statistics above each of the periods. During the 1970s into the mid-1980s, the oil market was plagued with a series of supply events, including the Arab Oil Embargo in 1973, the Iranian Revolution in 1979 and the Iran-Iraq War in 1980-88. This led to a positive correlation between oil prices and inventories. After Saudi Arabia ended its swing producer role in 1985, the correlation turned negative, although there were periods when prices rose with inventories, such as the Gulf War in 1990-91. From 2003 to 2007, China’s insatiable demand for oil tightened supplies and led to a strong positive correlation between prices and stockpiles. We are currently in a period of mostly inverse relations.

Prices would likely rise if we see an attempt by Iran to block the Strait of Hormuz. The degree and length of the increase would be sensitive to the success of the U.S. Navy and Air Force in securing the region to resume oil traffic. However, such an event would also trigger hoarding behavior and likely lift prices further. The U.S. and the OECD nations plus China would likely try to reduce hoarding tendencies through a well-telegraphed and coordinated release of oil supplies from the national Strategic Petroleum Reserve (SPR). However, there are risks to a reserve release. It has been years since oil has been released in any significant quantity and it is possible that the storage facilities may not work as planned. We note the Energy Department is conducting a study to determine how to manage the SPR as the government plans to reduce the size by 290 mb (it’s currently 665.5 mb) by 2027. The Energy Department notes that the system is over 40 years old and admits that pipelines, pumps and valves need to be replaced. The bottom line is that if an emergency withdrawal is required we may find that less oil is available than expected. That finding would, of course, lead to even more hoarding. Although the U.S. would eventually prevail in opening the Strait of Hormuz for shipping, a spike in prices that lasts several months is likely if the improbable event of a closure occurs.

Part III

Next week, we will conclude with a discussion on the potential for Iran to deploy a cyberattack against the U.S. along with the possibility that Iran uses allies to end sanctions and the likelihood that Iran would enter into direct negotiations with Washington. In the final segment, we will conclude with market ramifications.

Bill O’Grady