When it comes to retirement savings, many investors prefer to just set it up and then forget about it so that it will continue earning interest and returns until it comes time to retire. Unfortunately, while such a practice might be good for your mental health because it keeps you from becoming worried about every little downturn in the market, setting and forgetting your account puts it at risk for escheatment.

What is escheatment?

This just means that the managing firm on the account will be required to turn it over to your state’s unclaimed property fund because you aren’t actively managing it. On one hand, escheatment keeps accounts from ending up in limbo after an investor passes away and their heirs have no idea the account exists, but on the other, it’s a major convenience for those who are alive and were counting on a retirement fund that no longer exists.

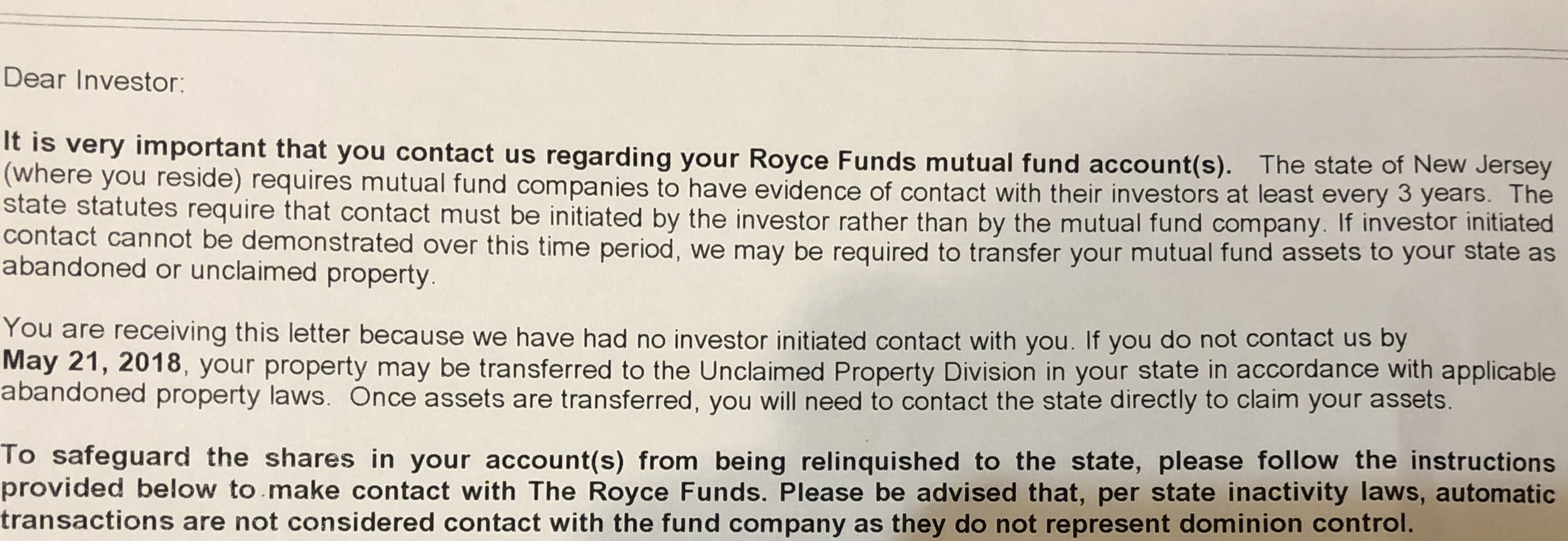

If any of your accounts are in danger of being escheated, the firm holding them must attempt to contact you and let you know that you must make contact with them to keep that from happening. You could end up receiving a letter that looks like this:

Other times, you may see a small note on the statement you receive regularly for your account, stating that you must make contact to keep your funds from being turned over to the state as unclaimed property.

Here’s what happens when your account is escheated

When an account manager turns over someone’s account to their state government, it doesn’t mean the funds are gone for good. States keep records of those who own unclaimed property, along with their last known mailing address and the amount of the account. It is possible to get the money back, but only after a lengthy process to reclaim the money.

Perhaps the biggest problem when it comes to retirement accounts that have been escheated is the fact that account owners are cheated of dividends, interest and other earnings on that money because they’re only entitled to the amount that was in the account at the time it was turned over to the state. The state reaps all the benefits of what basically amounts to a loan from consumers who may or may not reclaim their lost funds. In the case of retirement accounts, states typically sell all the securities and hold only the cash value at the time they took over the property, according to the Securities and Exchange Commission.

How to avoid escheatment

Keeping your retirement accounts from being escheated isn’t difficult. The biggest problem is simply knowing that you must keep in touch with the manager of your accounts, which many consumers don’t do for their retirement accounts. To keep your retirement accounts from being escheated, you must have some sort of contact with the firm that holds them, whether that’s a phone call, letter, or log-in on the firm’s website.

You may think your retirement accounts are safe because you have them set up for automatic deposits from your bank account, but in most states, automatic deposits or withdrawals do not count as contact with the account manager. Essentially, you must demonstrate in some way that you are actively managing your retirement accounts, and automatic withdrawals or deposits are considered to be passive in nature because they happen without the investor having to do anything.

Research your state’s laws

Every state has its own escheatment laws, which dictate how often you must have qualifying contact with the firm that holds your account. According to the SEC, most states require some form of qualifying contact within five years, although for some, the window is only three years or possibly even one year. States have gradually been tightening their laws on this, enabling themselves to take over more and more consumers’ accounts—just in case the owner won’t miss them. This, in turn, creates another revenue stream for states. Even if the owner does claim their lost funds, they still earn interest on them until the owner claims them.

A good rule of thumb is to keep a list of all your accounts, including your retirement accounts, and make sure that you get in touch with the firm holding them at least once a year. Look up your state’s rules regarding escheatment and make sure you comply with them to keep your accounts where you want them to be. If you think any of your accounts have been escheated, or you just want to check just in case, go to your state’s unclaimed property website to run a search on your name and city. This will tell you if the state is holding any of your money and, if so, where the money came from.