Companies that have at least 50 years of dividend growth are considered Dividend Kings. You can read more about this select group of companies here. Dividend growth investors won’t be surprised to find large cap names like Johnson & Johnson (JNJ) and 3M (MMM) among the Dividend Kings. These large cap names are some of the most widely owned and followed stocks among income investors. You can see the full list of all 25 Dividend Kings here.

Q1 hedge fund letters, conference, scoops etc

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

Click here to access our Members Area where you can easily download all our Excel databases in one place.

You might be surprised to find that there are some small cap names that have also raised their dividend for at least the past 50+ years. One such company is SJW Group (SJW), a water utility.

This article will examine SJW’s business, growth prospects and valuation in order to determine if shares are worth purchasing now.

Business Overview

SJW was founded in 1866 and was initially known as the San Jose Water Company. With a market cap a little over $1 billion, SJW is one of the smallest Dividend Kings. SJW is a water utility company that produces, purchases, stores, purifies and distributes water to consumers and businesses. SJW currently consists of three subsidiaries:

- San Jose Water Company

- SJWTX, Inc

- SJW Land Company

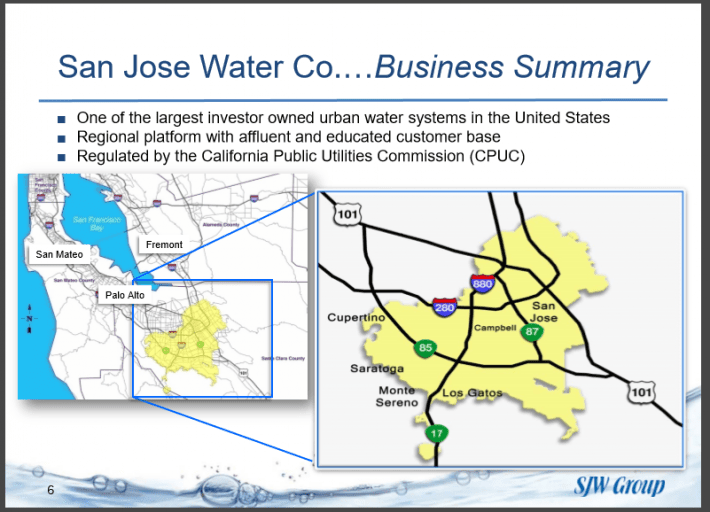

San Jose Water Company, a regulated utility, has almost 230,000 connections and provides water to nearly one million people in the Silicon Valley area.

Source: Investor Presentation

The company has more than 100 wells and 2,400 miles of water mains in a 138 square mile portion of Silicon Valley. San Jose Water serves a well-educated and affluent customer base. In order to improve operations in the area, the company spent $545 million on capex from 2011-2016. San Jose Water spent more than $141 million on capex during 2017 alone. The cost of these improvements are then passed onto customers.

SJWTX is a regulated water utility company that supplies water to more than 40,000 people in the area between San Antonio and Austin, Texas.

Source: Investor Presentation

This area saw population growth of 3% from 2006-2016. Population growth has accelerated as businesses provide jobs that have attracted new residents. SJWTX has more than 40 wells, 14,000 connections and almost 600 miles of water mains in the region. SJWTX has seen its customer base soar 90% since 2006 and the company continues to add 700-800 new connections each year.

San Jose Water Company and SJWTX, INC account for almost all revenues for SJW, but there is a real estate portion of the company as well. SJW Land owns and develops properties for both residential and warehouse customers in California and Tennessee. SJW uses the rental income for these properties to reinvest in its water utility business.

SJW used to have a fourth division of the company called Texas Water Alliance, or TWA. That division of the company was sold to the Guadalupe-Blanco River Authority. This transaction was completed on 11/15/2017.

Let’s take a look at how SJW’s most recent earnings report to see how the company is performing.

Growth Prospects

SJW reported fourth quarter and fiscal year earnings on 2/22/2018. SJW’s earnings per share was $0.84 for the quarter. Adjusting for the sale of TWA, EPS fell $0.24 year over year to $0.43. Management cited higher water production costs as a major reason for the decline in quarterly earnings. Adjusted EPS fell a penny short of estimates of $0.44. Revenue grew 18% from the fourth quarter of 2016 to $93.5 million. Revenue was $10.5 million above analysts’ expectations.

Adjusting again for the sale of TWA, the company had earnings per share of $2.45 for 2017. This was $0.12 below the 2016’s total. Sales for 2017 increased 15% from 2016 to $389.2 million. In both the quarter and the year, customer usage and rate increases added high levels of revenue to the company’s totals. Usage for the quarter grew 9.1% and 7.4% for the year. Rate increases of almost 3.5% also added to the company’s revenue totals.

Perhaps the best thing going for SJW is that it recently announced a merger with another water utility company. On March 14th, SJW announced that will merge with Connecticut Water Service (CTWS) in a $740-million-dollar all stock deal.

Source: SJW Group & Connecticut Water Investor Presentation

CTWS supplies more than 135,000 customers in Connecticut and Maine. This merger of equals is expected to be completed by the end of this year. Management expects that this deal will be additive to earnings a year after the two companies become one. In addition, the merger will create a much larger water utility company.

Source: SJW Group & Connecticut Water Investor Presentation

The combination of SJW and CTWS will make the combined company third largest water utility company in terms of both enterprise value and rate base. The combined entity will have about 380,000 connections between its operations in California, Connecticut, Texas and Maine. CTWS has grown earnings per share an average of 6.4% since 2011.

SJW currently receives about 92% of its net income from California alone while Connecticut accounts for 85% of income for CTWS. For the combined company, California’s percentage of income drops to 60% and Connecticut’s to 30%. Texas and Maine will each represent 5% of income. This merger will help to diversify both companies.

Competitive Advantages & Recession Performance

As a regulated utility, SJW is limited to the amount it can raise rates for customers. Fortunately for the company, they operate in areas, i.e. Silicon Valley and Central Texas, that have seen high population growth rates. As these populations grow, they need reliable access to water. To encourage SJW to spend on improving the water infrastructure in these areas, local governments allow the company to raise rates at fairly high levels.

For example, San Jose Water was granted a rate increase of 4.2% for 2018. The company also submitted its application for rate increase for 2019-2021. If granted, San Jose Water will be able to see increases of 9.8%, 3.7% and 5.2% for 2019, 2020 and 2021. Rate increases in 2017 contributed $1.27 towards earnings per share. Large rate increases will flow right to the company’s bottom line.

Another advantage for SJW is tax reform legislation that went into effect this year. Tax reform actually lowered SJW’s tax rate to 37% from 39% for 2017. The impact from tax reform will be even more profound going forward as SJW’s rate decreases to 21% for 2018 and beyond. Between tax reform and its merger with CTWS, SJW has an opportunity to offer robust dividend growth going forward.

SJW has paid an uninterrupted dividend for the past 74 years. The company has increased its dividend for the past 51 years.

The average raise over the past five years is just 4.1%, but the company has been increasing the size of the dividend hikes in recent years. The company raised its dividend 7.4% in 2017 and gave shareholders a 28.7% at the end of this past January. SJW even paid a $0.17 special dividend on December 11th, 2017.

This is a very shareholder friendly company. Shares have a forward yield a little over 2% with a payout ratio of about 46% based off of 2017 earnings. The company aims to have a payout ratio between 50% and 60% so there is still more room for dividend growth in the future. Remember, that future includes CTWS as well.

Let’s also consider CTWS’s dividend history, which is very impressive in its own right. The company has raised its dividend for forty-eight consecutive years. CTWS is just two years short of becoming a Dividend King itself. The company has raised its dividend an average of 4.1% each year for the past five years. The most recent raise resulted in a dividend increase of 5.31%. Upon closing, CTWS shareholders will receive the same $1.12 dividend that is scheduled to be given SJW shareholders in 2018. This is 7% above CTWS’s current dividend.

While future dividend growth looks attractive, it is also important to examine how a company performed during tough economic times. SJW’s earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share of $1.04

- 2008 earnings-per-share of $1.08 (3.8% increase)

- 2009 earnings-per-share of $0.81 (25% decline)

- 2010 earnings-per-share of $0.84 (3.7% increase)

Along with most companies in 2009, SJW saw its earnings per share get hammered as EPS dropped 25% in a single year. The company saw a modest increase in earnings in 2010, but growth really accelerated in 2011. And with adjusted EPS of $2.45 in 2017, SJW has more than tripled its earnings since 2009.

That is an extraordinary feat to pull off. Even in a recession, people will need water for drinking, cooking, cleaning and bathing. Looking at the earnings results and with just one year of declines, SJW seems fairly recession proof.

Valuation & Expected Returns

According to ValueLine, SJW is expected to generate earnings-per-share of $2.85 in 2018. That means that shares are currently trading at a price-to-earnings multiple of 18.5. The average P/E over the past ten years for the stock is 21.4, so shares are slightly undervalued against its historical multiple. The stock’s current P/E is also below that of the S&P 500 Index’s 25.4 multiple.

Source: ValueLine

SJW has seen an average growth in earnings per share of about 8% since 2001. CTWS has grown earnings an average of more than 6% per year over the recent term. The combined company should be able to grow earnings at a rate in the range of these two figures. In addition, SJW currently yields 2.08%, higher than the index’s yield of 1.8%. Going forward, investors can expect total returns to be the following:

- 6%-8% earnings per share growth

- 2% dividend yield

Between earnings per share growth and dividend yield, investors can reasonably expect SJW to return 8%-10%. Not a bad return for a water utility, assuming the price-to-earnings ratio does not decline from the present level. SJW is not overvalued, so this risk seems modest.

Final Thoughts

SJW reported adjusted earnings per share that were slightly below the previous year’s figure, but revenue increased double digits. A merger with CTWS will give the company a wider national footprint and help form the third largest water utility company in the country. With more than five decades of dividend growth, SJW looks like it will be able to offer generous dividend growth in future years.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Article by Nate Parsh, Sure Dividend

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.