Last week, used car prices had their biggest drop since 2009 – directly after the financial market meltdown of 2008.

Right now, the auto market is showing signs of incredible worry.

[REITs]Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital:

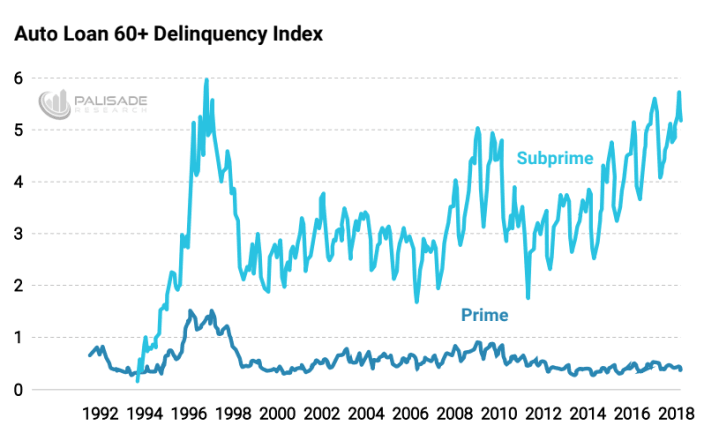

Delinquent subprime auto-loans are higher than they were in the last recession.

Look for yourself. . .

What’s interesting – and worrisome – is that consumers are defaulting on subprime auto loans when the economy is supposable doing ‘very well’.

Like I wrote last week – there are cracks under the economy’s foundation. And it’s like a bucket of cold water in the face of the mainstream financial media that’s pushing the ‘growth’ story.

We must ask ourselves – “if things are going so well, why are subprime loan delinquencies at a 22-year high?”

I can’t help but feel a bit nostalgic. This was the same situation that led up to the 2008 housing crisis. . .

First, there was massive growth in mortgage-backed securities and mortgage debt. Then, the Federal Reserve – led by Alan Greenspan – began aggressively raising rates after years of low rates. Soon after, subprime loans started blowing up – which trickled into the prime loans. And eventually, everything was in chaos.

Using the often-ignored Austrian Business Cycle Theory (ABCT) – coined by the little-known but brilliant economist Ludwig Von Mises – I am blaming the Fed for all this.

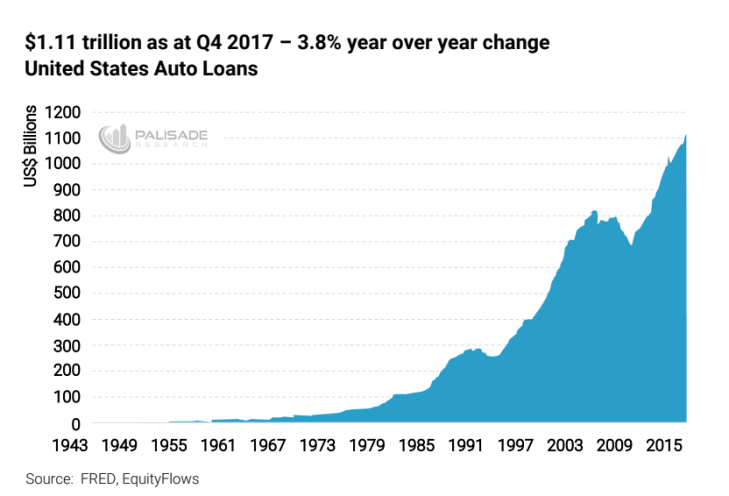

Thanks to the Fed, a near decade of zero-interest rate policies (ZIRP) and three rounds of Quantitative Easing (which totaled over $3.8 trillion in printed money) – the consumers became hooked on cheap auto loan financings. . .

Their policies made the entire system fragile by getting consumers addicted to cheap debt through their easy money.

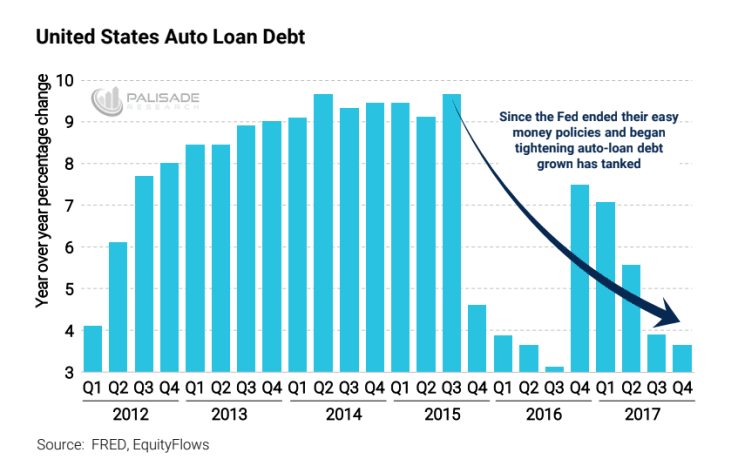

They then began tightening credit – crippling the borrowers.

Think of it this way – imagine you’re addicted to alcohol. And your bartender keeps giving you cheap drinks each night for months. Eventually, from drinking way more than you should’ve been able to afford, you now have a very high tolerance.

But suddenly – the bartender becomes strict and starts giving you less booze. He tells you, “sorry but no more free alcohol for you.” Problem is, you wouldn’t have drank so much if you had to pay full price for it.

Now you’re left with awful withdrawals – scrounging together all the extra money you can just to pay for a drink. But the only way you can really afford to feel better is if he starts giving out free drinks again or you painfully detox.

Just look at the collapse in auto-loan growth since 2015 – when the Fed began tightening with their end of QE and talk of rate hikes…

Clearly the higher rates had an impact on new auto loans.

But a bigger – and more pressing – problem is that the Fed’s short-term interest rate hikes are making these current subprime auto loans unserviceable. The borrowers are having a harder time paying more interest for an asset that depreciates 15% the moment they take it off the lot.

Clearly, affordability is becoming a problem. . .

As I learned from Ludwig Von Mises and the other brilliant Austrian economists – the Fed created a bubble in auto-loans by keeping rates low and printing trillions. And now they’re going to blow the whole thing up with their rate hikes.

Just like taking the free drinks away. . .

I expect delinquent subprime loans to keep hitting new highs. And I expect the ‘growth’ story the pundits keep pushing down our throats will fade.

Because even if the auto-loan industry and general economy hasn’t rolled over yet, each new Fed rate hike pushes us one step closer to the edge.

0.25% at a time. . .

So, with our Macro-Fragility Index (MFI) alarmingly high in the auto sector – I’m going to spend time looking for opportunities here.

History shows us that when things start their descent into collapse – the subprime market is the first to get hit.

Food for thought. . .

Previously Published HERE https://palisade-research.com/subprime-chaos/

Author Bio:

Adem Tumerkan, Editor-in-Chief of Palisade Research

Before joining Palisade Global Investments, Adem was a Research Analyst at Stansberry Research – under Agora Financial. Adem is a born contrarian and has extensive knowledge of markets, financial history, and economics. He is a value investor and fascinated with cycle theory. But his focus on ‘black swans’ and how to position oneself to make huge returns during volatile times is what really separates him from the rest.