What You’ll Learn

- Under Armour needs to improve performance and it has to be reflected in the financials first.

- Issues with inventory management. Quality factors are on the low end.

- Optimistic valuation is near current price.

To get this kind of information and other exclusive articles before regular readers, get on the VIP Mailing List today.

********

It’s old news that Under Armour (UA) is trying to find ways to right the ship. I won’t be far off when I say that I was rummaging through the clearance box when UA came up.

Stock prices don’t indicate a business value, but in the case of Under Armour, the stock price is saying that issues exist.

In the past 52 weeks, it has not been fun for shareholders.

It’s under-performed against rivals.

It’s under-performed the S&P.

One piece of good news pushing the stock higher is that President Patrik Frisk bought $500k worth of class A shares through his family trust.

When insiders sell shares, it could be for many reasons:

- diversifying

- lending money to someone

- to buy a yacht

However, buying signals one intent – belief that shares are cheap.

I’ll get to the data and let you be the judge, but from the looks of it, Frisk sees something investors and the market does not.

Sadly, CEO Kevin Plank and all other insiders have never purchased stock on the open market. Insiders were happily selling even during its lows.

Outside of Frisk, does no one in the company see value?

Q1 Overview

In case you haven’t had a chance to look at the results, here it is in a nutshell.

The good:

- Q1 revenue up 6%

- international market up 27% and 24% of sales

- direct to consumer (DTC) up 17% and 30% of sales

The bad:

- North American business flat

- Decrease in margin

- Increase in expense

- Operating loss

- Big inventory increase

- negative Free Cash Flow

With business in the US continuing to flat line and retail stores continuing to shut down, you can see how this has impacted the sales breakdown.

If international markets and DTC sales continue to increase at the current pace, it won’t be long before the wholesale side of the business is overtaken.

Other Asian markets (especially China) see Under Armour as a more premium brand than Nike. Maybe due to the limited supply.

Ralph Lauren and North Face are two brands that come to mind where Asian countries give it a very high brand cachet.

Can Under Armour Improve Operation?

The fact is that Under Armour was slow to respond to the changing retail landscape hasn’t helped with operations.

Simultaneously, the company is spending money to expand in international markets which makes it difficult to judge how well the business is being run. Look at the financials and for the first time in a decade, Under Armour posted an operating loss.

Actually, if you look at FCF, it has been down since 2015. A foreshadowing of what was to come?

Inventory Risk is Real

One of the problems is inventory management. It’s one of the key metrics I look at when evaluating retail businesses. After all, inventory is one of the biggest assets and managing it well is the difference between a well run business and one that isn’t.

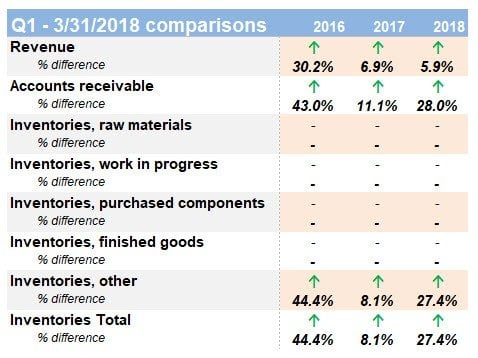

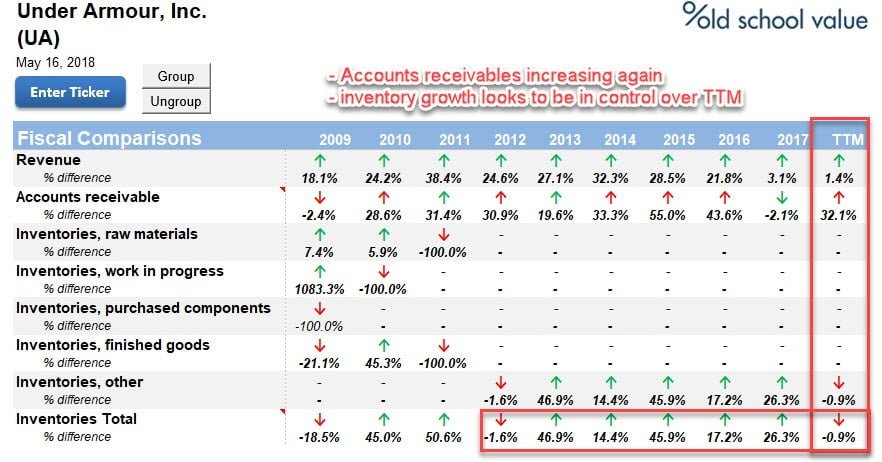

In this table, you see the year over year inventory analysis. Accounts receivable is back up. An increase of 32%. Means that they are giving lenient terms to retailers or trying to stuff the channel.

The inventory above looks to be in control as inventory growth is -1% over the TTM. But when I look at the quarterly comparison, the red flag is still there.

- Revenue only up 6%

- Compared to Q1 last year, accounts receivable is up 28%

- Inventory is up 27.4%

My understanding is from basic business class is that this is not the recipe for success.

This is Nike’s (NKE) latest quarter analysis.

- Revenue growth is up 6.5%

- Accounts receivable up only 1%

- Inventory up 9%

Quality Factors Continue to Be on the Low Side

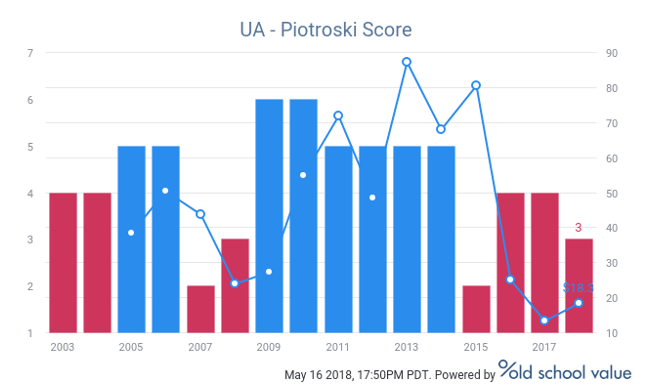

Another factor to use when checking quality of a potential investment is the Piotroski Score. It’s a simple 9 point fundamental check to gauge the quality of the business.

In 2015, the big drop in quality occurred. So far this year, it’s still on the low end with a total score of 3 points which is attributed to:

- Positive Operating Cash Flow

- Cash from Operations > ROA

- Decreasing long term debt (only slightly)

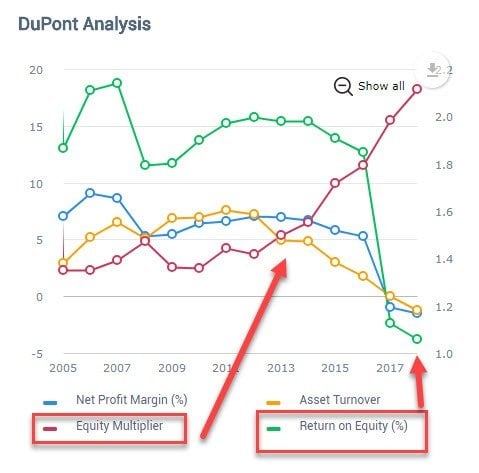

Just to be safe, I like to double check stats like this by looking at another angle.

A simple DuPont analysis reveals the condition of the business based on the make up of ROE and whether the Piotroski Score is giving the proper signal.

Here there are 3 red flags that show why ROE has crashed to -4%.

- Equity multiplier has been increasing since 2014. This flags that UA has been increasing utilizing leverage to try and grow.

- Asset turnover has slowed down. Not surprising looking at their inventory issues.

- Net margin is negative.

Under Armour is Hard to Value

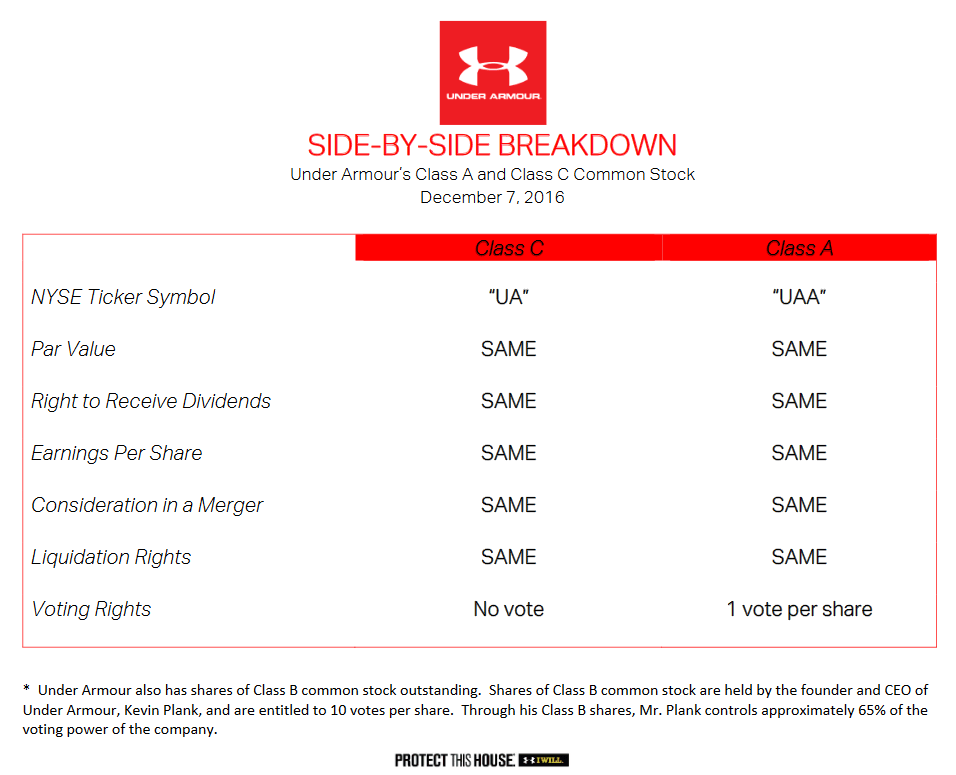

Since there are two classes, I find the Class C to be easier to value as it’s simply based on the business. The A shares get a premium because of the voting power, but it’s hard to say exactly what that voting power is worth when Kevin Plank has 65% commands voting power.

With the reshaping of the business as it invests in international expansion, it becomes more difficult to value.

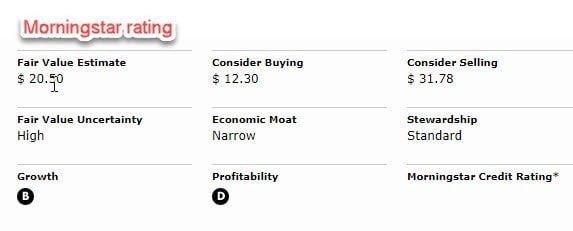

Morningstar says UA is worth around $20.

When I try to value the company, I get a few problems.

- Past free cash flow is lumpy so taking an average won’t work for a DCF.

- Current FCF won’t work because it’s negative.

- Earnings are negative for the first time and with the changing landscape, it’s a question of whether the EPS is currently depressed, or whether this is the new norm.

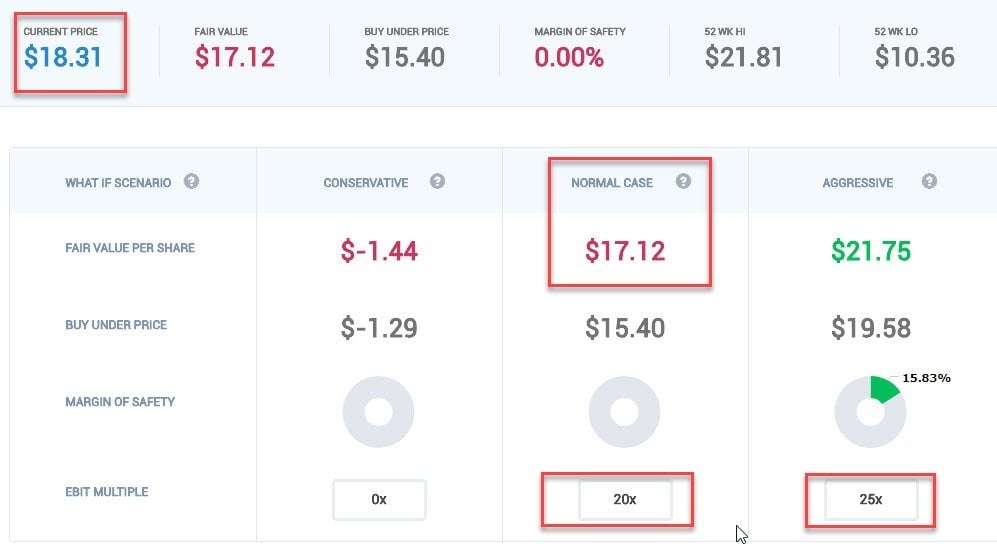

That brings me to my best tool for this type of scenario. A rebuild of the income statement to perform an EBIT multiples valuation.

Under Armour Valuation Range

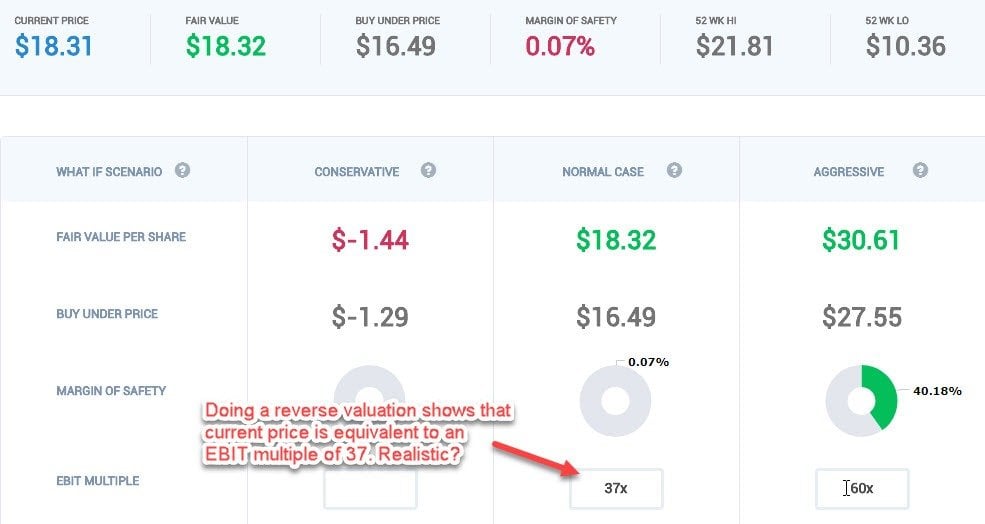

First, to get an understanding of what the current stock price is asking, I usually do reverse valuations.

It’s far easier to approximately see what the market is pricing in and decide whether it makes sense or not – as opposed to making forward looking valuations which could be completely wrong.

As Buffett said, it’s better to be approximately right, than completely wrong.

This image shows that the current stock price is baking in an EBIT multiple of 37x for the business.

Historically, the EBIT margin was around 11% and if I adjust it to this figure by assuming UA will get back to its heyday, the EBIT multiple for the current stock price is 15.5x.

There are two options to decide which one is realistic.

- Is a 37x EBIT multiple sustainable?

- Will UA be able to get back to its 2010-2014 operating level?

Seeing how Nike is the premium competitor, their aggressive EBIT multiple is 25x.

And no, I don’t see UA getting back to the heydays.

Next Scenario: Assume Moderate Improvement

If I assume that EBIT margins improve to 8% (currently at -0.2%) based on improving international sales and direct to consumer sales, the valuation looks like this.

I’ve used a “normal” EBIT multiple of 20x and the aggressive case of 25x EBIT which is on par with what Nike is going for.

The optimistic range that I see is between $17 to $22.

Considering that I’m wrong on many things, there is no margin of safety here for it to be a buy in my portfolio.

Summary

- Under Armour needs to improve performance and it has to be reflected in the financials first.

- Issues with inventory management.

- Quality factors are on the low end.

- Optimistic valuation is near current price.

- Not a buy at these levels.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.