Emerging Value Capital Management commentary for the first quarter ended March 31, 2018.

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

Dear Partners and Shareholders,

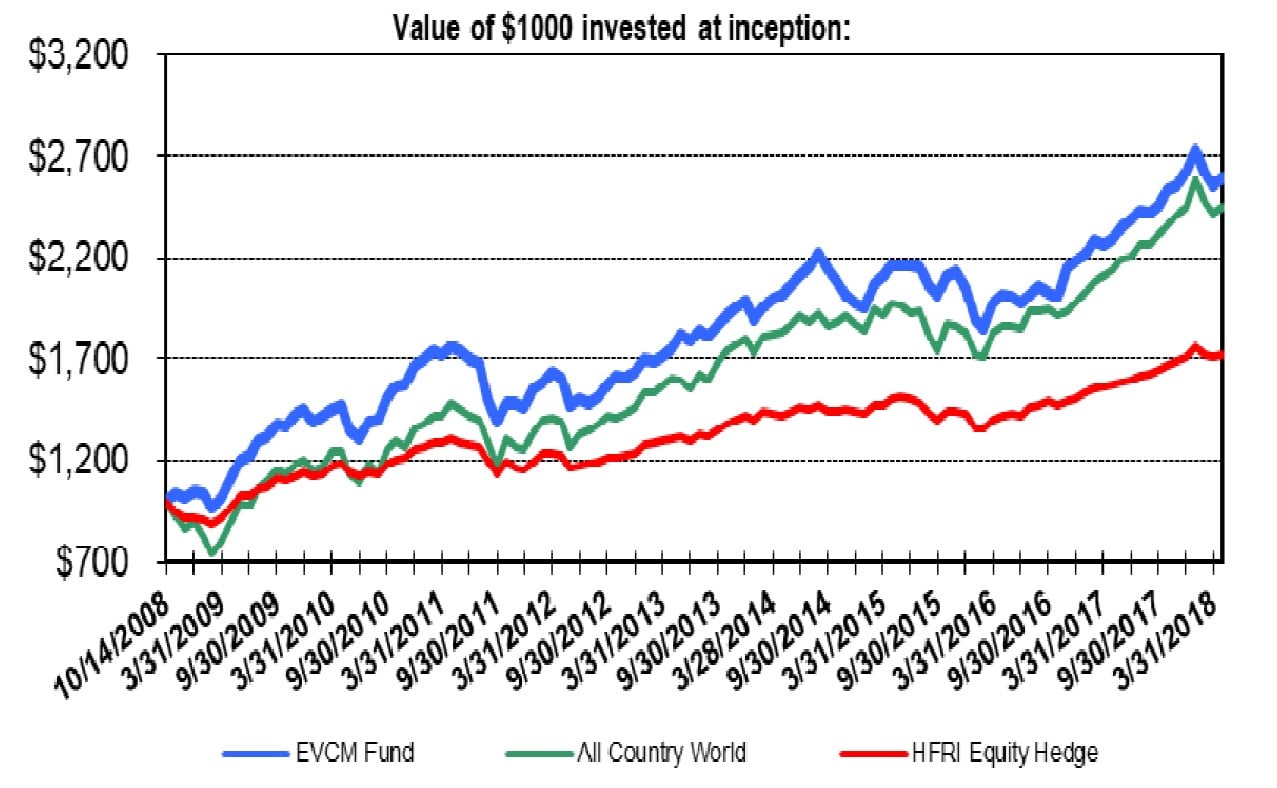

For Q1-2018, Emerging Value Capital Management fund declined an estimated -2.9% net to investors. Stock markets worldwide were mixed with the All Country World Index (ACWI) and the HFRI Equity Hedge returning -1.0% and +0.4% respectively.

Since inception (10/15/2008), EVCM Fund returned an estimated +159.7% (net to investors). During this same time period the MSCI All Country World Index (ACWI) and the HFRI Equity Hedge Index returned approximately +144.7% and +72.2% respectively.

Q1 Overview:

Stock price volatility significantly increased in Q1, following a year of low volatility and steadily rising stock prices. This is excellent news for EVCM fund investors. While price fluctuations have left us slightly down for the quarter, we have taken advantage of this increased volatility to sell positions that have gone up and to establish several new compelling investment positions which significantly enhance our expected future returns.

Specifically:

- We sold Howard Hughes Corp at a price close to its three year high.

- We trimmed General Motors, Fiat Chrysler and Interactive Brokers at prices close to their multi-year highs.

- We established new positions in Teekay Offshore Partners, Yatra Online, Yum China, JD.com and Despegar at what we view as exceptionally cheap prices.

- We took advantage of the markets overreaction to Facebooks data privacy scandal to increase our investment position in this rapidly growing business at an unreasonably cheap price.

- We added Barclays to our large cap financials basket while selling Citibank and PNC Financial Services from our basket at close to their multi-year highs.

- We sold Israel’s Bank Leumi for about 60% more than we paid for it two years ago.

- We increased our short position in the US Oil ETF (USO) while profitably trimming our short position in the US Natural Gas ETF (UNG).

- We removed about half of our South Korea ETF hedge as the risk of war in the Korean peninsula declined.

- We covered half of our short position in Tesla at a profit.

The main theme underlying all these moves is replacing appreciated positions, containing only a moderate amount of remaing upside, with new positions containing huge upside potential. These moves should significantly magnify our future returns. Following these changes, we are nearly fully invested, with cash comprising less than 1% of our portfolio, and find ourselves with more investment ideas than capital.

Looking Forward:

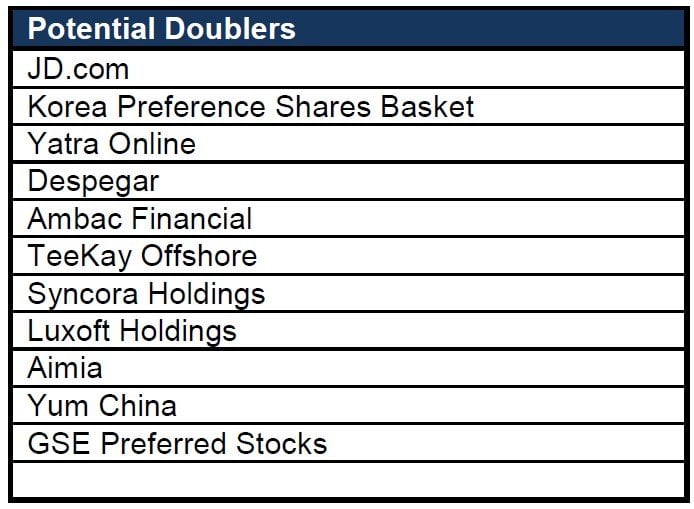

As an indication of the potential of our investment portfolio, following is a list of positions that we think are likely to at least double (or more) in the next 2 to 4 years. We discuss some of these positions in more detail below.

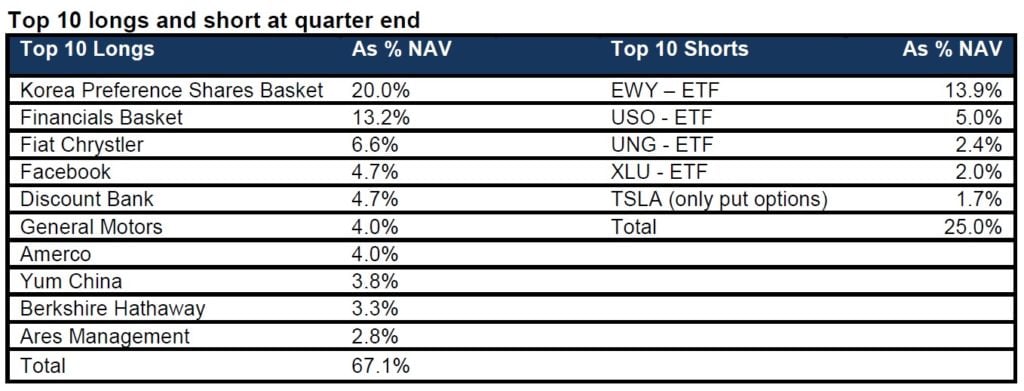

About 45% of our long portfolio is invested in these “potential doublers” with the rest of our portfolio invested in cheap and safe businesses that are growing their intrinsic value at double digit annual rates. Our top ten longs and shorts at quarter end are listed in the following table.

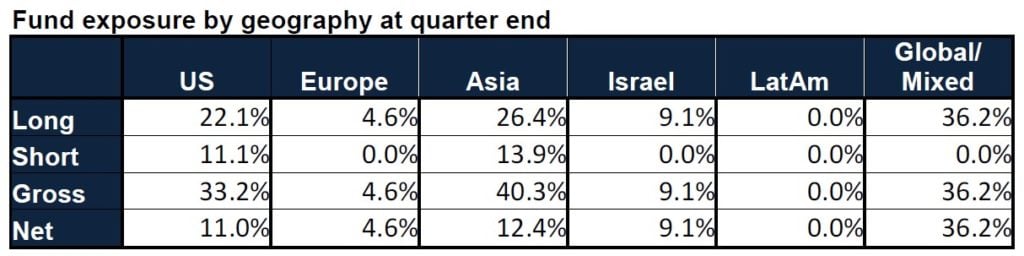

Below, we will go into greater detail on some of these positions. As of quarter-end, we were 98% long and 25% short. Our overall net exposure level of 73% reflects the compelling investments we are finding in global stock markets offset by our shorts and hedges.

The following table shows how our capital is allocated geographically:

We continue to view the US, Israel, and South Korea as the best countries in which to invest our capital. These three countries are true capitalist democracies, enjoy favorable demographic trends, and are the world leaders in technological innovation – the driving force behind today’s economic growth. With technology comprising an ever growing portion of the global economy and with more and more “old economy” sectors getting technologically disrupted, economic success in the future will be based on the ability to innovate and stay ahead of the advancing technological curve. Israel, South Korea, and the US are the best positioned countries to do so.

Main contributors and detractors in Q1-2018:

Main contributors to our returns in Q1-2018 include: Fiat Chrysler, Syncora and Interactive Brokers. Main detractors to our returns in Q1-2018 include: General Motors, Aimia, Luxoft Holdings and Amerco.

Brief discussion of some of our investment positions:

JD.com

While most investors view Alibaba as the “Amazon of China”, we think a more accurate analogy (although still not perfect) is that Alibaba is the “eBay of China” while JD.com is actually closer to being the “Amazon of China”. The main distinction being the issue of who holds, owns and ships the inventory of products being sold online.

Alibaba, like e-bay, is mostly an asset-light online network that matches buyers and sellers but does not own, store or ship any inventory itself. This is highly problematic in China where many sellers ship fake or low quality good and the package shipment infrastructure (both public and private) is often subpar, slow and unreliable.

In contrast, both Amazon and JD.com are mostly online retailers that own, store and ship the inventory of products they sell. This means that JD.com is able to inspect its inventory prior to selling it and ensure it is real, advertised accurately and of high quality. JD.com has also invested heavily in its own package shipment infrastructure allowing it to ensure faster and more reliable delivery than competitors.

In the US, Amazon proved to be a better business than e-bay. We think the same will ultimately happen in China, yet we find JD.com trading for about one tenth the market cap of Alibaba. Admittedly, JD.com has razor thin profit margins, since, just like Amazon, it invests heavily in its business while keeping product prices as cheap as possible.

We view JD’s founder and CEO, Richard Liu, as one of the best managers in China. His vision is to turn JD.com into the largest e-commerce company in the world. We think he has a chance to fulfill this vision.

Thanks to market volatility and investor concerns over profit margins remaining lower for longer, we were able to purchase JD.com shares in Q1 for prices below $40 / share. The company currently trades for 0.75 times 2018 revenue. A multiple well below JD.com’s average revenue multiple of 1.3 over the last four years and Amazons revenue multiple of 3.3. Assuming a 1.1 revenue multiple and 22% annual revenue growth, JD.com’s stock price would triple in four years.

Yatra Online

Yatra is India’s second largest online travel agency (OTA). Through its website and smart-phone app, personal and commercial travelers can book flights, hotels and travel packages. It has assembled the largest hotel network in India and can book travel on most domestic and international airlines. Online travel booking in India is rapidly growing driven by rising disposable incomes and increasing smart-phone penetration. Yet India’s per capita spending on online travel is well below that of the US and even China leaving room for tremendous growth.

Yatra began trading last year in the US when it was acquired by Terrapin 3, a special purpose acquisition company (SPAC). It declined significantly in Q1-2018 apparently due to forced and indiscriminate selling by some of its venture capital owners. We took advantage of this price volatility to purchase Yatra for about 2 times revenues, while peers trade for as high as 10 times revenues. We think Yatra can grow its revenues at 30% - 40% annually for the foreseeable future and become profitable by 2020. There is also a possibility that global OTA’s Expedia or Booking Holdings could acquire Yatra as a vehicle for entering the rapidly growing Indian market.

Basket of Korean Preference Shares

The risk of war on the Korean Peninsula has declined significantly as North Korea released American hostages and takes steps to end is nuclear program. At the same time, relations between China and South Korea are improving which is leading to a return and growth of inbound Chinese tourists. These events, combined with continued economic growth, technological innovation and government reforms are bullish for Korean stocks in general and for our basket of exceptionally cheap Korean Preference Shares in particular.

The current average price discount in our basket between our preference shares and their respective common shares is above 50%. We know of no other case in financial markets where essentially identical pairs of securities trade at such a huge price discount/premium to each other. Making reasonable assumptions for stock market appreciation, dividend yields and a narrowing of the price discount between common and preference shares shows our basket could at least double in price over the next few years.

General Motors

GM reported strong financial results, is restructuring its money losing operation in South Korea and signed an agreement with Amazon that will allow Amazon to deliver packages directly into GM’s connected cars. Despite these favorable developments, the stock declined in Q1. Investors are possibly worried about a slower than expected roll-out of GM’s autonomous vehicle technologies and a possible turn in the US economic cycle.

Last year GM unveiled its extensive R&D efforts in self driving cars, electric cars and transportation as a service. Investors following the company came to realize that these emerging technological areas were not just a risk factor for GM, but also a potential business opportunity. The stock remains very cheap trading for 6X annual free-cash-flow of $9B with a 4% dividend yield.

Fiat Chrysler

Good financial results continued to propel Fiat Chrysler’s stock higher in 2018. Investor concerns over uber CEO Sergio Marchionne’s expected departure are abating somewhat as no specific departure date has been set. The company recently announced its plan to spin off Magneti Marelli, one of its parts businesses. Excluding Marelli, we estimate Fiat Chrysler is trading for under 8X annual free-cash-flow of $6B.

We note that a merger between GM and Fiat Chrysler, if it can be approved by regulators, makes tremendous business sense. The companies have minimal overlap between their vehicle brands and could achieve several billion dollars in annual cost savings.

Interactive Brokers

Interactive Brokers offers the world’s lowest cost and most technologically advanced securities brokerage services. By relentlessly focusing on automation of back office tasks and expanding into ever more markets, the company has created a significant cost and coverage advantage over competing brokerages. Over the next decade, IBKR can disrupt the traditional brokerage industry and capture a large market share. We think CEO Thomas Peterffy is an exceptionally good manager and his incentives are aligned with long term shareholders.

IBKR’s stock increased in 2018 as the company reported strong results and continued growing its accounts base at over 20% per year. We have taken advantage of the stock price increase to trim our position. At over 30X 2019 earnings, IBKR is not obviously cheap, yet we think the price is justified given its huge future growth runway and disruptive potential.

Hilan

Hilan is Israel's leading payroll processing and HR service provider. US investors might think of it as the “ADP of Israel”. The company provides an array of solutions for organizations: payroll, human resources, time & attendance and pension administration. Hilan possesses the most advanced and comprehensive system of its kind in Israel, rendering services to about half of the mid-size and large businesses in Israel.

Payroll processing and HR services is a predictable, slow growth business which generates a lot of recurring free cash flow, requires minimal capital investments, is recession resistant, and provides a high return on capital invested. Customers are very “sticky” since it would require a lot of time, effort, and expense to switch service providers.

Leveraging its existing customer relationships, Hilan continued its expansion into software services and IT infrastructure services. These segments are more competitive and lower margin than payroll & HR, but do provide more rapid growth. Hilan is a cheap, high quality business trading for about 11 times our estimate of 2019 operating earnings with a 2.4% dividend yield.

Facebook is one of the world’s best businesses, with a dominant and growing share of the advertising market. It offers advertisers an unprecedented ability to target their ads to users based on a large array of geographic, socio-economic, life situation and personal interest criteria. A Facebook users outside the US generates only about 20% of the revenue that a US based user of Facebook generates. This large gap should narrow over time and provides Facebook with a large growth runway for many years ahead.

Facebook’s stock declined in Q1-2018 following revelations that it allowed an external consulting company access to private user data. While the charges are serious and could lead to a fine and enhanced regulations, investors over reacted in selling Facebooks stock. First, relative to its size, any fine Facebook may face will likely be immaterial. Second, enhanced regulation protecting consumer privacy and data will likely increase compliance costs, hurting smaller companies much more so than Facebook and thus indirectly enhancing Facebooks competitive position. We took advantage of the excessive price decline to significantly increase our investment position size. We paid about 20 times 2018 earnings per share. A cheap price for a business growing its earnings faster than 30% a year.

Bank Leumi

Bank Leumi is Israel’s second largest bank. It is a well-managed, conservative, slow growth bank offering the standard assortment of retail and commercial banking services to its customer base. Its size, large branch network and strong local brand afford it a competitive advantage in Israel where it earns about a 9% return on equity.

As sometimes happens with “boring” companies, Bank Leumi was neglected by investors who were searching for more “exciting” investment stories. As a result we were able to purchase Bank Leumi in 2016 for about 0.7 times tangible book value. By Q1-2018, book value had grown approximately 20% and the book value multiple increased to 0.9, allowing us to sell our shares for a 60% profit. We may have sold too early since Bank Leumi still has some upside and deserves to trade for at least tangible book value. However, we chose to sell since we found even more attractive uses for our capital.

Syncora Holdings

Syncora Holdings was a leading bond insurance company that got badly hurt in the 2008 financial crisis and its aftermath. It has been in recovery mode ever since and is now in run-off (winding down its insurance business). Actions taken and being taken include settlements of various litigations, business restructuring, offloading of insurance liabilities via re-insurance and sale of assets that had been received as collateral for defaulted bonds.

Synocra is underfollowed and misunderstood as the high degree of complexity and uncertainty keeps most investors away. Shares trade for $3.20 while adjusted book value per share exceeds $7. Including the potential value of Syncora’s tax NOL’s would increase adjusted book value per share to $10. As management continues to successfully wind down the insurance business while searching for a good use for their NOL’s, we expect Syncora’s share price to at least double or more.

Reaching Out to New and Existing Investors:

Emerging Value Fund is fully invested, yet we continue finding highly attractive investment opportunities around the world. Plainly put, we have more great investment ideas than capital. As you know, in 2017 I added over $100K to my personal EVCM Fund investment account. In 2018 I plan to add an additional $100K or more to my personal account. Actions speak louder than words so I hope these personal actions demonstrate my positive expectations for our future returns. I wish to invite both existing and new investors to join me.

We spend little time and effort on marketing Emerging Value Fund so that we can, instead, focus our efforts on protecting and growing our capital. As a result, we expand our investor base mostly via word of mouth and recommendations. In other words, if you have a family member, friend, or acquaintance that could benefit from including Emerging Value Fund in his/her investment portfolio - we would greatly appreciate and welcome the referral.

Concluding Remarks:

While market volatility can sometimes feel uncomfortable, it creates the buying and selling opportunities that ultimately lead to strong returns. We have taken advantage of the recent volatility to upgrade our portfolio in terms of quality, growth and expected upside.

Since our inception, we have delivered market beating returns for our investors despite the drag of conservative investing on our results. This is exactly what a hedge-fund is supposed to do. Having just completed a full review of our portfolio, I feel optimistic that we will continue to outperform in the future.

Sincerely Yours,

Ori Eyal

Managing Partner

Emerging Value Capital Management