Arquitos Capital Management commentary for the second quarter ended June 30, 2018.

Q2 hedge fund letters, conference, scoops etc

The truth is cruel, but it can be loved, and it makes free those who have loved it. - George Santayana

Dear Partner:

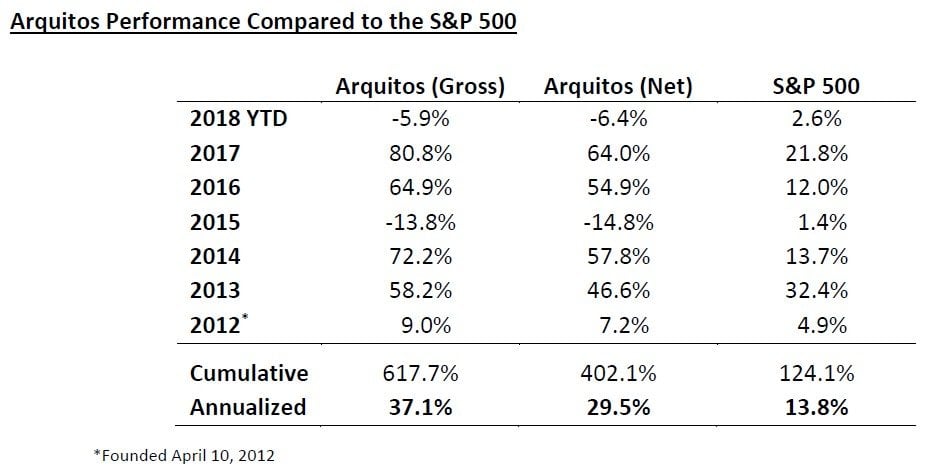

Arquitos returned 3.0% net of fees in the second quarter of 2018, bringing the year-to-date return to -6.4%. Our annualized net return since the April 10, 2012 launch is 29.5%. Please see page four for more detailed performance information. Individual performance may vary.

We will be holding our annual investor dinner in New York City on Monday, September 10. Current investors will be receiving invitations with additional details shortly. We will also have a limited number of seats available for prospective investors. If you are a prospective investor and are interested in learning more, please let us know.

The Danger of Crowds

Thousands of years ago, before the use of horses, Native Americans utilized a hunting technique that preyed on animalistic instincts. This technique was called the buffalo jump. Hundreds of buffalo could be killed at a time without the use of weapons.

Tribesmen would set up a path lined with piles of rocks and tree stumps, creating a “road” towards the cliff. Hunters would then frighten a lead buffalo in a herd onto the path and cause a stampede.

Stampedes are not unique to buffalo and happen with humans as well, even today.

Psychological stampedes are more widespread than physical stampedes, though. The dot com bubble was a psychological stampede. The run-up in housing prices prior to 2008 was a psychological stampede. So were Beanie Babies, the Salem witch trials, tulips, the nifty-fifty, and too many more examples to list.

Stampedes (or bubbles or manias) are a staple of human nature. We have a fear of missing out. We are greedy and fearful. Like the buffalo, we feel safer in the crowd. As Keynes has said, “Worldly wisdom teaches that it is better for reputation to fail conventionally than to succeed unconventionally.”

Sometimes it takes courage simply to be a bystander. We don’t have to be Michael Burry betting against sub-prime mortgages. During the housing bubble, we could have succeeded by simply sitting it out, not investing in lenders, homebuilders, and other ancillary businesses, staying away from AIG, Lehman Brothers, Bear Stearns. If we can be the hunter, then great, but we can also win by not being the prey.

How does that apply to our portfolio? I avoid companies in industries that attract risk-takers. It is very difficult for a company to go bankrupt if they don’t have debt, so I avoid margin leverage in the portfolio, and I avoid companies that rely on debt.

As a passive owner in a business, we want the decision-maker at the company to like vanilla ice cream and The Andy Griffith Show, and we want him or her to drive a Toyota Corolla. The more boring the better. Sure, we can get rich riding along with a daredevil, but how would we know when to get off the ride? We know compounding works in our favor, so why take the risk?

Ideal CEOs for us are people like Brian Moynihan at Bank of America and Mike Falcone at MMA Capital. Both are focused on creating long-term value for their shareholders and not taking unnecessary risks. Ironically, it be unconventional to be a boring CEO!

There is both wisdom and madness in crowds. The point is to be thoughtful about who we follow, what companies we own, and how we go about making decisions. Without that thoughtfulness, we would have no chance of beating the markets.

Portfolio Update

Our three largest positions remain Sitestar/ENDI (SYTE), MMA Capital (MMAC), and Westaim (WED.V). Each of the companies has been a long-term holding and I remain confident in their future prospects.

Over the last two months, I have initiated small positions in three new companies. I am actively buying one of the three companies and will disclose it if it becomes a sizeable piece of the portfolio. The company has low debt levels, high insider ownership, a strong capital allocator at the helm, and should trade two to three times higher than where it currently trades. The company also has been actively repurchasing shares. These are all characteristics that I like, and this new company fits into the portfolio nicely.

Sitestar Update

FINRA approved Sitestar’s name change and reverse stock split requests on July 23. The new name of the company is Enterprise Diversified, Inc. I will refer to the company by its nickname, ENDI. If you are following along, the ticker symbol will remain SYTE. However, it will trade as SYTED for the first 20 business days after July 23.

The name change and reverse stock split highlight the progress that the company has made since we took control nearly three years ago. ENDI’s focus going forward is on our asset management and real estate subsidiaries.

Liquidity in the stock has also increased significantly since the approval. I expect this to continue as additional brokers will now facilitate trades after the reverse stock split.

Performance Reporting

We launched our offshore fund on March 1. We also will likely launch a second U.S.-based fund in the coming year for institutional investors. For those interested in the minutiae, our original fund, Arquitos Capital Partners, LP, is a 3(c)1 fund limited to 99 investors. Because we are approaching that 99-investor limit, we would need to launch a 3(c)7 onshore fund to accept new investors. The 3(c)7 fund would allow us to accept up to 499 additional investors, though the minimum investment requirements will be more stringent.

Our offshore fund, Arquitos Capital Offshore, Ltd., is domiciled in the British Virgin Islands. Each of the two existing funds, and any future funds, feed into Arquitos Capital Offshore Master, Ltd. Arquitos Capital Offshore Master, Ltd. is also domiciled in the British Virgin Islands and serves as the entity that holds the portfolio. This setup ensures that each of the “feeder” funds are invested in the exact same portfolio.

I expect that investors in the existing funds and future funds will have similar returns. To simplify reporting in the quarterly letters, I will refer to the returns from the original fund, Arquitos Capital Partners, LP, to consistently capture the historical investment performance.

Thank you again for your commitment. I look forward to continuing to compound funds on your behalf, and I hope to see you at our upcoming annual investor dinner.

Best regards,

Steven L. Kiel

Arquitos Capital Management