DoubleLine Shiller Enhanced CAPE/CAPE International webcast for the month of April 2018.

TAB I - DoubleLine Shiller Enhanced CAPE® Strategies

What is Double Value?

- The DoubleLine Shiller Enhanced CAPE® Strategy creates “Double Value” for investors when combining two unique sources of value:

- The Shiller Barclays CAPE® S. Sector Index attempts to shift portfolio exposures to the “cheapest” sectors of the U.S. large cap equity market

- DoubleLine’s Fixed Income strategy strives to shift its exposures to the “cheapest” sectors of the fixed income

- Both strategies offer a value play in their respective markets, and when combined investors receive “Double ”

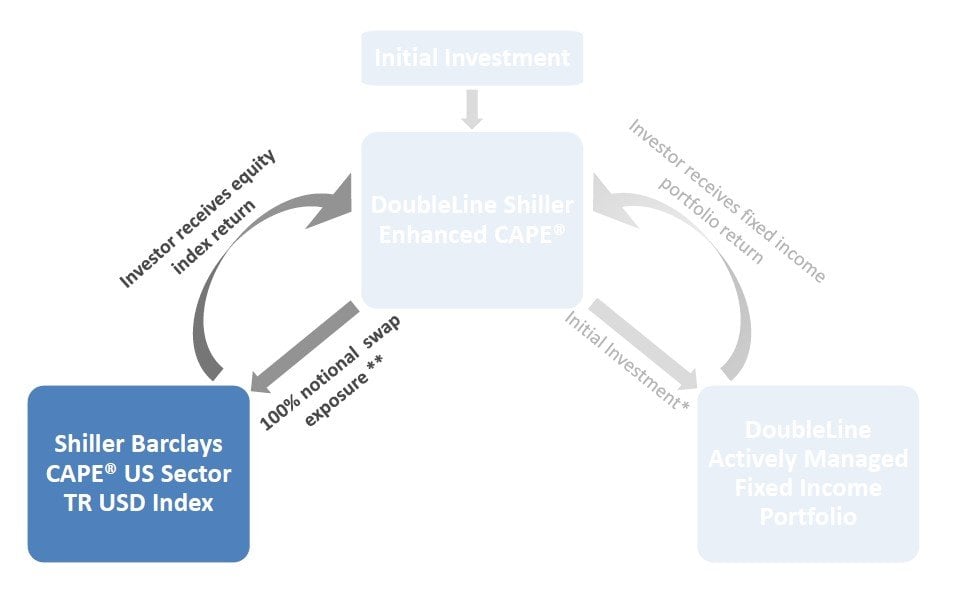

DoubleLine Shiller Enhanced CAPE® Structure

- The distinct structure of the DoubleLine Shiller Enhanced CAPE® Strategy allows investors to simultaneously access returns of the equity markets and fixed income By using an equity index swap, $1 invested in the strategy provides approximately $1 of exposure to each market.

What is Double Value?

- The DoubleLine Shiller Enhanced International CAPE® Strategy creates “Double Value” for investors when combining two unique sources of value:

- The Shiller Barclays CAPE® Europe Sector Net Index attempts to shift portfolio exposures to the “cheapest” sectors of the European large and mid cap equity market

- DoubleLine’s Fixed Income strategy strives to shift its exposures to the “cheapest” sectors of the fixed income

- As with the S. version both strategies offer a value play in their respective markets, and when combined investors receive “Double Value.”

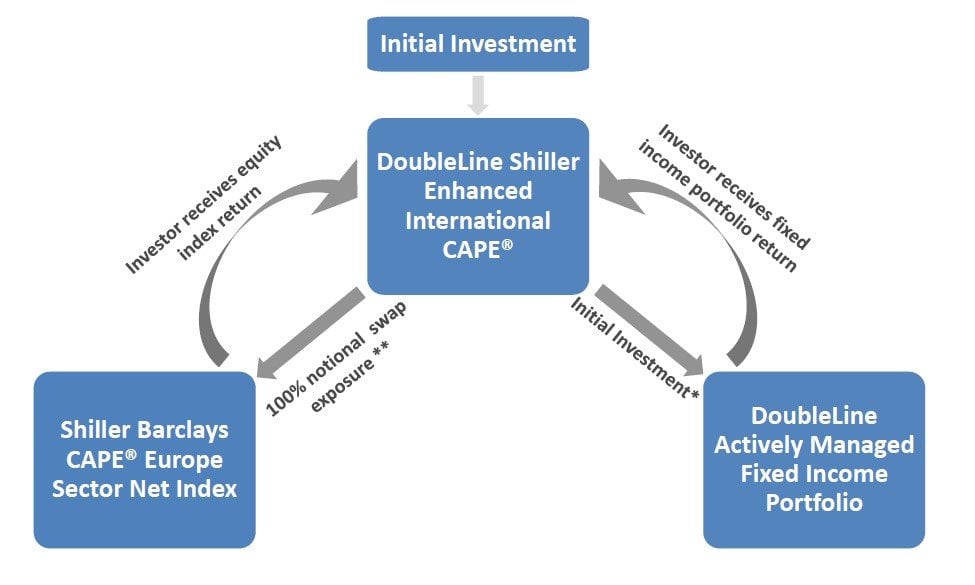

DoubleLine Shiller Enhanced International CAPE®

- The distinct structure of the DoubleLine Shiller Enhanced International CAPE® Strategy allows investors to simultaneously access returns of the equity markets and fixed income By using an equity index swap, $1 invested in the strategy provides approximately $1 of exposure to each market.

TAB II - U.S. Equity Earnings

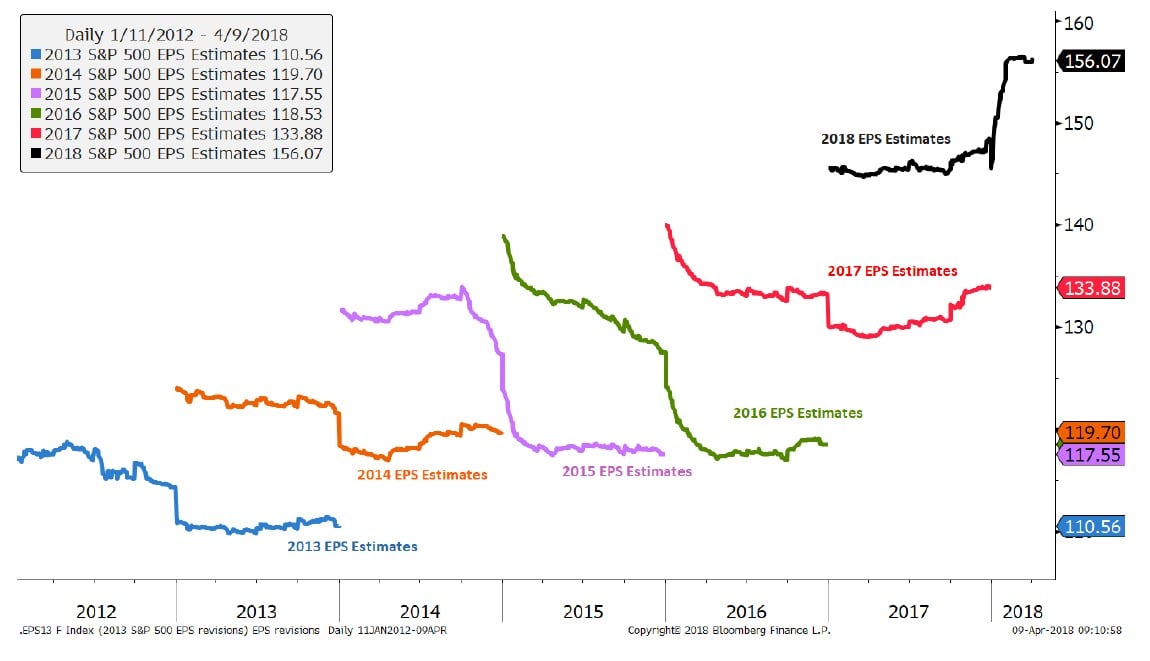

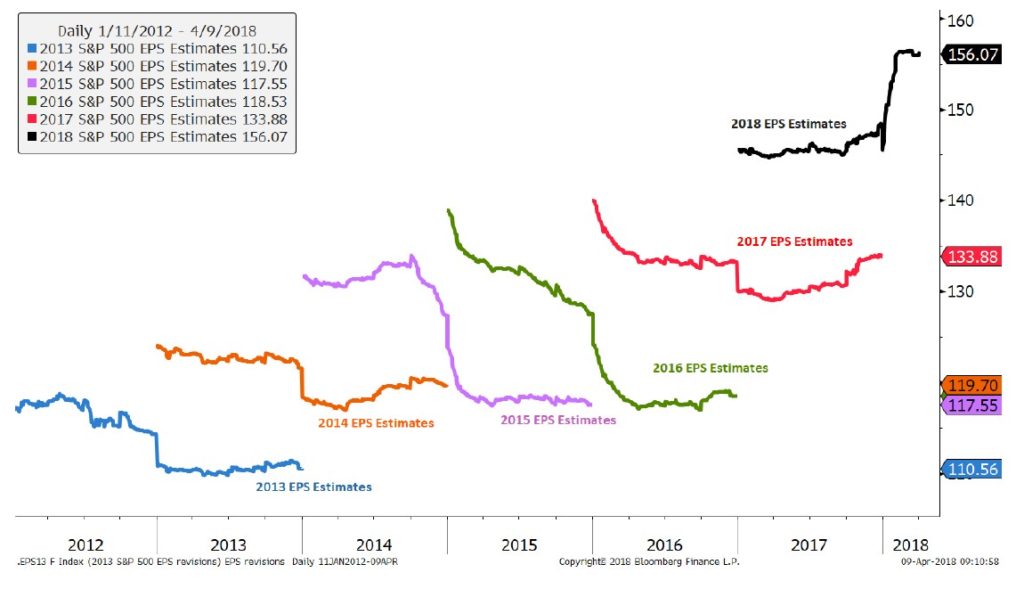

S&P 500 Earnings Estimates

Source: Bloomberg, DoubleLine

EPS: Earning Per Share

TAB III - Smart Beta: Shiller Barclays CAPE® U.S. Sector Index

Shiller Barclays CAPE® U.S. Sector Index

* A portion of the Initial Investment may be pledged as collateral under the swap

See the full PDF below.