By Nate Anderson, CFA, CAIA of Hindenburg Research

We have no position in Inpixon (Nasdaq:INPX), a tiny little $3 million market cap company that is not particularly noteworthy in any way except for one. We are writing this because we saw something we think is pretty ridiculous, and we like to call-out ridiculous things.

Q1 hedge fund letters, conference, scoops etc

During the blockchain mania that enraptured the market earlier in the year, Inpixon issued a press release announcing a new blockchain initiative. This alone would be a fairly mundane revelation given the number of similar stories at the time, but in Inpixon’s case there was one unique factor: the blockchain press release was shared with a select group of investors in advance. Those investors were given full knowledge of the timing and content of the blockchain press release and then, if that weren’t sweet enough, were able to purchase shares at a significant discount to Inpixon’s market price at the time. Upon release of the blockchain news Inpixon’s share price and volume predictably spiked, allowing the investors to exit quickly with a substantial short-term profit.

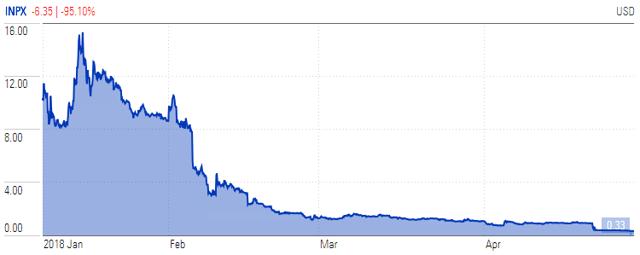

Presumably the other side of those trades included people who saw the exciting blockchain news and were hoping to take the stock for a ride. That didn’t work out to well for those who hopped aboard. Inpixon is down about 95% since that blockchain release just months ago:

(source: Morningstar)

So in short, it appears that select investors were given access to market-moving information in advance of the public and profited tremendously at their expense.

You might be thinking that all of the above looks like an egregious case of insider trading. You may even be wondering how we found this out. Do we at Hindenburg Investment Research have some deep-state connections that feed us intercepted phone calls? Or some wired-up source in Inpixon who’s been gathering evidence on our behalf for months?

No, it turns all this information is available in Inpixon’s public filings, and the whole scenario could actually be completely legal.

You see, Inpixon, with the help of its investment bank Roth Capital used a process called “wall crossing” to share the material non-public information (aka “MNPI”) with investors, who then purchased the discounted shares through a private placement offering. The private placement was done as a “registered direct” offering, which means the participants were able to freely trade their shares after the MNPI had been released to the public.

While the above may strike some as a nuanced legal loophole, what that nuance means is that technically no trades took place until the MNPI had been released and became public (i.e.: until after the press release was issued.) Therefore, there was no insider trading.

Background on Inpixon

Inpixon (NASDAQ: INPX) is a company the describes itself as “a leading indoor positioning and data analytics company”. By late 2017 the company was nearly bankrupt. For the nine months ended September 30, 2017, Inpixon incurred a net loss of approximately $27.1 million and had a working capital deficiency of approximately $30.8 million. By the end of the same period the Company had only $107,000 in cash compared with current accounts payable of almost $28 million and total current liabilities of almost $45 million. The Company described its precarious financial condition as follows:

“Our financial statements as of December 31, 2016 and September 30, 2017 include an explanatory paragraph referring to our recurring and continuing losses from operations and expressing substantial doubt in our ability to continue as a going concern without additional capital becoming available.”

Things looked dire. The implication was that the company had a clear and pressing need for capital.

Roth Capital is Hired to Run an Offering

In steps Roth Capital, an investment bank based in Newport Beach, California which was hired exclusively to run an offering for Inpixon. By way of background, Roth has raised over $45 billion for small-cap public and private companies and completed approximately 300 merger, acquisition and advisory assignments since it was founded in 1992, according to the company’s website.

Roth largely operates in the murky world of small and microcap banking where it specializes in providing creative financing solutions. The firm has garnered its fair share of controversy and has developed a rather odious reputation among some members of the financial community. Roth’s BrokerCheck report shows 26 total disclosure events, comprised of 14 regulatory events and 12 arbitrations. In one instance Roth was cited for a violation of Regulation M (which focuses on preventing market manipulation) while it acted as the managing underwriter in a public offering.

Known for hosting lavish parties, in 2007 Roth infamously threw a party where “[t]he primary feature . . . was the presence of ‘several dozen’ topless Asian models, with the ticker symbols of the companies Roth underwrote body-painted on.” In 2011, Roth hosted a wear-only-white “Miami Glam” party where bikini-clad hostesses served cotton candy while guests listened to a performance by Pitbull.

Roth was also well-known for its role in facilitating several suspect reverse mergers involving Chinese companies, raising approximately $3.1 billion for China-based clients from 2003 to 2012. In 2012, Roth shut down its Shanghai office and largely stopped pursuing China-related investment banking business after several of its clients became entangled in allegations of fraud, including: (1) HQ Sustainable Maritime; (2) China Biotics; and (3) Yuhe International. Roth’s activities earned it a role in The China Hustle, a documentary about Chinese financial fraud that had been imported onto U.S. exchanges via such reverse mergers.

The Inpixon “Blockchain” Deal

Blockchain was all the rage during the Inpixon deal's offering period. Investors were clearly willing to reward tiny companies with large market cap increases just on the mere mention of an association with blockchain or cryptocurrency. The approach had proved reliable on a number of occasions:

- Long Island Iced Tea’s shares jumped more than 500% after changing its nameto Long Blockchain;

- A small cap company named Longfin’s shares soared more than 2000% after announcingthat it would be acquiring a blockchain company from its own CEO;

- A medical devices company, changed its name from Bioptix Inc. to Riot Blockchain and its shares surgedmore than 700%; and

- Kodak’s shares rose 120% after it announcedthat it would launch an Initial Coin Offering (ICO).

Inpixon’s blockchain announcement was released on January 9th. The day before, Inpixon closed a registered direct offering with the help of Roth, raising approximately $3.2 million in exchange for almost 18 million shares of common stock. The shares were purchased at a roughly 20% discount to Inpixon’s market price at the time. (Note that these numbers are prior to a later 30/1 reverse split.) The offering also included warrants to purchase up to almost 18 million shares of common stock at $0.2260 per share.

To say the offering was dilutive doesn’t do justice to the term. Prior to the offering Inpixon had only about 29 million shares outstanding as of January 5, 2018, suggesting that the offered shares represented a massive 62% increase in total common share count. When including the potential dilution from warrants the offering had the potential to more than double the Company’s shares outstanding.

Details of this astronomically dilutive share sale were first revealed to investors at 8:46:09 a.m. on January 9, 2018 when the company filed its form 8-K with the SEC. The filing included multiple exhibits and a 53-page securities purchase agreement. All told, the filing and exhibits comprised 116 pages of nuanced legal material detailing the specifics of an offering that had closed several days earlier, unbeknownst to outside investors until that point. The Company did not issue a press release announcing the transaction.

Thirteen minutes later, at 8:59 a.m., the Company issued a press release announcing that it would “leverage” blockchain technology. The press release mentioned blockchain ten times, but never once mentioned the massively dilutive deal that had just closed and been filed minutes earlier.

Inpixon’s stock price responded as one might expect, surging over 192% from the previous day’s close within 9 seconds on heavy premarket volume.[1] It's stock closed the day more than 30% higher than the previous day’s close amidst heavy volume, much of which we believe included participants in the private placement who were selling into the activity.

How Do We Know This?

Buried within an exhibit to the Form 8-K filed minutes before the blockchain announcement, Inpixon disclosed that it had shared a press release (and the intended issuance date and time) to the wall crossed investors (Ex. 10.1 Pg. 25 sec 4.4):

“The Company shall, by 9:00 a.m. (New York City time) on January 9, 2018, (a) file a Current Report on Form 8-K disclosing the material terms of the transactions contemplated hereby, including the Transaction Documents as exhibits thereto, with the Commission (the “Form 8-K”) and (b) issue the press release of the Company that was previously disclosed to the Purchasers (the “Press Release”)”

Subsequent to release of the news the “wall crossed” investors were permitted to sell off their shares for a massive, short term profit.

Filings suggest that is exactly what happened. One investor in the deal filed a Schedule 13G on January 11th (two days after the blockchain press release.) For context, a 13G is used to report a party’s ownership of stock that is more than 5% of a company. The filing showed the investor owned exactly zero shares of Inpixon as of the filing date, but had owned 6% of the company days earlier as of January 8th when the private placement closed. The inference is that the entire stake had been unloaded in the interim.

Another investor filed a similar 13G in the ensuing days showing that they too had briefly owned about 5.5% of the company but had summarily dumped about 1.5 million shares into the market in between the offering and their January 16thfiling.

All told the offering looks to have been a sweet deal for Roth and the investors.Roth pocketed $334,800 for their role in the deal according to a form D filing. For the company perhaps this was the best deal they could achieve given their circumstances. The only clear losers in all of this seemed to be anyone in the investing public who bought into the news and took a bath in the ensuing share price collapse.

Background on Wall Crossing Offerings

Wall crossing offerings can serve a useful purpose in the market. Through wall crossings companies are able to share MNPI with prospective investors to get feedback or gauge interest in a prospective deal without alerting the entire market to their proposals.

Often when a proposed investor is brought over the wall it is to review limited data related to a financing. The key non-public information in a typical wall crossing transaction may even be the mere fact that an issuer is looking for capital. As one commentator stated:

“Generally, potential investors do not receive any material non-public information regarding the issuer or its business. Marketing materials are limited to an issuer’s exchange act or other public filings or to a ‘road show’ type presentation that is viewed by pre-cleared investors. However, the fact that the issuer is considering a financing may itself constitute material non-public information.”

As noted by Bloomberg’s Matt Levine:

“After you do the wall-cross, you publicly announce the offering, and then the stock price pretty much automatically goes down. This is especially true for small companies, and is just a matter of supply and demand: The company is diluting its current shareholders and is raising money from new investors who will demand a discount to the previous market price to commit more money to the company.”

A Wall Crossing Unlike Any We Have Ever Seen

Contrary to the typical wall crossing deal, the terms of the Inpixon deal strike us as highly irregular for a variety of reasons.

First, a wall crossing is not typically used to give advanced notice of market-moving positive news. Here, Roth’s clients appear to have been brought “over the wall” in large part to view the blockchain press release. We found no mention of blockchain in the actual prospectus documents for the private placement. Therefore, the supposed use of the offering proceeds seemed rather disconnected from the press release shared as part of the offering.

Second, Inpixon’s direct offering has been highly dilutive to public shareholders, potentially more than doubling the shares outstanding when including warrants. Most companies wait until after they release market-moving positive news in order to complete a capital raise in order to minimize dilution. Here investors were offered shares at a steep ~20% discount to the market price just beforereleasing market-moving positive news, which seemed to actually enhance the dilutive effects of the offering.

Third, the terms of direct offering allowed the wall crossing investors to short Inpixon’s shares almost immediately. Often, direct offerings prohibit a purchaser from selling short the offering-company’s shares for a period of time to help stabilize the share price. Here, purchasers in the direct offering were allowed to sell shares short and hedge their warrant exposure with minimal limitation (Pg. 17 sec. ff):

“The Company further understands and acknowledges that (y) one or more Purchasers may engage in hedging activities at various times during the period that the Securities are outstanding, including, without limitation, during the periods that the value of the Warrant Shares deliverable with respect to Securities are being determined”

This language gave a potential arbitrage profit to the purchasers because they could sell short Inpixon’s shares at any point above the warrants’ strike price and cover their short at a profit once the warrant registration became effective.

Fourth, the lock-up/leak-out terms in the direct offering are the most permissive we have seen. For context, a lock-up provision prevents someone from selling shares for a specific period of time, while a leak-out provision forces a seller to stagger their sales, either over a period of time or as a percentage of their holdings. Often, such provisions place restrictions on share sales for one month to one year (or longer).

Here, the leak-out agreement provided that on the date of the blockchain press release the wall crossing investors could not make up more than 35% of the trading volume in the Company’s common stock. Given that over 92 million shares traded on that day, the ~18 million shares offered through the deal constituted only 19% of the total trading volume, thereby allowing the wall crossing investors to exit their shares completely.

In sum, the offering was unusually permissive in several areas, with the effect of providing advantages to the wall-crossed investors and disadvantages to the general public to an extent we haven’t seen before.

Why the Markets May Be In Deep Trouble

We think the implications of this tiny deal at this tiny company could be big. If this kind of deal is permitted, Roth may have succeeded at pioneering a legal form of capital raising that is more egregious than any illegal insider trading scheme we could ever conceive of. For example, in a typical insider trading scheme (which again, this is not):

- The person receiving an illegal tip has to purchase or sell shares in the open market, and thus can’t get a hold of more shares than actually exist at the time, unlike in this instance.

- The person receiving an illegal tip must pay the market price for shares. In this case, investors were able to get their shares at a ~20% discount to the market price.

- The person receiving an illegal tip may be limited by imprecise timing of the news release or may have imperfect information. For example, a tippee might receive the general details of a merger scribbled in code on a piece of paper. By comparison, the Inpixon deal allowed investors to buy the deal with an apparently perfect sense of both the content and timing of the market-moving news.

The ramifications of permitting this, shall we say…creative form of capital raising could be disastrous. What would stop companies from bringing favored investors “over the wall” in advance of any surprise positive news? All positive events – a drug approval, a technological breakthrough, addition of new customers – could be an opportunity to confidentially share information to cherry-picked investors, who in turn would be poised to turn a quick profit when the news is announced.

What About Regulation FD (Fair Disclosure)?

Reg FD was designed to prohibit the selective disclosure of material non-public information. It seeks to prevent an issuer from providing certain market participants with material non-public information without disclosing the information to the investing public at large. The regulation more or less aspired to plug up weaknesses with existing insider trading laws in order to make the markets fairer (as the name implies).

Reg FD typically exempts disclosures made in connection with securities offerings (because again, there is technically no trade). However, the same section of Reg FD that exempts securities offerings also notes that an issuer cannot avoid the prohibition against selective disclosure by simply registering an offering in order to evade the requirements of Reg FD. [See: 17 C.F.R. § 243.100 (b)(2)(iii)]

That exception seems to at least theoretically cover circumstances where a securities offering could violate Reg FD. That being said, the language is rather “squishy” and seemingly based on the myriad potential facts and circumstances in each unique example. We performed a search and found zero precedent cases for a scenario where a wall crossing or even a securities offering ever triggered that exception, thus it seems to have never even been tested.

Conclusion: Crossing the Wall, or a Line?

We think the Inpixon deal is an absolutely bizarre case of a wall crossing offering that strikes us as spectacularly sketchy but potentially legal. It is a potentially worrying sign of things to come. If in 5 years the micro and small cap markets devolve into a web of dubious wall-crossing offerings this little deal may mark a point in time where it all began. We have no idea how this all ends up but it will likely be interesting to watch.

Disclaimer: Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. Following publication of any report or letter, we may transact in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein.

[1] Source: NasdaqArticle by Nathan Anderson, CFA, CAIA - Co-Founder of ClaritySpring