These two metrics may be missing from your investment product evaluation process. Here’s how they work.

The more tools you have to make sure you’re choosing the best products for your clients, the better. And active share and the Sortino ratio can help. Learn how they could enhance your process and how to make them work for you.

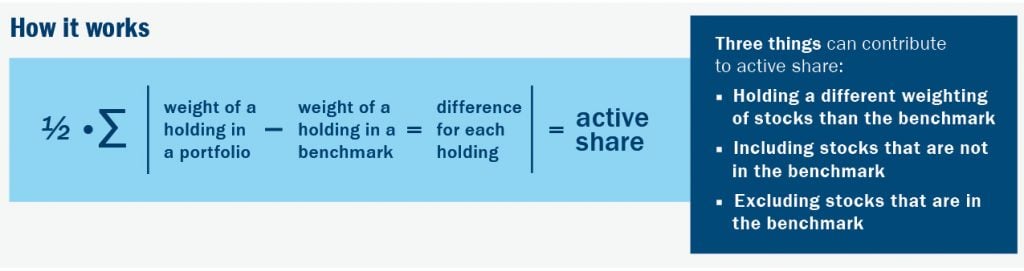

Evaluating active management: How active share works

Active share is a measure of how different a portfolio is from its benchmark.

Investors only want to pay for active management if they believe a manager is building a portfolio different than the benchmark. It makes sense — no one wants to spend money if they think they could get the same thing elsewhere for less.

That’s where active share comes in. It measures the extent to which the holdings in a portfolio differ from the holdings in a benchmark.

What active share can tell you:

- A higher active share indicates more variance from the benchmark. An active share of 0% indicates the portfolio holds every stock in the same proportion of the benchmark, while 100% indicates there is no overlap.

- Active share can be looked at over time. In addition to showing overlap between holdings, tracking active share over time can be an indication of how consistent a portfolio’s investment process is relative to the benchmark.

What active share can’t tell you:

- Active share isn’t a meaningful metric for passive, fixed-income or asset allocation portfolios. It works best for actively managed equity products.

- Active share isn’t a measure of risk. Two portfolios with vastly different stock holdings, and therefore different types of risk, could have similar active share. It should be considered in conjunction with risk and performance metrics such as tracking error, information ratio or Sortino ratio.

- Active share shouldn’t be compared across investment styles and sectors. Global, small-cap equity or high conviction concentrated portfolios that are benchmarked against a well-diversified index may be expected to have higher active share. Single country or sector-specific portfolios that have a less diversified benchmark will likely have lower active share.

- Active share isn’t an indicator of a manager’s skill. Active share indicates if a portfolio manager picked different holdings from the benchmark, but it doesn’t indicate whether those were good decisions that will improve the investment result.

Better product selection: How the Sortino ratio works

Whether or not it’s part of your process, more financial advisors are using the Sortino ratio to select products that may deliver more reliable returns.

Let’s face it, investors are generally less concerned about volatility when they’re getting good returns. But the risk of losing assets often affects their behavior.

That’s where the Sortino ratio has a distinct advantage over other risk comparison tools. It allows you to compare the past performance of products on a risk-adjusted basis and isolate negative volatility. The benefit? A tool that can be used to evaluate investments and select investment options that improve the investors’ experience — to help them reach their long-term goals.

What you should know:

- It can be used across asset classes, including equity, fixed‑income and alternative investments.

- It’s a comparison tool. The ratio of one product by itself may not tell you much.

- A higher Sortino ratio is preferable. Higher means more return with less risk of negative returns.

Sortino ratio is based on past performance and cannot predict future results. Downside deviation is the standard deviation of negative returns. Sharpe ratio divides an investment’s return in excess of the 90-day Treasury bill by the investment’s standard deviation to measure risk-adjusted performance. Standard deviation is a statistical measure of the degree to which an individual value in a probability distribution tends to vary from the mean of the distribution.

Article by Columbia Threadneedle Investments