Article by RCM Alternatives

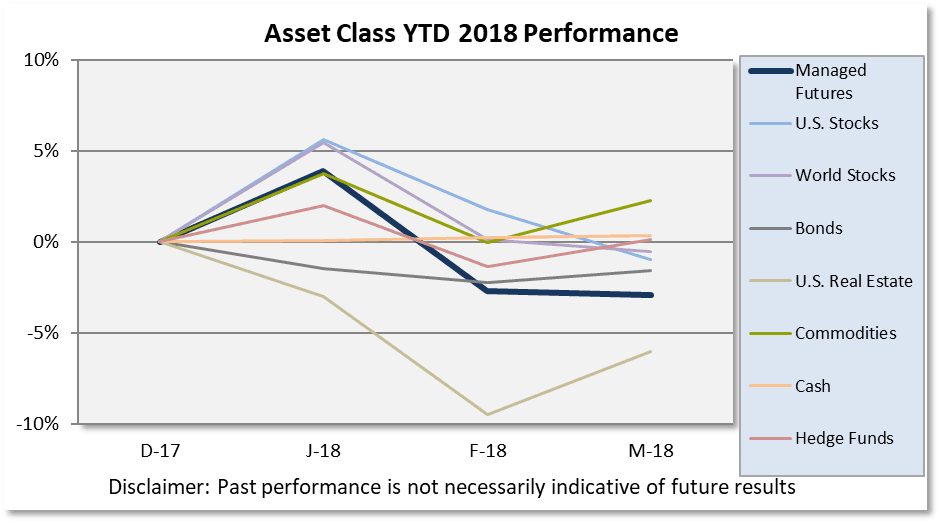

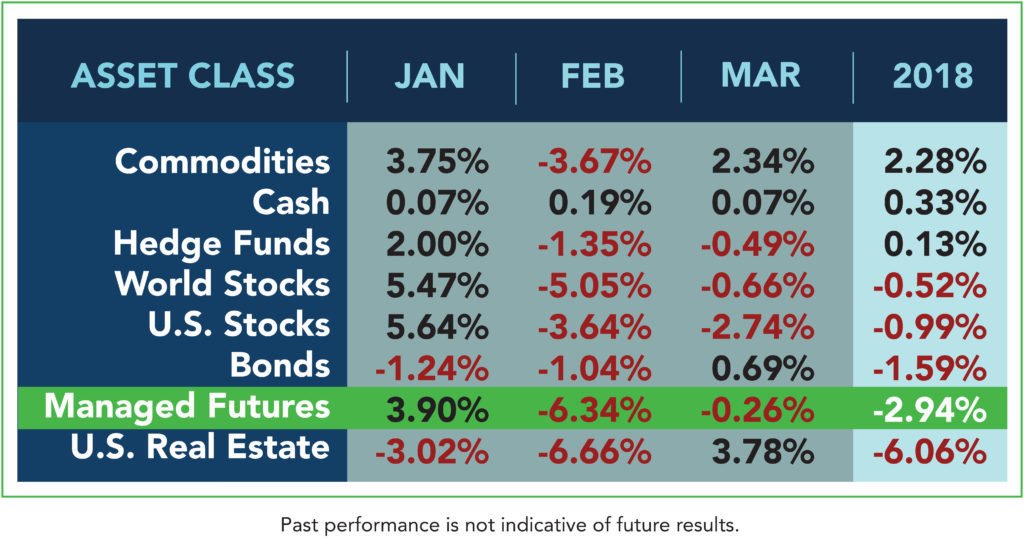

It finally happened. The market went through a major move (in February) but the recovery wasn’t enough. Sure, there were really good days in March (like the 3rd best single day performance in the Dow in its history) but it wasn’t enough to make up with consistent loses or large swings the other direction. U.S. Stocks and World Stocks recorded back to back monthly loses for the first time since Jan and Feb of 2016.

What makes this time special? Most commentary points to President Trump’s $50 Billion in tariffs on China. We don’t have a crystal ball, but in our Managed Futures 2018 Outlook, we did say President Trump’s unpredictability always gives the possibility of shaking up the markets and more binary events:

Bottom line, the more ultimatums and deadlines we see out of Mr. Trump, the more binary market movement could become – with prices moving quickly to meet the new reality instead of building into a new reality over time.

Beyond the tweets, a correction was always on the horizon, we just didn’t know when. Despite the market being off 10% from its highs, we are sure spending a lot of time talking the S&P 500 being down 99 basis points on the year. Here’s our take on an anticipated correction in our 2018 Outlook:

“We can get a correction AND the bull market continues. All we’re talking about here is a return to some normal level of volatility, which tends to happen after a period of extremely low volatility.

Elsewhere, after years and years sitting at the bottom of the asset class scoreboard, Long Only Commodities holds the top slot, at least for now. Managed Futures licked their wounds in March, only losing 26 basis points in the month following one of its worst months in history. Finally, the ETF tracking Hedge Funds managed to stay above water in Q1, outperforming equities (or losing less) when it needed to and it’s important to point out, this is just an etf tracking hedge funds.

If you’re reading this and wondering how to find true diversification in Managed Futures / Global Macro, we’ll offer you this advice from our Outlook:

Beware the managed futures programs who have ‘cheated’ a little over the past few years to get additional return by adding short vol exposure to their models. They’ve been smarter than their peers for doing so the past few years, but may underperform should we see a more normal vol pattern. Of course, if they’re really, really smart -they’ll know when to turn off that model feature just as they knew when to turn it on.

Source: All ETF performance data from Morningstar.com

Sources: Managed Futures = SocGen CTA Index, Cash = 13 week T-Bill rate,

Bonds = Vanguard Total Bond Market ETF (BND),

Hedge Funds= IQ Hedge Multi-Strategy (QAI)

Commodities = iShares GSCI ETF (GSG);

Real Estate = iShares DJ Real Estate ETF (IYR);

World Stocks = iShares MSCI ACWI ex US Index Fund ETF (ACWX);

US Stocks = SPDR S&P 500 ETF (SPY)