Northwest Natural Gas (NWN) has a track record of dividend increases that puts it in very exclusive company. NWN has increased its cash dividend for more than 60 consecutive years, making NWN one of just a handful of companies in the entire market with a dividend increase streak of that length. That puts it among the elite Dividend Kings, a small group of stocks that have increased their payouts for at least 50 consecutive years. You can see the full list of all 25 Dividend Kings here.

Q1 hedge fund letters, conference, scoops etc

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

Dividend Kings are the best of the best when it comes to rewarding shareholders with cash and this article will discuss NWN’s dividend and outlook.

Business Overview

Northwest Natural Gas is headquartered in Portland, Oregon just a few blocks from where the company was founded in 1859. The business that started with just 49 customers in one square mile of Portland has since grown to serve almost 740,000 customers in 107 communities in Oregon and Southwest Washington. NWN has grown to 1,100 employees since its founding by just two men, a product of the amount of growth it has experienced.

Northwest Natural Gas’s stated mission is to deliver natural gas safely and reliably to its customers in the Pacific Northwest. The company achieves this by purchasing natural gas from suppliers in the Western US and Canada and distributing it to residential, commercial and industrial customers throughout its service area. NWN builds, maintains and operates the local natural gas distribution system including pipes and related equipment that transport natural gas to its customers. NWN believes customers in its service area prefer natural gas to electricity for heating needs and continues to capitalize on that growth opportunity.

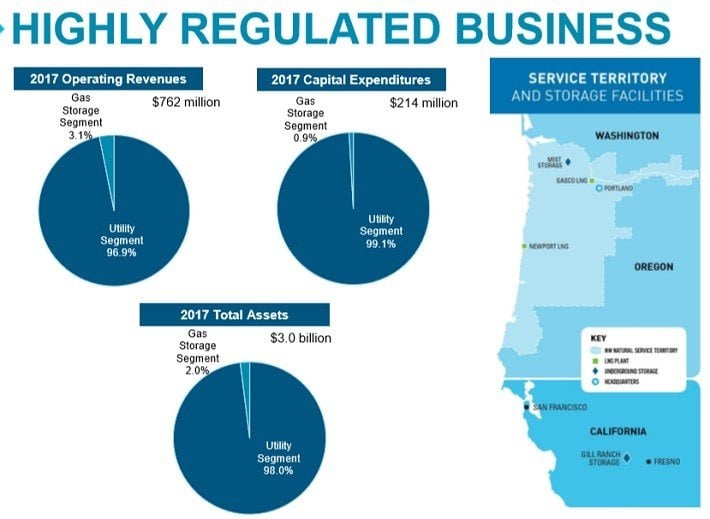

NWN gets almost all of its revenue from selling natural gas to its customers. This chart shows not only how the company’s revenue is broken down, but also the composition of its asset base and capex.

Source: March 2018 investor presentation, page 7

Northwest Natural Gashas a gas storage segment it operates via two subsidiaries but as you can see, that segment is but a small fraction of NWN’s total business. This is a pure-play LDC natural gas enterprise in every sense of the term and this company is very good at it.

NWN’s pricing – as a regulated utility – is completely out of its control. Oregon and Washington regulators require NWN to adjust its rates each year based on how much it pays for gas during a 12-month period. The Weighted Average Cost of Gas helps determine how much its customers will pay for each therm (a unit of heat equivalent to 100,000 Btu) of gas. These annual Purchased Gas Adjustment changes take effect on November 1 of each year.

NWN does not profit from the price of gas; the cost of natural gas is a pass-through and is not marked up. This obviously introduces some level of risk to NWN’s revenue growth but of course, this is not unique in the utility industry; it is just something to be aware of.

Northwest Natural Gas’s market cap is about $1.6B and it is expected to do almost $800M in total revenue this year. The company’s residential customers make up roughly two-thirds of its business while commercial accounts are about one-fourth, with the balance coming from industrial clients. You’d expect this sort of makeup from a utility so no red flags here, and NWN is committed to growing its residential business in particular because the market opportunity is significant; more on that later.

NWN’s risks to revenue include population growth in its service areas, regulation in terms of pricing as well as potential consumer preference shifts away from natural gas. NWN also faces the risk of some sort of environmental disaster at one of its facilities that could potentially not only disrupt service, but carry with it extraordinary cleanup and legal costs. However, these risks have been present for as long as NWN has been in business and will continue to be and at this point, should not be considered material. NWN operates as a monopoly in its service areas, competing only with other forms of energy, and it plays nice with regulators and the environment.

Growth Prospects

Northwest Natural Gas’s growth prospects – as you’d expect – are pretty limited. However, there are some avenues it could use to produce a bit of expansion over the long term. For instance, the company’s 740,000 customers only represent a fraction of the potential it has in its covered service areas. NWN estimates there are 3.7M people in its service territory and while not all of them are going to use natural gas, certainly there is some room for expansion.

Source: Investor presentation, page 19

NWN’s customer growth rates have picked up in recent years but of course, we are talking about sub-2% numbers for every year going back to 2008. Customer growth rates for natural gas usage in the Pacific Northwest have been among the highest in the country due to lower market saturation. This is because in this area of the country, natural gas became an available heating source for residential customers after other fuel options were already established, so it is a bit of a newcomer, at least in utility terms.

That means NWN is uniquely positioned among natural gas utilities in terms of being able to generate higher levels of customer growth, and it has been doing so. Single-family new construction is NWN’s highest single contributor to growth rates, meaning natural gas – when given the choice – is a consumer favorite. Again, while growth rates aren’t going to be enormous, NWN is better positioned than most in its industry.

Northwest Natural Gas’s customers and others are taking notice of its commitment to quality as it was named the number one gas utility in the West for the 5th consecutive year. In addition, it was awarded the 2nd highest score in the entire nation by J.D. Power in 2017. These accolades can seem hollow at times but given that NWN continues to perform very well for a utility, customers are taking notice and the company’s growth rates show that it is working.

NWN has to go to the states of Oregon and Washington and ask for rate increases – something that hasn’t happened for a long time – but in December, NWN went to Oregon to ask for a rate increase. Last year saw customer rates lowered for the third consecutive year and they were at the lowest levels in 15 years. NWN’s Oregon rate case is currently asking for a 6% increase, although that amount will likely be amended lower due to federal tax reform; the regulators would prefer that money benefit consumers and not NWN.

At any rate, the increase would be effective this November, should it go through, and could easily be a source of meaningful growth for 2019 and beyond. As mentioned, we don’t yet know what the rate increase will be but given how long it has been since NWN saw an increase, the odds are in its favor and management seems optimistic.

Interestingly, Northwest Natural Gas recently acquired Salmon Valley Water Company in Oregon and Falls Water Company in Idaho, two privately-owned water utilities. Obviously this is a foray into a new business for NWN but one that management feels is a good strategic fit given that the risk profile is about the same as a gas utility. The transactions still need to be approved by regulators and combined, the companies only serve 6,500 customers, so they are very small. But NWN sees that growth is going to be challenging if it sticks with gas only and management is thinking outside the box in order to spur some growth in the future.

Most utilities are happy to maintain the status quo but NWN isn’t and it will be interesting to see how the water business treats this company; that will determine just how far the water utility acquisitions go in the future, if at all. On the whole, NWN has much better growth prospects than most gas utilities to be sure.

Competitive Advantages & Recession Performance

NWN’s competitive advantages are few but also very important. Its excellence in customer service and satisfaction ratings mean that NWN has a proven track record in terms of keeping customers happy. As we all know, utilities don’t generally receive high marks from customers but NWN is different and that matters in this space.

In addition to that, it has no direct competition from other natural gas distributors in its service areas. It does, however, have to compete with other forms of energy including propane, fuel oil and electricity. However, natural gas has favorable marks when it comes to price, efficiency, reliability and environmental impacts when compared to other fuels. NWN has capitalized on this in the past with its high rates of customer growth.

One thing to note for NWN’s industrial clients, which make up a small percentage of total revenue, is that competition is fiercer. Industrial clients often have the opportunity to bypass the local distribution network NWN offers and instead go straight to a natural gas wholesaler. In addition, large industrial customers could bypass NWN by installing their own direct pipeline connection to the interstate pipeline system. NWN works to head off this threat by offering competitive rates, but it is still a risk to growth.

Being a utility, Northwest Natural Gas is extremely recession-resistant. The company’s earnings-per-share during and after the Great Recession are below:

- 2007 earnings-per-share of $2.76 (increase of 21%)

- 2008 earnings-per-share of $2.57 (decrease of 7%)

- 2009 earnings-per-share of $2.83 (increase of 8%)

- 2010 earnings-per-share of $2.73 (decrease of 4%)

These numbers are fairly flat throughout the period of the Great Recession and in fact, look like they could be from any random four-year period; you’d never know by looking at them that an enormous economic crisis was occurring. NWN’s pricing is highly regulated but its usage is also fairly flat given that no one uses natural gas in a discretionary manner; you either need it or you don’t. While that limits growth, it also creates a floor for recessions and as you can see, NWN is about as recession-resistant as a company can be.

Valuation & Expected Returns

According to ValueLine, Northwest Natural Gasis expected to generate earnings-per-share of $2.45 in 2018. As a result, the stock trades for a price-to-earnings ratio of 23.3, compared with a 10-year average price-to-earnings ratio of 20.5. A price-to-earnings ratio above 23 indicates the stock is overvalued, particularly since it is a slow-growth utility company. This exposes investors to the risk of contraction of the price-to-earnings ratio, which would reduce annual returns moving forward.

Source: ValueLine

The PE multiple has crept up in the past 10 years or so as earnings have been basically flat, but the share price has continued to move higher so again, on that metric, Northwest Natural Gas looks pricey.

However, NWN is obviously an income stock given that it not only has a 50+ year track record of raising its dividend, but because it pays out the majority of its earnings to shareholders. At 3.3% presently, its dividend yield is right in the middle of the range the stock has produced for the past decade.

In other words, the stock has risen in value because the value of the dividends it offers shareholders has risen as well. That means that from a valuation perspective, although NWN looks expensive based upon the PE, the yield is saying NWN is probably right around fair value as of now. That will make multiple expansion an uphill battle but there also shouldn’t be a lot of downside, either.

While NWN has certainly put together an impressive streak of dividend increases, recently they have been very small. This year’s increase was 1 cent annually, which was also the case in the prior three years. Before that, increases were in the 2 to 4 cent range annually but NWN’s increases have slowed of late. Remember that customer rates are the lowest they’ve been in 15 years so earnings growth has been basically impossible for NWN to produce, and the dividend’s growth is suffering for it.

From an expected total returns perspective, NWN looks to be an income story and that’s it. You don’t buy a utility stock for the capital appreciation and this one is no different. In a rising rate environment, utilities tend to underperform and if we get a big spike upward in rates, NWN’s share price will likely fall. Conversely, if rates stay tame and/or fall, NWN’s total returns could be much higher as the value of its dividend – which is extremely safe and well-covered – relative to the risk-free rate would increase.

Looking forward, total returns in the low single digits is probably all one can expect from NWN. Earnings growth, likely in the low-to-mid single digit range, could be offset by a declining valuation. However, with most of the expected returns coming in the form of a cash dividend, that is just fine if you’re looking for income; just don’t buy this stock expecting to get rich overnight.

Final Thoughts

NWN’s long and impressive history of dividend increases as well as its operational excellence have made it into a true Dividend King. The company is exploring out-of-the-box avenues for growth but it has the ability to continue to produce low single digit rates of growth in its core market as well. If the rate increase goes through in Oregon this year NWN may put some of that money to use in the dividend to make up for years of token increases, but even if that doesn’t happen, it offers a 3.3% yield that grows over time and is very safe.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.