Grey Owl Capital Management commentary for the first quarter ended March 31, 2018.

“If the path before you is clear, you’re probably on someone else’s.” – Joseph Campbell

“Of all the paths you take in life, make sure a few of them are dirt.” – John Muir

Q1 hedge fund letters, conference, scoops etc

Dear Client,

Two of our largest individual equity holdings announced game-changing transactions at the end of the first and beginning of the second quarter of 2018. On March 8, Cigna (CI), one of the largest health insurance companies, announced that it would acquire Express Scripts (ESRX) for approximately $92 per share in stock and cash; an almost 25% premium to the March 7 ESRX closing price. Then, on April 9, Leucadia National Corporation (LUK) announced the sale of 48% of its largest subsidiary, National Beef, and 100% of its Garcadia auto dealership group. Combined, LUK’s two divestures result in gains of over $1B. With shareholders’ equity1 of ~$10B prior to the sales, this represents a meaningful increase in per share book value. The ESRX and LUK deals are big transactions for two important Grey Owl holdings and therefore warrant discussion in their own right. In addition, they provide context for examining an important concept – the uneven path of investment returns.

Investment returns are not linear. This is the case regarding broad market aggregates (e.g. the S&P 500) but even more so the case when it comes to individual securities. Before delving into the details of Express Scripts and Leucadia National Corporation, for perspective it is worth reviewing the historical returns of a more widely known company run by the world’s most famous investor – Warren Buffett’s Berkshire Hathaway.2

Berkshire Hathaway’s Uneven Path to Outperformance

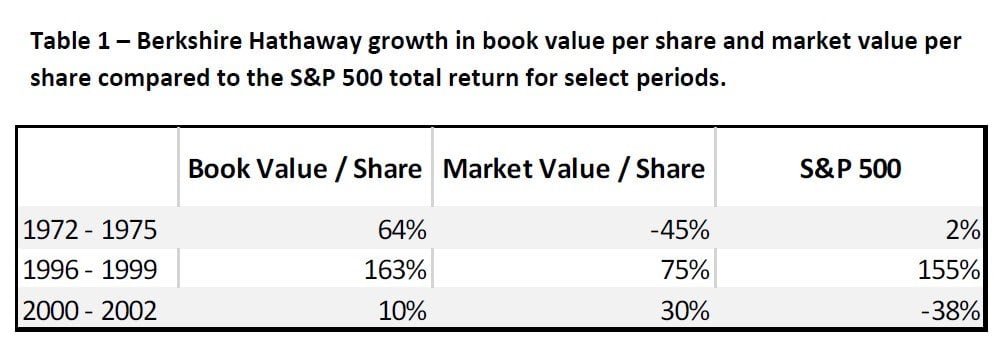

From 1965 to 2017, Berkshire Hathaway has grown book value per share at an annual compound rate of 19.1%. In turn, stock price has compounded at a similar 20.9% per year. These numbers are approximately double the 9.9% compound annual return of the S&P 500 over the same period. Yet, while the full 52-year period tells a glowing story, there were several multi-year periods contained within where some portion of the Berkshire machine slumped. Table 1 below summarizes three such periods.

1972 - 1975

From 1972 through 1975, Berkshire made significant progress as a business. Book value grew by 64%. However, during this period, the stock price not only underperformed growth in book value, it underperformed the S&P 500, and most shockingly, it was negative. Berkshire Hathaway’s share price lost a combined 45% during these four years.

1996-1999

Many investors know that the second half of the 1990s were a challenging period for Berkshire. Mr. Buffett shunned technology stocks as valuations for internet companies grew into the stratosphere. Between 1996 and 1999, Berkshire’s growth in book value at 163% actually slightly outperformed the S&P 500 at 155%. Nonetheless, due to the lack of technology investments, investors perceived Berkshire as staid, behind the times, and the stock price grew by “only” 75% - less than half the S&P 500 performance.

2000-2002

Finally, from 2000 through 2002, Berkshire’s stock performed well on an absolute basis and exceptionally on a relative basis. During that period, the stock price was up 30% while the S&P 500 was down 38%. However, Berkshire only grew book value 10% total over those three years. Despite entering the early 2000s stock market correction and recession with a conservative posture, Berkshire’s business essentially went sideways for three years.

The point is, even a business and stock that we know has had a spectacular 52-year performance has long periods where the business and/or stock might not “work.” In addition, there are periods when the business and stock may do ok, but still significantly underperform a broad equity market index like the S&P 500. As Warren Buffett’s mentor, Ben Graham, said, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” An important added point is that the short run can easily be several years. Patience may be a successful investor’s most important attribute. The Berkshire story offers useful background to examine our investments in Express Scripts and Leucadia National Corporation.

Express Scripts

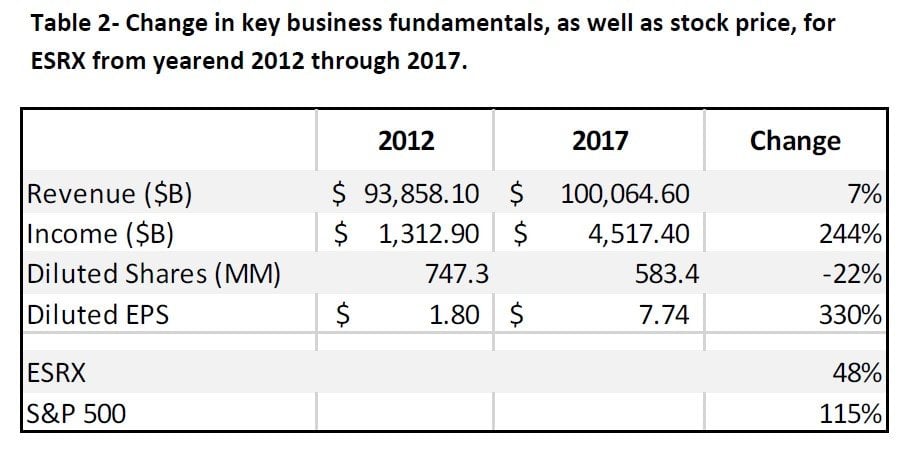

We initially purchased ESRX shares on November 30, 2012 at approximately $53.70 per share. On March 8, when Cigna/Express Scripts announced their transaction, ESRX closed at $79.72. This represents a gain on our initial ESRX purchase of 48% compared to 115% for the S&P 500 over the same timeframe. Despite the mediocre relative stock performance, ESRX’s business fundamentals soared. Table 2 below tells the story of ESRX’s impressive fundamental growth over our five-year holding period.

When we first purchased ESRX shares on the heels of its merger with Medco, ESRX’s stock price had taken a hit as integration of the two firms lagged expectations. As the years went on, the integration proved successful and profitability climbed. Still, recurring concerns about drug pricing and the role of pharmacy benefit management companies in containing cost and improving efficacy3 kept downward pressure on investor sentiment. While earnings grew, the multiple investors were willing to pay for those earnings shrunk considerably. The stock price never kept up with the business fundamentals. If Cigna’s stock price is at $170 when the deal closes, ESRX shareholders will receive the equivalent of $89, adding another 12% to the return listed above.4 Should the deal close by the end of 2018, we will have earned close to a 9% annualized return on our initial investment. Unless there is a significant broad market correction, this will be significantly less than the S&P 500, but still a solid absolute return.

Will the deal close? Today, mid-April 2018, ESRX stock trades at over a 15% discount to the current deal value. This is an unusually wide spread for a merger that is expected to close by the end of the current year. To the best of our knowledge the deal spread is wide given the recent challenge to a “vertical merger” (the AT&T / Time Warner merger) by the Justice Department – a challenge that has not occurred since the early 1970s. Given the historical difficulty in blocking vertical mergers, we think the likelihood of the deal closing is high. However, we do not underestimate the vagaries of the current political winds. On the small chance the deal is blocked, we feel comfortable owning ESRX at less than 9x projected 2018 earnings.

Leucadia National Corporation

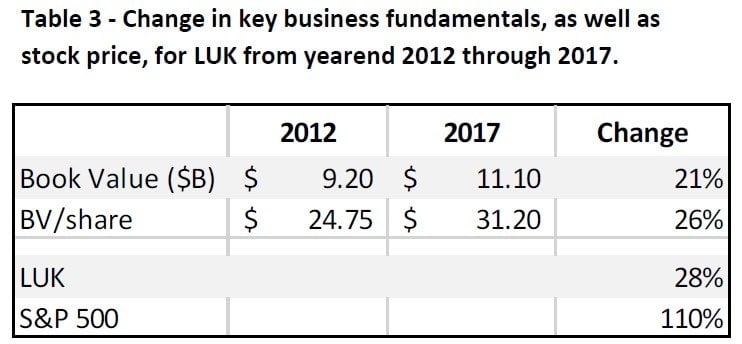

We initially purchased LUK shares on November 11, 2012.5 At the time, the stock traded at $20.40. On April 9, 2018, the day the National Beef and Garcadia sales were announced, LUK closed at $24.29 for a total return (including dividends) of 28%; a lackluster result compared to the S&P 500 total return of 110% over the same period.6

Unlike ESRX, LUK key business fundamentals have made only modest progress in our five years of ownership. Book value per share has increased just 26% and at 28%, the stock price tracked closely. Table 3 below provides details.

While LUK’s business fundamentals are an entirely different story than ESRX’s, so too are our thoughts for the future of this investment. If all goes as planned, ESRX will cease to exist as a standalone company toward the end of 2018 and our investment in it will conclude. As for LUK, our hope is that this is just the beginning of the story.

Today, LUK trades at approximately 1x tangible book value. At $24 / share, it trades at just 77% of stated book value.7 While little measured progress appears to have occurred over the past five years, LUK today is in fact a very different company. Several businesses have been divested for significant gains and several promising new investments were made. Unfortunately, in the last few years, LUK had to weather what we think will prove a historical anomaly – by far it’s two largest businesses, Jefferies and National Beef, both simultaneously experienced their worst twelve-month periods ever. Going forward, LUK’s ownership in National Beef will be a much smaller portion of LUK overall. In addition, Jefferies, has come out of its challenges a leaner trading operation and a platform designed to grow via higher return on capital investment banking.

When thinking about Leucadia, it is important to review its full history. Over the 33-year period prior to its combination with Jefferies, LUK compounded book value at 18.5% per year (and this does not include regular annual dividends and a significant one-time dividend in 1999). In other words, LUK’s performance was at a similar level to Berkshire’s historical performance. Critical to our analysis, LUK’s historical performance has been far more prone to fits and starts than Berkshire’s performance. Comparing the standard deviation of annual returns – an inadequate statistic but at least one that demonstrates the degree of difference between the two firms – Leucadia’s growth is far more volatile. The standard deviation in annual book value growth for BRK from 1965-2017 was 14%. For LUK from 1978 to 2011 it was 37%. In addition, several times, years have passed before LUK’s book value per share was able to top an old record. The sideways period we have recently experienced is not out of historical context and we do not see it as a sign LUK will fail to compound shareholder capital at a very strong rate going forward.

The Opportunity is in the Crooked Path

The point of the above discussion is to demonstrate that investment returns are rarely smooth. That is not to say that occasionally things cannot work out better and faster than expected. For instance, another large holding, Booking.com (BKNG) has performed spectacularly well in just over two and one half years of ownership. We first bought BKNG8 in early July 2015. Through the end of March 2018, that position has returned 81% compared to 34% for the S&P 500. The important take away is that this does not always happen and an investment process that requires it to always happen is likely doomed to failure. Such a process will lead to selling what in the end will prove to be successful investments. It might have led to selling Berkshire in the mid-1970s.

When asked why value investing can continue to work when everyone “knows” the formula, most practitioners have a standard answer. Value investing works because it does not work all the time. That is true in the general sense. It is also true in the sense of individual securities. We are optimistic that the ESRX deal will close this year and mark a solid absolute return for this investment. We are more optimistic, though less certain, that a streamlined Leucadia will again demonstrate its ability to compound capital at a high rate for years to come. Until evidence develops to the contrary we will continue to be patient and embrace the sometimes opaque, sometimes dirty path.

*****

As always, if you have any thoughts regarding the above ideas or your specific portfolio that you would like to discuss, please feel free to call us at 1-888-GREY-OWL.

*****

Sincerely,

Grey Owl Capital Management, LLC

See the full PDF below.